CVCs invested over 50% more dollars in transport year-on-year, while they train their eye on connected industries in 2025

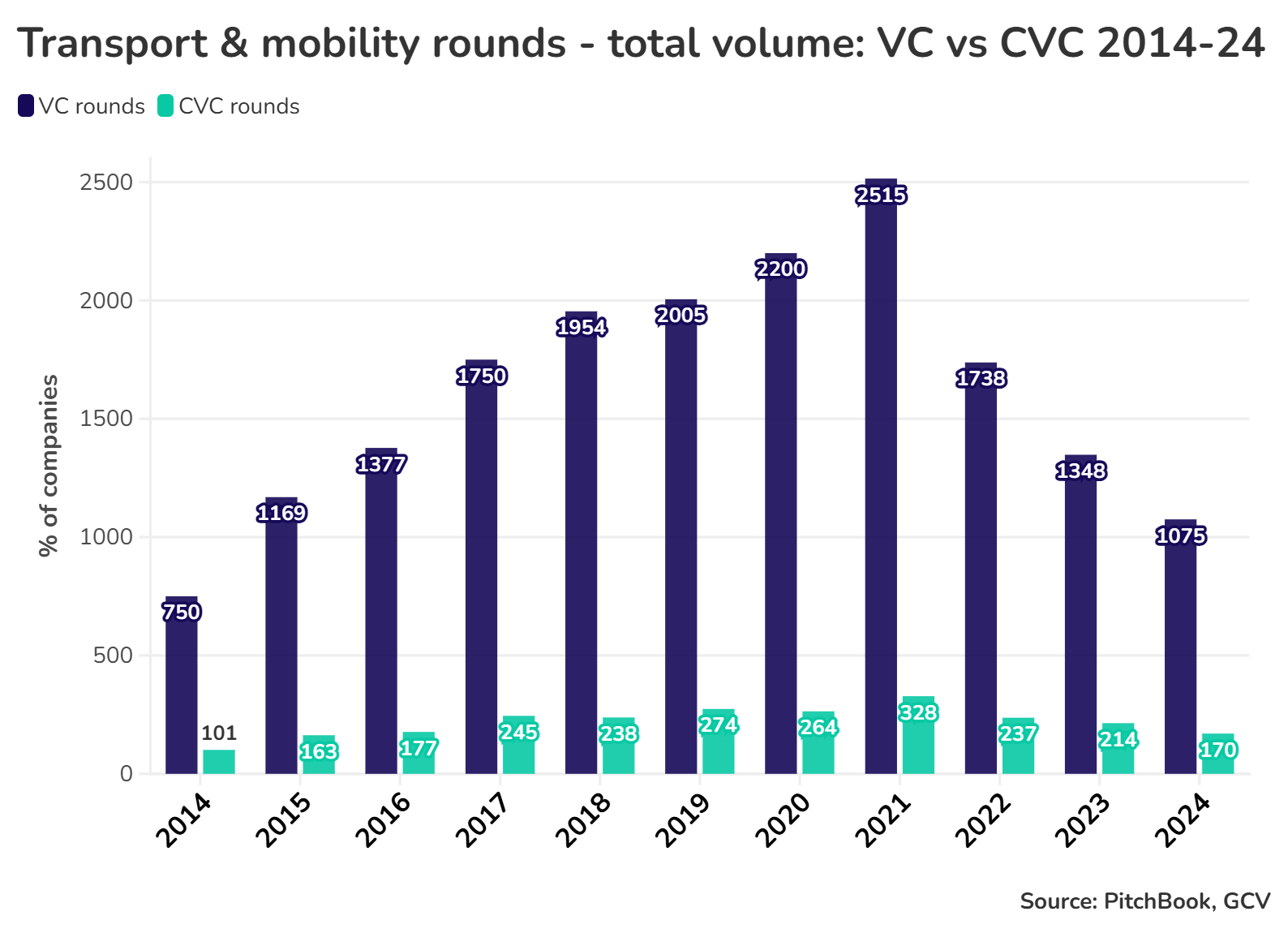

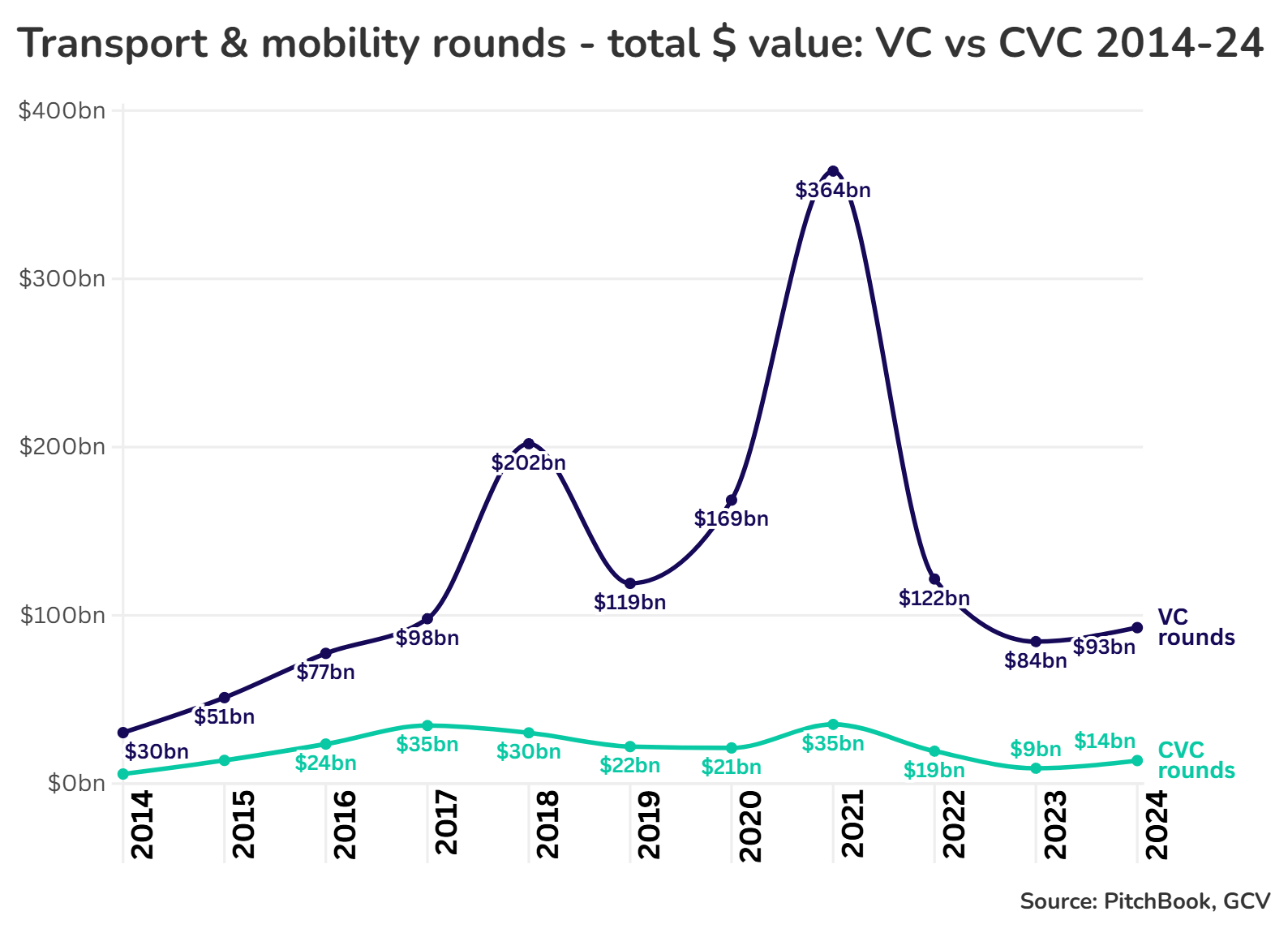

2024 might be described as a caretaker year for the transport sector. The number of corporate-backed startup funding rounds for transport startups was down from the previous year, but the amount of dollars invested is on its way back up both for VC-backed and CVC-backed rounds. For CVCs the increase was over 50% from 2023 to 2024, although still nowhere near the levels seen just a few years ago.

