Uncertainty in the insurance sector is growing as climate change exacerbates natural disasters. But insurance companies appear to be slowing investment in new technologies that could help.

Wildfires in LA have shone a harsh spotlight this week on the vulnerability of some US insurers to the rising volatility in weather driven by climate change. JP Morgan analysts say losses from the LA fires could exceed $20bn, according to reports in the Financial Times. This is a rising yearly threat: natural disaster-related losses in the US are now routinely hitting $100bn and above. The costs are causing some providers to stop issuing property coverage in the riskiest areas, leaving people either uninsured or with an over-stretched insurer of last resort to rely on.

Changing weather patterns are disrupting the insurance industry to its core — but are insurance companies investing enough in technologies that might help them navigate a more uncertain future?

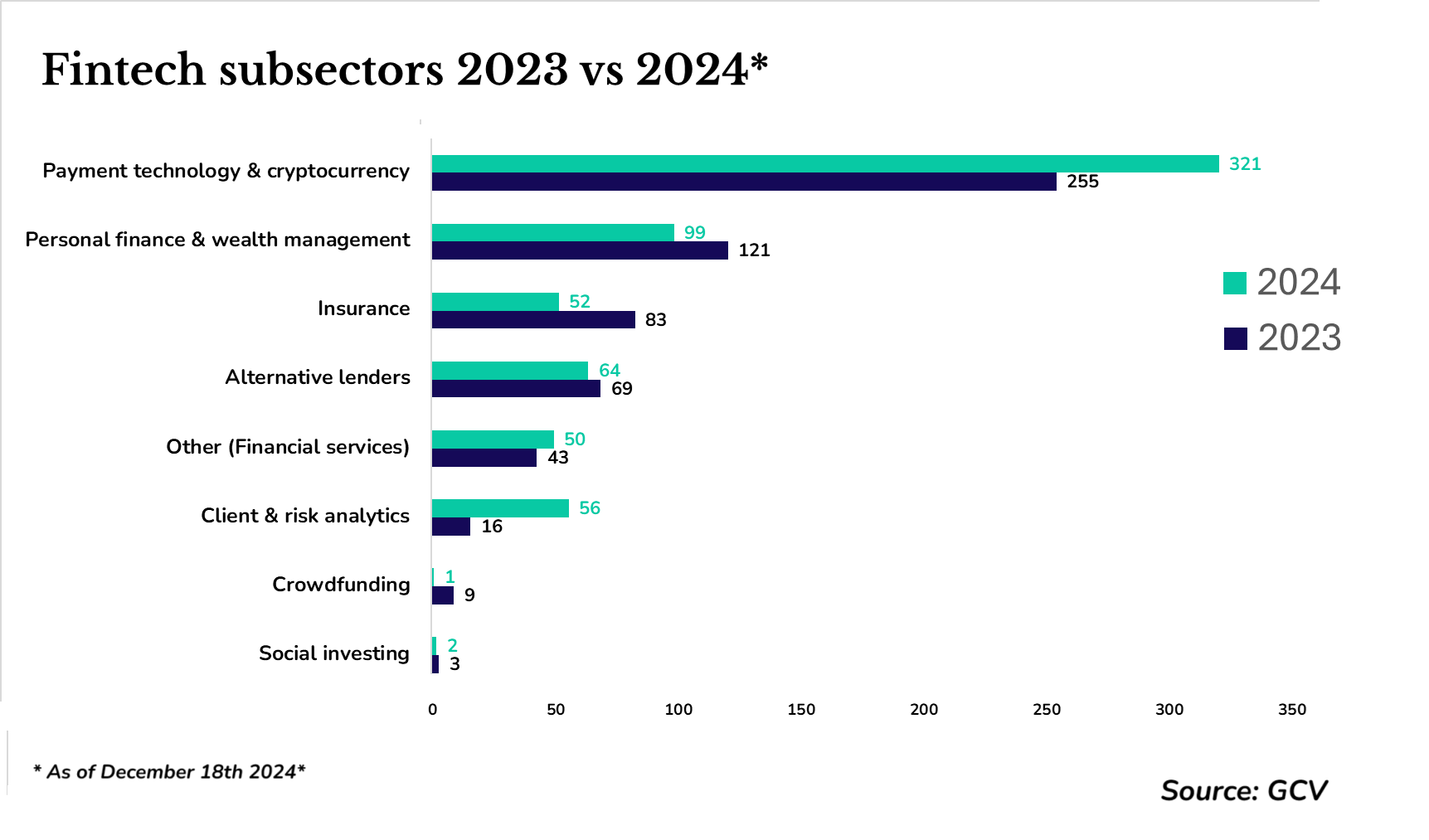

GCV data for 2024 suggests that corporate-backed insurtech deals have markedly slowed down. Almost all areas of fintech saw waning interest from corporate investors in 2024, but insurtech was the area that saw the largest decline, with deal numbers down more than a third last year. The value of deals — where the value was disclosed at all — has nearly halved from $2.8bn to $1.6bn.

Insurance sector investors say a climate of higher interest rates and a sluggish IPO environment are to blame.

Despite this pull-back, many insurance companies are still showing a willingness to invest. Liberty Mutual and Prudential Capital both launched corporate VC funds in 2024, totalling $579m between them. Japanese insurance group MS&AD’s US-based CVC unit, MS&AD Ventures, also recently launched a $100m fund.

There is also cautious optimism that AI technology could revive CVC interest in this area, with some strong examples seen over the last year.

