Q1 investment numbers see corporate investors staying strong, big rounds on the increase, and the crypto revival continuing.

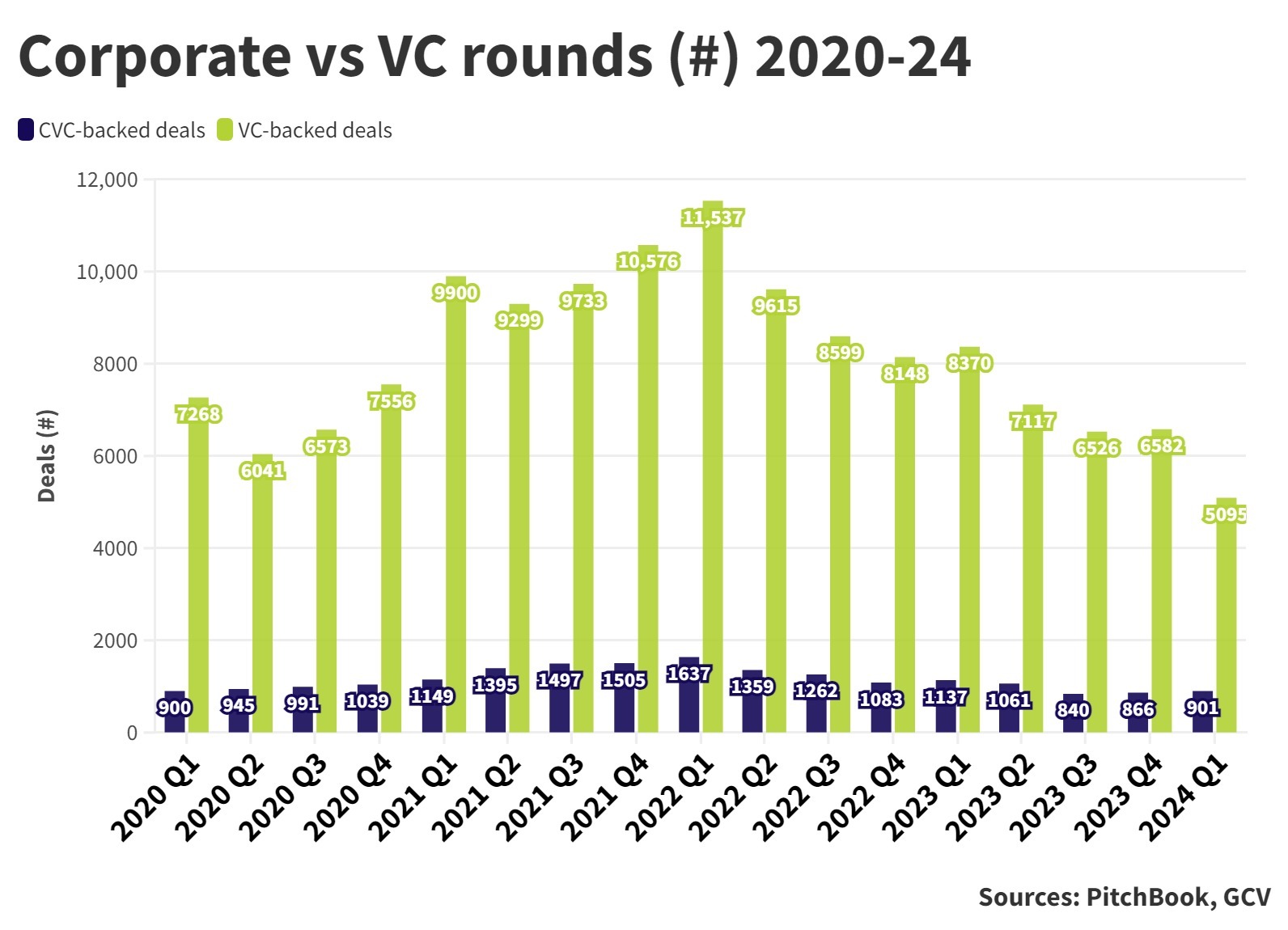

Corporate investors have kept up their momentum in the first quarter of 2024, while traditional VC investors have pulled back, suggest data collected by GCV and PitchBook.

The downward trend in traditional venture capital investment continues, and while corporate-backed funding rounds have also experienced a dip along with the wider market, we have noted an increase in corporate investment in the past two quarters. There were 901 corporate-backed rounds in Q1 2024, a 4% increase over Q4 2023.

Take a look at the corporate deal data collected by GCV.

