Startups are at risk of failing because artificial intelligence is rendering their business models obsolete, says Jeffrey Li, managing partner of the Chinese technology company's CVC.

AI is developing at such a fast pace that even startups are threatened by advances in the technology, and it is making the business models of some portfolio companies’ defunct, says Jeffrey Li, managing partner of Tencent Investments, the corporate venturing arm of the Chinese gaming and social media company.

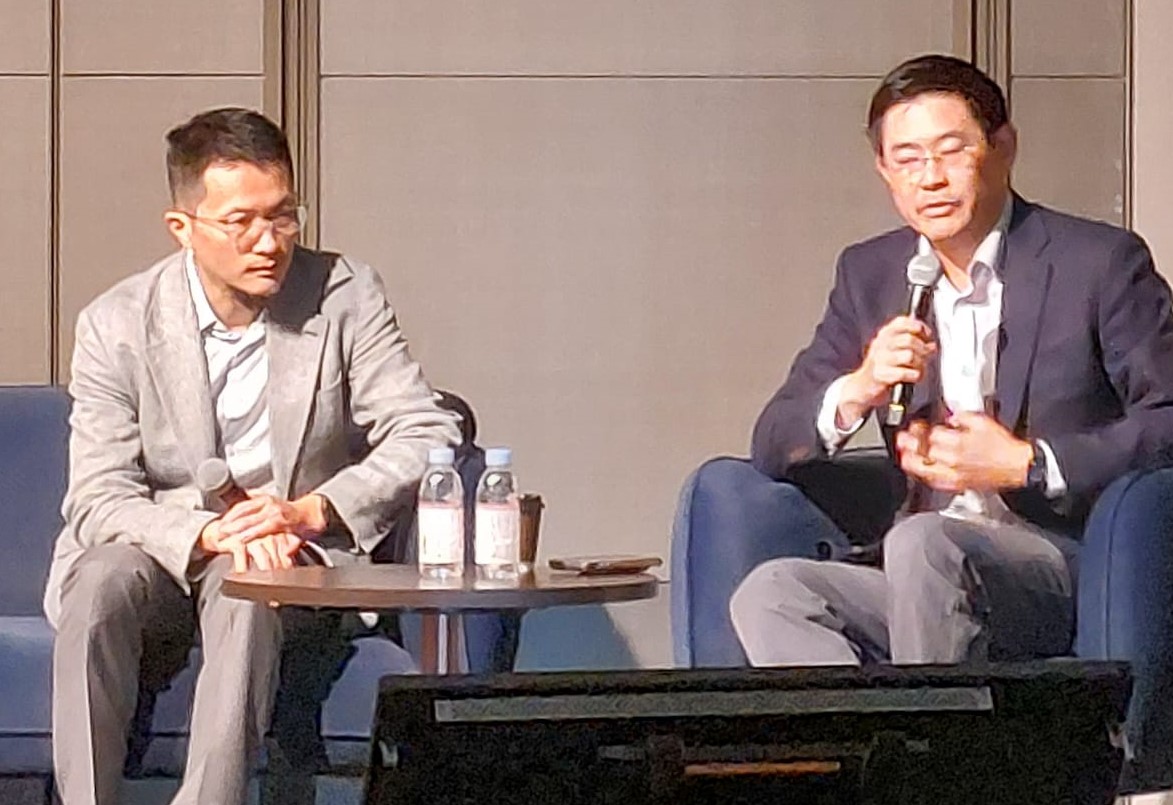

AI developments are a “death sentence” for some startups because it means “the total replacement of what they are doing now,” says Li, speaking at the GCV Asia conference in Tokyo, Japan, this week.

Tencent Investments is one of the world’s biggest corporate venturing units. It has more than 800 investments in its portfolio and 100 people just working on its investment team. Sixty percent of the unit’s investments are in China with the remainder spread globally.

Gaming companies, an investment focus for Tencent, are particularly impacted by developments in AI large language models, he says. Chinese gaming companies are using the technology to do tasks previously done by people, such as artwork and programming.

He sees a similar trend in the advertising sector. Advertising companies, particularly in Asia, are using AI to produce ads more efficiently.

In five to 10 years, all portfolio companies will be AI enabled, says Li. He sees the most opportunity in companies that use AI large language models in business applications.

“I want to focus on the real business part, the data part, rather than the AI concept. Once you have a business advantage by having proprietary data and a deep understanding of a vertical domain, you can usually apply AI as a tool rather than claiming to be an AI company and then following the user model to try to solve something.”

China’s investment landscape has slowed considerably since the Covid pandemic. Geopolitical tensions between the US and China have contributed to the slowdown by dissuading US investment in the Asian country. Relations between China and the US will remain “very challenging in the coming decades,” says Li.

The investment slowdown has caused investors in China to focus more on portfolio management and achieving exits, says Li. “We are consolidating our efforts to focus on generating a superior return for the corporation,” he says.