Startups backed by corporate investors are less likely to go bust. This pattern holds true even in a tough investment climate.

Startups with corporate investors are half as likely to fail and tend to achieve higher exit multiples when acquired or listed on the stock market. This holds true even after two years of an investment bear market, which has seen the overall number of bankruptcies increase.

A study we conducted last year, based on PitchBook data for corporate-backed startups and those without corporate investors, showed this trend over a decade. We re-ran the analysis this year on a global cohort of startups over a decade (2014–2024), to see if a second year of tough market conditions had changed the pattern. We found the the trend still held true, most notably when it comes to avoiding bankruptcy.

CVC investors often boast about the advantages they bring to startups, offering practical support such as access to testing labs, distribution networks, and connections to potential customers. It has, however, often been hard to see if involvement significantly impacts the outcomes of startups they back.

We examined PitchBook´s data between January 2014 and the end of November 2024, encompassing all VC transactions across the globe during the period. All companies were split into two major cohorts. The first group included those that had raised at least one round backed by at least one corporate investor since inception and had also raised a minimum of two VC rounds since 2012. The other group included companies that had not received any corporate backing in any round ever but had raised at least two VC rounds since 2012.

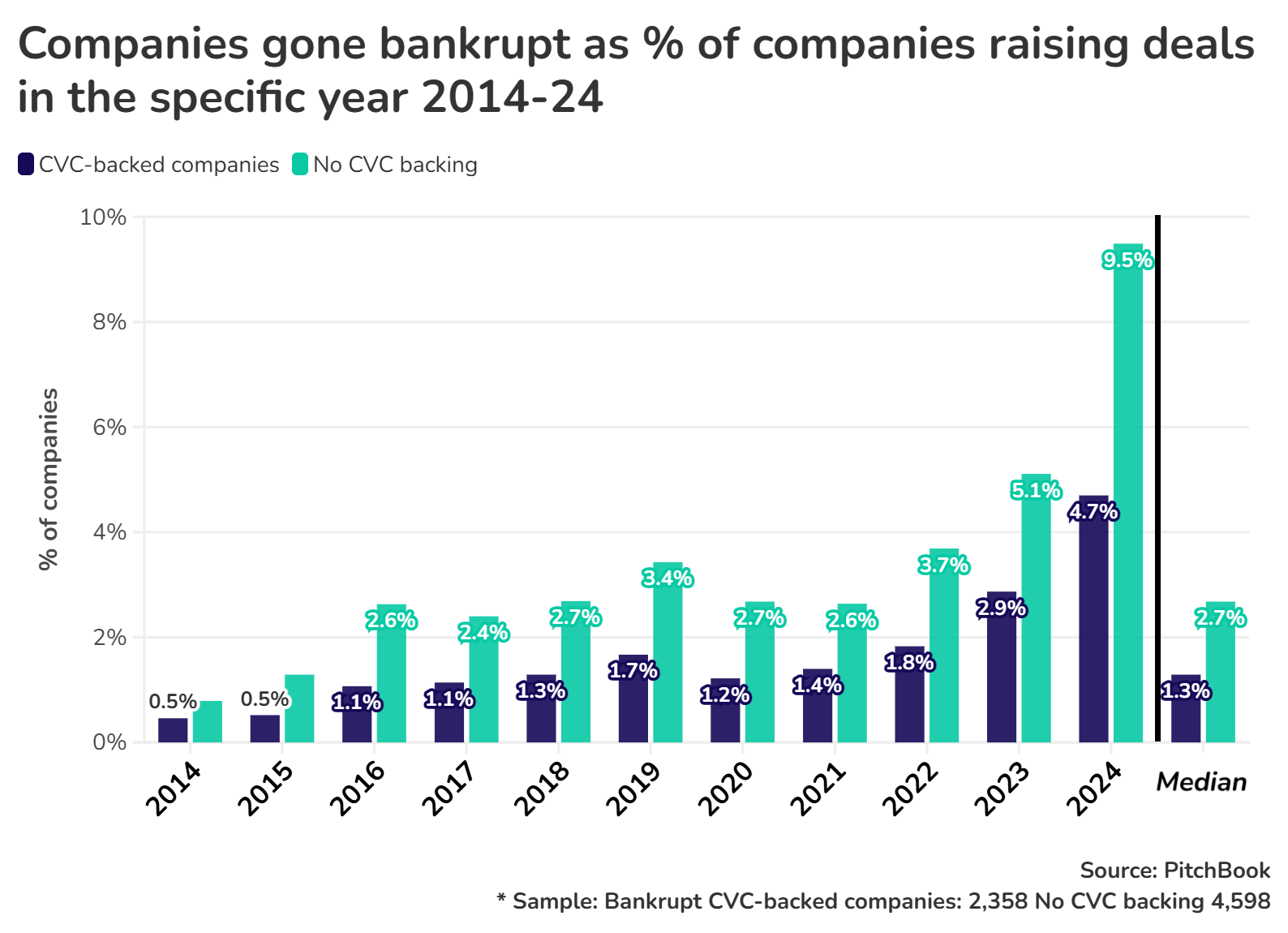

We looked at the rates of bankruptcy relative to overall fundraising activity in the market — obviously higher in a year that has seen relatively muted investor backing for startups. But the relative rates of bankruptcy for corporate and non-corporate-backed startups remained very constant. Startups that had no corporate backers were roughly twice as likely to go bust than those with a corporate backer. This is true for almost every year in the dataset we analysed.

It is also true on median basis as well. In any given year, the probability for a company without a corporate backer to go bust is 2.7% vs 1.3% for a company that has had at least one such investor on its cap table.

It is worth noting that bankruptcy rates in general need to be treated with some caution. Companies do not always announce these proactively, so they can sometimes be slow to get captured by database compilers like Pitchbook. But while startup bankruptcy figures may be somewhat underreported, this applies equally to both datasets and does not distort the overall comparison.