Looking ahead at 2025, transport sector investors are signalling interest in areas adjacent to people transport systems themselves — logistics, industrials, autonomous vehicles for workforces — and a revival of interest in areas that have had less attention in recent years.

Micromobility, for example, is back on investors’ radars as providers consolidate. Combinations such as the merger between Tier and Dott in early 2024, for example, are making the market less fragmented and potential winners easier to identify.

The year has been an unpredictable one geopolitically – there were elections all around the world, and given the demise of most incumbent governments in those elections, the results themselves didn’t always assuage the uncertainty. It is making investors double down on fundamentals in terms of valuing and looking at the potential of new businesses.

“I think everyone was saying let’s wait and see what happens. I think we probably could have predicted some of those political changes, but maybe not others,” says Mike Smeed, managing director of InMotion Ventures, the corporate VC unit of Jaguar Land Rover.

“There’s nothing like a crisis to focus the mind, so if anything it’s probably strengthened conviction.”

More value-add on top of automotive

Automotive OEMs are spending more and more of their time on software-defined vehicles, and their investment arms on technology that supports them. The opportunities that opened up from an increasing switch to electric vehicles (EVs) have added layers of opportunity.

“When you have an EV, all of a sudden you care about your utility bill and what your kilowatt-per-hour is when charging overnight, or when you’re out and about making sure that you get to the right charge point,” says Smeed.

“Anytime that there’s a crap customer experience, it opens up an opportunity for someone to fix it.”

Mike Smeed, InMotion Ventures

Amid the fragmentation that has come out of the EV ecosystem — different charging points for different cars, lack of standardisation, different payment platforms — creates opportunities for startups that can smooth over bad customer experiences that exist.

“Anytime that there’s a crap customer experience, it opens up an opportunity for someone to fix it,” says Smeed.

Meanwhile, the growing amount of software technology in a vehicle — as well as the over-the-air software updates and maintenance required — have also helped change the relationship customers have with car brands themselves, which are now more direct than they have been in the past when they were dealerships had more of a role.

Things like vehicle warranties, for example, which used to be handled by dealerships, are increasingly being done directly by OEMs themselves, opening up avenues for fostering customer loyalty more directly as they interact with the brand.

Transport sector looks to robotics and logistics

As transport and mobility itself has still to warm up again, investors are looking to adjacent industries, where startup technology can have multiple applications and sell into multiple markets.

Investors in both automotive and aviation are investing more in industrial technology – robotics, autonomy and logistics, to name a few.

“Areas that touch aviation but also touch other industries, we’ve always been a huge fan of.”

Andrew Chang, United Airlines Ventures

Aviation, in particular, is a highly capital intensive and regulated industry, making it difficult for pure play startups. Any young company trying to do some kind of new aircraft design, alternative propulsion or other aviation-specific work, especially in an environment where it’s tougher to raise money, will be having a difficult time.

They would need to have some kind of collaboration with plane manufacturers, whose supply chains already have deeply entrenched players. It’s a tall order, almost like re-inventing the wheel.

“Areas that touch aviation but also touch other industries, we’ve always been a huge fan of,” says Andrew Chang head of United Airlines Ventures.

“I want a technology that can be utilised in multiple sectors — that’s a huge win. We prioritise anything that comes in and says, ‘Hey, we’d love United to be a leader in aviation and get a foot in the door for us in aviation, but by the way, we already sell to retail, we sell to grocery stores, we sell to automotive’. Those are great businesses to try to be a part of.”

Particularly exciting are sectors that access high-margin, low-volume products and services.

