South Africa's strong fintech sector, financial and regulatory systems make it an opportunity for foreign investors, but local corporates need to help seed the startup ecosystem.

South Africa has potential to be a key entry point for international investors wanting to engage with the African startup ecosystem. Home to renowned research universities and with a strong financial and regulatory set up, the country has many of the factors needed for a tech ecosystem. But venture capital is still limited — and corporate venture capital (CVC) investors could be key pushing the market forward.

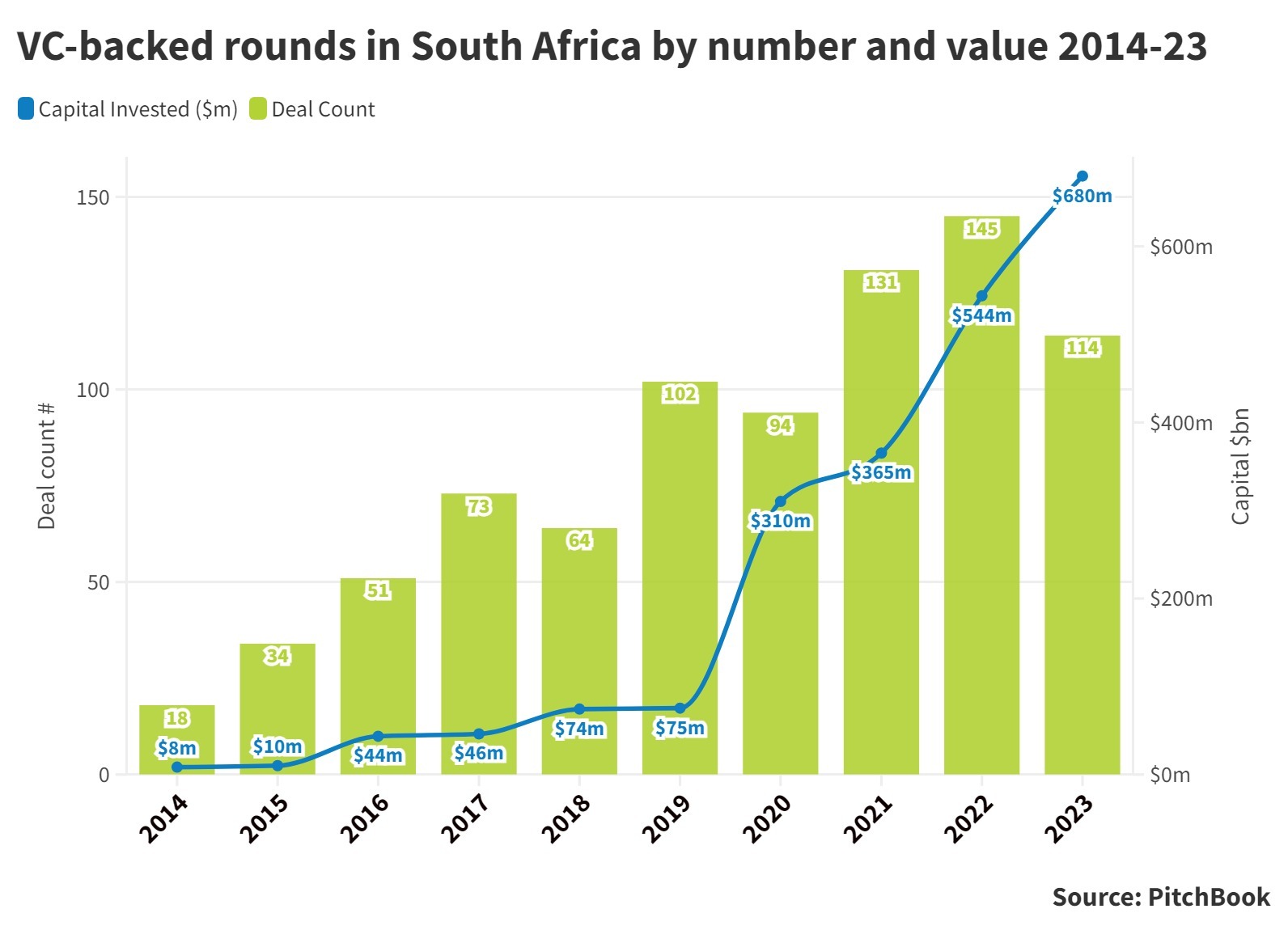

Africa, overall, is seeing growing interest from international investors. Although the continent as a whole is still nascent in terms of its tech scene, it has the fastest growing population, and investment in startups rose 150% between 2019 and 2022 according to Bpifrance figures, with South Africa one of the three largest markets alongside Kenya and Egypt.

