Klarna's 83% drop in valuation to $6.7bn is the most visible harbinger of a buy now, pay later sector suffering from defaults and competition - some from the same corporates investing there.

Klarna secured $800m yesterday from investors including fashion brand Bestseller and Commonwealth Bank of Australia (CBA) in a round that shrunk its valuation 83%, as buy now, pay later (BNPL) services suffer a post-lockdown hangover.

The round valued the Sweden-based company at $6.7bn, down from the $45.6bn valuation at which it last raised cash, in a $639m round led by telecommunications and internet group SoftBank’s Vision Fund 2 in June 2021 that pushed its total funding past $3.3bn. It is likely to be the largest inter-round valuation drop for a pre-IPO, VC-backed company yet reported.

Vision Fund is the corporate that invested in Klarna at peak valuation but it is far from the only one to back the company at an inflated price. Media group Bonnier bought shares in September 2020, the same month Klarna raised cash at a $10.7bn valuation.

Financial services provider Ant Group invested in September 2019, after CBA had provided $100m in a round valuing Klarna at $5.5bn the previous month before adding $200m the following January. Fashion retailer H&M had supplied $20m in 2018, the year after Klarna raised cash at a $2.5bn valuation, but the latest round likely diluted its shareholding far enough that it too could well be looking at a loss.

Although it is facing some of the same issues as the overall tech sector right now following a period of heady growth during 2020 and 2021, the BNPL sector has its own particular issues.

Customers are defaulting on loans in financially significant numbers but perhaps more crucially, the technology is being adopted by incumbents – in this case by some of Klarna’s own strategic investors.

A rapid rise in activity

BNPL offerings, which allow e-commerce customers to buy a product immediately and spread the payment over a series of instalments, was one of the winners in the covid era, benefitting from a large increase in online spending, expanded adoption of digital payment tools and consumer caution related to job insecurity.

