Healthcare systems are failing BIPOC women, but entrepreneurs are trying to fill some of the gap — if they can get the funding.

Photo courtesy of FreePik

Healthcare is failing women of colour. Black women are three times more likely to die from pregnancy compared to their white counterparts according to the Centers for Disease Control and Prevention, the US national public health agency.

In the UK, Asian women are 1.8x more likely to die during childbirth compared to white mothers, according to a report by MBRACE UK, a UK government organisation that researches deaths in pregnancy.

UK charity Birthrights claims that mothers of black indigenous people of colour (BIPOC) origin feel unsafe and ignored when it comes to their symptoms, pain and care management which contributes to their greater likelihood of death. Factors such as lack of research and racism have been posited as the cause for this harsh statistic.

This is a gap where venture-funded organisations could potentially step in.

In addition, many entrepreneurs have now emerged, namely non-white women, who are creating startups and technology to support BIPOC mothers and women. Media and technology platform developer Narrative Nation, for example, seeks to tackle disparities in racial maternal and infant health. However, these startups often struggle to find the funding to take their technology to its fullest potential. Could the corporate investment sector do more to back these initiatives?

The startups tackling healthcare inequality

The femtech market overall is growing fast, predicted to grow from $5.79bn in 2022 to $20.59bn by 2030 according to Fortune Business Insights, the India-based market research company. Every Mother, a US-based company that offers evidence-based exercise therapy for mothers, raised $1.5m in a seed funding round in 2020; with participation from Serena Williams’ venture firm Serena Ventures.

Femtech focused on minority women, too, has gained traction. In January, Health In Her Hue, a digital platform that connects black women and women of colour to culturally sensitive healthcare providers, raised $3m in a seed round with corporate investors including Johnson & Johnson’s Impact Ventures and Morgan Stanley Ventures, the corporate venture unit of financial company Morgan Stanley.

Maternal healthcare company Mahmee raised $9.2m in a Goldman Sachs-led series A round in 2022.

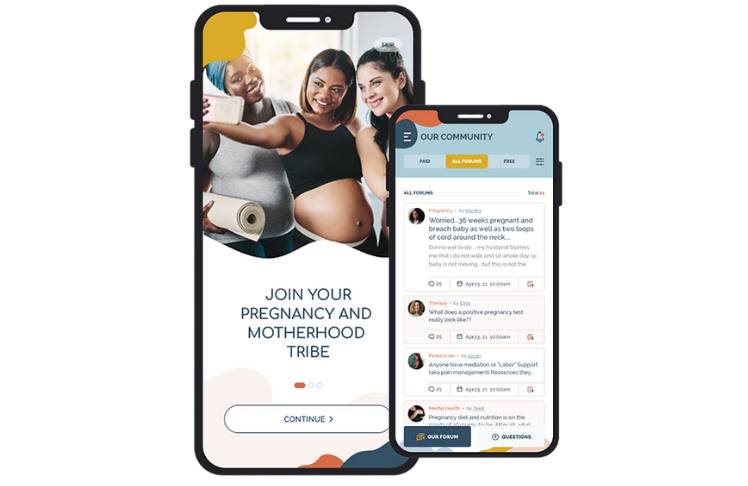

One startup, focused on BIPOC women, which came out of the Google for Startups accelerator progamme, is Wolomi. It is creating a US-based digital community for women of colour working to improve maternal outcomes. The company supports BIPOC women through pregnancy and motherhood, providing community care and experts for better outcomes and experiences through this process.

Layo George, founder and chief executive says that the focus on community is what makes her startup unique.

“Our ability to centre around community and allow BIPOC mums to thrive amongst a group of like-minded individuals, where they don’t have to explain themselves and just be who they are, is what makes us stand out. Gaining that authentic trust and delivering culturally competent care is what makes us different,” she says.

George continues: “We are also led by a clinical person and a woman of colour who is creating a space for someone who is like her. Oftentimes you see these spaces being created by people who don’t understand our community which is something BIPOC women need.”

The importance of George’s platform can not only be felt in the US but globally. “I get emails all the time from people in Europe or the UK saying they are dealing with the same thing as US BIPOC mothers. So we are creating a better and dignified way of supporting mothers globally to make people feel good about the care and support they need during this journey,” George says.

Will digitisation and AI exacerbate inequality?

Healthcare is changing, especially with the rise of digital software and artificial intelligence. While digitisation can make healthcare more efficient, George worries that it may replicate — or even exacerbate — inequalities.

“In some ways, the digital world will help keep the healthcare system more efficient and deliver more accurate care to many. But, the digital world will follow trends in the healthcare system,” says George.

“AI only reads human behaviour, it is an aggregate for human behaviour so it will not pay attention to nuances with race. This is why startups like Wolomi are so important. We provide the real human aspect of the BIPOC experience. Whatever input you place in an AI will provide the same results seen in current healthcare,” she says.

