MOL Plus, Maersk Growth and IMC Ventures will maintain the investment pace next year while exploring ways to further transform the industry.

Corporate investors in the logistics sector are optimistic about the investment climate in 2024, and say they are particularly looking to back startups in areas such as automation, sustainability and supply chain optimisation.

More forecasts for 2024

- Transport in 2024: investors eye pick-up in startup deals after a stalled year

- Energy in 2024: Plenty of funding rounds but few exits, say energy investors

Automation and AI

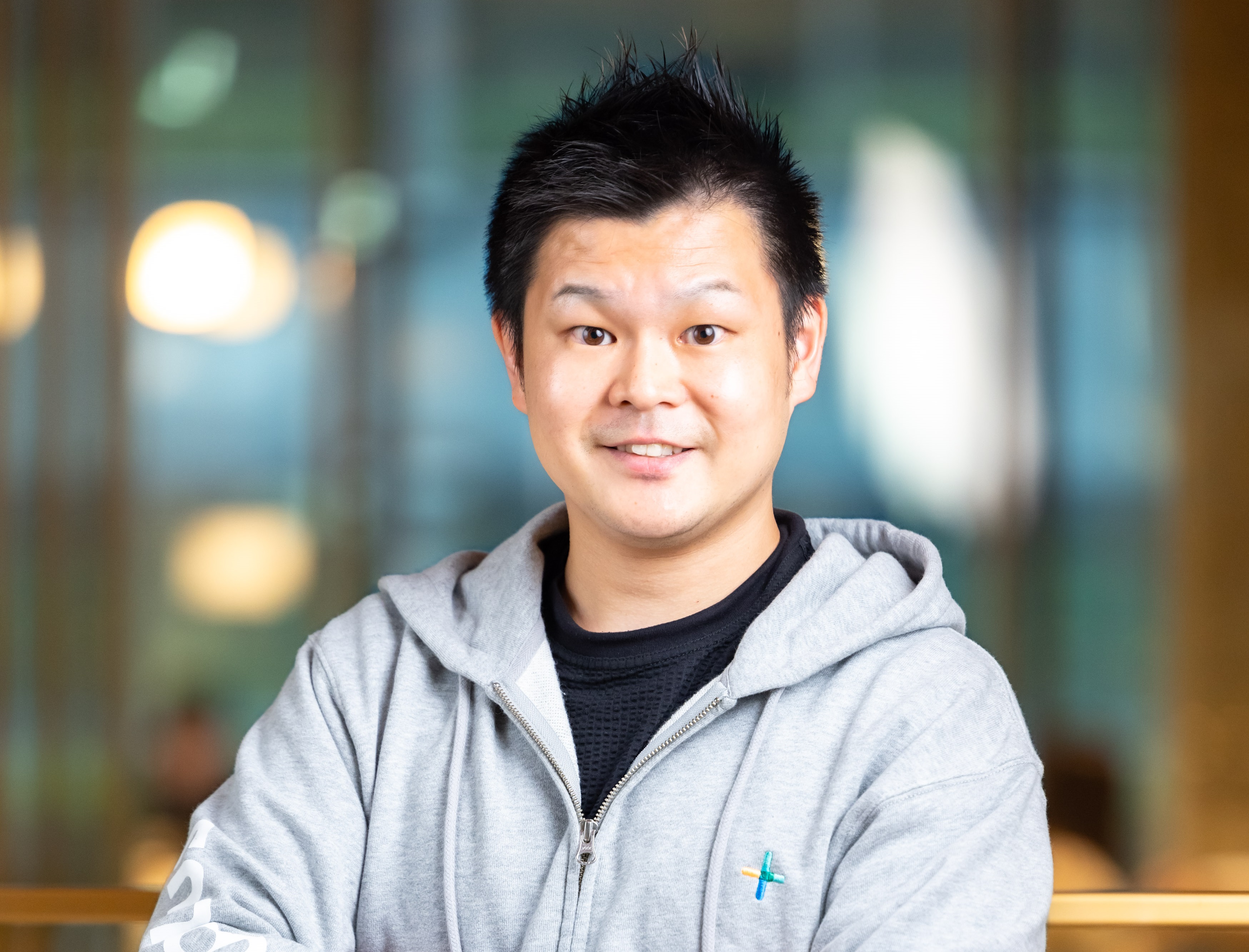

Automation will be a focus for investment for logistics companies because of labour shortages in the sector, says Takuya Sakamoto (pictured left), chief executive of MOL Plus, the strategic investment subsidiary of Japanese shipping company Mitsui OSK Lines.