When Sony entered the continent with a $10m fund this year, its first investment was in South African mobile game publisher Carry1st. And for Founders Factory Africa, a pan-African, seed-stage venture firm headquartered in the country, it’s full of potential.

“I believe Africa represents a tremendous CVC opportunity and South Africa is probably one of the easiest markets for a CVC to operate in,” says its chief portfolio officer, Sam Sturm.

“If you don’t know the players on the ground, the market or the customer base, it can be really hard to engage. But if you’re looking at markets, it’s one of the easier ones on the continent to do business in and to plug into if you aren’t on the ground and local.”

South Africa is home to 14 of Africa’s 20 largest companies by revenue. Few of them have a CVC arm but these big companies can serve as customers for local startups, even if they aren’t providing equity funding.

“Broadly, there is a much more developed corporate enterprise ecosystem than in places like Kenya or Nigeria. The startup ecosystem there has really evolved in large part around that, for better and worse,” Sturm says.

“You have lots of smart, really talented people employed by banks, insurance companies and consultancies. There are a lot of other markets where entrepreneurship is maybe more necessary as a job opportunity than in South Africa. The flipside of that is that there is a robust corporate ecosystem to support and partner with startups.”

The country has other advantages, says Vuyo Mpako, who runs South African financial services group Old Mutual’s venture investment and studio arm, Next176. It has a young, tech-savvy population, a stable and mature financial system and a reliable regulatory environment.

“Globally, we have a very strong regulatory system that makes sure the rule of law is upheld,” he says. “When you do something, you know that contract is enforceable, and we have a judiciary that has been kept very immune from any kind of political influence.”

Old Mutual invests in a range of areas including health, education and employment, but in South Africa it has focused most notably in fintech, as can be seen in this table listing some of the largest rounds of the past three years. Old Mutual’s fintech success stories in South Africa include digital bank TymeBank, which closed a Tencent-backed round last year valuing it just shy of $1bn, and digital payment company Onafriq, which raised $100m from investors including CommerzBank and Axa in 2022.

Top VC rounds in South Africa 2021-2024

| Company Name | Deal Date | Sector | Deal Size ($) |

| All Weather Roads Engineering | 12/01/2024 | Industrial/Construction | 200 |

| Onafriq | 14/06/2022 | Financial services | 200 |

| Red Rocket Energy | 27/09/2023 | Energy | 160 |

| Jumo | 08/11/2023 | Financial services | 120 |

| Planet42 | 22/02/2023 | Transport | 100 |

| Yoco | 27/07/2021 | Financial services | 83 |

| TymeBank | 22/05/2023 | Financial services | 78 |

| Yoco | 01/12/2022 | Financial services | 70 |

| Cassava Technology | 18/07/2022 | Telecoms | 50 |

| VALR | 01/03/2022 | Financial services | 50 |

| Wetility | 07/09/2023 | Energy | 49 |

| Ozow | 20/11/2021 | Financial services | 48 |

| Bio2Watt | 30/01/2023 | Energy | 39 |

| Lula SA | 01/02/2023 | Services | 35 |

| Peach Payments | 01/05/2023 | Financial services | 31 |

Like many other developing nations, South Africa has limited startup capital. There is more than in neighbouring countries, but there are few local VC firms and those that exist focus on early-stage investing.

“It’s a very, very small market from a pure investor perspective. There are a couple of players who’ve been around for a decade now, maybe a little bit longer, and they are well established,” says Mpako.

“The markets are not well matured and some of the fence instruments the Silicon Valley world is used to are still fairly new in some of our markets, so those are challenges. But it is evolving.”

Part of the problem is that South Africa doesn’t have much of a history of venture capital. VCs used to be looked at as “private equity guys in hoodies,” Sturm says. This has meant that investors like Barati Mahloele, a GCV Rising Star who oversees packaged food and beverage group Tiger Brands’ CVC activities, have had to work hard to educate the market and broaden the range of investment.