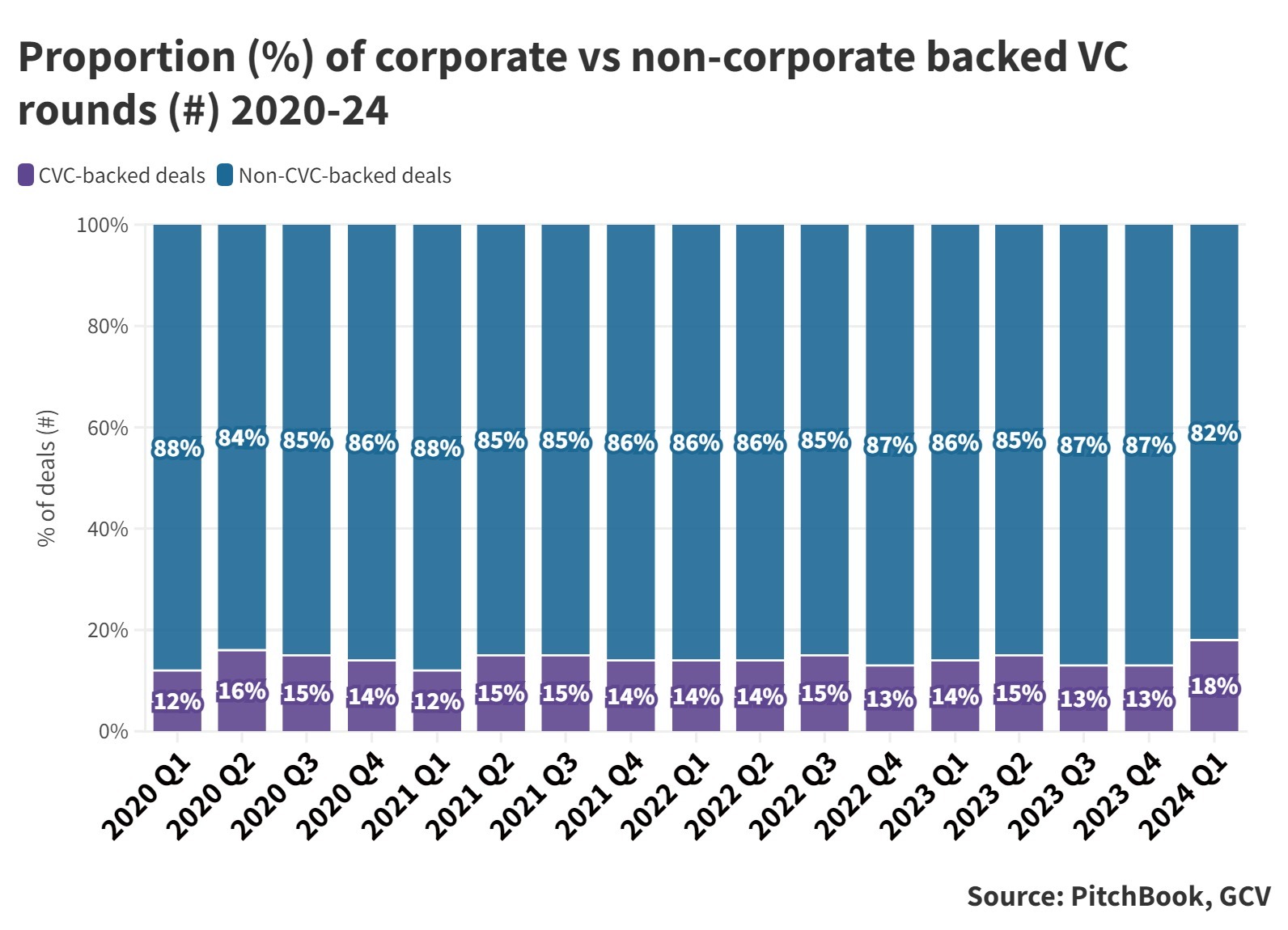

The data also highlight that Q1 saw the proportion of corporate-backed rounds rise to 18% when compared with rounds that did not include a corporate backer. This was a jump from the more typical proportional percentage of between 13% and 15%.

