There is potential to create several $1bn-plus companies focused on products and services for older adults. But few corporate investors have this on their radar yet.

In 2023, Japan had the third lowest number of traffic fatalities since records began in 1948. But a disproportionate number of those road fatalities that did occur were caused by older drivers. Elderly drivers accounted for nearly 55% of total traffic-related deaths last year, only a slight decrease on the year before.

This is one of the many issues that Japan is grappling with as its elderly demographic balloons. The Asian country has the world’s fastest ageing population: one in three citizens are 65 and older. It poses a quandary for carmakers. As a growing portion of Japan’s adult population becomes too old to drive because of age-related symptoms such as poor eyesight and slow reaction times, the percentage of customers it can sell cars to shrinks.

But the rapid shift in demographics also presents opportunities for mobility companies willing to invent new modes of transport for older customers. This demographic also tends to have more money to spend compared with younger consumers.

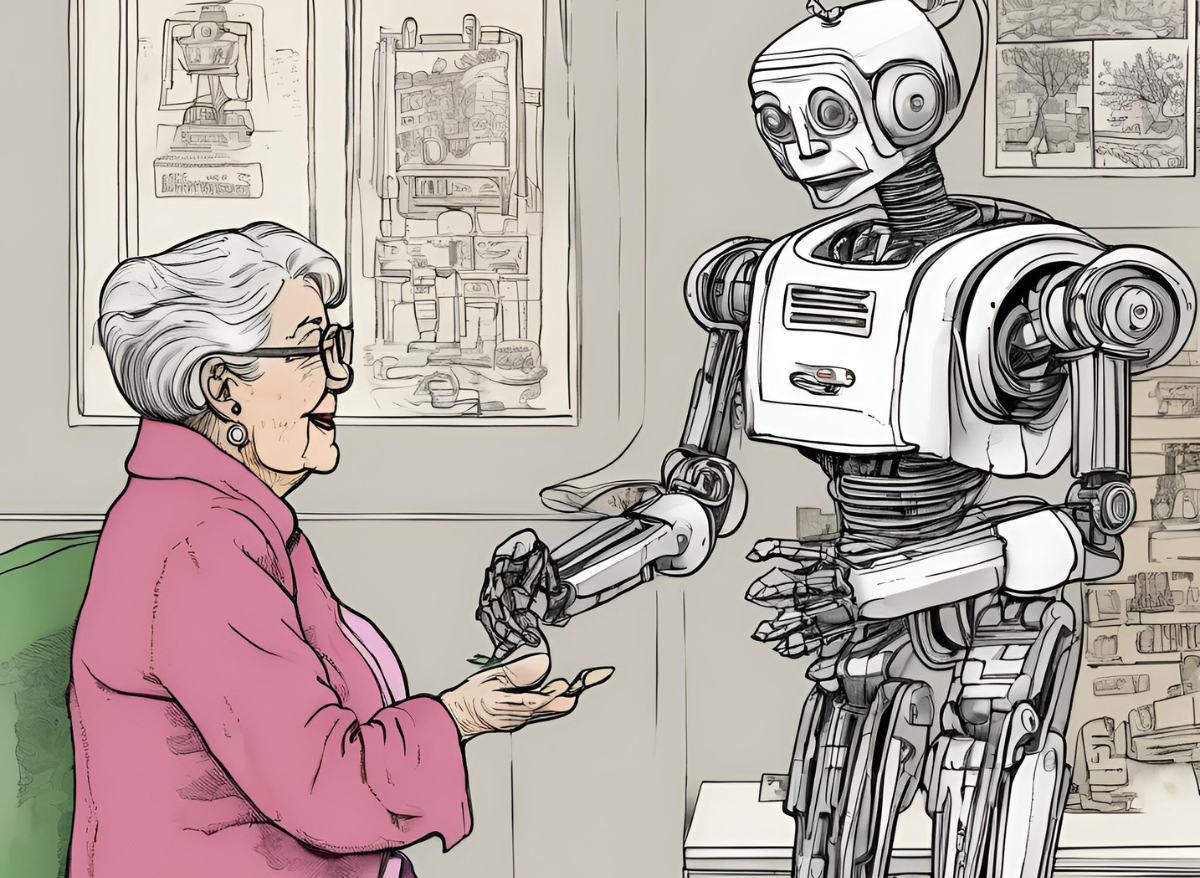

Woven Capital, the growth-stage investment fund of Japanese carmaker Toyota, has invested in two startups that cater to older customers: Whill, a short-distance mobility vehicle, and Intuition Robotics, a digital care companion.

