The cancer drug developer popped after an upsized offering, allowing Alexandria Venture Investments to exit and showing the IPO market is still breathing in the US.

Precision cancer therapy developer Acrivon Therapeutics provided a brief glimpse of hope for the US public markets this week, floating in a $94.4m initial public offering and seeing its shares pop on their first day on the Nasdaq Global Market.

The company’s investors include Alexandria Venture Investments, the venture capital arm of life sciences property manager Alexandria Real Estate Equities, and it issued just over 7.5 million shares priced at $12.50 each. Its shares closed at $15.72 yesterday, up nearly 26% from the IPO price giving it a market cap of approximately $294m.

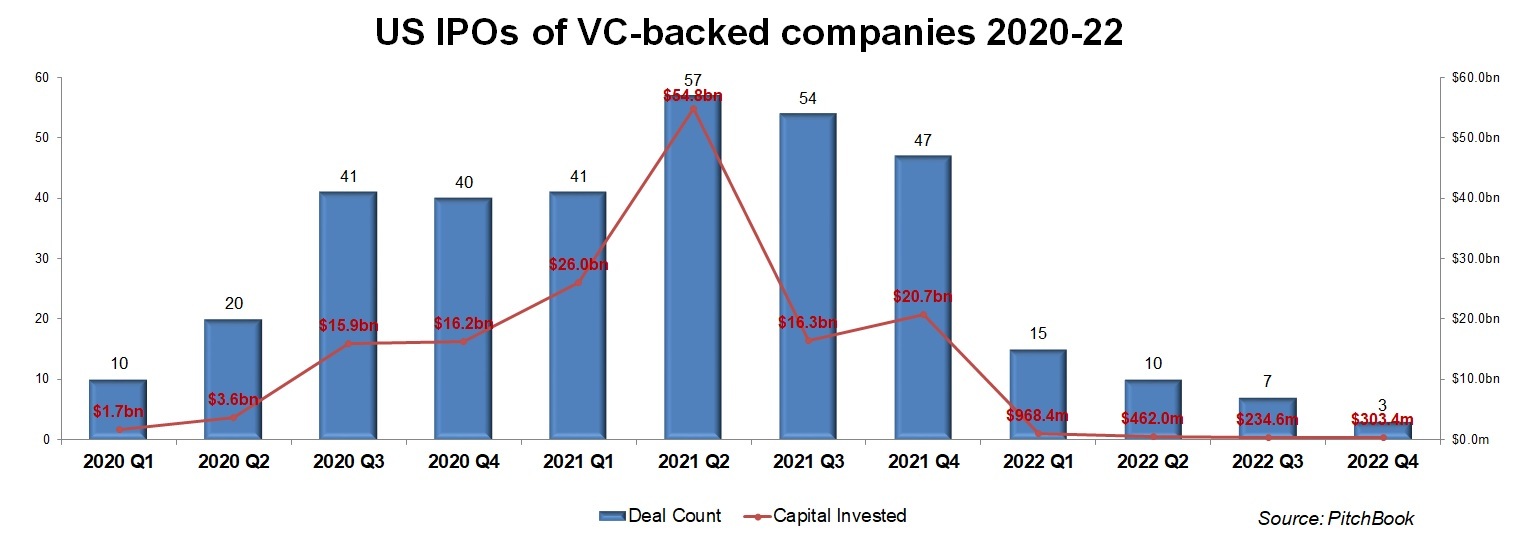

The offering comes in the wake of a dismal year for IPOs in the US. As the chart below shows, the total raised by VC-backed companies over the first three quarters of 2022 was under $1.7bn, a small fraction of the total in any of the preceding six quarters.

Acrivon’s IPO wasn’t all plain sailing – it upped the number of shares in the offering from 5.9 million but priced them well below the $16 to $18 range it set a month ago. But its largest shareholder, an investment vehicle called Chione, is buying a further $5m through a private placement, and the IPO could top $108m if the underwriters take up the over-allotment option.

The company has created a precision oncology platform which can match individual patients to medicines best suited to treat their particular tumour, and it will put the IPO proceeds into phase 2 clinical trials for its lead product candidate, ACR-368, licensed from pharmaceutical firm Eli Lilly.

An ongoing drought for US IPOs

Flotations have been relatively rare for tech companies this year, particularly in the US which has seen activity virtually flatline on the larger exchanges like Nasdaq and the New York Stock Exchange. The meagre numbers have been hit further by some startups opting to list through reverse mergers rather than IPOs.

The numbers represent a significant fall from the heights of 2021, when electric jeep developer Rivian’s $11.9bn IPO headed a list that included Robinhood, Asian startups like Kuaishou, Coupang and Didi – all of which raised 10-digit sums in US flotations – and direct listings for the likes of Roblox, Warby Parker and Coinbase.