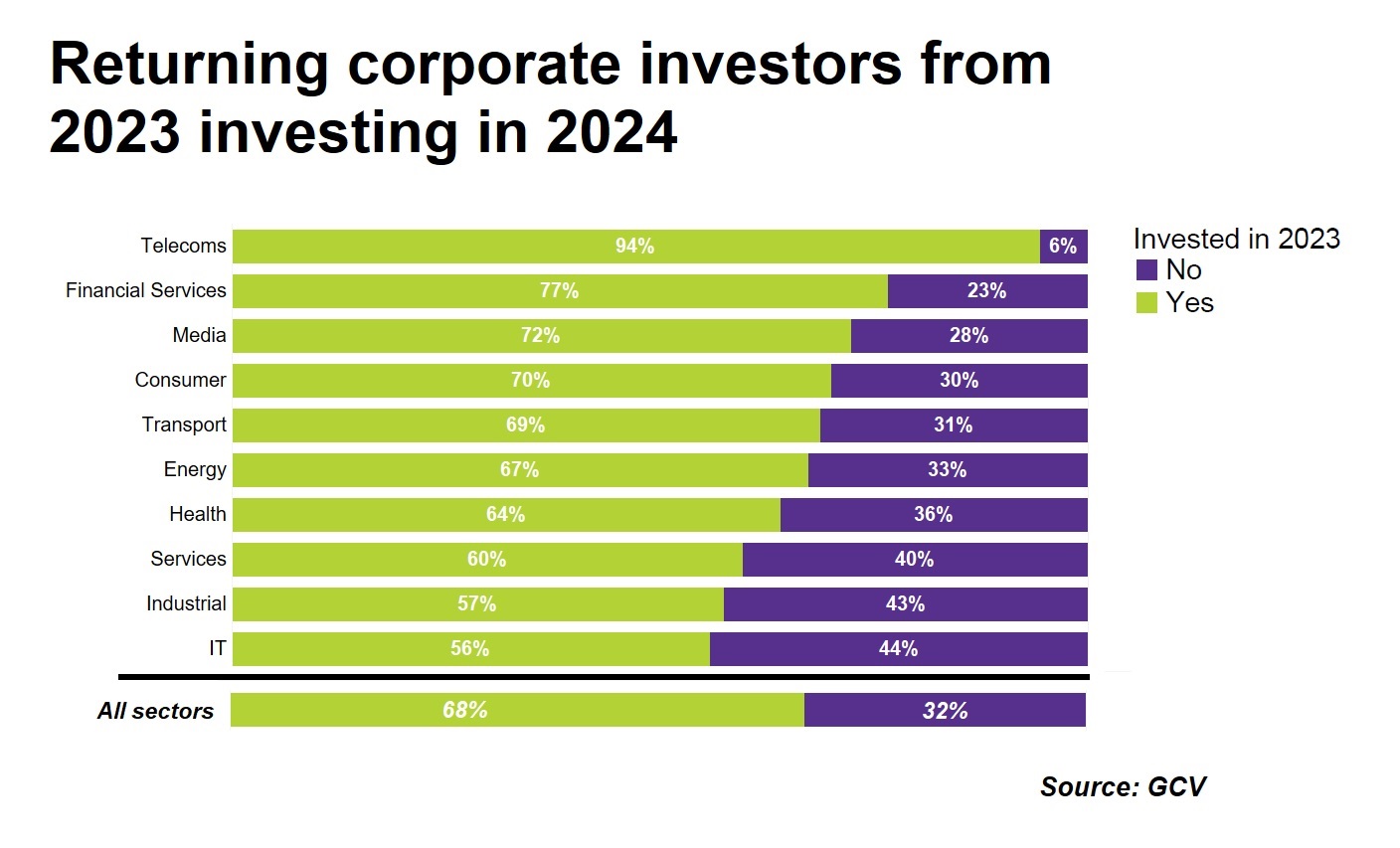

It is encouraging for the innovation sector to see that corporate investors are proving their worth when times are tougher. According to our data, nearly seven out of every 10 corporates that have invested so far in 2024 (68%) were returning investors from 2023. The total dollar value of corporate-backed deals in Q1 2024 stood at $31.78bn, a 14% increase from Q1 2023, which stood at $27.95bn.

Big rounds continue to feature

As we noted in our February round-up, the first quarter of 2024 solidified our observation that bigger deals seem to have made a return.