Boosted exit multiples

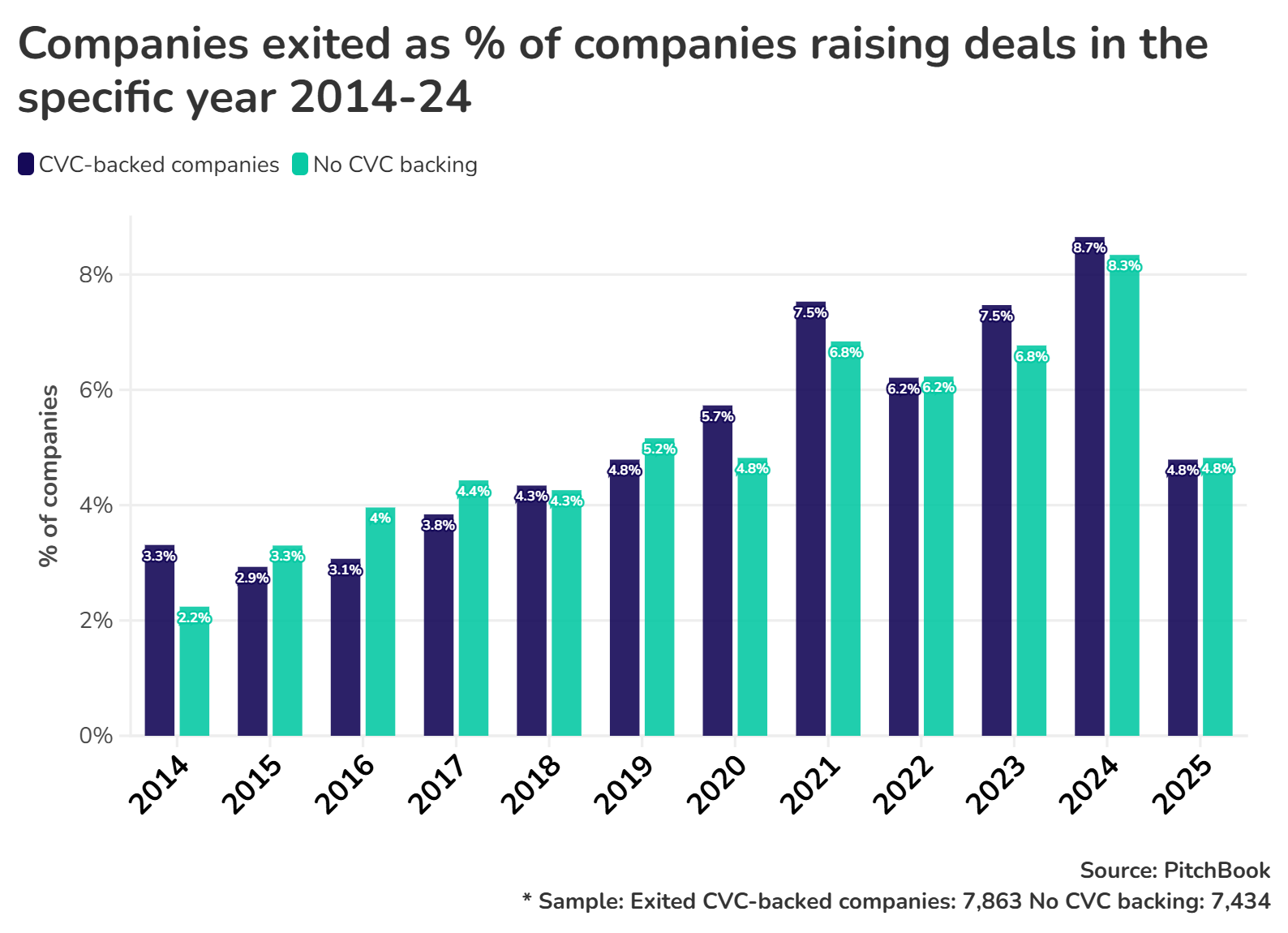

Corporate backing, by itself, typically has little to no impact on a startup’s likelihood of being acquired or going public. This continues to be true in a market where exit activity has been constrained.

The median percentage of exits of corporate-backed companies in a given year stood at 4.79% (out of the total of all companies that raised a round), which was only marginally lower than that of companies without corporate backing (4.82%). Corporate backing or not, one in about every 20 portfolio companies is likely to exit in any given year.

Notably, though, the odds for corporate-backed ones have been a little better in the past couple of years – 7.47% vs 6.77% in 2023 and 8.65% vs 8.34%. for 2024, respectively. This is significant, given the relative difficulty of achieving exits during this period.

