Half of all of the energy startups raising money from corporate investors in 2024 tapped up companies outside the energy sector.

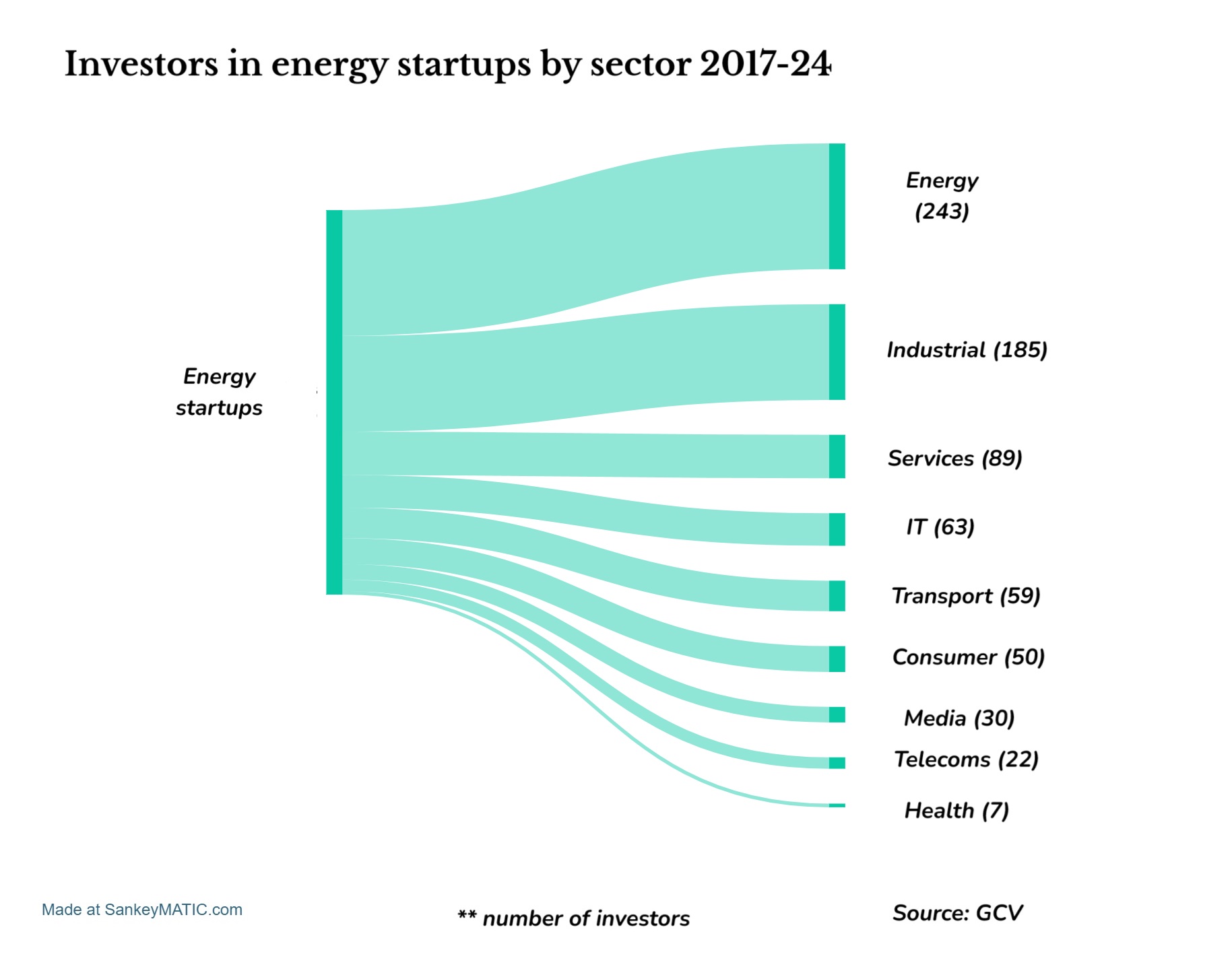

It might seem obvious that an energy startup looking for investment might tap up funding from a utility company or an oil major. But corporate investment in emerging energy businesses now is just as likely to be provided by a tech company or a transport operator.

