Pharmaceutical startups have had a strong start to 2024, showing off areas like psychedelic mental health treatments, radiotherapeutic cancer drugs and medicine for underserved populations.

2024 has started slowly, as investors have returned from the holiday period. But one industry has been active: healthcare, particularly pharmaceuticals.

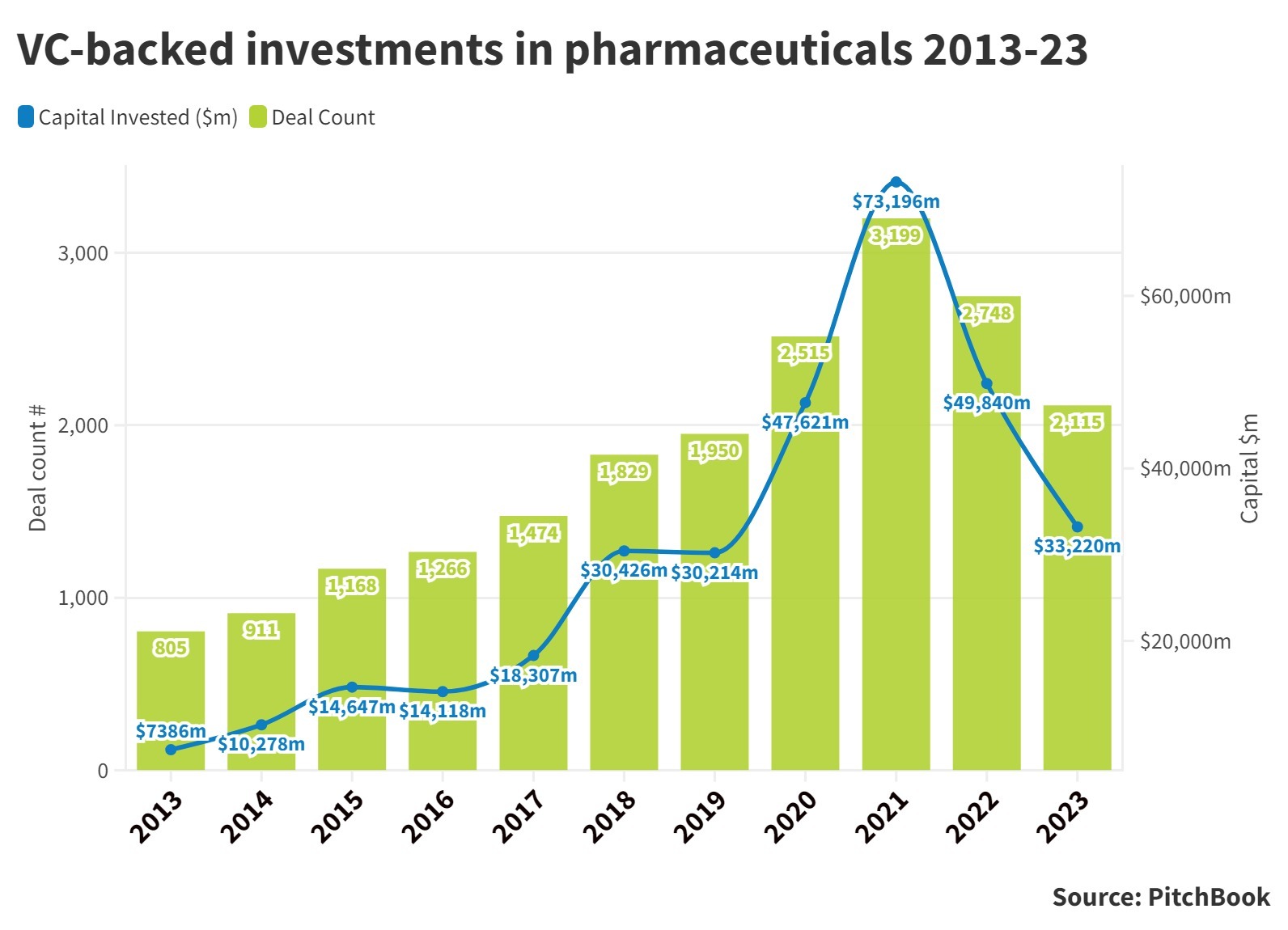

This isn’t a case of historic funding rates – the sector is still recovering from the hangover following the Covid-era boom (see below). But healthcare funding rounds have made up the bulk of the larger funding rounds we have seen since the start of the year. (See all of our January deals here.)

The activity comes as we’re seeing additional corporate funds being raised to invest in healthcare, the latest being Taiho Ventures, which received $100m from drug producer parent Taiho Pharmaceuticals yesterday to hike its overall capital to $400m.

