It is time for startups and investors to get pragmatic about down rounds

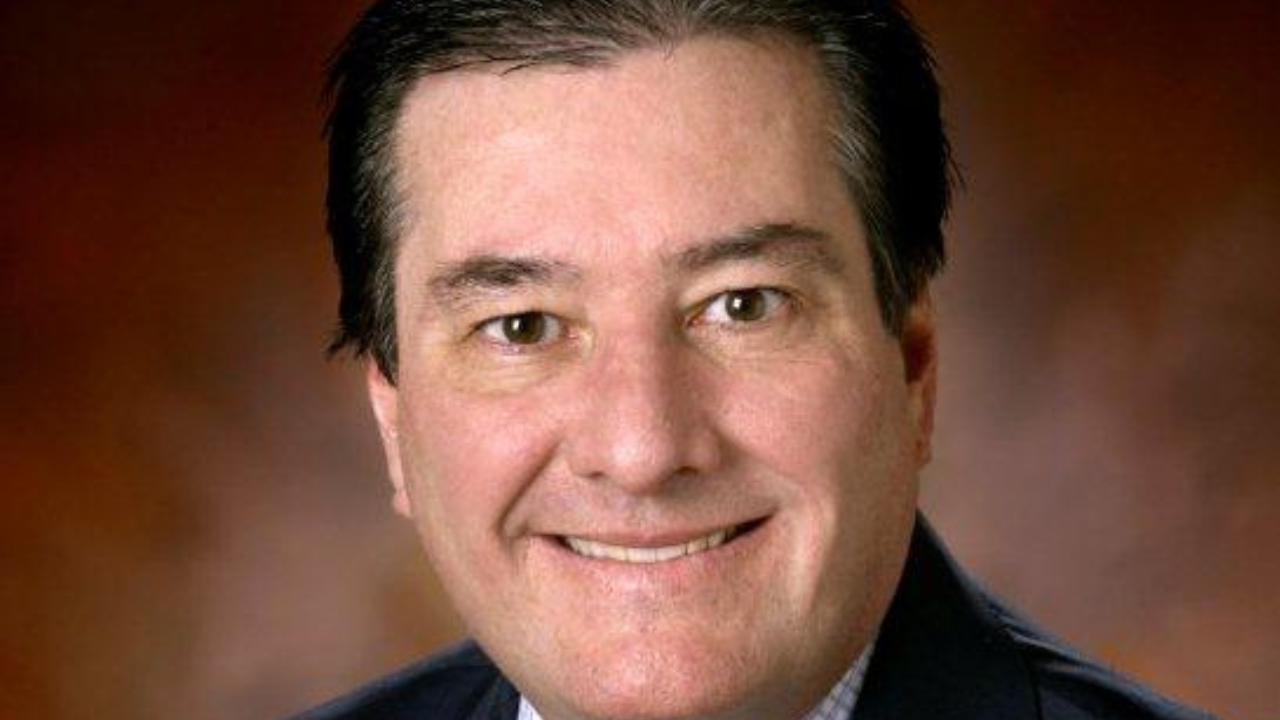

The investment downturn is likely to last through to the first quarter of 2024 and more companies will have to accept down rounds in order to make it through the current drought in capital, says Bill Taranto, president of MSD Global Heath Innovation Fund, the corporate investment arm of MSD.

Down rounds are already happening — in the first quarter of 2023, 10% of all corporate venture capital rounds raised by Europe-based companies were down rounds, which is the highest percentage since 2020 according to Pitchbook data cited by Taranto. But this is likely to be just the beginning.

In the first quarter of 2023, 10% of all corporate venture capital rounds raised by Europe-based companies were down rounds. This is likely to be just the beginning.

“In the US, we’re seeing a 95% drop in exits, that’s across M&A, IPOs and Spacs. That affects the European market because most European companies try to come to the US for an exit. Right now exits aren’t necessarily an option,” says Taranto.

The lack of exits, in turn, is making a lot of investors hold back on news financing rounds.

“There’s lots less capital in the market, which either means venture capital firms like ours are pulling back and waiting, or we’re being very choosy about who we invest in,” says Taranto. Europe-based startups raised just $10.4bn in the first quarter of 2023, compared with $29.5bn in Q1 of 2022, according to CBInsights.

