BCR Seed Starter will invest about $545,000 per deal in startups working on banking processes, portfolio services and ESG initiatives.

Banca Comercială Română (BCR), a Romanian banking subsidiary of Austrian financial services provider Erste Group, has formed a €5m ($5.5m) corporate venturing arm.

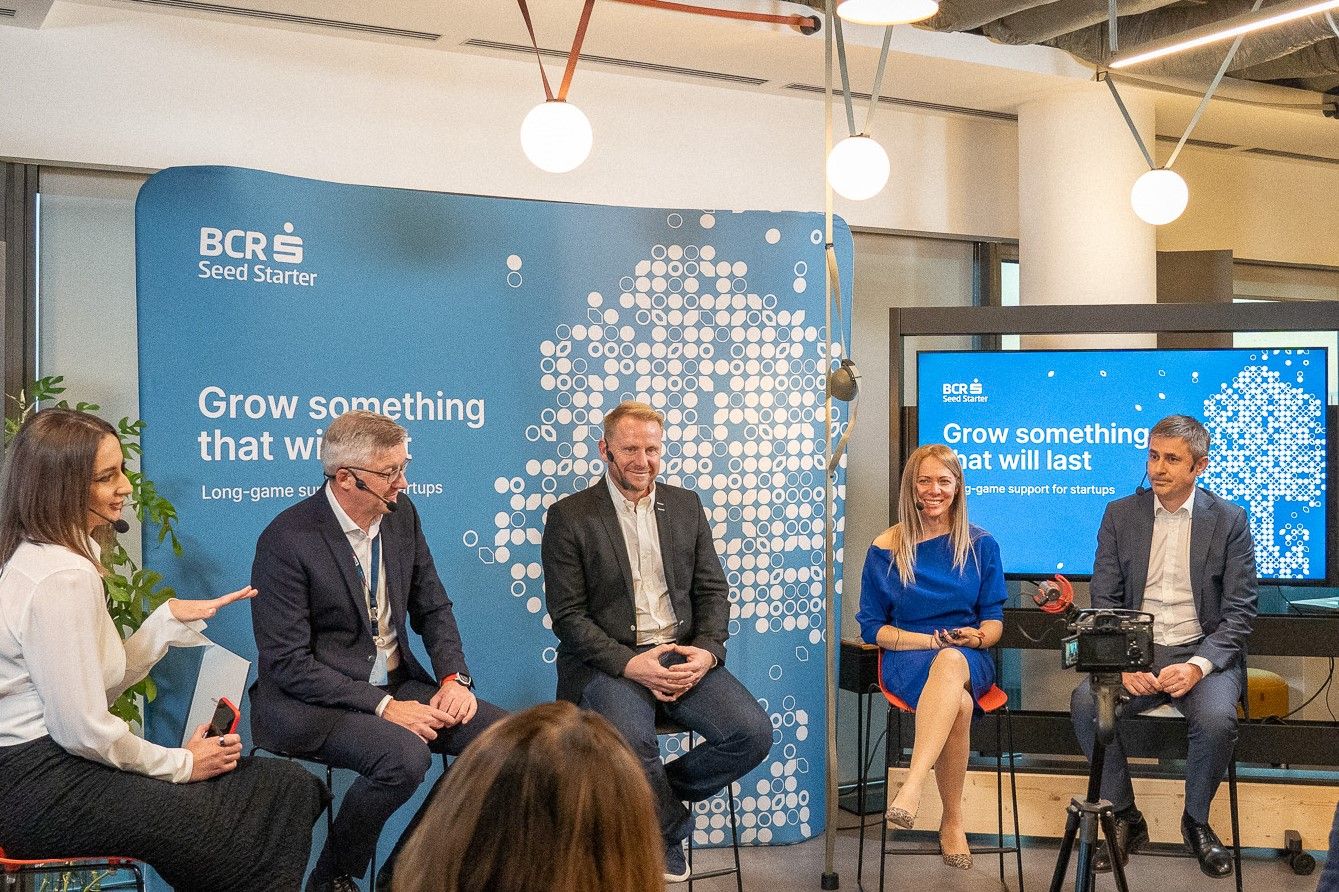

Called BCR Seed Starter, the unit will invest in technology startups for five years from January 2024. Areas of interest include internal banking process optimisation, portfolio services improvement as well as environmental, social and corporate governance (ESG) goals.

Founded in 1990, BCR is the largest bank in Romania that covers universal banking services including retail, corporate and investment banking. BCR Seed Starter represents the first CVC group formed by a Romanian bank.

BCR Seed Starter intends to diversify the parent firm’s traditional banking model, enter new markets and accelerate innovation in Romania through startups’ technologies and offerings.

“BCR Seed Starter will give startups the opportunity to develop, test, adapt and offer value-added products to the BCR and Erste ecosystem or directly to the bank customers,” says Carmen Dibus, chief executive of BCR Seed Starter.

“The collaboration will be on a non-exclusive basis, as our goal is to help startups grow in their target markets. Our aim is to invest an average ticket size of €500,000 ($545,000), in exchange for a maximum of 24,99% non-controlling equity stake.”