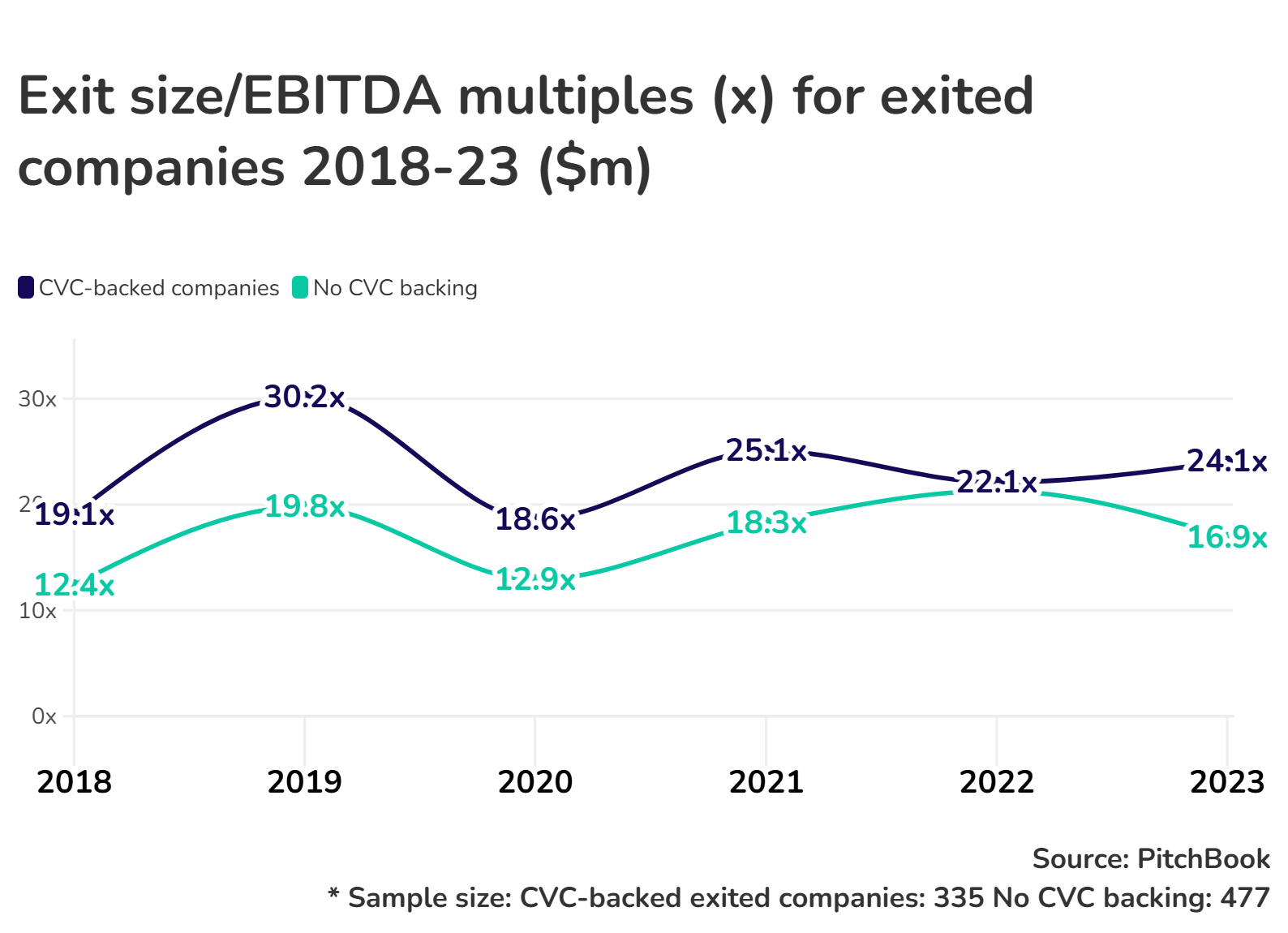

Where corporate-backed companies seem to have a considerable advantage, though, is the multiple they achieve when they do exit. We looked at the ratio of exit value to the startup’s earnings before interest, tax, depreciation and amortisation (EBITDA), provided by PitchBook.

We found that since 2018, this metric has generally been higher for corporate-backed firms, except during 2020 and 2021. The divergence in those years likely reflects the impact of the covid-19 pandemic and the wave of massive monetary stimulus that followed. Our analysis included 397 corporate-backed exits and 250 non-corporate-backed exits, with the sample size difference driven by information availability in dataset.

Crucially, not all these valuations can be chalked up to corporations buying their own portfolio companies at inflated multiples. There were a few cases in 2024 when a corporation bought a startup it already had a minority stake in, including Nippon Life’s $8.2bn acquisition of Resolution Life, Salesforce’s $1.9bn purchase of Own Company and US healthcare company MSD buying EyeBio for $1.8bn.

But while acquisitions are one reason corporations partner with startups, they’re far less common than many might assume. In our latest GCV Keystone benchmarking survey of corporate venture units, a majority—60%—reported that none of their portfolio companies had been acquired by their corporate parent.