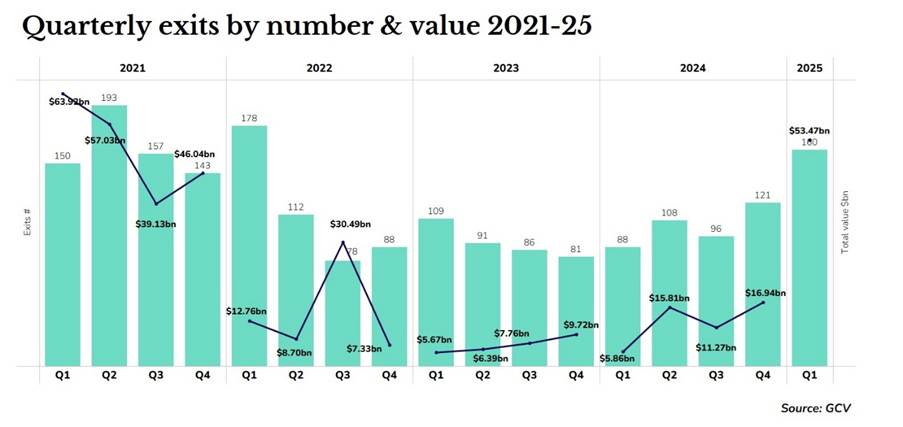

Corporate-backed startups exits were at their highest level for over two years in Q1 2025, with large acquisitions spiking the total value.

Three months of high acquisition activity meant Q1 2025 saw significantly more corporate-backed startup exits than any other quarter since the start of 2022. GCV tracked 160 in the period, which was a 32% rise on Q4 2024, the second-highest total seen in two years.

A string of high-value takeovers in March also meant the dollar value for exits was higher, at $53.4m, than had been seen in over three years.

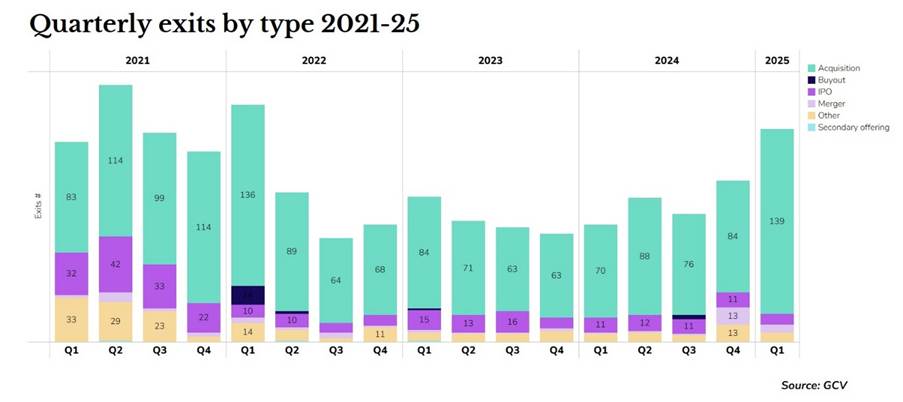

This comes as IPOs remain low in a market, which stock exchange professionals say has felt too volatile since the start of the year. While CoreWeave’s $1.5bn debut last month was considered a test case for other companies preparing to go public, the Trump administration’s recent tariff programme has made a renaissance in the public markets somewhat unlikely.

Wiz: The big buy

Most of the $53.4m dollar value of the deals in Q1 came from just one big deal: Alphabet’s acquisition of the cybersecurity company Wiz for $32bn.

Wiz is an Israeli-US company that protects cloud infrastructure from attack. Its clients include the world’s largest cloud providers such as Amazon Web Services and Microsoft Azure, which Alphabet’s subsidiary Google competes with. The startup’s previous backers include the enterprise software company Salesforce and the Japanese telecoms and investment firm SoftBank.

Alphabet attempted to acquire the company last year but was unsuccessful because Wiz preferred to try for an IPO. When market conditions made the prospect of going public too risky, the talks were revived.

The overall effect for Alphabet is a boost to its cloud services, with Wiz due to be absorbed into Google’s cloud unit. Bringing about such a prominent exit is another way the tech conglomerate has dominated corporate venturing activity this quarter, along with it being the most prolific corporate investor in startup funding rounds tracked by GCV.

March madness

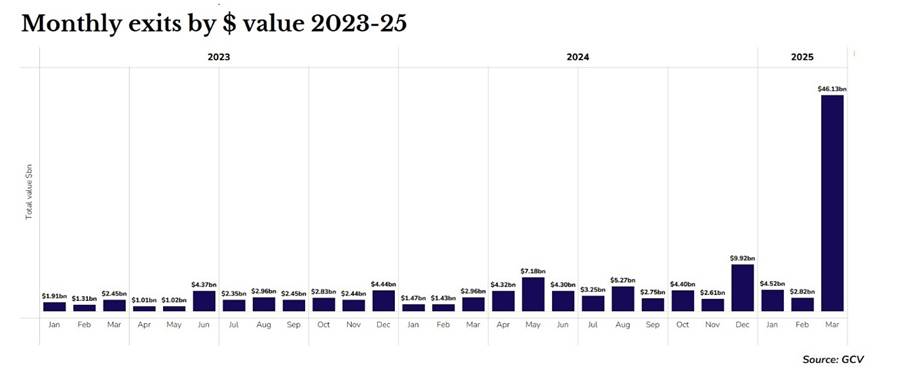

The Wiz acquisition alone does not account for that large spike in the monthly exits value graph. In an unusually high spate of large acquisitions, a string of other corporate-backed startups in the US were bought for amounts running into the billions.

Ampere

SoftBank acquired the fabless semiconductor company Ampere for $6.5bn, in the second biggest exit of the month.