The party was coming to a close by the end of 2021 as tech stocks began to fall, and that’s continued in earnest this year along with interest rate rises and concerns about a recession on the horizon. The drought for the first nine months of this year was the longest in some two decades, beating both the period following the dotcom crash and the 2008 financial crisis.

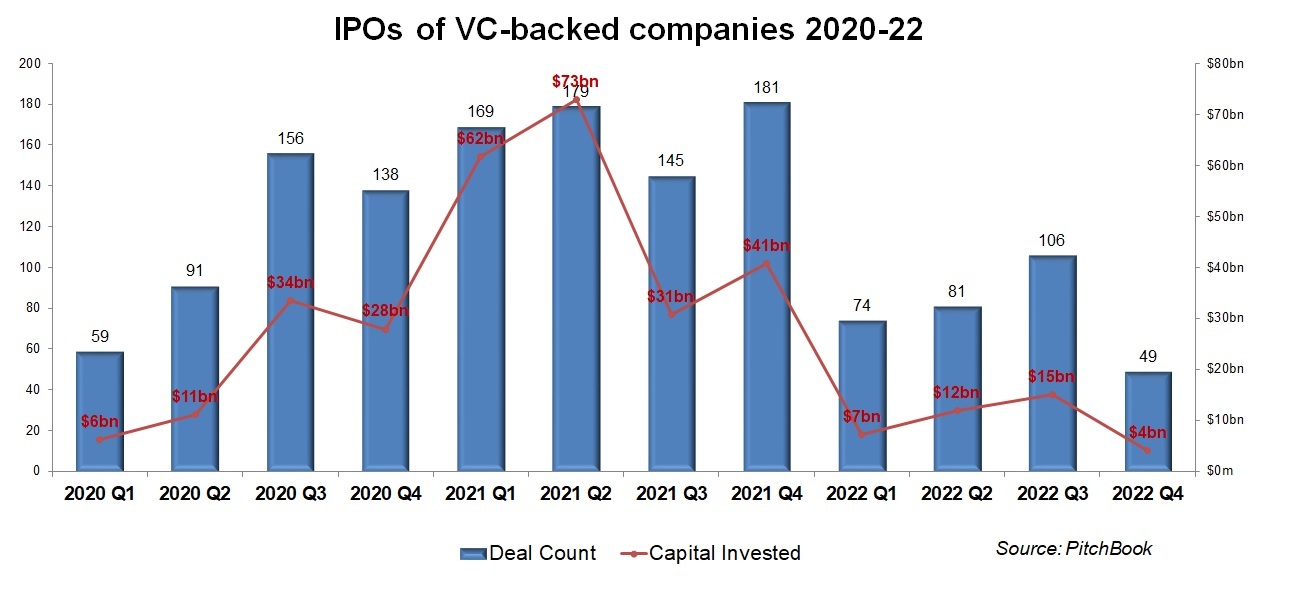

Interestingly, the impact has been felt less in Asia, meaning the fall for offerings worldwide has not been as pronounced (see graph below). IPOs are still down in Japan but not to the same extent, while China has recorded relatively strong numbers, partially because so many domestic companies have delisted in the US in order to float at home.

Acrivon’s own offering came in the wake of $115m of funding, most recently in a $100m series B round in late 2021 backed by Alexandria, which has become one of the most active investors in the life sciences sector over the past five years. This is Alexandria’s third public markets exit of the year, following a $1.2bn reverse merger for Greenlight Biosciences in February and a similar deal for Senti Biosciences four months later.

The last significant slump in the IPO market was eded by a flurry of activity in the biotech sector.

It’s worth noting that the last significant slump in the IPO market, in the middle of the 2010’s, was ended by a flurry of activity in the biotech sector, which was responsible for 44 US offerings in 2017 alone.

Life sciences companies represent an interesting element in the VC ecosystem as they largely float before their products are commercialised, in comparison to startups in other sectors that need to show revenue. They don’t tend to raise huge amounts as a result, but in theory they also shouldn’t be subject to the same market pressures.

In that regard, onlookers will hope Acrivon’s IPO is a harbinger of increased activity in 2023. If we start seeing drug developers target the public markets for the capital they need to complete late-stage clinical trials, that increased activity might be the trigger for flotations in the wider market, particularly for late-stage companies looking to avoid a big valuation drop in their next round.

Stripe and Instacart were among the most valuable corporate-backed companies to miss the last IPO window while the likes of SpaceX and Databricks are also still in play. Move outside North America and you can add Canva, Revolut and TikTok owner ByteDance to the list.

It’s clear there are valuable players out there and returns to be made. It may not be the biggest flotation, but every Acrivon is vital if confidence in the market is going to be restored.