And, at the same time, the crutch that many startups leaned on in 2022 — debt financing — has just become harder to access.

“Everybody was raising debt in 2022. [But] when you raise debt, you kick the can down the road. It comes due the next year, and then you got to either raise more debt or do a proper round and clean up that debt,” he says.

Now, even the debt market has run dry, especially as Silicon Valley Bank — one of the biggest providers of debt to startups — went bust earlier this year.

“The amount of money [in the debt market] has dried up and even if you are good enough to acquire debt, the cost is so much higher, because interest rates are going up. You have to have a spectacular P&L and a spectacular company to even get the debt,” Taranto says.

It is the perfect storm, and we are only now going to start to see its casualties.

Turnaround in 2024?

Taranto and his team are betting on this continuing through 2023 with a pick-up starting only after the first quarter of 2024. Most of the startups in the MSD GHI portfolio have equipped themselves with enough cash to last that long.

“We do believe in 2024, we’re going to start to see a turnaround. We hope it will started in the third or fourth quarter, but we have to get through the first three quarters to see that change.”

Taranto is worried that many companies — who will have already been struggling to raise for the past year — won’t have the reserves to get through another 12 months.

“What tends to happen is that companies wait too long. Even in Europe companies have less than 12 months of cash left, but it takes at least 12 months to raise your round. It’s a catch 22.”

“You would be surprised the lack of planning that occurs,” Taranto says. Part of it is simply not believing that markets will go down, and companies believing in their own greatness — that they will always be able to raise a round. It’s also down to the inherently hopeful nature of investors.

“I think the newer, less mature CVCs are going to bolt. If you started a fund in the last two years, you started at the wrong time. You don’t have enough performance under your belt yet.”

“We think the market is going to get better quicker than it actually does. This works in all types of investing, especially the venture market. We have hope. But hope is not a viable strategy,” says Taranto.

“What ends up happening is a lot of really good companies fold, not because they did anything wrong, or because they’re bad companies. It’s they just don’t have access to capital. And that’s what ultimately foils companies.”

He’s also worried that newer corporate investors will not survive.

“I think especially the newer, less mature CVCs are going to bolt. Because in the end performance trumps everything. If you started a fund in the last two years, you started at the wrong time. You don’t have enough performance under your belt yet.”

There’s not going to be many exits and then you’re going to take down rounds or some parts of your portfolio maybe even go bust. You will only have bad news. If you started in 2018 or 2019 your survival is going to be iffy.

Embrace the down round — it won’t be as bad as you think.

There is a way to avoid disaster, however, and that is, to embrace the need for down rounds quickly and decisively.

“I run into lots of investors and lots of companies that, for different reasons, don’t want to do those down rounds. But you can have access to capital if you’re pragmatic about the problem,” says Taranto. “You have options — going down the down round route. Because if you don’t do the down round, and you can’t get access to capital, then your other choices are bankruptcy or no funding.”

A down round should be considered a temporary measure, Taranto says.

“It’s okay to take a step back and say: ‘maybe my valuation was too high, I’ll re-establish a new valuation and then work to build that up again’.”

There are a few things worth noting about down rounds, says Taranto. First, not all down rounds are the same. Good companies with solid financials will have less painful down rounds.

“Good companies with a solid P&L and a good product good can still raise money. Even good companies may be forced to take a slight down this year, but they will have more options. It might only be a small 5% haircut versus a 20 or 30% haircut,” he says.

Down rounds can also be relatively small. About twelve months’ worth of cash is all you need.

“It’s not as simple as raising your hand and taking a down round.”

“People don’t realise you don’t have to raise massive rounds. All you have to do is raise enough to get you to this downturn, simply about a year’s worth of cash. That’s all you need. The down round can be small. And then when you build a company back up again, you raise the higher round at the back at the higher valuation.”

Finally, you have to do some preparation to do a down round correctly.

“It’s not as simple as raising your hand and taking a down round.”

Taranto has a five key tips for how to manage a down round well. He is planning to share these at the GCVI Symposium in London on 20 June.

Click here to find out more of the event. We will also be sharing learnings from this event on the GCV website following the presentation.

Maija Palmer

Maija Palmer is editor of Global Venturing and puts together the weekly email newsletter (sign up here for free).