Corporate investors are still showing strong interest in quantum computing, but there is growing pressure to show these bets will pay off.

Quantum advantage, the point at which quantum computers can outperform classical machines, is expected to transform industries as diverse as manufacturing, logistics, drug design and finance.

Large corporations are already working with developers to devise practical ways of using the advanced capabilities in their businesses. According to Olivier Tonneau, partner at Quantonation, a quantum technology VC fund, the race to prepare is well underway.

“We’re getting close to quantum advantage on several potential use cases,” he says. “So if you want to be relevant in a few years, you have to start right now”.

But although there are optimistic predictions being made for the technology, investors cannot wait forever for a breakthrough in commercial deployment.

“Quantum computing is really on the outer edge of what you can do in venture capital in terms of risk, money involved and timeline [to a commercial deployment],” says Jan Westerhues, an investment partner at Bosch Ventures, the CVC fund backed by the German technology company. “It’s the furthest out of all our investment areas, but it will hopefully bring the largest reward too”.

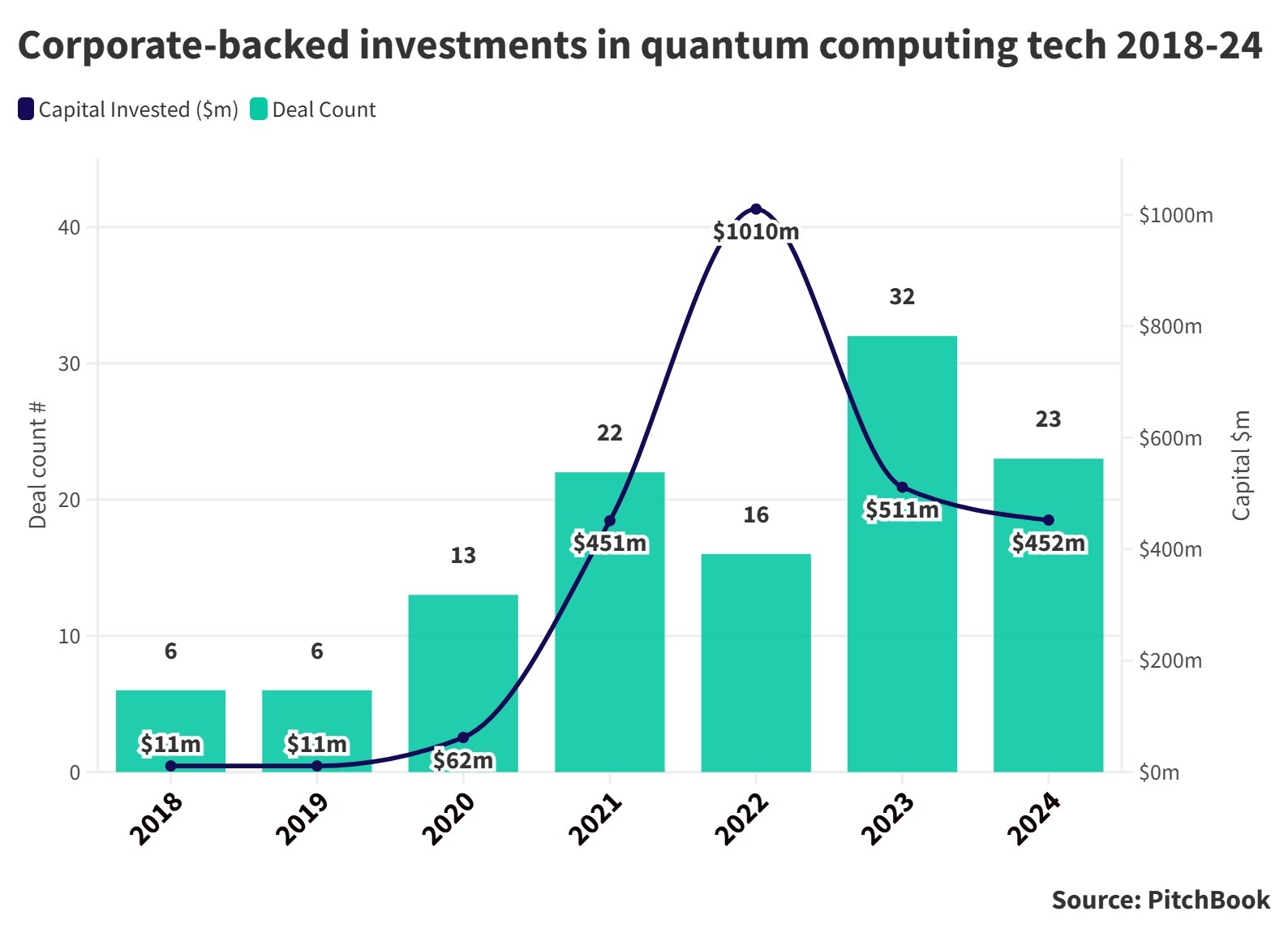

Corporate-backed deals in quantum computing have come down since their dollar value peak in 2022, but there is still strong activity in the sector. In August, Riverlane, a UK startup, raised $50m in its series C funding round. It makes error correction software and algorithms to bridge the gap between today’s experimental hardware and a commercial use.

