Corporate venturers from the IT sector completed 191 exits between June 2021 and May 2022 – 125 acquisitions, 30 IPOs, four mergers of equals, six buyouts and 26 other transactions.

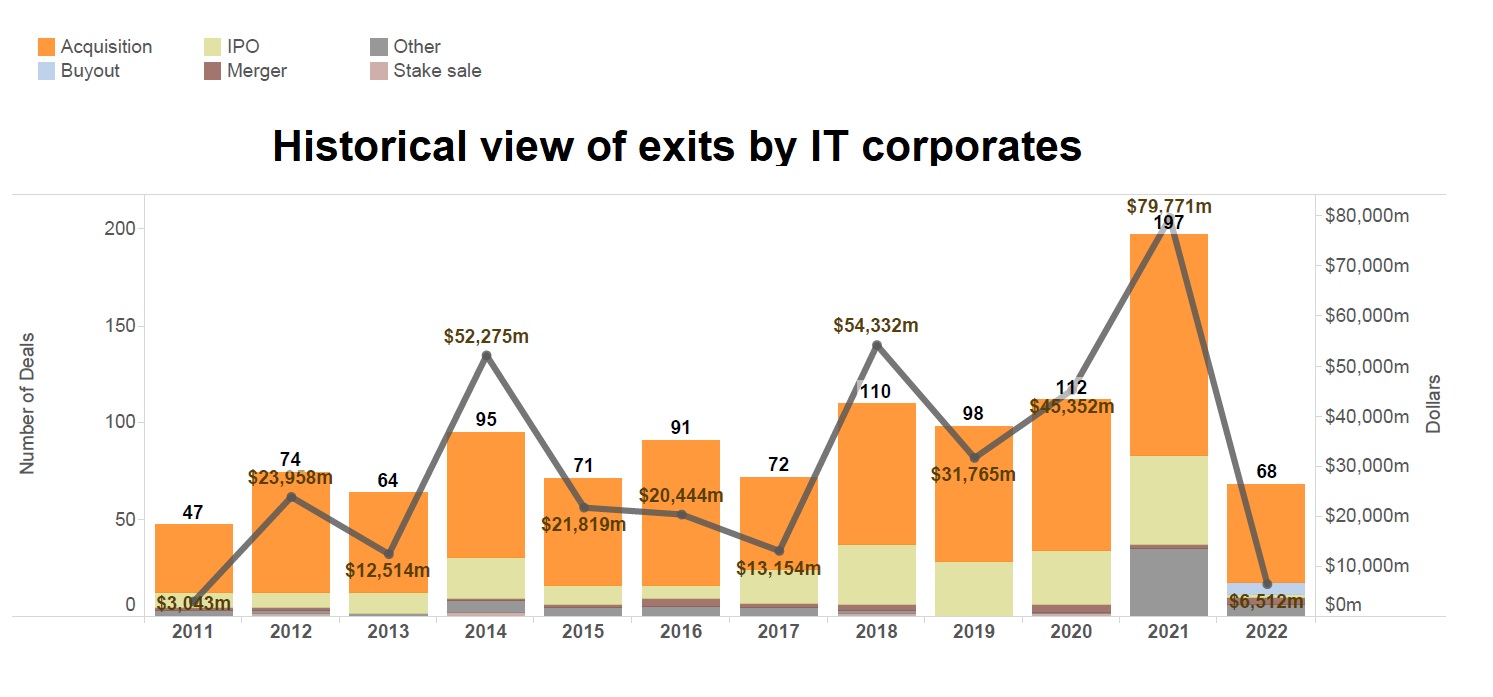

Corporate venturers from the IT sector completed 191 exits between June 2021 and May 2022 – 125 acquisitions, 30 initial public offerings (IPOs), four mergers of equals, six buyouts and 26 other transactions (including reverse mergers with special purpose acquisition vehicles). As for year-on-year, the transaction volume went up 76% from 112 to 197 between 2020 and 2021, while the estimated dollar value increased by 76% from $45.35bn up to $79.77bn.