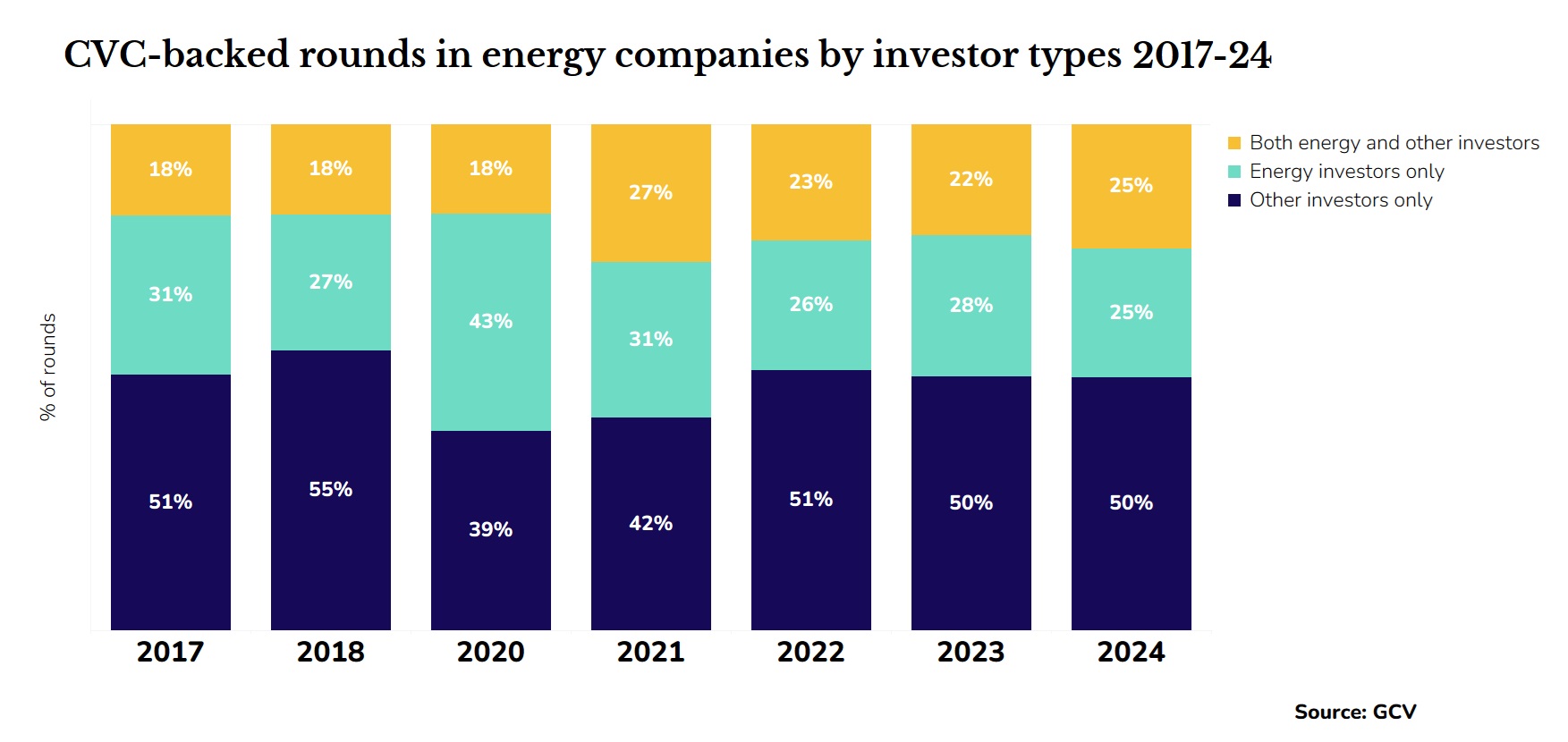

In fact, half of all of the energy startups that raised money from corporate backers this year got that funding in rounds featuring non-energy companies only, according to GCV data.

Only a quarter of energy sector startup funding rounds had money only from energy sector corporate investors, and another quarter raised money from both energy and non-energy CVCs.

The tech industry has been increasing its backing of energy startup as growing use of generative AI makes finding new energy sources more urgent.