It’s a similar offering to Q-CTRL, an Australian startup that also works on error correction and raised $113m in its series B round last month. Both are examples of the investor focus in what Tonneau is calling the new phase in quantum investment, where it’s not just about improving hardware offerings, but also making existing hardware operate more effectively.

Every method of building a quantum computer suffers from the instability of the subatomic matter used to carry a unit of information, known as a qubit. If you run an operation, it is often only a matter of time before the qubits fail and produce error. The more qubits that are used, the harder it is to keep calculations accurate, and so scaling up the technology has proved difficult.

Reaching quantum advantage will involve a combination of developments in hardware, error correction software and the algorithms designed to be run using quantum principles.

With investors under pressure to have their commitments in the sector pay off, the question is how these developments will be achieved, and when.

Alternative approaches

The most advanced method for generating stable qubits is known as superconducting. This has been pursued by some of the leading companies in hardware research and development, including IBM, Google and Rigetti Computing.

But it may not be the most fruitful technology for a hardware startup.

“This is an area [Bosch Ventures] currently won’t invest in,” says Westerhues. “It is too crowded.”

Instead, Bosch Ventures and other investors have considered a range of hardware types where there is not yet a clear winner. Each relies on a different approach to creating qubits, which has implications on size, cost, application and, crucially, the ability to scale.

Trapped ion, photonic and neutral atom quantum computing encode information, respectively, on an ion suspended in an evacuated chamber, a light particle, and an atom caught at an extremely low temperature.

“It’s difficult to say that there will be a single winner,” says Olivier Tonneau. “Superconducting, trapped ion, neutral atoms and photons could all probably perform some complementary computations.”

Like Bosch Ventures, Quantonation is exploring all the main approaches.

Pasqal, one of its portfolio companies, makes full stack quantum computing products, producing neutral atom-based hardware and its own software.

In 2023 it raised $109m in a series B funding round led by Temasek, which saw participation from Quantonation and Wa’ed Ventures, the CVC arm of the Saudi state-owned oil and gas company Aramco. This year, Pasqal signed an agreement with Aramco which will see the startup supply Saudi Arabia with its first quantum computer.

“If you are a big corporate and you want to benefit from quantum, you have to move now,” says Nicolas Proust, Pasqal’s head of strategy and corporate development.

Proust says Pasqal is working with energy provider EDF to optimise the charging of electric vehicles, and with Johnson and Johnson on drug discovery.

“We have a full software stack, meaning we make algorithms very close to the quantum processing units to enhance all the capabilities of our hardware and focus on applications.”

Pasqal works with industry partners to refine the computer to a specific use.

“AI is booming these days because the hardware allowed it to boom. Companies need to understand that hardware will be key to capturing the value of quantum.”

Nicolas Proust, Pasqal

“AI is booming these days because the hardware allowed it to boom. Companies need to understand that hardware will be key to capturing the value of quantum,” says Proust.

Proust’s expectation is that quantum advantage will be reached in the next 24 months. But similarly optimistic predictions have been made before, and falling investment since 2022 suggests excitement has cooled.

Jan Westerhues says that this was to be expected. “In a hype cycle you always have these big rounds, and then people sober up and realise that deep tech is hard, things take more money to build.”

Photonic and trapped ion approaches have received investor attention. IonQ, a US company making trapped ion hardware and which was a Bosch Ventures portfolio company, went public in 2021 via a special purpose acquisition vehicle. In October, the Israeli photonics hardware startup Quantum Source raised $50m in its series A funding round, with Dell as a corporate investor through Dell Technologies Capital.

“Build small and work up from there”

On the smaller end of the scale is silicon spin qubit technology, which uses electrons as qubits on a semiconductor chip. While it is in an earlier phase of development with fewer stable qubits, its developers promise easier scalability using existing chip manufacturing processes.

Bosch Ventures led the $50.5m funding round into Quantum Motion, a UK silicon spin qubit startup, in 2023. In November, Quantum Motion announced it had worked with Goldman Sachs to develop a quantum algorithm for options pricing, which requires a time pressured calculation involving multiple variables, making it risky when performed on a classical computer. The research is still undergoing peer review.

“We see scaling quantum computers to many qubits is most likely to work if you build small and work up from there,” says Westerhues. “The world’s best tool for this is silicon.”

Quantonation’s portfolio company Diraq, an Australian silicon spin qubit startup, has partnered with two of the world’s leading research and development semiconductor foundries to build prototypes of its designs, Imec and Global Foundries.

Andrew Dzurak, Diraq’s CEO, says that measurements indicate its first chip wafer has achieved a fidelity rate for its two qubits at over 99%, a key industry benchmark for stability.

