The corporate-backed fashion and beauty marketplace operator listed on the BSE and NSE in India and reached a market cap of $13.5bn.

FSN E-Commerce Ventures, the India-based, corporate-backed operator of fashion e-commerce platform Nykaa, went public, securing over $721m in its initial public offering. The company counts conglomerates Max Group and TVS among backers. Nykaa’s shares rose 89% to Rs 2,129 ($28.67) on the BSE while those listed on the National Stock Exchange (NSE) reached Rs 2,018 ($27.17) apiece in the opening, representing a 79% rise from the issue price. The listing gave company a market capitalisation of about $13.5bn.

Founded in 2012, Nykaa has built an online marketplace for beauty, personal and pet care products which also offers its goods through more than 80 brick-and-mortar retail partners across India. The company intends to use the IPO proceeds to increase its offline presence through new stores.

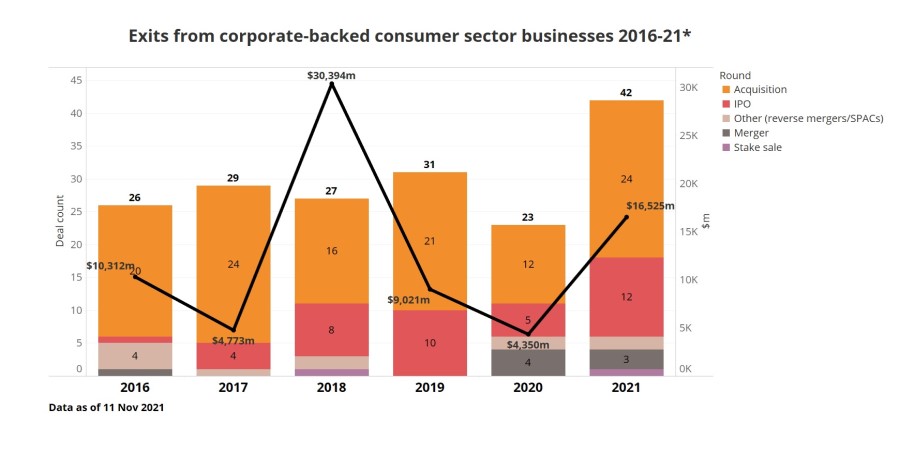

Nykaa is part of the broader consumer sector from which corporate venture investors have seen exits over the years, as shown on the graph below by GCV Analytics. While in previous years we had tracked between 25 and 30 exits, there were only 23 last year. However, by the beginning of November, we had already reported 42 exits for 2021, worth an estimated total of $16.52bn. This surge may be attributed to the boost to e-commerce services adoption given by the pandemic and the overall tailwinds for consumer products over the past year and a half.