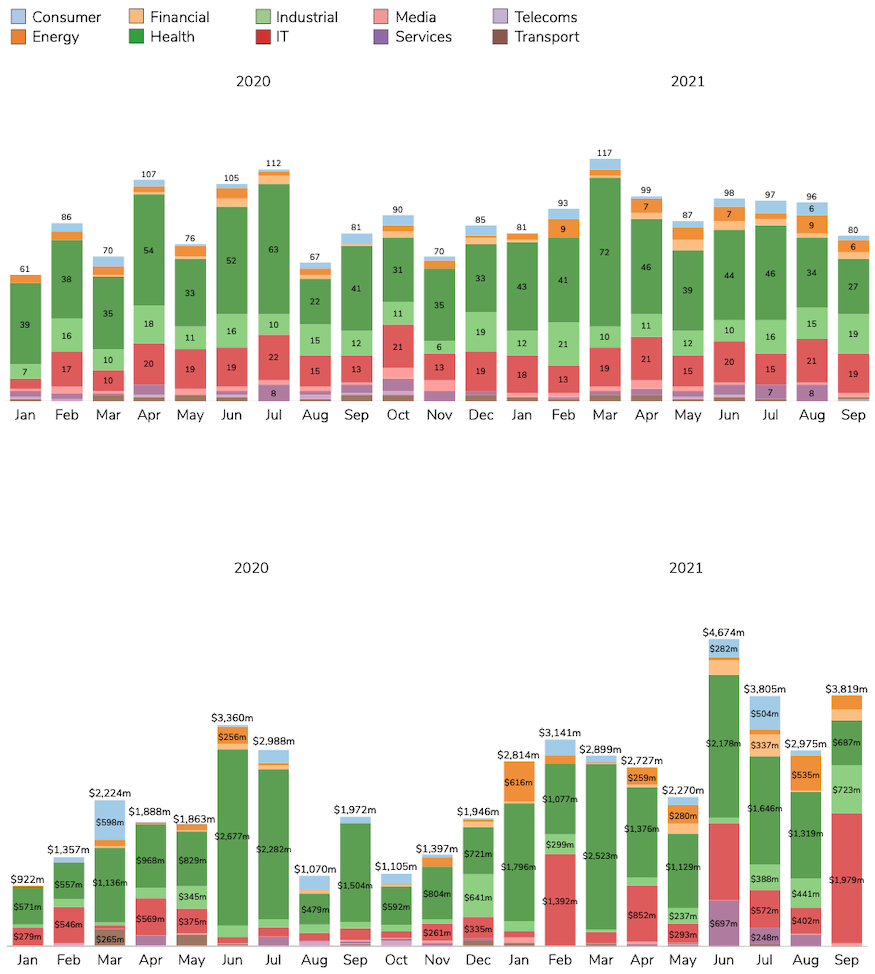

Perhaps the only way for university venturing to go after a truly astounding first half the year was always in the same direction. And with 273 investments worth a combined $10.6bn, the months of July, August and September did not disappoint.

The total for the year now stands at 848 deals, not too far off the 1,010 count for all of last year. It means an average of just 54 deals every month for the final quarter is needed to reach the same number of investments in 2021 – considering the least active month since January 2020 was still 61 deals, it would be a fool’s bet to believe it will not happen. Indeed, a cursory look at our data for October to date already shows more activity than that.

There was a slight drop in activity in September to 80 deals, making it the least active month of the year. Looking only at the number of deals, it could be argued that this was a delayed summer lull – August 2020 counted only 67 deals – but that does not actually appear to be the case when considering the amount of money invested.

In fact, August 2021 was the slower month in terms of money invested in spinouts and September was the busiest. Notable, too, is that despite the month of June continuing to tower over everything else with $4.67bn, the second quarter only accounted for $7.2bn invested – below the $8.85bn in the first quarter – making the most recent three-month period the one with the highest monetary value by a margin of almost $2bn.

There was no summer lull. That is true perhaps of macro-economic factors that means money is being poured into the market everywhere, not just spinouts, but maybe also because many countries continued to struggle to emerge out of lockdowns or other restrictions. With no possibility of travelling on a vacation, it is easy enough to keep sitting in front of the computer reading term sheets.

There is a question as to whether – or rather, when – this bubble will burst. There is a real frenzy going on and this is not to sound alarmist, but the nature of economies is cyclical: the crash always comes eventually.

Massive challenges are already here: gas and electricity prices have risen so much in Europe, and particularly in the UK, that – as of the time of writing – Britain has seen 16 utility companies go bust this year – a dozen of those in September and October alone. With consumer rates capped by the government based on wholesale prices during the preceding six-month period and those wholesale prices continuing to increase, suppliers are currently losing around £400 ($545) per customer.

The UK has of course also been in the news because of the COP26 conference in Glasgow in early November and the government has set a net zero target for 2050 which appears ambitious, but it relies on carbon offsets – at best a band aid – and 2050 is too far off in the future to really make the impact needed. As campaigner Eleanor Salter wrote in a New York Times op-ed in October: “Johnson may claim the country leads the world on climate action, but we should not fall for the trick.”

That is all before we even consider the societal issues of the pandemic that means the richest countries in the world have been throwing away vaccines because conspiracy theorists have conned people into refusing the shot, while poor countries are desperately waiting for more doses. The pandemic has also meant that more money has flown to the top of the pyramid, with the bottom further hollowed out: Jeff Bezos, founder of e-commerce group Amazon, is so rich that spending $1.7m is the equivalent of the average American spending $1.