According to a recent report by the International Energy Agency, electricity consumption from data centres, AI and the cryptocurrency sector could double by 2026. These activities made up around 2% of global electricity demand in 2022, consuming an estimated 460 terawatt-hours (TWh). By 2026 that could rise to more than 1,000 TWh, roughly equivalent to the electricity consumption of Japan.

It is little wonder, then, that big tech companies like Microsoft, Google and Amazon are investing in nuclear power. Amazon and Google both recently announced plans to invest in small modular nuclear reactors, Amazon taking a stake in X-energy while Google has teamed up with Kairos Power. Microsoft, meanwhile, is in talks to start buying electricity from the formerly shuttered Three Mile Island nuclear facility.

But nuclear is not the only option they are looking at. Amazon also backed Germany-based electrolyser maker Sunfire, which raised €210m ($233m) in a series D funding round earlier this year. Sunfire develops industrial electrolysers designed to convert renewable electrical energy into renewable hydrogen. The funds will go towards setting up the company’s first factory.

Google purchased a stake in New Green Power, a Taiwanese solar power company, and Google Ventures led a $40m series C funding round for Dandelion Energy, a geothermal company.

Software and networks company Cisco, meanwhile, recently invested in CorPower Ocean, a Swedish company that is looking to turn wave power into an energy source.

While their energy needs rise, tech companies are under pressure to reduce their carbon emissions in order to meet UN Sustainable Development goals. They have established sizeable climate-focused funds, which are also making investments in the energy sector.

● In 2020, Microsoft established its Climate Innovation Fund with a $1bn commitment, targeting underfunded climate tech solutions across carbon capture, water conservation, waste management, and ecosystem health.

● Also in 2020, Amazon upped the ante and committed $2bn to its Climate Pledge Fund to advance innovations in climate tech seeking to reduce carbon emissions across logistics, construction and data centre operations.

● In 2021, electronics manufacturer Apple, launched a $200m Restore Fund, which seeks to invest in forest restoration projects, aiming to remove CO₂ from the atmosphere while generating a return on investment.

Recent tech sector investments in decarbonisation startups include cloud and IT services company Hewlett Packard Enterprise backing the $52m series B round of French emission tracker developer Greenly, and Alphabet taking part in the $50m series B round raised by its spinout 280 Earth, a developer of direct-air-capture CO2 removal technology.

Transport sector

Transport companies, too, are investing into energy startups that promise more sustainable fuel options. United Airlines set up the UAV Sustainable Flight fund in February 2023, to invest in sustainable aviation fuels, pulling in a number of other investors, including American Express, Bank of America, Boston Consulting Group, Groupe ADP, Hawaiian Airlines, JetBlue Ventures, Air Canada, Boeing, GE Aerospace, JPMorgan Chase, Saudi Aramco and Honeywell.

Both United Airlines and Amazon were investors in the $245.7m series B round raised by Denver-based geologic hydrogen company Koloma. Koloma is developing technology to extract hydrogen from underground deposits.

Alaska Airlines’ investment arm, meanwhile, was one of the backers of the $200m series C funding round for Twelve, a US-based startup that turns CO2 into sustainable aviation fuel.

It is not just the aviation industry investing in energy. Automaker Stellantis, meanwhile, purchased a 49.5% stake in Argentina-based solar power producer 360 Energy Solar for $100m. The move was part of Stellantis’ strategy to increase energy self-sufficiency in its operations. The partnership will focus on the development of new solar plants, the installation of large-scale solar storage systems and the production of hydrogen energy.

Japanese car company Toyota, meanwhile, invested in the seed round of Oxylus Energy, a US startup turning carbon dioxide into methanol, a liquid fuel.

On the shipping side, Mitsui O.S.K Lines, one of the largest shipping companies in the world, took part in the $87m series H round raised by US-based battery maker 24M, which is rethinking the manufacturing process of batteries.

French shipping and logistics company CMA CGM, through its PULSE – CMA CGM Energy Fund, backed the series D round of Ascend Elements, which raised $704m in total. Ascend makes sustainable, engineered battery materials for electric vehicles. Japan Post also backed energy wholesale trading marketplace Enachain’s $38.2m series B round, which also featured several energy utility investors.