The startups raising these bigger rounds also give an insight into some of the trends we are likely to see in healthcare this year.

Psychedelics

Although it seems like an edge technology, psychedelics are increasingly being used by doctors to treat issues like addiction, anxiety, depression and post-traumatic stress disorder (PTSD).

That usage has been traditionally been restricted by anti-drug laws, but with certain US states legalising medical marijuana and Australia authorising psychiatrists to prescribe psilocybin and MDMA for select mental health conditions, there is hope researchers can make effective use of them in dedicated drugs.

Lykos Therapeutics led the way on Friday with over $100m in series A funding from investors including Eir Therapeutics. Lykos, formerly known as MAPS Public Benefit Corporation, is developing psychedelic-assisted mental health therapies and has just secured phase 3 results for the clinical trial of an MDMA-assisted treatment for PTSD.

But Lykos is not alone, Atai Life Sciences just paid $50m for a 35% stake in Beckley Psytech and plans to incorporate Beckley’s psychedelics-based treatments for depression and alcoholism into its own mental health therapeutics platform. These drug candidates are also still in the clinic, but corporate funding may also help to legitimise the field of psychedelic medicine and hopefully insulate it from excessive regulation.

Radiotherapeutics

There were more than 18 million new cancer diagnoses worldwide in 2020 and 10 million deaths, and those rates are expected to rise in line with trends over the last 30 years – research by medical journal BMJ Oncology last year showed cancer deaths for under-50s have increased 27% over that time – but there are also a range of techniques being developed to treat the disease.

One of those techniques is radiopharmaceuticals. Oncologists already utilise radiotherapy to detect cancer as well as treat it, using concentrated doses of radiation to kill cancer cells. In theory, pharmaceutical equivalents could be more highly targeted at tumours to shrink or kill them while minimising side effects.

Two radiopharmaceutical companies pulled in a total of almost $100m last Wednesday. Radionetics Oncology, spun off by Crinetics Pharmaceuticals, closed a $52.5m series A round featuring its former parent to fund work on its small molecule radiopharmaceuticals, while oil and gas provider Saudi Aramco’s Prosperity7 unit co-led a $47.5m series B for prostate cancer radiotherapeutics developer Full-Life Technologies.

Radiotherapy is still used largely the way it was when first introduced: by beaming rays into the body externally. The hope is that new technologies like small molecule drug development and antibody engineering (used by Abdera, which completed a $110m round last year) can take it to the next level.

Underserved populations

Medical research and diagnostics have long been subject to both a gender gap and, in the case of western medicine at least, a similar discrepancy by ethnicity. The good news is that drug developers and care providers are beginning to wake up to the problem and are taking note of it as both an area of unmet need and a commercial opportunity.

Johnson & Johnson Impact Ventures was among the investors in a $3m seed round yesterday for Health in Her Hue, which uses technology to provide women of colour with specified health information and access culturally sensitive healthcare providers.

See our forecasts for 2024

- Transport in 2024: investors eye pick-up in startup deals after a stalled year

- Logistics in 2024: Labour shortages and climate to drive investment

- Energy in 2024: Plenty of funding rounds but few exits, say energy investors

- Fintech in 2024: investors eye payments, interest rates and a shift to emerging markets

- Robotics in 2024: GenAI and global trade shifts to boost sector

Meanwhile, the last week of December saw funding rounds for two startups that are expanding treatment options for medical conditions that solely affect female bodies.

Heranova Lifesciences emerged from stealth with $13.5m from backers including Nan Fung-backed Pivotal BioVenture Partners China and a range of non-invasive endometriosis tests as well as two potential treatments. Prosperity7 Ventures meanwhile led a $14m round for Cispoly, a developer of gynaecological tumour detection technology. Interestingly, both companies came out of China – could this be an area in which it has a lead over the US?

AI drug development

Using artificial intelligence in drug development is not new – we’ve seen an increasing number of startups using it as their calling card, even if it’s too early to see them bring their therapeutics out of the clinic and into commercialisation.

But it is interesting to see how many companies outside the healthcare sector have started to invest in healthcare-related AI.

Consulting firm Accenture is one of those, and its Accenture Ventures unit just provided approximately $2m for QuantHealth, creator of an AI-powered clinical trial simulator that promises to streamline the clinical testing process for new drugs.

QuantHealth isn’t the first medical startup Accenture Ventures has backed in the past year, and it joins the likes of GV – probably the first non-healthcare corporate to go big in the sector – and chipmaker Nvidia in exploring pharmaceuticals and biotechnology.

These kinds of investors crossed into digital healthcare some years ago, but they appearing to be pushing deeper into new areas of healthcare.