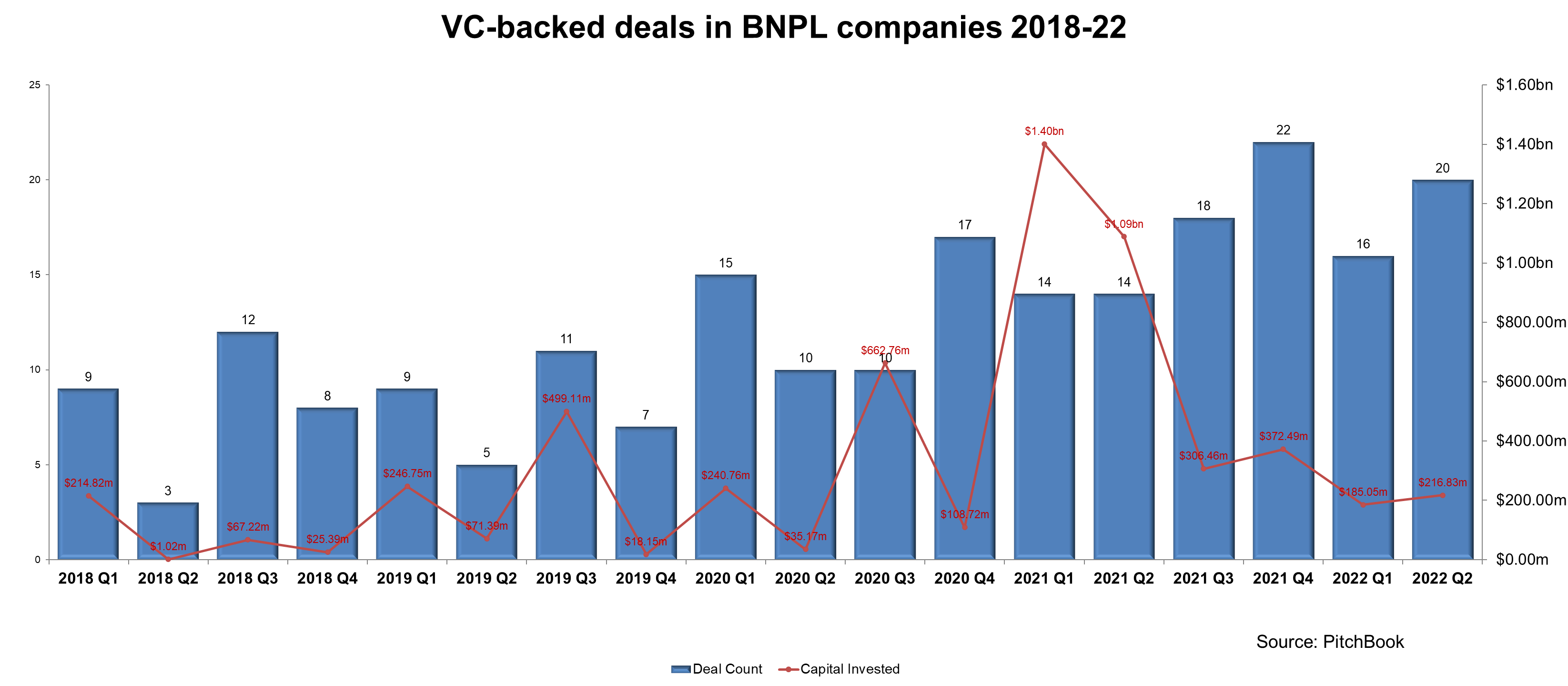

Quarterly funding for BNPL providers shot up to a peak of $1.4bn in Q1 2021 according to Pitchbook data (pictured). Activity fell slightly to nearly $1.1bn in Q2 and has been declining since, with 2022 only recording a touch over $400m in the first half of the year.

Klarna was the most visible face of the sector in this time. It was quick to point out yesterday that this valuation is triple that of the company in 2019, having more than doubled its US users year on year to 18 million as of the mid-2021 round. Its app has been downloaded more than 60 million times and its worldwide user base stands at 150 million today.

Bur Klarna is not the only big name in the BNPL space. US-based Affirm went public in a $1.2bn initial public offering valuing it above $11bn in January 2021. Block, the payment technology provider then known as Square, agreed in August to buy Australia-based Afterpay in a $29bn all-stock deal.

Two big issues for the BNPL sector

Despite all that activity, the clouds were already beginning to form, with two problems in particular to impact the sector’s startups.

The first is the default rates. While Klarna has not disclosed details on how many of its customers default on part or all of the money they owe, Affirm’s latest accounts show a the amount of outstanding loans at least 30 days late had more than doubled year on year from 1.4% to 3.7% by March 2022.

Australia-listed Zip meanwhile revealed last week that its bad and doubtful debt provision has risen to 12.4%, an announcement followed by news this morning that a planned merger with US-based counterpart Sezzle had been called off.

The other is the increasing rate of adoption by larger financial and payment service providers, including three of Klarna’s corporate backers. Ant has allowed users of its Alipay platform to access credit through a service called Huabei since 2014, but CBA launched its BNPL service in March 2021 before Visa began offering customers the option to add BNPL options to their services a few months later.

A wider-ranging problem

However you slice it, Klarna’s huge valuation cut is part of a wider trend in the industry, something it acknowledged when disclosing the round, claiming the valuations of its peers have fallen 80% to 90% from their peak valuations.

Affirm’s market cap is currently around the $6.5bn mark, an 87% fall from its peak valuation in November 2021, while Zip’s is down a huge 95% from last August. The final price Block paid for Afterpay when the deal closed in January may have come out as $13.9bn – under half the initial price – but that still seems exorbitant right now.

It’s also worth noting there are a range of smaller operators behind the headliners, most notably UK-headquartered Zilch, Colombia-based Addi and Billie, which operates out of Germany. All three have netted nine-figure sums in the past year through corporate-backed rounds valuing them above $600m.

Despite the valuation drop and a cost-cutting exercise that involved it cutting 10% of its 700-strong workforce last month, Klarna’s brand recognition may be enough to see it through despite increased competition, especially if the market crunch thins down the competition.

The biggest issue however must be the delinquency rates, which the company has always claimed are low but which are certain to rise amid reports low-income customers are using the app to buy everyday items like groceries or petrol as inflation bites, as opposed to one-off consumer purchases. If we begin to see those customers default in large numbers, Klarna could be looking at much more than just a down round.

Photo courtesy of Klarna Bank AB.