Ampere designs chips for large servers, making them appropriate for cloud and AI data centres. SoftBank’s acquisition is part of the company’s strategy to expand its dominance in the AI sector, which also saw it invest in OpenAI’s record $40bn funding round in the same month.

SoftBank also owns Arm, a UK chip design company that licenses some of its architecture to Ampere and has announced plans to make its own proprietary chip, moving away from the licensing model. Arm was one of the previous backers of Ampere, along with Oracle, the US computing and cloud company.

Next Insurance

US insurer Next, which specialises in coverage for small to medium businesses (SMB), was acquired by Munich Re, the German multinational reinsurance firm for $2.6bn.

Munich Re was a previous investor in the startup alongside a number of financial services and insurance companies, including Allianz, Allstate, American Express and Mitsui Sumitomo Insurance.

It plans to make Next part of Ergo, its primary insurance arm. By acquiring the company, Munich Re has gained a foothold in the US small and midsize business insurance market which it can exploit through Next’s technology stack and digital platform.

Ninja Trader

NinjaTrader, a futures trading cloud platform provider, was acquired by the cryptocurrency exchange Kraken in a $1.5bn deal to join crypto with traditional finance. NinjaTrader’s previous backers included DRW, a US trading firm.

Kraken began by offering trades in Bitcoin and a few other cryptocurrencies. Today, it also offers a broader suite of financial services, including trades in conventional US-listed stocks and offerings for institutional investors and hedge funds.

With this takeover, Kraken can now offer crypto futures and derivatives in the US using NinjaTrader’s license. In a press release announcing the acquisition, the co-CEO of Kraken Arjun Sethi said the company plans to create a financial trading platform that works around the clock for both conventional financial assets and cryptocurrencies.

This comes as the Trump administration takes a more favourable stance towards crypto as an asset class, which may encourage similar moves in the sector.

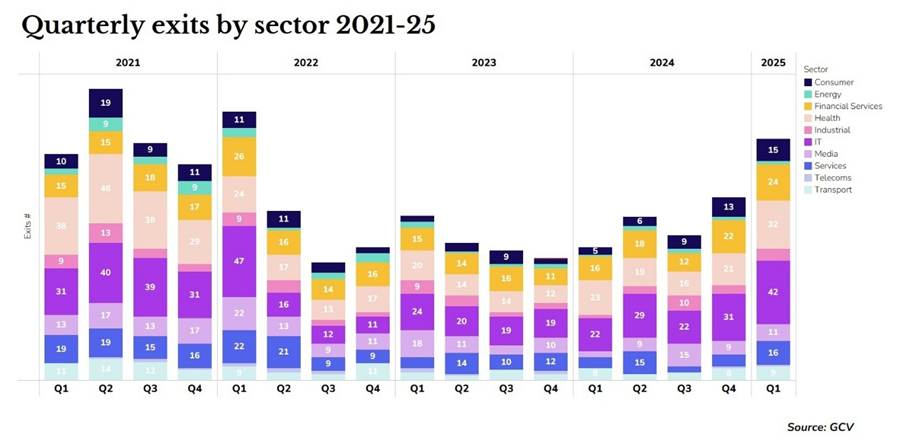

Exits by sector

The bulk of Q1’s exits were in sectors that typically see a higher level of corporate-backed deals: financial services, healthcare and IT. Each of these had more exits in the quarter than they had in the last two years.

Web3 rolls up

In the financial sector, there were several acquisitions of crypto and blockchain startups by other small Web3 companies.

For example, the on-chain compliance company Forte acquired Sealance, which makes a platform for crypto users’ privacy. The crypto exchange Coinbase was one of Sealance’s previous backers. Similarly, Shipyard Software, which provides bespoke crypto trading services, was acquired by SushiSwap, an Ethereum swap platform.

Both trades are examples of the kind of consolidation that has been ramping up among smaller businesses in the sector.

Drug deals

In the health sector, exits were dominated by pharmaceutical startups.

Another of the quarter’s $1bn+ acquisitions was GSK’s January purchase of IDRx, a US biopharma company that is developing treatments for gastrointestinal stomal tumors, cancers of the digestive system.

It was backed by MSD, the US pharmaceutical multinational.

Anthos Therapeutics, a US startup which makes targeted therapies for cardiovascular diseases, was bought by the Swiss pharmaceutical company Novartis for $925m in February. Novartis had previously been an investor in Anthos, along with Novo Nordisk.

IPOs

IPOs represented only a slither of the total exits in the quarter. There were eight in total – fewer than in any single quarter in 2024.

US

The largest IPO of the quarter was the GPU infrastructure provider CoreWeave in the US, which had previously been backed by OpenAI, Cisco and Zoom. It raised $1.5bn.

None of the others came close to that. Metsera, a US anti-obesity drugmaker that had received funding from Alphabet and several VC investors, raised $275m in its January debut.

China

The FT recently reported that regulators in China are starting to encourage more companies to begin filing for IPOs, after a long period in which few companies went public. This could mean that its market is just warming up at a time when US companies, spooked by volatility, decide to hold fire.

We tracked three IPOs of corporate-backed startups in China for the quarter.

Bloks, a producer of educational products for children, raised $215m in a January listing. It had been backed by Lenovo’s Legend Holdings. Hanshow Technology, which makes smart electronic displays for retail pricing and information, raised $161m in March.

Suteng Juchuang, a startup that makes AI-driven robotics components for cars, raised $128.6m in January. BAIC motors was a previous backer, along with other VC firms.

There is a lot of corporate investment in robotics startups in China, with nine deals recorded over Q1. Much of the money is flowing to humanoid robot companies and startups developing embodied intelligence models.