The value of corporate-backed deals slumped in the third quarter, but sectors like energy and telecoms bucked the trend as did a few geographies like Israel.

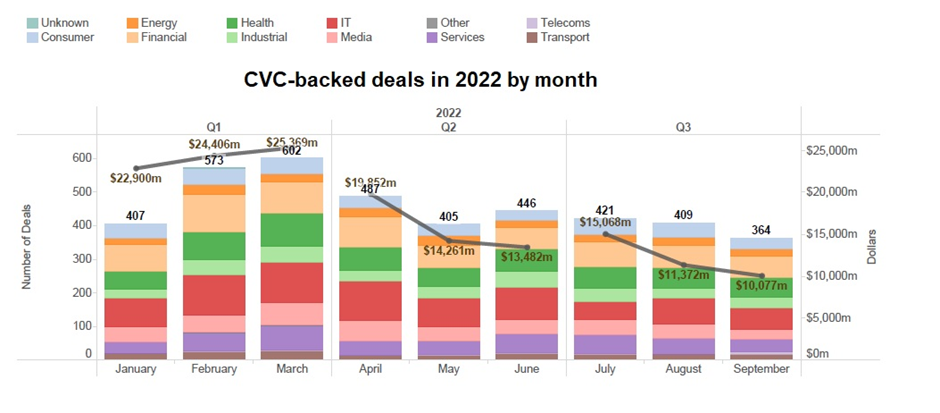

Corporate venture activity slumped noticeably across the board in the third quarter, with the number of rounds involving a corporate backers down 17% from the same period last year. The total value raised in those rounds was down 57% from the year-ago period. The same pattern was true also for exits and funding initiatives.

It wasn’t doom and gloom in all innovation geographies, however. Some, like Israel and UK, didn’t register a quarter-over-quarter drop in deals and there were several multi-billion dollar funding initiatives in geographies outside the US. The energy and telecoms sectors also saw increases in the number of deals, bucking the general trend.

Overall, however, corporates appear to be catching up with the risk-off attitude already assumed by their traditional VC peers. The total dollar value drop for the entire VC space –…