“When we’re using standard transistor [manufacturing techniques], it’s very easy to conceive of how [scaling up to a large number of qubits on one chip] can be done,” says Dzurak. “The engineering is not so easy, of course.”

Silicon spin works by trapping a small number of electrons in the device. To work, the electrons need to be kept at a very low temperature, and as using the chip generates heat, it is a challenge is to keep the qubits stable.

“It’s a significant engineering challenge, but we’re confident we know how to do it,” says Dzurak. If achieved, successful cooling on a chip could be combined with the existing scale of semiconductor technology to rapidly reach a much more powerful computer.

“Because you will be able to get everything in one cryogenic system, the cost of operating an error-corrected quantum computer will be much lower,” he says.

“Quantum computing is only going to be transformational if you do it in a cost effective manner. If you’re going to design a new drug, but the computer costs $10 billion and has to be run for ten years to get your answer, I don’t think that’s very transformational, because no one’s going to do it.”

Beyond hardware

While the capital-intensive hardware startups are working to build more powerful and stable machines, another set of companies are coming at quantum advantage from a different angle, designing and refining the algorithms that quantum computers will eventually run.

“The vast majority of venture funding has gone into making hardware that can perform more operations,” says Gabriele Maroso, strategy and operations officer for Phasecraft, a UK quantum algorithm company which had a $17m series A funding round last year.

“The other side of [making quantum computers that can be used effectively] is developing algorithms that are more efficient and require fewer operations to generate results.”

Phasecraft was founded in 2019 by academics who had been working on quantum algorithms for years. One of the problems the team is working on is developing algorithms that can be used to simulate next generation battery materials. This is beyond the abilities of current quantum computers, but Maroso says improving the maths can help close the gap.

“We are pinning our algorithms to the state of the art in quantum hardware,” Maroso says. “With some of the road maps on how [hardware developers] are scaling up to quantum advantage, we think some of the hardware they will produce next year, combined with our algorithms, will yield some sort of advantage, likely scientific [as opposed to commercial] at first.”

Kipu is a German startup that makes quantum software that gives access to its algorithms as a service. Like Phasecraft, the focus is on making them as efficient as possible.

“Our algorithms lower the computational resources like total quantum gates or computational time, the number of measurements to be able to perform meaningful computations on a quantum computer. You can also turn this around, you can say if you’re looking at a given quantum computer, applying these algorithms will create significantly better results.”

Solving one mathematical problem with an algorithm can open up multiple use cases across different industries, says Volz.

“If you look at things like asset allocation, or portfolio optimisation in finance, these can be described in similar ways as protein folding.”

Kipu has partnered with hardware companies using computing architectures ranging across superconducting, trapped ion and neutral atoms. Volz says this is because the different types are better suited to certain mathematical problems.

IBM’s superconducting processors are very fast, making them better in cases where real-time optimisation is needed.

“But [superconducting-based computers] don’t feature all-to-all connectivity,” he says. “Meaning a qubit only communicates with its nearest neighbour. If you have a problem that has a lot of variables that depend on all the other variables, you gain more by running them on an ion trap or neutral atom device [where all the qubits are connected]. However, the operation time on these devices are significantly slower than SC devices.”

“Selection of the right hardware for use case depends on the time expectation being in real time or not real time, as well as whether the mathematical structure of the problem requires full connectivity [between the qubits].”

A report by the management consultancy McKinsey said quantum computing shows the potential to be useful in chemical and pharmaceutical design, as well as in optimisation tasks, which could be applied to financial portfolios or to improve the efficiency of logistics.

On industry’s radar

New corporate investors continue to enter the quantum computing sector. State Farm, a US insurance company, made its first quantum computing investment in 2023, taking part in the $5.5m series A round raised by Entropica Labs, a Singaporean error correction software company.

Michael Remmes, innovation executive at State Farm Ventures, the insurance company’s CVC arm, says his team is currently scouting for other opportunities.

“By investing in these companies we are going to get a better view into the quantum world, into the timelines and how we can incorporate this into our business,” he says.

“One use that’s going to be very important for insurance companies like State Farm is catastrophe modelling. In the future, it could be very helpful to incorporate complex weather data to give us a better indication of risk.”

Other corporates from outside deep tech industries are exploring opportunities too. Toyota Ventures, Toyota’s CVC unit, took part in the $4m funding round in the US quantum software company Haiqu last year. And Accenture Ventures, the CVC of the US professional services company Accenture, invested in Aliro Security in May, which makes networking technology for quantum hardware.

Bosch Ventures invests independently of Bosch Group, its parent company and sole limited partner, but Jan Westerhues says, “We are a radar for [Bosch Group]. We see waves of interesting technology way before they impact Bosch.”

“Given where we are with quantum computing, this is explorative. We are preparing for the day when Bosch can do something useful with it.”