“There is definitely a lot of opportunity and there isn’t a shortage of innovative companies,” she says. “I think the venture capital funds that have been in the market a while have done well to develop it, but there’s a long way to go in terms of other pools of capital.

“For example, we’re currently doing a lot of work to get pension funds to invest in this asset class, and there has been a lot of work done in education, in terms of asset managers and the opportunity of this asset class. It’s risky but there is a great potential upside. It’s about how we manage the risk/return profile to make it more attractive for additional pools of capital.

“Corporates play a big role…we believe it could be a very key lever of growth going forward.”

“And corporates play a big role, we’ve put this out here at Tiger Brands because we believe it could be a very key lever of growth going forward.”

Another solution involves getting more foreign funding for startups, which is perhaps where a local partner can come in. Sony is working with the International Finance Corporation to find African startups while Next176 has Singapore-based Standard Chartered’s SC Ventures unit among its partners. The international corporate gets eyes on the market while the local CVC gets access to deep pockets and a global investor for its startups.

“Sometimes, the risk/return profile or ticket sizes are a little above the limit for some local investors,” Mahloele says. “But it would be very clear for an international investor – if your appetite is in Southern Africa, East Africa, West Africa, you can align yourself with the VC funds and corporate VC funds in that market and you’ll see the opportunities that are available.”

However, if you can secure foreign funding, there is an added issue: currency instability. The South African rand has lost roughly half its value against the US dollar over the past decade, and if you’re raising money from US-denominated funds and getting revenue in rands, it can be trickier to generate returns for your investors.

The Rainbow Nation needs to reach out to the rest of Africa

Diversity is another imbalance that South Africa needs to deal with. Despite being branded the Rainbow Nation for 30 years, some of South Africa’s old problems linger. It ranked as the most unequal nation in the world according to Harvard University Press’s 2022 World Inequality Report.

The level of diversity among its funds varies, but many market observers noted, for example, that Naspers Foundry, the $100m local investment arm of internet and investment company Naspers, had only one startup with a black co-founder among its portfolio of nine before the unit closed last year.

South Africa’s inequality — which means a sharp division between large corporations and the majority of the population — can also limit the customer base for startups.

“You have very viable startups that are serving corporate clients, because you have a large corporate client base you don’t have in other markets,” Sturm says. “But at the same time, you have the needs of lower-income consumers at the bottom of the pyramid.”

Agtech startups, for example, can find rich clients in South Africa’s large commercial farms, but then struggle to adapt those solutions to other parts of Africa.

“If you look at the average farm size in South Africa, it’s something like 20 times what it is on the rest of the continent, where you’re mostly talking about smallholder farmers,” he says.

“So, there is a big challenge, between the shape of the challenge and the user in South Africa. What that means is that if you invest in a solution in Nigeria, you imagine it’s appropriateness to farmers in Ghana or Benin and the whole region. In South Africa, we don’t see as many of those solutions because that consolidation means the smallholder user base isn’t that viable, so, you see fewer solutions locally to serve that [Africa-wide] market.”

Sturm is an American who spent a year in South Africa as head of new ventures for Founders Factory Africa and who now deals with the whole continent out of an office in London. He says that what strikes him as an outsider is another issue you could also link to its Apartheid past – how seemingly isolated it is from Africa’s other markets. Next176 may for instance be looking beyond the country’s borders, but the rest of the market has to follow suit.

“To move to the next level, stronger ties with the rest of the continent would be really valuable. It needs to move from ventures that are built for South Africa to ventures built for Africa and beyond”

“To move to the next level, stronger ties with the rest of the continent would be really valuable. It needs to move from ventures that are built for South Africa to ventures built for Africa and beyond,” Sturm says.

Sturm believes this ability to look beyond the county’s borders is growing.

“The next wave of startups we are seeing are thinking more about pan-African or even global expansion. We have a South African startup considering the Philippines as its next country, because they think that’s an interesting model,” he says.

And, he adds, corporates have the chance to move the needle for startups in South Africa because of the influence they wield there. Africa as a region is a place where startups are solving interesting, practical problems, and South Africa has several good research universities working on innovative technologies. The potential is there – and CVCs can make the difference.

“We have some amazing venture capital funds and they’ve got a role to play, but we have so many listed corporates with money that could further develop the venture ecosystem,” says Mahloele. “It’s about continuing to develop this ecosystem, but there definitely isn’t a shortage of opportunities.”