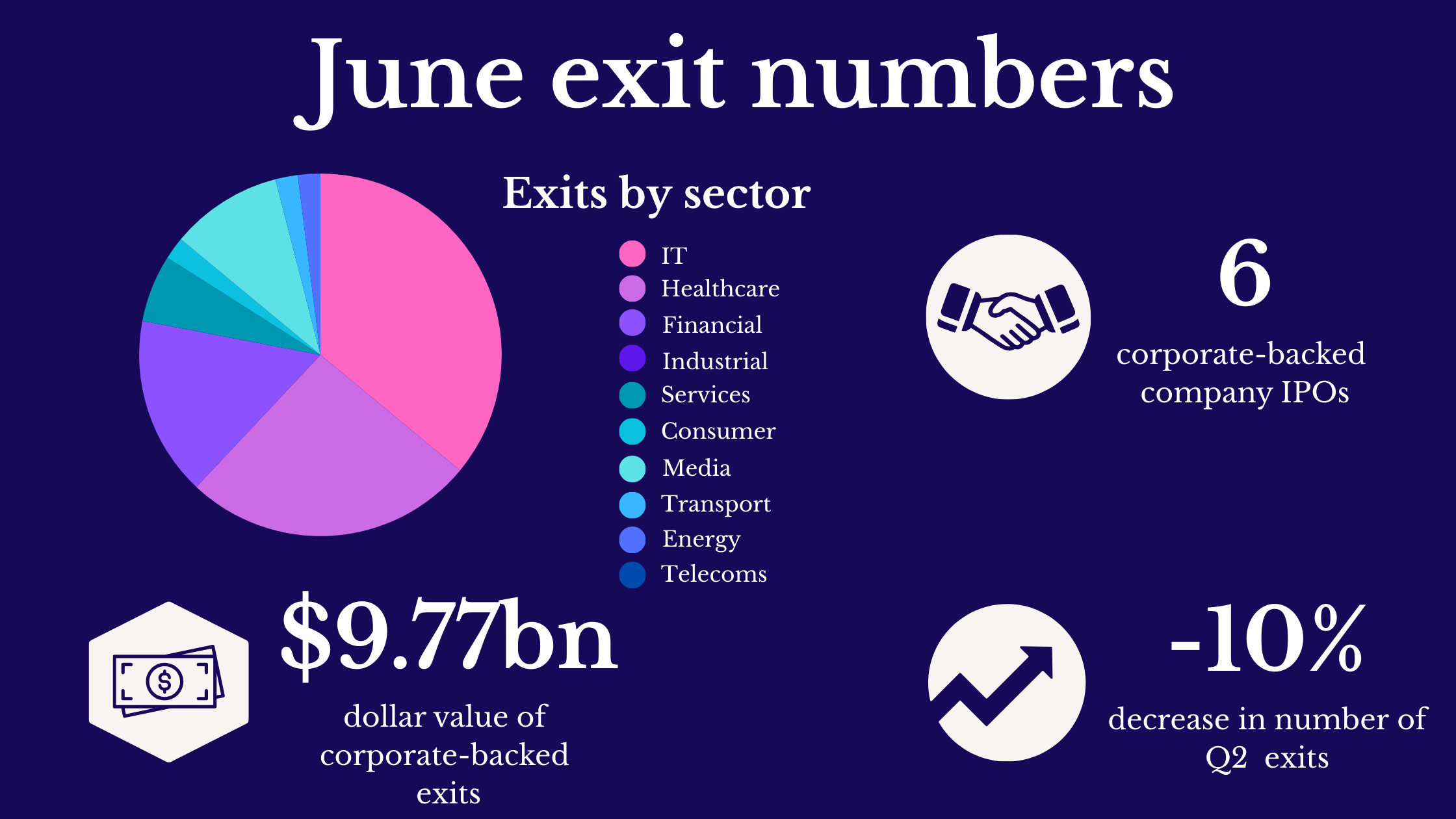

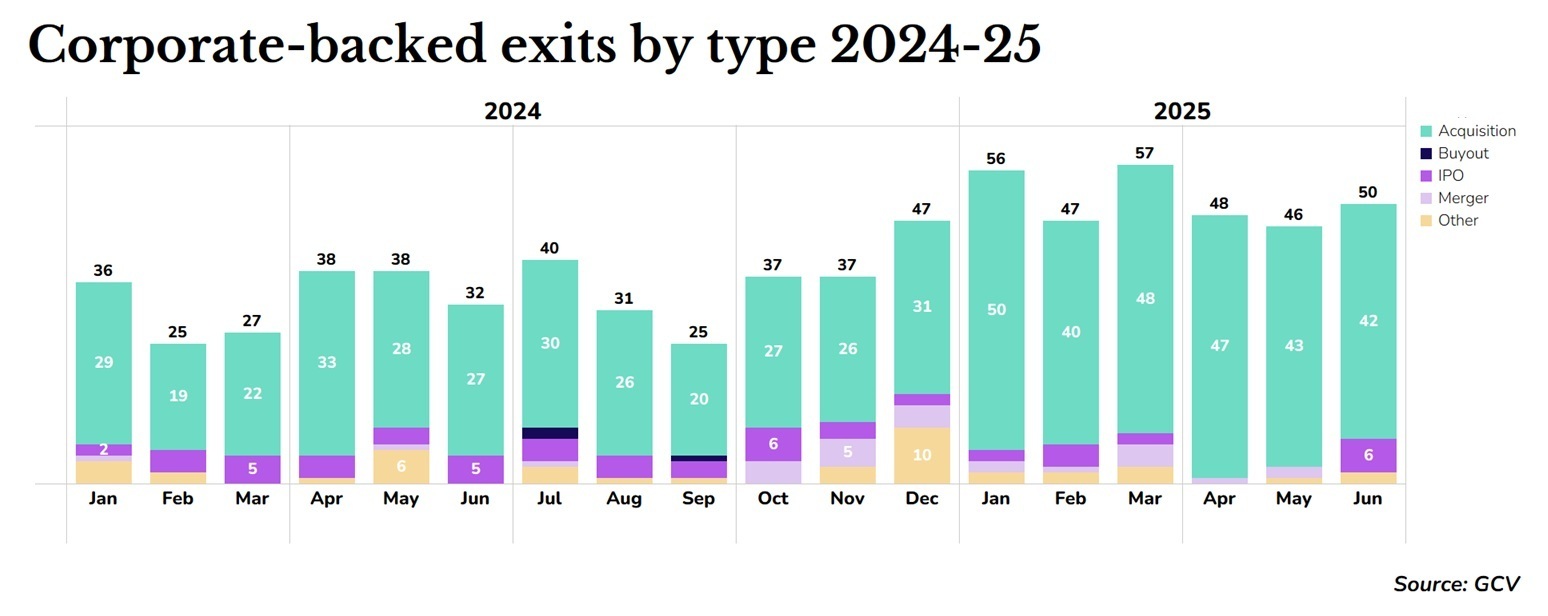

Some 50 corporate-backed startups had an exit in June including six stock market listings and two company closures.

After two months in which stock market listings appeared to be on hold, June saw a flurry of IPO activity with six corporate-backed startups