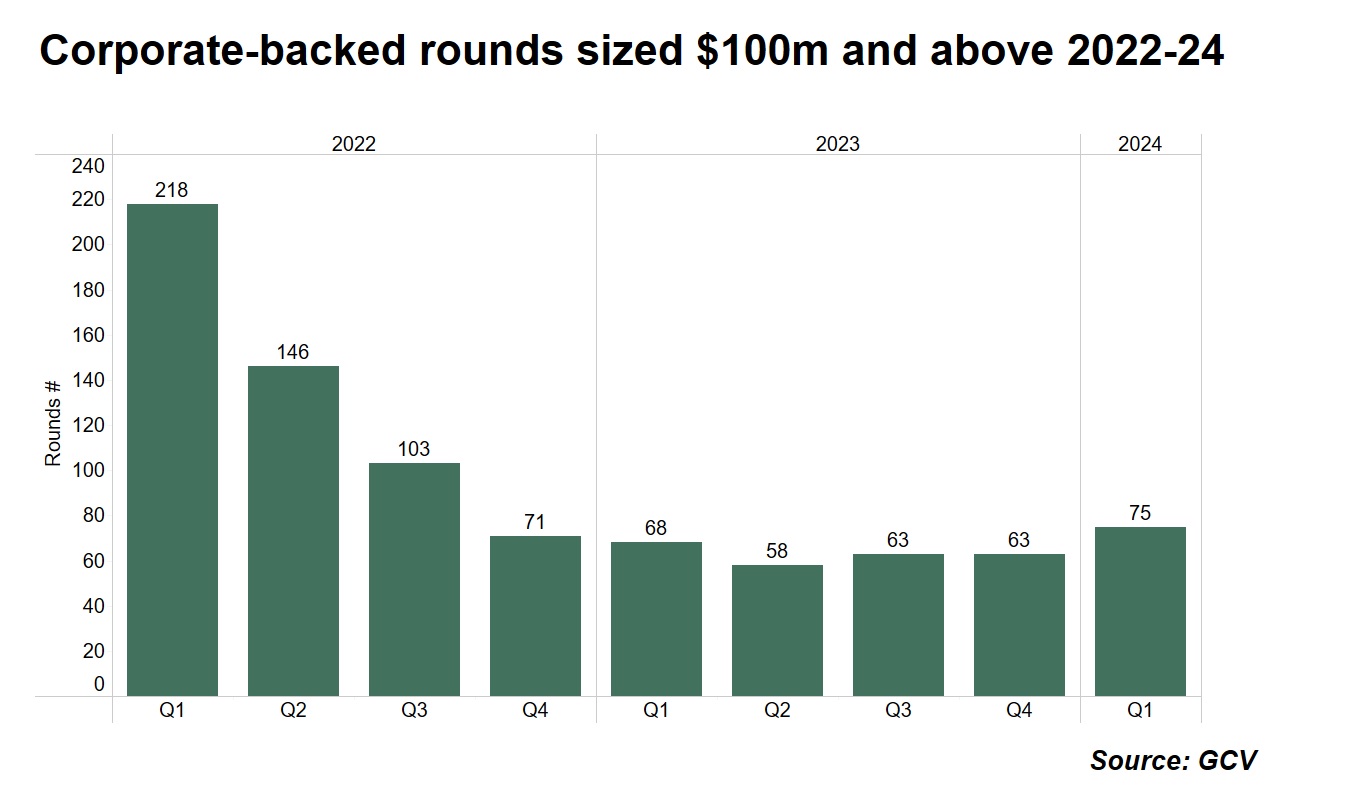

Eleven percent of the corporate-backed funding rounds we saw in Q1 were $100m or more. This is the highest proportion we have seen since Q4 2022, as shown on the following chart.

Four funding rounds in Q1 raised more than $1bn, including a $1.5bn investment in video game developer Epic Games from Walt Disney. This large size of this investment is testament to the integration of online gaming with storytelling and mainstream entertainment.

Other big gaming investments in Q1 included game developer Build a Rocket Boy’s $110m series D round, which saw contribution from corporate backers Netease and Endeavour.

Investment in artificial intelligence showed no signs of slowing down, with several large rounds raised including a $1bn investment in large language model building firm Moonshot AI, led by Alibaba and supported by Meituan and Xiaohongshu. Elsewhere, Celestial AI raised a $175m series C round, with contribution from a host of corporate investors, including AMD, Koch Industries, Samsung and Porsche.

Renewable energy was another sector that raised larger rounds in Q1. Natural hydrogen explorer Koloma raised a $245m series B round backed by corporates Amazon and United Airlines as well as Khosla Ventures. Amazon also bet big on high temperature fuel cell developer Sunfire, contributing to its $233m series E round.

Crypto continues to make bank

As we noted in our January and February round-ups, corporate-backed funding rounds in the cryptocurrency space are experiencing a notable surge. Alongside the recovery of the price of Bitcoin to $64,000 (and above) and the launch of Bitcoin exchange traded funds, this activity reflects the growing confidence and interest from established companies in blockchain technology and digital assets.

This trend underscores a shift in the perception of cryptocurrencies, as more corporations recognise their potential to reshape traditional finance and various industries.

