Under pressure to simplify supply chains and improve sustainability, Nupo Ventures is building startups, with six under its belt so far.

Consumers might not recognise the name Olam Group but will likely have eaten something the Singapore-based conglomerate supplies. The company is one of world’s largest suppliers of cocoa beans, coffee, cotton and rice, operating in 60 countries with annual revenues of more than $37bn.

With operations spanning everything from Nigeria to Singapore, Olam is at the forefront of wrestling with the complexities of global supply chains and, increasingly is under pressure to make the agricultural sector more sustainable.

Olam began addressing some of these issues in 2016 with a digital transformation programme, moving into venture building activities in 2020. In 2022 these were turned into Nupo Ventures, Olam’s corporate venturing arm, which houses all the company’s incubated ventures and portfolio of new ideas. Now, after creating six successful startups so far, Nupo Ventures is spinning out as a separate entity that can take in capital from outside of Olam.

Suresh Sundararajan, chief executive of Nupo Ventures, says this move could help the venture unit move faster and cover more ground in its mission of reimagining global agriculture and food systems.

“We harbour aspirations to launch more ventures. We can do this by looking for support from Olam for future capital or explore independence to tap into other sources of capital. We are exploring both avenues,” Sundararajan says.

An experimental beginning

Like many venturing units Nupo Ventures began as an exercise in digital transformation that grew into something more.

“Back in late 2016 I was put in charge of the Group’s digital transformation journey, leading an internal task force that attempted to disrupt and transform the group’s own supply chains using technology,” says Sundarajan.

“Then, the efforts were mostly exploratory. One concept that captured everyone’s imaginations was Olam Direct, which explored whether an agri giant like Olam could buy cocoa directly from a South Sulawesi farmer with just one hectare of land,” Sundararajan says.

Olam Direct sowed a seed that would eventually become the company’s first internally created startup, Jiva, a platform that allows smallholder farmers to sell their produce, secure loans and access crop advice.

“Olam Direct helped us to set out the boundaries that we use to assess new ventures in a disciplined manner,” says Sundarajan. Among other things the team learned to focus on digital ventures rather than asset-heavy models. Nupo Ventures is interested in digital technologies “which solve environmental, social, and governance challenges in and around the food and agri value chain,” he says.

