The gaming sector saw a surge in interest from corporate investors in April. Deals in India and China are also bouncing back.

April 2024 saw an uptick in the number of corporate-backed investments in the gaming sector, with 16 corporate-backed rounds taking place. Set against April 2023, when only 7 corporate-backed deals took place, it’s an increase of nearly 130%.

Corporate investors may have been inspired by Disney and Epic Games joining forces, a partnership announced in February this year. Gaming, as a medium, is beginning to be seen as books, movies, music or TV – or all of these combined.

April’s corporate-backed gaming deals included the series D round for Brave Group, a virtual esports outfit that is creating an e-commerce platform for Vtubers (content creators that use computer generated avatars). The round was funded by real estate company Mitsui Fudosan’s CVC unit 31Ventures and Japanese broadcasting company TV Asahi.

UK and Norway-based multiplayer games developer Red Rover also raised a $15m series A round, led by South Korean games publishers Krafton, and supported by games software platform developer Overwolf.

With trends like VR gaming, esports and even retro games on the increase, it seems like corporate investors are finally sitting up and taking notice of how integral gaming is becoming to the way people relax, consume media and socialise. Forbes is also predicting that generative AI will soon start to make an appearance in the games we play.

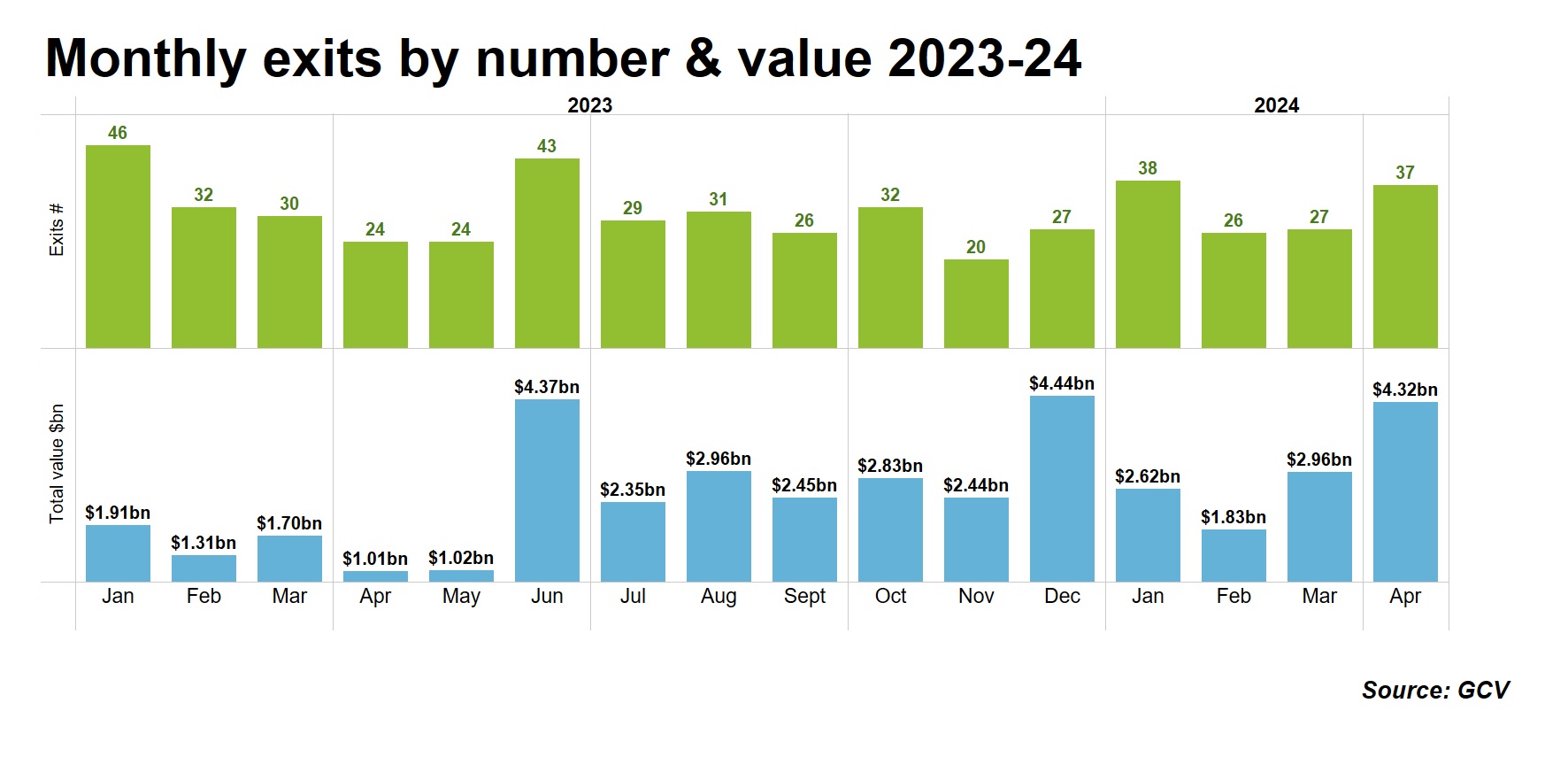

Exit numbers are up

April 2024 saw 37 corporate linked exits, up 37% from last month (27) and up 54% from April last year when there were just 24. The dollar value of these exits showed an even more prominent rise. Exits for April 2024 (for the transactions that were made public) reached a total of $4.32bn. That’s a 64% increase on last month, when the figure was $2.96bn, and a 327% increase from April last year, where the total value was estimated at $1.01bn.

The boost in numbers partly reflects the bumper $1.8bn acquisition of cancer drug developer ProfoundBio by Danish biotech company Genmab. Previous investors in ProfoundBio included corporate Eli Lilly. Other large exits included cloud and data security startup Rubrik’s IPO, which raised $752m. Investors in Rubrik included corporate Microsoft and insurance company MS&AD.

Digital couponing app Ibotta went public in April, with the shares rising 17% from its $88 IPO price, which was already at the top of the range bankers expected. The company’s market cap nudged above $3bn. Koch Industries is an investor in Ibotta.

But even stripping out the biggest exits, the healthy rise in the dollar value of exits in April is also a good sign that M&A and public market appetite might be growing.

India and China are bouncing back

India and China have seen some of the biggest falls in corporate investor deal flow over the past year. But now they are showing signs of rapid recovery. Startup funding rounds including corporate investors rose 50% from April 2023 and China they saw a 31% surge from last April.

The largest deal in India was from last week, when digital pharmacy PharmEasy raised $216m in a funding round led by leading medical research company Manipal Education and Medical Group, and supported by corporate Prosus among other investors. Although PharmEasy’s raise indicated an estimated 90% drop in valuation since 2021, the round was still the region’s largest corporate-backed deal.

The biggest funding round from China was Terminus Group, a company that leverages AI and IoT to develop products for smart cities. It raised $276m in a series D round supported by real estate developers Gemdale Corporation and artificial intelligence company SenseTime, among others.