Enterprise software will no longer be designed with humans in mind, upending the sector and putting incumbents and even startups at risk.

Enterprise software companies are facing an existential shift with the arrival of artificial intelligence. Business software will go from being designed around people to being designed around data, and this will create a space for innovative startups to challenge incumbents.

“Every software that’s been designed has been designed around users that are doing data entry,” says Deepak Krishnamurthy, founder of VC firm Gaia Ventures. “The fundamental thesis that software is built around people is going to change with AI. Software workflows aren’t going to be built around people; they’re going to be built around data and AI.”

Customer service software, for example, which traditionally is built for service representatives to enter data, will no longer be designed for people to interact with. It will not need to be accessed through screens.

“Screens don’t make sense if the AI is interacting directly with a database system,” he says.

The customer relationship management (CRM) software market alone will generate close to $100bn in revenues in 2025, according to estimates by Statista. The sector is still heavily dominated by Salesforce, but this moment of technological change creates an opportunity for startup challengers to take market share.

This is one of the reasons that, in 2022, Krishnamurthy, a former chief strategy officer at software company SAP, set up Gaia Ventures, to focus exclusively on investing in early-stage enterprise software startups driven by AI.

Krishnamurthy, who founded SAP’s now shuttered corporate venture fund, SAP.iO, during his decade-long tenure at the firm, has made several investments so far. These include Pay-i, a generative AI platform for optimising financial operations, Ninetailed, a software that enables users to create personalised website content for visitors, and Flavor, AI-driven accounting automation software. He plans to aggressively grow the portfolio with the aim of closing between 30 and 35 deals over the next two to three years.

From copilot to autopilot

Today, AI is used as a so-called co-pilot that assists people in doing a task. Krishnamurthy predicts that the term will morph into “autopilot”. AI will do the job on behalf of a human rather than supporting a human.

The switch to AI automating workflows means software companies, whose business models are built on charging businesses a fee for the number of users of their software, will have to rethink this strategy. Fees will have to be based more on outcomes or results rather than the number of software users.

The large incumbents are likely already preparing for what is coming.

“A few are more prepared than others. The ones that are going to proactively change their business models are the ones that are going to win,” says Krishnamurthy.