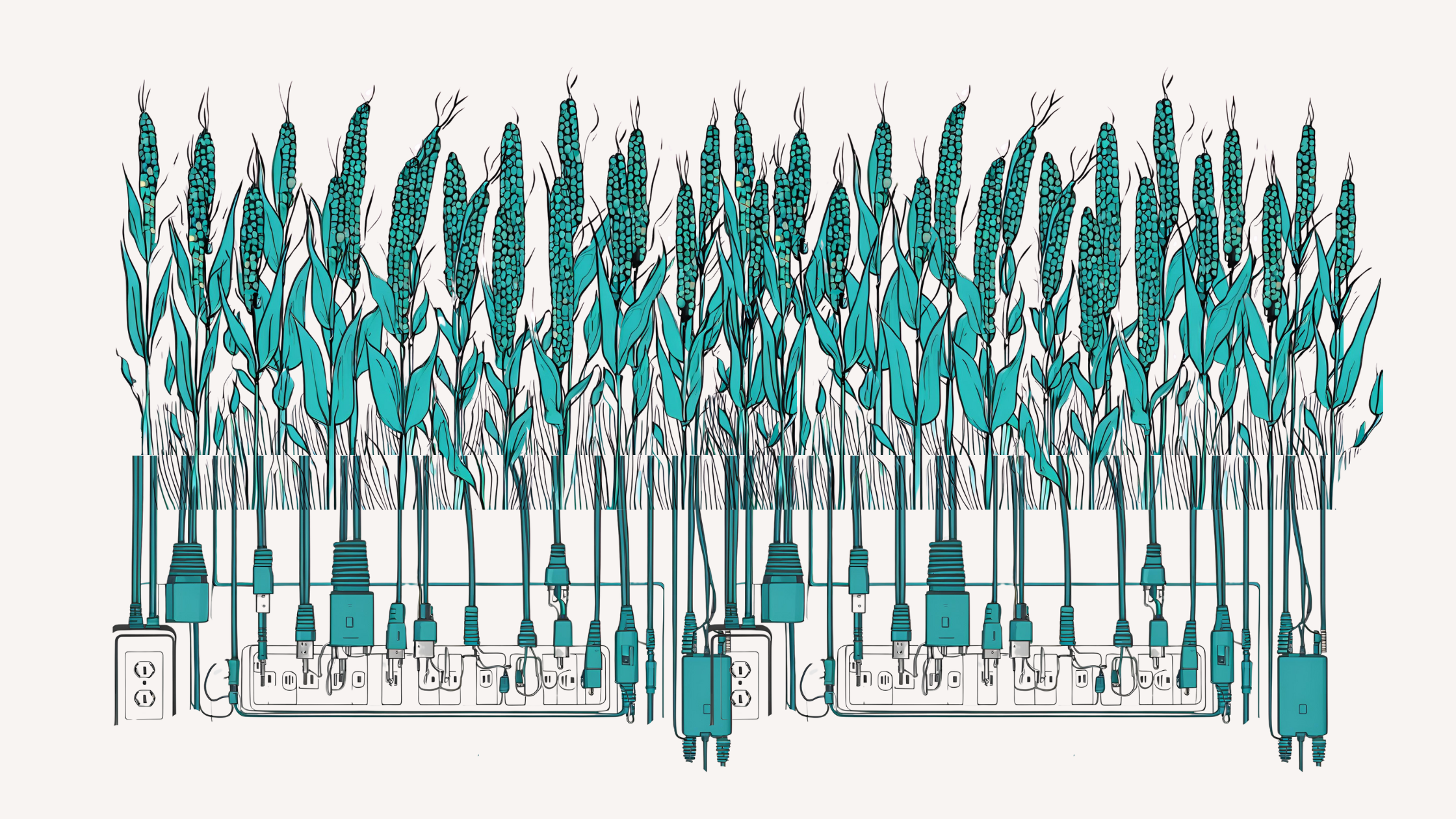

Sundarajan says Nupo is looking to re-imagine global agriculture and food systems. The food and agriculture sector accounts for a large, growing and impactful share of greenhouse gas emissions. However, only less than one percent of sustainable financing was dedicated to food and agriculture in 2022. Capital investments in the food and agriculture sector are expected to grow rapidly and Nupo wants to be at the forefront to take advantage of this.

“Food producers are incentivised to transition to a regenerative food system. To accommodate and support the transition to regenerative food systems, supply chains need to become more future-ready,” Sundararajan says.

Being part of Olam meant the venturing arm had plenty of knowledge and expertise in the food and agriculture space which allowed it to have access to wider markets as well as an entire network of suppliers and partners that it could test solutions with.

“Of the roughly ten topics we have explored in the last 4-5 years, we incubated total of six ventures. Of those, three are scaling well today and we are exploring other ideas in our pipeline,” he adds.

Increasing independence

In 2022, Olam Group announced the creation of three key operating groups – the food ingredients group ofi, the agri-business arm, Olam Agri, and the Remaining Olam Businesses. Nupo Ventures, Mindsprint, and Olam Global Holdco were in the remaining group.

The Nupo Venture’s new name is made up of two Latin words nutrire and potential, which mean to nourish potential.

“We see our role as exactly that. We want to be working on ideas that will help nourish the people, the planet and the potential of the creative, passionate entrepreneurs we work with. Nupo is a venture studio for new businesses that pioneer our vision of bold sustainability in food, agriculture and beyond. Collectively we’re aiming to achieve positive and meaningful change by supporting successful, visionary businesses that can unlock great financial value for all our shareholders,” he continues.

Venture studio model still new in Asia

Although companies all address innovation in a variety of ways, very few companies in Asia have the kind of a venture building model that Nupo has, where they are setting up ventures and spinning them out as independent units. Standard Chartered bank runs a large venture building operation in Singapore also, but outside of that the venture studio concept not well known in the region.

“There are some independent venture studios in US like Flagship Pioneering which are quite prolific but not so many which are corporate-backed. In that sense, we believe Nupo Ventures is charting a very new and differentiated course,” says Sundararajan.

According to Sundararajan, the VC community doesn’t always fully understand the venture studio model and sometimes are hesitant to invest in corporate-backed ventures.

“There is a lot of education that we have to do with investors. Beyond VCs, we are also looking at investment from strategics, family offices, to widen our target to overcome some of the fundraising challenges. In parallel, as we become independent from Olam, we are also exploring other ways of structuring our ventures so that we can work with VCs better in the future,” he says.

Flexibility is the key, he adds.

“Markets are dynamic, and things can change. So, we should also have the mental agility to pivot and adjust to this.”

Plans for VC-like returns

Nupo sets up its ventures as separate entities early and Sundararajan says nurturing independence has worked well for both Nupo and the companies.

“We were able to attract relevant talent from the market because they received management independence and even ownership of some of the equity. We are present on their boards, but we don’t dictate strategic directions or shape their business,” he says.

The goal of Nupo is to generate VC-like returns from its venture portfolio.

“We are early-stage investors who also act like co-founders for the various start-up teams as they get started. But slowly over the next few lifecycle stages of the ventures we look to dilute our stake in the ventures and attract external investment in.”

The external investors provide a validation of the value created by the ventures and support them as they scale up. Nupo Ventures can then deploy its capital to incubate the next series of ventures.

“In five years, we envision all three of our current ventures attracting external investment, securing the capital needed for growth, and expanding their cap tables.

“Additionally, we aim to launch 1-2 new ventures each year, continuing our commitment to fostering innovation and sustainability,” Sundararajan concludes.