The logistics sector is still recovering from post-Covid labour shortages. The world road transport organisation IRU, for example, is forecasting that there will be a 7m shortfall in truck drivers by 2028, a situation that will continue to worsen as few young people come into the sector.

Such pressures will cause logistics companies to consider automated alternatives, says Sakamoto. “Innovative technologies will be considered seriously after the issues become more apparent.”

The is also a continuing shift to digitalise the supply chain, with artificial intelligence coming in to play a pivotal role, says Jonas Linnebjerg (pictured right), head of Maersk Growth, the external innovation arm of the Danish shipping firm, AP Moller-Maersk.

“[This adoption] also has the benefit of enhancing customer experience by providing faster, more personalised and transparent services,” says Linnebjerg, who is also leading its consulting unit, Maersk Management Consulting.

Sustainability

The increased pressure from global regulations, emissions targets and related taxes have created a strong push to decarbonising supply chains, says Axel Tan (pictured left), head of IMC Ventures, the corporate venturing unit of US shipping company IMC Group.

The increased focus on decarbonisation has led IMC Ventures to broaden the scope of the opportunities it will consider, adds Tan. In April 2023 IMC collaborated with software provider Microsoft and shipping groups Hafnia, DNV and Wilhelmsen to launch a venture studio called Studio 30 50 to develop startups that can reduce emissions in the maritime industry.

“Our partnership with Studio 30 50 aims to build an ecosystem to identify and accelerate such ideas,” adds Tan.

Sustainability is also on the radar for MOL Plus. Sakamoto says shipboard carbon dioxide recovery, marine business – including offshore renewable energy and water mobility – as well as circular economy are of particular interest given their alignment with Mitsui OSK Lines’ value.

“The first two [focus areas] are strategic to Mitsui OSK Lines’ business, while the third has the potential to solve ongoing social issues,” explains Sakamoto.

As part of Maersk’s net-zero goals, the firm is looking to transition to green fuels, enhanced energy efficiency and a shift from linear to circular supply chains.

Green fuels like biofuels and green methanol are currently seen as the most promising options for achieving substantial emissions reductions in ocean freight, says Linnebjerg. His team also follows the potential of future green fuels such as green ammonia and hydrogen.

Linnebjerg believes energy efficiency is an “exceptionally intriguing area of exploration” to help Maerk achieve its ambitious goal to transport at least 25% of ocean cargo using green fuels by 2030. With that, Maersk Growth will focus more on decarbonisation and green energy going forward.

“The shift in our focus reflects the current market – six years ago, fewer funds invested in supply chain tech, but this has now changed and we have been following that path for a while,” says Linnebjerg.

Southeast Asian gaps

There are huge growth opportunities in Southeast Asia because demand is rising but the region is suffering from supply chain gaps, says Tan.

“The significant growth of ecommerce, egrocery and food delivery will require more comprehensive and flexible fulfilment networks with digital backbones,” says Tan. He warns incomplete supply chains may result in problems such as significant food waste.

In line with this, IMC Ventures has invested in Fresh Factory, a startup addressing the cold-chain fulfilment gap in Indonesia. The unit has also explored topics such as farm-to-table and food logistics.

Challenges and opportunities in 2024

Despite challenges like elevated rates and inflation, Tan is confident about logistics innovation in 2024 and IMC Ventures does not intend to vary the investment levels.

During the Covid-19 pandemic, last-mile delivery hit its peak in venture funding to support the boom in ecommerce. Linnebjerg reiterates the industry’s struggles with complex supply chains, highlighting the need for omnichannel fulfilment and efficient transportation.

The economic aftermath of Covid-19 is also a potential hurdle, particularly in navigating the first fully normalised year. “The funding scene has seen vast fluctuations over the past few years due to the pandemic, and I expect the first year ‘back to normal’ to offer a few challenging or unforeseen curves as well,” says Linnebjerg.