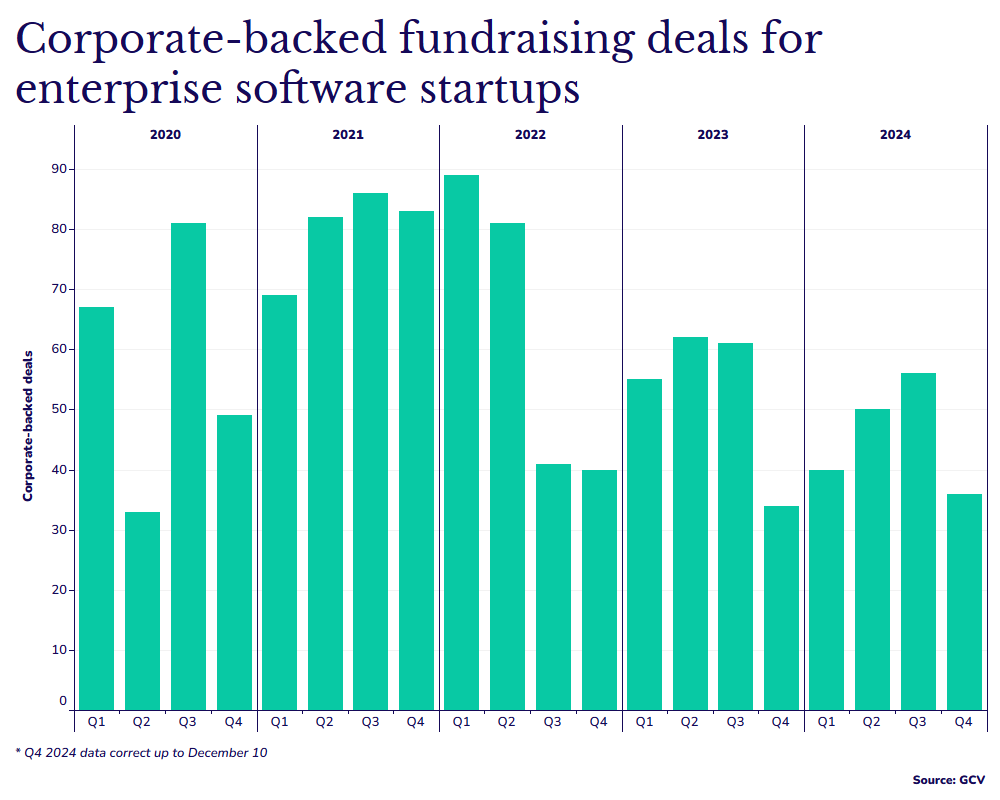

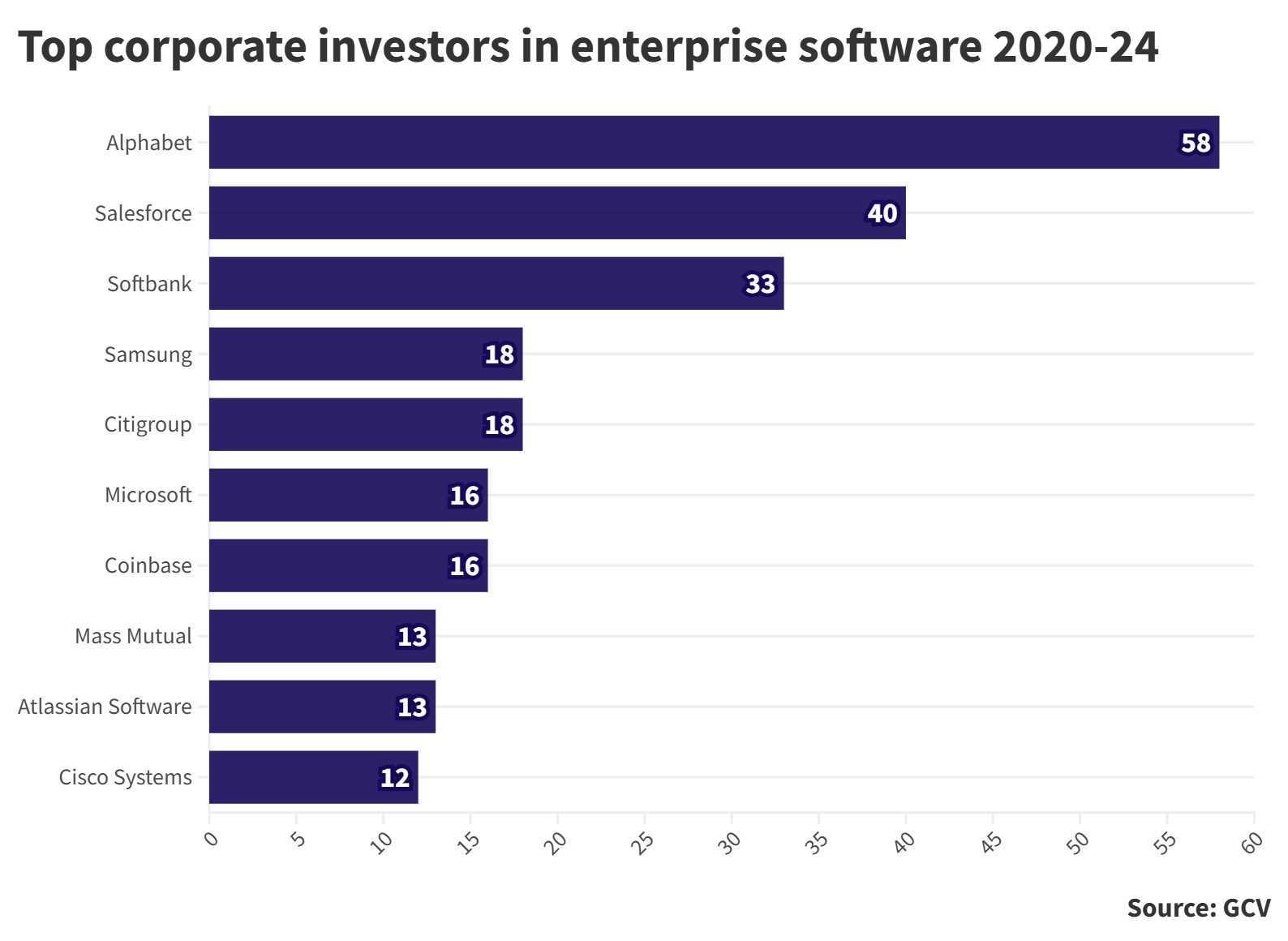

Corporates are investing in the next generation of B2B software through their corporate venturing units in a bid to stay on top of the technology. The biggest corporate investors in enterprise software include Alphabet, Salesforce, Microsoft and Cisco Systems.

Founders don’t want to sell

Mergers and acquisitions will likely dominate the enterprise software sector over the next few years, Krishnamurthy says. But he also predicts that more young companies will chose not to sell at an early stage with the aim of scaling to the point of doing an IPO.

“More and more founders are being bold in terms of the way they are looking to build out a business. They will not necessarily take the first offer that comes to the table or even the third offer that comes in when they’re at a reasonable stage.”

Startups are also under less pressure to seek liquidity through a sale or IPO to buy the shares of early employees who want to exit. “Previously, you either had to sell or do an IPO to get liquidity. But now the liquidity market is very different because of secondary funds or options for companies to raise money for just buying employee shares,” he says.

Gaia Ventures invests solely in early-stage companies. At later stages, valuations are too frothy, he says. The rapid advancements in AI technology also mean that later-stage startups struggle to keep up and adapt.

“I’d rather invest early and have a startup that is able to pivot rather than invest late and be stuck with a startup that is challenged by the changing technology,” he says.

“Every time Open AI or any of these new models releases a new piece of functionality, a lot of startups go out of business because their reason to exist disappears.”