An overwhelming majority of respondents in our poll said they took board seats — mainly to influence and help the startups in their portfolio.

Last week we asked corporate investors to tell us if they took board seats at their portfolio companies or not — and if they did, whether those were observer or director positions.

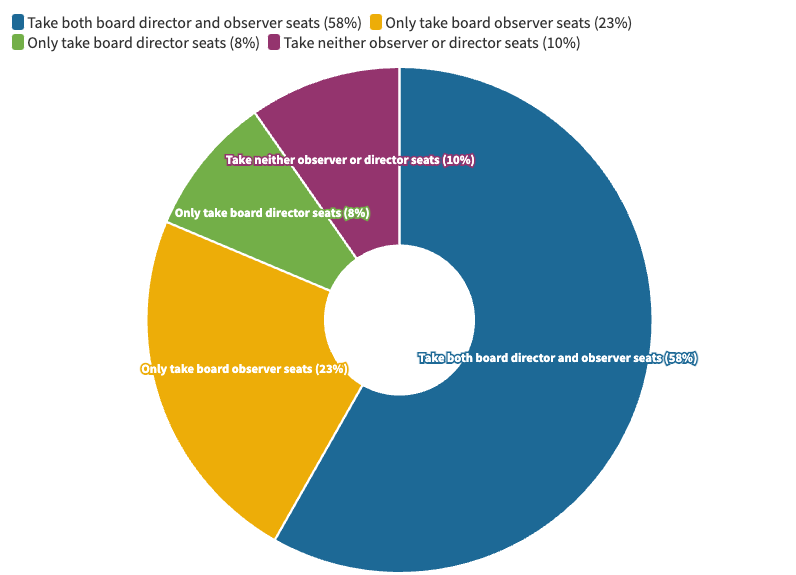

The answer was pretty clear. The overwhelming majority — 90% — of the respondents to our poll said they take some kind of position on the boards of portfolio companies. Only 10% do not.

‘It is essential to take board seats to have an influence on the company,’ one respondent told us.

We had some 134 respondents to the poll, both through our newsletter and on LinkedIn, including some of the big names in corporate venturing including Citi Ventures, TDK Ventures, Woven Capital, HG Ventures to name just a few.

The reasons for taking board seats tended to be about being able to influence the portfolio company and to find business collaboration opportunities.

“Although our participation is usually small (mostly 1-5%), we ask for observer seat in order to be best positioned to identify opportunities for synergies between the companies,” one respondent told us.

Board seats are “very important to help the startup develop with an insider’s view in the sector,” said another.

The majority — 58% — take a mixture of director and observer roles, with around 23% taking just board observer seats.

Sometimes observer seats are a deliberate strategy. “Observer is likely best practice for purely strategic CVCs,” one respondent told us. Sometimes there are concerns that if a startup is seen as too much under the influence of a corporate investor, it might scare away other clients and investors. In these cases the observer role can give a sense of more separation.

However, for some, an observer role is a fallback. “We usually take a board seat with the observer seat more optional,” said one investor. “If we lose the board seat we get an observer seat.”

This question is part of our annual CVC benchmarking survey of corporate venture funds. If you’d like to take part in the full study, please 👉 click here.

All respondents will get a copy of the GCV Touchstone Survey, published in January. The survey covers a broad range of industry-critical topics, the more questions answered, the richer the data we can make available to you and the CVC community. We appreciate your support!

Maija Palmer

Maija Palmer is editor of Global Venturing and puts together the weekly email newsletter (sign up here for free).