Spinouts can – and will – tackle many of the challenges that face us. They have made solar panels more efficient, they have created coatings to keep fruit fresh for longer and above all they have given us several covid vaccines. But they are vulnerable to the same economic realities as everyone else.

It is no doubt a great time to be an investor and more money for university innovation is absolutely to be welcomed, but if we are not careful it could be a very painful landing. The current trend will continue for a while yet and some fantastically successful winners will emerge. But we also need to make sure that, once the next crash occurs, we do not let that be an argument to go back to not having as many spinouts and money being put into that particular ecosystem.

Is that really a danger? Perhaps not, but to not consider the possibility and how we can prevent it from happening would be short-sighted.

For now, of course, everything looks rosy and the top 10 largest deals of the quarter were all impressive numbers worth at least $200m.

The largest investment was the $1.6bn series H round picked up by Databricks, a US-based data analytics software developer based on research at University of California (UC), Berkeley. Valuing the business at $38bn post-money, investors that poured more cash into Databricks included UC Investments, which manages UC’s retirement, endowment and cash assets, and the House Fund, a vehicle focused on the UC Berkeley ecosystem. It brought Databricks’ overall equity to some $3.5bn and notably came just seven months after the spinout picked up $1bn in its series G round from a consortium that included corporates Microsoft, Alphabet, Amazon and Salesforce.

The huge size of Databricks’ latest round means the second-largest deal of the quarter looks comparatively small, although quantum computing technology developer PsiQuantum still raised a significant $450m in its series D round that valued it at $3bn and thereby became the first unicorn in the portfolio of Imec.xpand, the venture fund launched by research institute Imec. Although PsiQuantum is not a spinout – its co-founders stepped down from University of Bristol and Imperial College London to form the business – the involvement of Imec.xpand still makes it a noteworthy example of how academic institutions can play a significant role in innovation.

Nature’s Fynd, similarly, is not a spinout but Montana State University was one of the company’s earliest supporters and all of that groundwork has meant the alternative protein developer was able to collect $350m in its series C round from telecoms giant SoftBank’s Vision Fund 2, food producer Danone, agribusiness Archer Daniels Midland, conglomerate SK and others.

| Company | Institution | Sector | Round | Size |

|---|---|---|---|---|

| Databricks | University of California, Berkeley | IT | H | $1.6bn |

| PsiQuantum | Imec | IT | D | $450m |

| Nature’s Fynd | Montana State University | Consumer | C | $350m |

| Spiber | Keio University | Industrial | Undisclosed | $312m |

| Sonoma Biotherapeutics | Health | B | $265m | |

| Apeel Sciences | University of California, Santa Barbara | Industrial | E | $250m |

| Clearco | University of California | Financial | Undisclosed | $215m |

| InterVenn Biosciences | Stanford University | Health | C | $201m |

| Prime Medicine | Broad Institute of MIT and Harvard | Health | B | $200m |

| Form Energy | Massachusetts Institute of Technology | Energy | D | $200m |

When it came to exits, a record-breaking 16 were achieved in July 2021 for a total of 26 for the quarter – bringing the year’s total to 68. That, like the number of investments, is scratching the total of 78 for 2020.

The largest exit was the $521m initial public offering of Duolingo, the US-based language learning platform developer spun out of Carnegie Mellon University, which listed on the Nasdaq Global Select Market in late July after pricing its shares at a whopping $102. As of the time of writing, they are trading at $157.91, having risen as high as $205 in late September.

Not too far behind was the flotation of Oxford Nanopore with a $478m initial public offering, which fetched a $4.7bn valuation and perhaps most importantly elected to list on the London Stock Exchange – eschewing the US, which has typically managed to attract such large-scale IPOs. For a closer look at what Oxford Nanopore’s listing means, read our in-depth look at Oxford’s spinouts in this issue.

UC Berkeley not only had Databricks as an occasion to celebrate this quarter, as Caribou Bioscences went public following a $304m IPO on the Nasdaq Global Select Market at a valuation of nearly $910m. Although shares have continuously traded above the IPO price of $16 and briefly reached a peak of $32.65 in September, they have largely hovered between the $20 and $30 marks and are, at the time of writing, going for $19.78.

There is one aspect of the top 10 largest exits of the quarter that warrants highlighting: all but one of them were traditional IPOs, with only University of Chicago-backed home insurance provider Kin Insurance conducting a reverse merger. This reflects the public market at large, which has gone cold on private investment in public equity financing after a frenzy early on in the year – a recent analysis by the Financial Times showed that this trend continues, with October marking yet another drop in such activity.

That public markets have been so receptive to IPOs of spinouts – and that spinouts have chosen this route – is reassuring and promising that this ecosystem remains healthy. That is good news for when the crash comes – the majority of spinouts will hopefully survive that downturn.

| Company | Institution | Sector | Round | Size |

|---|---|---|---|---|

| Duolingo | Carnegie Mellon University | Education | IPO | $521m |

| Oxford Nanopore | University of Oxford | Health | IPO | $478m |

| Caribou Biosciences | University of California, Berkeley | Health | IPO | $304m |

| Kin Insurance | University of Chicago | Financial | Reverse merger | $280m |

| Sophia Genetics | Stanford University | Health | IPO | $234m |

| Icosavax | University of Washington | Health | IPO | $182m |

| Tenaya Therapeutics | Gladstone Institutes | Health | IPO | $180m |

| Aerovate Therapeutics | Health | IPO | $121m | |

| T-Scan Therapeutics | Harvard University | Health | IPO | $100m |

| Biotalys | VIB | Industrial | IPO | $64.5m |