“We will continue to be an active profile in the startup ecosystem, backing the leading decarbonisation startups financially and strategically. Amidst the changes, we will continue to uphold and honour our commitments to our current portfolio – including continued follow-on investments, board participation and facilitation of commercial and strategic partnerships with Maersk.”

“The shift in our focus reflects the current market – six years ago, fewer funds invested in supply chain tech, but this has now changed and we have been following that path for a while.”

Jonas Linnebjerg, head of Maersk Growth

Most funded company in the logistics sector in 2023

The largest corporate-backed logistics deals this year included B2B trade platform Tradeshift’s $70m round in August and ecommerce fulfilment service Cart.com’s $60.5m round two months before.

| Companies | Total Raised ($m) | Corporate Investors | Last Financing Date | Year Founded | HQ Location | Last Round | Last Round Size ($m) |

|---|---|---|---|---|---|---|---|

| Tradeshift | 879.50 | AYTK, Lun Partners Group, Fuel Venture Capital, Notion Capital, IDC Ventures, The Private Shares Fund, Qatar Free Zones (Doha Venture Capital) | 14-Aug-2023 | 2009 | San Francisco, CA | 70.00 | |

| Cart.com | 470.10 | Snowflake (Snowflake Ventures), Saudi Aramco (Prosperity7 Ventures) | 27-Jun-2023 | 2020 | Austin, TX | Series C | 60.50 |

| Yellowbrick Data | 245.58 | BMW (BMW i Ventures), Alphabet (GV), Samsung (Samsung Venture Investment) | 01-Mar-2023 | 2014 | Mountain View, CA | ||

| LeafLink | 386.44 | KI Group (KI Capital) | 05-May-2023 | 2015 | New York, NY | Series D | 100.00 |

| Optoro | 409.47 | eBay, Ikea (Ingka Investments), Sumitomo (Presidio Ventures), United Parcel Service of America, UPS (UPS Ventures), Zebra Technologies | 30-Jun-2023 | 2010 | Washington, DC | 25.00 | |

| Odeko | 176.08 | American Express (American Express Ventures), Aramex (Aramex Ventures) | 18-Apr-2023 | 2019 | New York, NY | Series D | 53.56 |

| Deepway | 179.39 | Baidu, Lenovo Holdings (Lenovo Capital and Incubator Group), SoftBank (SB China Venture Capital), Weiqiao Pioneering Group | 20-Mar-2023 | 2020 | Beijing, China | Series A1 | 111.39 |

| Caddi | 173.10 | Arena Holdings, Globis (Globis Capital Partners) | 05-Jul-2023 | 2017 | Tokyo, Japan | Series C | 83.05 |

| Huboo | 182.73 | Hearst (Hearst Ventures), Maersk (Maersk Growth) | 30-Nov-2023 | 2015 | Bristol, United Kingdom | 35.98 | |

| Captain Fresh | 130.07 | Nekkanti Sea Foods, Prosus (Prosus Ventures) | 05-Sep-2023 | 2019 | Bengaluru, India | Series C | 71.72 |

Most active corporate investors in the logistics sector in 2023

Maersk Growth was one of the most active corporate investors in the logistics sector this year, followed by Prologis Ventures, Amazon Industrial Innovation Fund, Qualcomm Ventures and Wayra, respective CVC units of property developer Prologis, Amazon, mobile chipmaker Qualcomm and telecoms firm Telefónica.

| Investors | HQ Location | Investor Type | # Logistics Investments in 2023 | Last Closed Fund Vintage | Last Closed Fund Name | Year Founded |

|---|---|---|---|---|---|---|

| SMBC Venture Capital | Tokyo, Japan | VC | 7 | 2022 | SMBC Venture Capital Industry-Academia Collaboration No. 3 | 2005 |

| Maersk Growth | Copenhagen, Denmark | CVC | 5 | 2022 | Maersk Growth Venture Fund II | 2017 |

| Aozora Corporate Investment | Tokyo, Japan | VC | 4 | 2023 | Aozora HYBRID No. 3 Investment | 2018 |

| Global Brain | Tokyo, Japan | VC | 4 | 2023 | SMBC-GB Growth No. 1 Fund | 1998 |