Deals have fallen – will 2025 see a rebound?

According to GCV’s data, the value of corporate-backed funding rounds for fintech startups generally have fallen from $12.4bn in 2023 to $10.7bn in 2024. But even in that context, the 43% decline in the value of insurtech investments is steep.

The average value of a corporate-backed insurtech startup funding round was down to $35m from $42m last year.

Michael Remmes, principal at US insurance mutual State Farm’s CVC unit, State Farm Ventures, says low morale in the market might be to blame.

“I think one of the big drivers here is the lack of IPOs in the market,” he says. “And so if founders don’t see a clear exit, maybe they’re not going to start a business.”

Remmes thinks founders’ aversion to holding funding rounds is limiting the investment opportunities.

“Another thing is the down market. We’re seeing a lot of insider rounds [and] a lot of that is because the company looks at the market and doesn’t want a new valuation, they don’t want to be priced lower on a down round.”

GCV tracked just six exits for corporate-backed insurtech startups in 2024, and all of these were acquisitions or buyouts.

| Companies | Investors | Deal Date | HQ Location | Exit Type |

|---|---|---|---|---|

| JustInCase | Sony Financial Group | 22-Nov-2024 | Tokyo, Japan | Merger/Acquisition |

| Marble (Financial Software) | The Zebra(Keith Melnick) | 25-Jul-2024 | New York, NY | Merger/Acquisition |

| Planck | Applied Systems(Taylor Rhodes), CapitalG(Gene Frantz), Hellman & Friedman(David Tunnell), JMI Equity(Paul Barber), Stone Point Capital(Charles Davis) |

23-Jul-2024 | New York, NY | Buyout/LBO |

| Sensely | Mediktor(Cristian Pascual) | 06-Apr-2024 | San Francisco, CA | Merger/Acquisition |

| Tensorflight | Lead Edge Capital(Zach Ullman), Nearmap Australia, Thoma Bravo(A.J. Rohde) |

14-Oct-2024 | New York, NY | Buyout/LBO |

| Uno Re | SYSLabs(Jagdeep Sidhu) | 06-Feb-2024 | Tallinn, Estonia | Merger/Acquisition |

Fewer — and less significant — large insurtech deals

Large corporate-backed funding rounds for insurtech companies have dwindled in 2024. In 2023, there were eight such rounds, including a $265m funding round for Next Insurance, a US small business insurance provider, which saw participation from the insurance firms Allstate and Allianz.

There was also a large exit for Resolution Life, a UK life reinsurance consolidation business which was acquired by Japanese insurer Nippon for $650m.

In 2024, there were only three deals valued over $100m. The largest of these was a $480m funding round for Ruby Reinsurance, a US third-party life reinsurance company.

GCV subscribers can see all the corporate-backed startup funding rounds going back to January 2023 here.

Insurtech startups increasingly working with corporates

An earlier wave of insurtech startups found that pitting themselves against the large industry incumbents was a difficult strategy to pull off. Current insurtech startups are much more likely to see cooperation with incumbents as the way forward.

“Our view has always been that the most effective way for insurtech [startups] to be successful is through collaboration with incumbents in symbiotic partnership,” says Nhi Huynh, a senior manager at Allianz X, the CVC unit of insurance multinational Allianz.

“It allows them to leverage the size, infrastructure and expertise of incumbents to scale their innovations more effectively. And vice versa: it allows established insurance companies to drive growth in new areas, test assumptions and modernise.”

This kind of partnership was the target of Allianz X’s investment in Next Insurance, the $265m 2023 deal. Next provides another foothold into the small business insurance market.

AI could drive 2025 funding

The insurance industry is a relative latecomer to AI. Earlier this year, many insurers told GCV they were enthusiastic about the technology but not entirely clear about use cases. This may be changing.

A report from reinsurance company Gallagher Re, released in November, said that nearly two-thirds of insurtech VC deals went to AI-centred startups.

Among the backers of these deals were a number of insurance sector companies making small to medium-sized bets in AI insurtech startups. Guidewire, an insurance software developer, for example, backed the $120m funding round for Akur8, a French startup using AI in its insurance pricing software.

Gradient AI, which makes AI-based insurance risk analytics software, raised $56m in its July series C round from investors including Massachusetts Mutual Life Insurance through its MassMutual Ventures CVC. Sixfold, which makes AI-powered underwriting software, raised $15m in a series A round that saw participation from the enterprise software CVC Salesforce Ventures.

Could new funds shake things up?

The US insurance company Liberty Mutual established a $200m fund in July to target insurtech. It will mainly target startups in the property and casualty insurance market, with a focus on technologies including AI, data, cybersecurity and clean energy.

Then, in September, PruVen Capital, a CVC established by the US insurer Prudential, launched a second fund that raised $379m.

This saw the CVC take on other insurance companies as limited partners, expanding the investment sources from just Prudential, the sole backer of the first fund. These include US insurance companies TIAA, Lincoln Financial and Mutual of Omaha. The Japanese insurer Nippon Life and and Italy’s Generali also contributed, as did the US-UK company Willis Towers Watson.

MS&AD Ventures’ $100m fund, the unit’s fifth since starting in 2018, underscores the parent company’s commitment to innovation. This will continue the unit’s investment across insurtech and other sectors including property, health, fintech and transport. Jon Soberg, the unit’s CEO and managing partner, says the fund has already made two investments, with details to be announced.