Michiko Kato, partner at Woven Capital, says the CVC’s investment thesis naturally encompasses older customers as part of its parent’s aim to be a provider of multimodal mobility for all ages.

Japan is an extreme example of a rapidly ageing population, but the so-called silver tsunami of retirees is prevalent in a growing number of developed countries, including several European nations such as Italy, Finland and Portugal.

The impact of ageing consumers cuts across most sectors of the economy, including health, mobility, consumer and finance. But, despite the shift in demographics globally, it is hard to find many examples of corporations doubling down on investments in technologies that address ageing consumers.

Untapped potential

“I don’t see demographic change as a topic for many corporations,” says Philipp Maul, chief executive of 120 Ventures, the venture studio of ÖAMTC, an Austrian emergency services and roadside assistance company.

“It should be. It is a huge and obviously expanding market. There’s an immensely untapped potential there.”

The market for agetech could grow to $2 trillion, according to an estimate by 4Gen Ventures, a VC agetech fund. Technologies for older generations include smart appliances, in-home connected devices, wearable robotics and digital care companions.

Retirees are a valuable consumer demographic because the have spending power. The 50-plus population accounts for half of global consumer spending. By 2050 this figure will reach nearly 60%, or $96 trillion, according to an economic analysis done on behalf of AARP, an advocacy group for older Americans.

Venture capitalists who see the potential for agetech include David Krane, head of GV (formerly Google Ventures), who is quoted as describing the agetech sector as “hot” and predicting that more people will wake up to the investment opportunities that the market offers.

The few corporates that have invested in agetech (aside from biotechnology and pharmaceutical sectors) include Japanese electronics maker Edion, which launched a $63m CVC fund in June this year to invest in age-related technologies that address the shifting demographics of its consumer base.

In Europe, Miele Ventures, the corporate venturing arm of German appliance maker Miele, recently backed health monitoring app and device maker Hello Inside, whose target audience includes older women experiencing menopausal symptoms.

‘Death tech’ is also a growing sector. DMG Ventures, the CVC of UK media group Daily Mail and General Trust, invested in Farewill, a UK-based funeral preparation and will writing service. Japanese wedding and funeral services firm Alpha Club Musashino formed a corporate venture arm, Lifeshift Innovation Fund, in June this year to invest in funeral-related technologies.

Discerning consumers

The team at Toyota’s Woven Capital were drawn to Whill because of the sleek design of its electric mobility scooter, which they felt was more refined than typical electric wheelchairs. Design is important for older people in places like Japan where they tend to live long lives and so could potentially use a device like an electric mobility vehicle for decades.

“Just because customers are aged doesn’t mean they don’t care about design or function. Having an attractive option is becoming more and more important for senior people,” says Kato.

“The market for senior cars will expand more. As a corporate we do have some in-house options, but we wanted to support having more options for drivers,” she says.

Austrian mobility services group ÖATMC is unusual among corporates for making demographic change central to its investment thesis.

“Everything that we do has some element of demographic change at its core,” says Maul, who heads the company’s venture studio, 120 Ventures.

Four years ago, ÖATMC started to consider the future challenges that its 2.5 million members in Austria, and the general population in Europe, might face.

“One of its three strategic pillars is preparing for shifting demographics – which services can it can offer members, other parts of Austrian society, and to a certain extent the European and global society. This fits the core purpose of ÖAMTC but goes beyond its core business, into new markets, into new demographics,” says Maul.

“If you look at the care sector – not even health tech just care – there are so many topics where you can build five or six unicorns.”

Philipp Maul, CEO, 120 Ventures

The company decided the best way to look at opportunities in agetech was to form a venture studio that builds startups from the ground up.

Formed in 2023, the venture studio has three startups in stealth mode: One is a fintech solution for pension saving. Another is a technology platform providing information on how to get support and funding for care. The third is a matching service for people looking for short term care.

The overlooked care tech sector alone has the potential to create $1bn-plus companies in Europe, says Maul.

“If you look at the care sector – not even health tech just care – there are so many topics where you can build five or six unicorns.

“It is a market where Europe is leading the world. It is really big because of the social systems and structures that we have in the different countries,” he says.

Back in Japan, Kato says the country is a good test bed for agetech products and services.

“Japanese consumers tend to be very sophisticated and severe in selecting products,” says Kato. “If they can succeed in Japan, they can go abroad. I am passionate in supporting these ambitious companies.”