| Prologis Ventures | San Francisco, CA | CVC | 4 | 2016 | ||

| Amazon Industrial Innovation Fund | Seattle, WA | CVC | 3 | 2022 | Amazon Industrial Innovation Fund | 2022 |

| Cathexis Ventures | Houston, TX | VC | 3 | 2018 | ||

| Eight Roads | Hamilton, Bermuda | VC | 3 | 2022 | Eight Roads India Healthcare Fund | 1969 |

| EIT InnoEnergy | Eindhoven, Netherlands | Impact | 3 | 2010 | ||

| Qualcomm Ventures | San Diego, CA | CVC | 3 | 2022 | Snapdragon Metaverse Fund | 2000 |

| Seeds Capital | Singapore, Singapore | VC | 3 | 2001 | ||

| Wayra | Madrid, Spain | CVC | 3 | 2011 | ||

| 31Ventures | Tokyo, Japan | CVC | 2 | 2020 | 31 Ventures Global Innovation Fund II | 2015 |

| Airbus Ventures | Menlo Park, CA | CVC | 2 | 2020 | Airbus Ventures Fund III | 2016 |

| BMW i Ventures | Mountain View, CA | VC | 2 | 2021 | BMW i Ventures II | 2011 |

| Chevron Technology Ventures | Houston, TX | CVC | 2 | 2021 | Future Energy Fund II | 1999 |

| China Capital Management | Beijing, China | Growth | 2 | 2023 | China Capital Shanxi Military Technology RMB Fund | |

| China Merchants Venture Capital | Shenzhen, China | VC | 2 | 2021 | Qingdao Qingkong CMB Innovation Fund | 2015 |

| Colopl Next | Tokyo, Japan | CVC | 2 | 2022 | COLOPL NEXT No. 8 Fund Investment Partnership | 2015 |

| Conexus Venture Capital Fund | Regina, Canada | VC | 2 | 2022 | Conexus Agtech Venture Capital Fund | 2019 |

Most successful exits in the logistics sector in 2023

American industrial automation technology group Rockwell Automation bought Canadian autonomous mobile robot developer Clearpath Robotics for about $470m according to PitchBook data, or $600m according to the Globe and Mail, allowing corporates Mitsubishi Electric, General Electric and Caterpillar to exit.

Chinese car aftersales service Tuhu Car was listed on the Hong Kong Stock Exchange and raised about $152m according to PitchBook data. Diversified group Legend Holdings and internet groups Baidu and Tencent were among the company’s investors.

| Companies | Year Founded | Investors | Deal Size ($m) | Deal Date | HQ Location | Exit Type |

|---|---|---|---|---|---|---|

| Clearpath Robotics | 2009 | Rockwell Automation (NYS: ROK)(Blake Moret) | 471.78 | 02-Oct-2023 | Kitchener, Canada | M&A |

| Tuhu (HKG: 09690) | 2011 | BP Castrol (TKS: 5015), Gotion High-tech Company (SHE: 002074), Leapmotor (HKG: 09863), Tencent Investment, Zizhu Park Incubator | 151.72 | 26-Sep-2023 | Shanghai, China | IPO |

| Clutter | 2013 | Iron Mountain (Systems and Information Management) (NYS: IRM) | 60.60 | 29-Jun-2023 | Culver City, CA | M&A |

| Guoquan Shihui (HKG: 02517) | 2017 | N/A | 52.58 | 01-Nov-2023 | Shanghai, China | IPO |

| Log56.com (HKG: 02482) | 2002 | Hefei Hi-Tech VC | 15.97 | 02-Mar-2023 | Hefei, China | IPO |

| Sailvan Times (SHE: 301381) | 2012 | China Merchants Capital | 11.38 | 12-Jul-2023 | Shenzhen, China | IPO |

| Mesh Korea | 2013 | Hwy Company | 0.06 | 06-Apr-2023 | Seoul, South Korea | M&A |

| Bluesight | 2011 | Monroe Capital, Monroe Capital Income Plus Corp BDC, Thoma Bravo(Carl Press) | 17-Jul-2023 | Alexandria, VA | Buyout/LBO | |

| CTAuto | 2014 | Tuhu (HKG: 09690) | 11-Jan-2023 | Guangzhou, China | M&A | |

| Garvis | 2020 | Logility | 20-Sep-2023 | Antwerp, Belgium | M&A |