“We’re looking at some automation AI because it would be great for baggage handling, for example. Anything you’re talking about logistics and tracking, leveraging productivity, efficiency, and safety for labour, we’ll find interesting,” says Chang.

Most other sectors that startups would be selling into would be easier than aviation itself — less capital intensive and less regulated.

Autonomous vehicles

After a few years in the doldrums, autonomous vehicles have also come back into focus for corporate investors. There is now more focus on pragmatic, shorter-term use cases. Things like automated freight, last-mile delivery, port automation, automated mining or agriculture vehicles and internal logistics are where investors are pinning their automated hopes.

“We’ve seen people go into that area and not quite park automotive, but certainly you have automotive as something we need to focus on, but we need to get traction right here right now,” says Mike Smeed,

“We’ve got some real workforce challenges in the future. People don’t want to be truck drivers anymore. So autonomous trucks are becoming a big thing. People don’t necessarily want to work in production facilities anymore.”

BMW iVentures and Nabtesco Technology Ventures recently invested in Embotech, a provider of autonomous vehicle technology for logistics applications.

Investors are also eyeing remote control vehicles as they have the potential of having lower costs of entry relative to autonomous vehicles.

GCV subscribers can see all the corporate-backed startup funding deals since January 2023 here.

Batteries

It has been a complicated year for European battery producers. Perhaps the most emblematic example of this is Northvolt – the Swedish battery manufacturer that was heralded as Europe’s battery champion to mirror Asia’s giants – filed for Chapter 11 bankruptcy, saw its CEO step down and board members leave, and had to get loans from shareholders to have a fighting chance at survival after problems with production and delays.

It’s not just Northvolt. According to Bloomberg, 11 out of 16 battery plants led by European companies on the continent have been delayed or cancelled.

This doesn’t mean no factories are being build in Europe, though – 10 out of 13 led by Asian companies, including Samsung and Amperex, are on track, adding to the head start they already have on the technology.

“People aren’t there yet. We know that 50% of the net zero journey is going to be a psychological one.”

Mike Smeed, InMotion Ventures

The line between mobility and energy is also continuing to blur – particularly with energy storage and grid technology – as more investments are being made in technologies that optimise the power grid for EV uptake, and capabilities like vehicle-to-grid get more funding to let people supply the grid from their own garages. Woven Capital, Toyota’s growth fund, led a $28m round for Weavegrid – which developed technology for grid-interactive vehicles – in December, which also included Salesforce Ventures and other investors.

Sustainability and circularity

Aviation and automotive OEMs are both looking at how to make the materials they use on their vehicles more circular. After years of figuring out how to make their vehicles out of materials strong enough to withstand operational pressures and light enough to maximise fuel, they’re now having to think about how to give them a second life.

The inconvenient truth of anything related to sustainability, however, is that price remains king. You could cut carbon out of a process entirely, but if the end product is still more expensive, it will lose in the marketplace.

“People aren’t there yet. We know that 50% of the net zero journey is going to be a psychological one. People are still not willing to pay more or suffer inferior quality for enhanced sustainability credentials.” says Smeed

“That just means we’ve got to work harder and we’ve got to compete against industries that have been cost-engineered to hell for the last 50 years.”

SAF back to Europe

Europe is looking more attractive for sustainability plays in aviation, too. For something like sustainable aviation fuel, for example, there is only a carrot-based framework in the US, whereas Europe also has a more structured stick, mandating progress on the issue.

With the new, less-environmentally-concerned administration taking power in the US in January, it is likely that even the carrot will become less enticing. The benefits brought by the Inflation Reduction Act, which was heralded as a boon for renewable technologies, has yielded relatively little for renewable hydrocarbon fuels – even some of the loans that were given were conditional in nature and it’s unclear whether they will end up being given under the incoming administration. The voluntary nature of the market is still a roadblock to meaningful adoption.

“In the EU, you do have a mandate for SAF for aviation . As an investor I look at that and say, okay, there may be more structure, I understand the rules. As an investor, tell me what the rules are and I will try to find a way to make money following those,” says Chang.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.