For George, BIPOC women must be at the forefront of digital change to ensure their needs are met in the data.

One of the ways to minimise bias in digital healthcare is to make sure that there are plenty of startups with diverse founders in this sector, says Arianna Kidder, partner at Seae Ventures.

Seae Ventures is a $107m fund dedicated to investing in women and BIPOC-led companies focusing on women’s health, mental health and IT sectors. The firm has 16 companies in its portfolio and has invested in 24 startups including Needed, Kiyatec and Altopax.

Seae Ventures was spun out of healthcare insurance provider Blue Cross Blue Shield of Massachusetts’ Zaffre Investments unit in June 2022. The firm is backed by pharmaceutical conglomerate Eli Lilly and managed care company Health Care Service Corporation.

“Diverse teams drive higher returns and have a material impact on delivering better health outcomes,” she says. “Underrepresented founders are often solving problems for underserved populations.”

Kidder continues: “Addressing the care needs of these populations can go a long way towards addressing the range of health inequities in this country. The benefit is both societal, in terms of equal access to quality care, and a cost savings to all.”

Why investment still lags

The BIPOC market offers huge investment potential. A recent article by Skoden Ventures, a boutique venture fund that invests in indigenous, black, and brown women entrepreneurs, found that since 2012, $10 trillion of potential wealth from BIPOC business has been lost.

But investment still lags.

“In the US, 1% of the startups being invested in are led by women, and those startups being led by minority women is even less than that,” says George.

Kidder agrees: “Despite growing awareness of the lack of funding for diverse entrepreneurs, the numbers have held relatively steady over the years and declined proportionally more in 2022 when overall venture investment declined. This signals that any pullback in venture funding disproportionately impacts women and minorities who are already at a significant disadvantage.”

“People tend to gravitate to, and in this case invest in, what they know,” says Kidder. “The traditional venture landscape is dominated by white men from elite institutions and they tend to source opportunities from within those networks. We believe that as diverse managers, our networks are an advantage in surfacing entrepreneurial opportunities that may have been overlooked by traditional venture firms.”

Layo says that investors are too focused on returns rather than realising the potential of healthcare startups for minority women. “When I tell certain investors about my product, the first thing they ask is if it is going to make them money. I have also had investors tell me I should be a social media influencer rather than continue my business,” she says.

She continues: “It was strange because there are many business platforms out there to support men’s and women’s health that have been successful – but I was specifically told that I should focus on influencing even though I am a nurse by background and have a Master’s degree in healthcare administration.”

George thinks the lack of investment is down to two things: lack of a globalised mindset and racism.

“Many investors think that the BIPOC population is small so it won’t make any money, which is of course untrue, I mean look at how big Africa and Asia is – we are everywhere,” she says. “I also think that VCs and CVCs don’t take us seriously. It’s hard to say because I am the recipient of this, so I can’t explain why they are not investing – and I shouldn’t be the one explaining if there is racism,” she says.

“I can only really speculate why CVCs are not investing as much as they should. But I think it’s the same reason why black women are dying at an alarming rate in the US healthcare system, there just is not the system there to support us.”

Wolomi, founded in 2019, is planning to raise funding this year. “We wanted to nail down what we were selling and grow fast before we focused on financing,” George says.

Although George knows funding may be hard to raise, she is determined to take the business forward, one way or another. “I don’t want to wake up every day and feel like I am a victim of the system. I know what I am creating and why I need to create it. I have no choice, it’s life for death for women who look like me. So it’s great to have the financing to become sustainable, but we have to act regardless of the investment or what the statistics show,” she says.

Corporates begin to explore the sector

It is not all doom and gloom. Some corporations have begun to take notice, such as US-based healthcare company CVS Health, which committed $600m to address racial inequality in healthcare and provide greater access to healthcare for BIPOC individuals.

Eli Lilly and Company also have a $350m Social Impact Venture fund which aims to stop the racial injustice of black Americans and marginalised groups in the US.

Wolomi, meanwhile, was helped by the initial push from Google for Startups, the corporate startup programme run by US-based conglomerate Alphabet.

“Google for Startups has been amazing. They believe in us and understand us. The fund was created by BIPOC leaders in the Google family so they took their time to figure out what we need,” George says.

John Banta, president and managing director at Blue Venture Fund says that his team is starting to address some of the challenges faced by minority women in healthcare. “We are trying to address affordability and equity, the rural health crisis and the behavioural health crisis, particularly adolescent behavioural health. We are trying to ensure behavioural health is integrated more with primary health care,” he says.

Progress may be slow, but CVCs are slowly beginning to see the potential in investing in healthcare for minority women.

“The scope of innovative solutions in the market today is truly breathtaking. There are so many talented entrepreneurs who see an opportunity to improve a piece of the healthcare system and are dedicating their lives to building companies to have an impact. It’s in our collective best interest to ensure that everyone has access to the healthcare they deserve,” says Kidder.