Some 31% of corporate investors told us that the main thing they wanted to get from their startup investments was insights.

Corporate investors all have strategic reasons for investing in startups — but which are the most important?

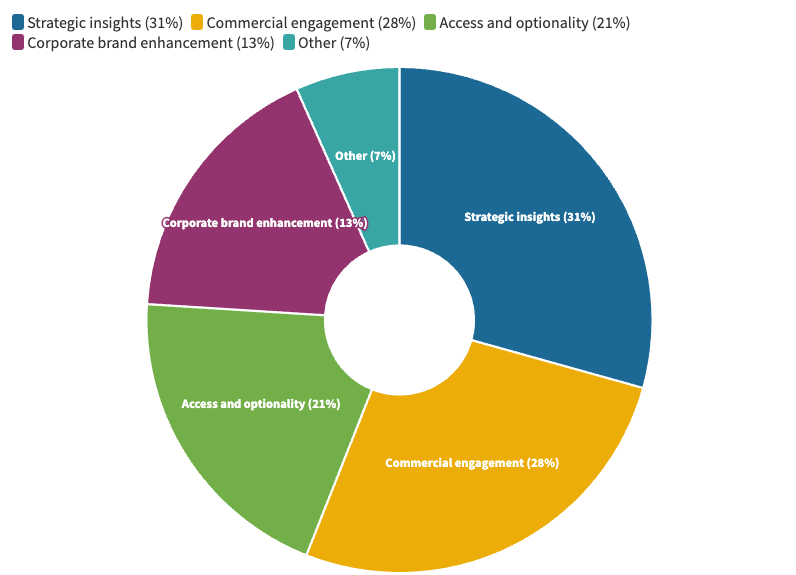

Some 31% of corporate investors who took part in our recent poll said they were looking for strategic insights — a view on emerging technologies, a look at where markets were going.

Commercial engagement with the startups came a close second, with 28% citing this as their main strategic driver for investing. This isn’t surprising as we have seen an increasing number of corporate venture units investing in business development teams that can create collaboration opportunities between portfolio companies and the parent corporation.

Access and optionality — that is, access to new technologies and options to acquire startups — was the key strategic reason for investing by 21% of corporate investors. The least popular of all was using startup investment to look good. Only 13% said that enhancing the corporate brand was their main reason to invest.

This question is part of our annual benchmarking survey of the CVC ecosystem. We’d like to invite every CVC to fill in the full survey so that we can build up a full picture of what “good” looks like for the industry. Survey answers are anonymised and cannot be traced back to individual respondents. All respondents will receive a free copy of the benchmarking survey, which is published in January.

Maija Palmer

Maija Palmer is editor of Global Venturing and puts together the weekly email newsletter (sign up here for free).