With companies across sectors investing in blockchain projects and digital currencies, the influx of corporate capital is not only driving innovation but also signalling a maturation of the cryptocurrency ecosystem, paving the way for broader adoption and integration into mainstream finance.

Among some of the larger crypto deals to take place in Q1 was digital asset financial services company Hashkey Group’s $100m series A round, a deal that secured its status as a unicorn. The round was co-led by OKX Ventures, the corporate venture arm of crypto exchange OKX.

Singapore continues to increase its corporate venturing activity

Singapore is the only major geography to increase its corporate venturing activity in the first quarter of 2024.

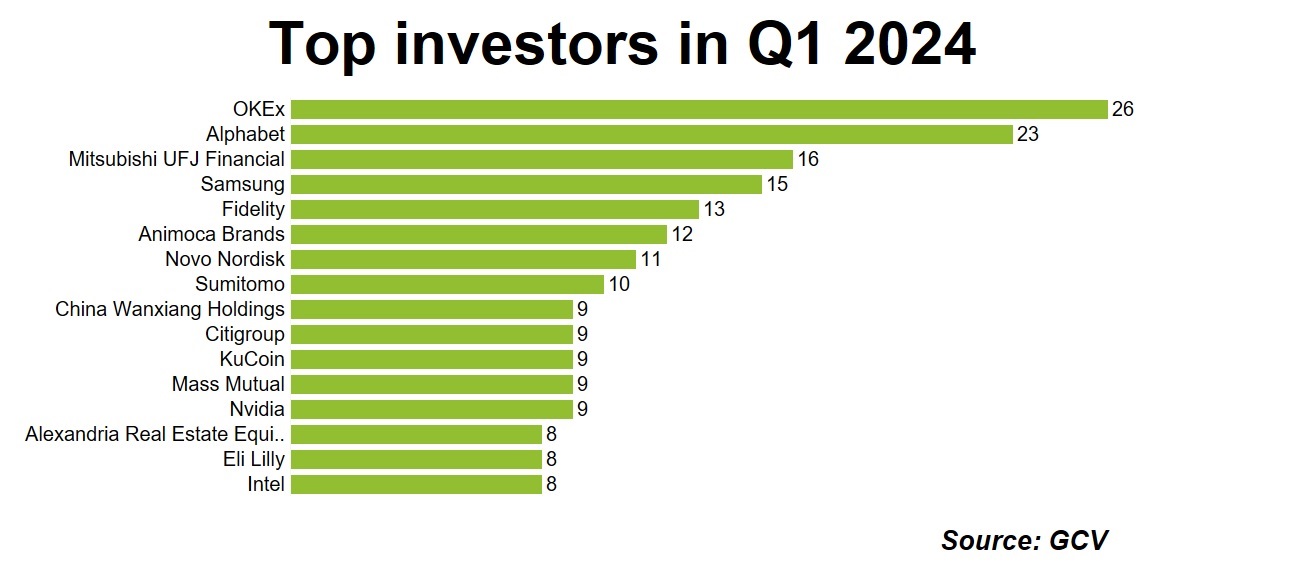

Singapore has become an appealing investment hub for US investors, due to the robust economy, good business climate, advanced infrastructure and strategic geographical location. Cryptocurrency exchanged OKX invested heavily in Q1, coming out as the top investor.

Our of 26 funding rounds that OKX contributed to, 11 of them were in companies based in Singapore. One of the largest was a $50m series A round for Singapore-based company Eclipse, which is building a blockchain to secure Ethereum. The funds were supplied solely by OKX.

Exits

The first quarter of 2024 saw 11 corporate IPOs, and 90 corporate M&A exits.

The biggest exit of the quarter was Danish pharmaceutical company Novo Nordisk’s acquisition of Cardior Pharmaceuticals, a German biotech firm, for approximately $1.1bn. Cardior Pharmaceuticals specialises in developing therapies for heart conditions, presenting an opportunity for Novo Nordisk to expand its presence in this therapeutic area. OKX were investors in Cardior.

Visa, the global payments technology company, acquired Pismo, a Brazil-based core banking platform, for $1bn. Corporate backers that exited include Amazon and Softbank.

The most notable IPO was that of prominent forum and social network Reddit, which went public on 21 March, becoming the first large social media site to launch an IPO since 2019.

Initially planning to go public in 2021, Reddit postponed its IPO due to uncertainties brought about by the Covid-19 pandemic. But, with its active monthly audience soaring by approximately 40% between 2021 and 2023, Reddit finally debuted on the New York Stock Exchange, raising a total of $748m – $229m for existing shareholders, which included corporate Tencent.