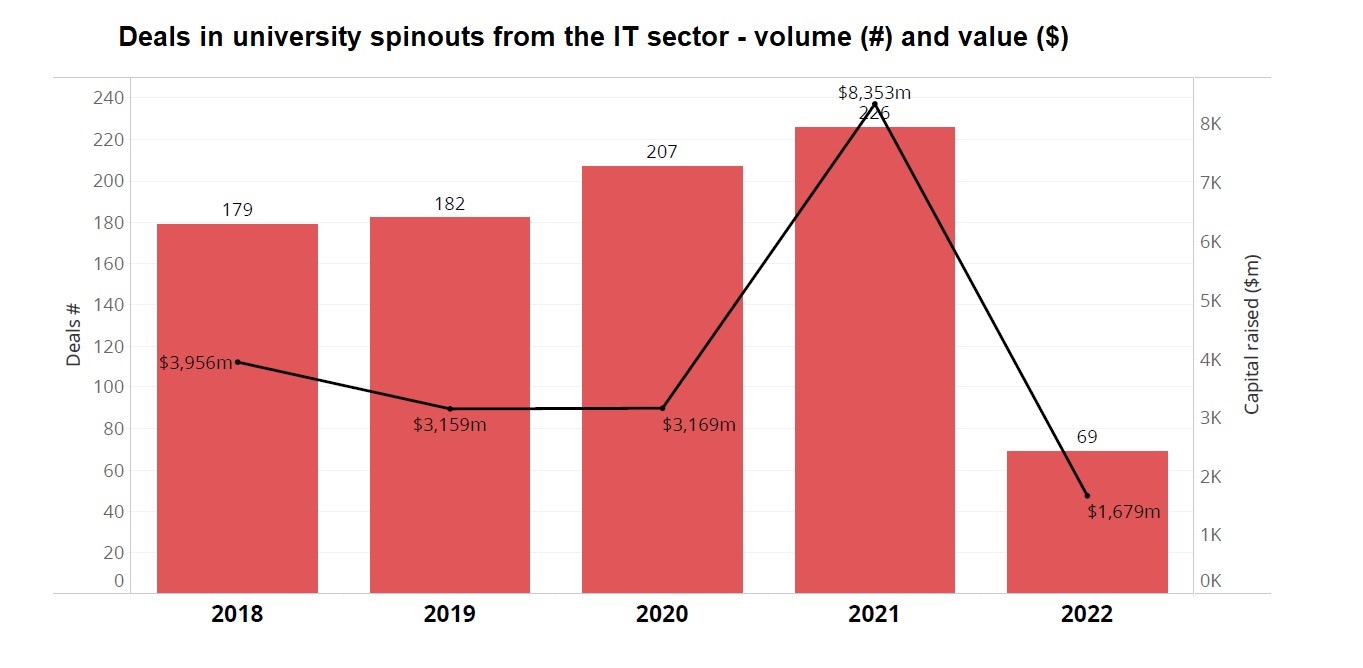

By the end of 2021, there were 226 rounds raised by university spinouts, up 9% from the 207 registered in the previous year.

Over the past few years, we reported various commitments to university spinouts in the IT sector through our sister publication, Global University Venturing. By the end of 2021, there were 226 rounds raised by university spinouts, up 9% from the 207 registered in the previous year. The level of estimated total capital deployed last year stood at a record $8.35bn, more than double the $3.17bn in 2020.

Celonis, a Germany-based business process analytics software spinout of Technical University of Munich (TUM), raised $1bn in a series D round co-led by Durable Capital Partners and funds and accounts advised by T Rowe Price Associates. Franklin Templeton, Splunk Ventures and assorted private investors also joined the round. The round valued Celonis at $11bn post-money. Founded…

LEADERSHIP SOCIETY

Informing, connecting, and transforming the global corporate venture capital ecosystem.The Global Corporate Venturing (GCV) Leadership Society’s mission is to help bridge the different strengths and ambitions of investors across industry sectors, geography, structure, and their returns.