making a market debut. This is the largest number of IPOs the CVC sector has seen since October 2024.

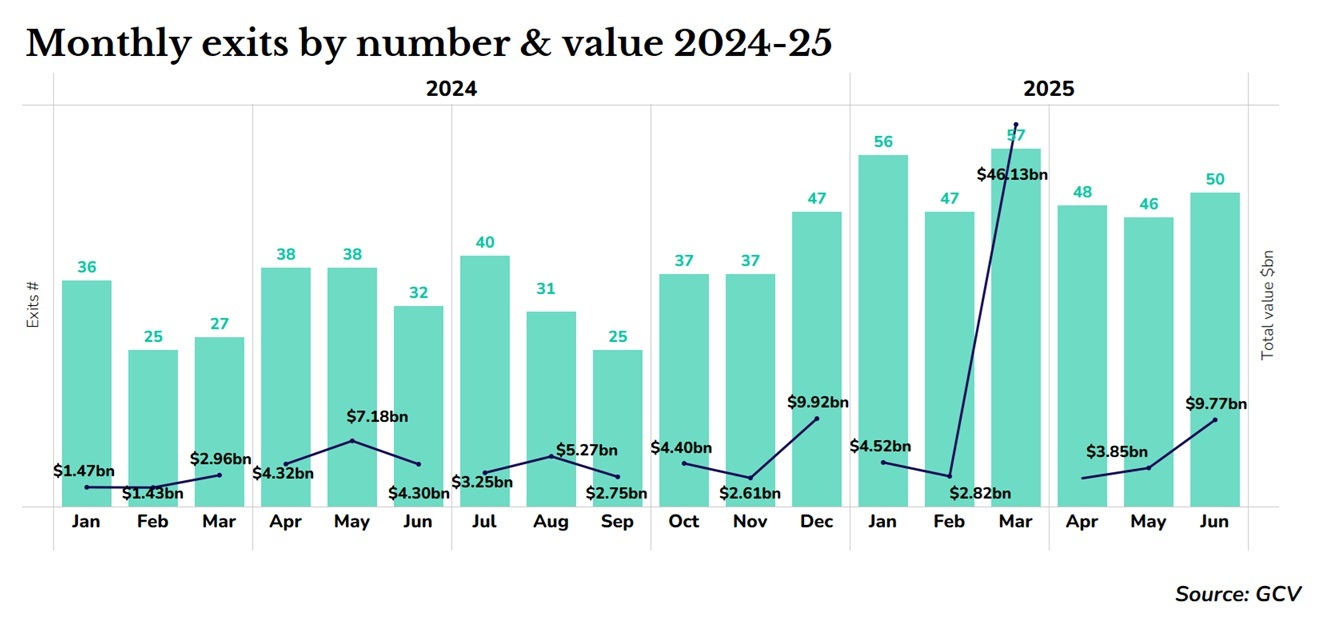

Overall, exits for CVC-backed startups inched upwards, to 50, while the value of exits — where the valuation was disclosed — jumped to $9.77bn, the third-highest value seen in over two years.

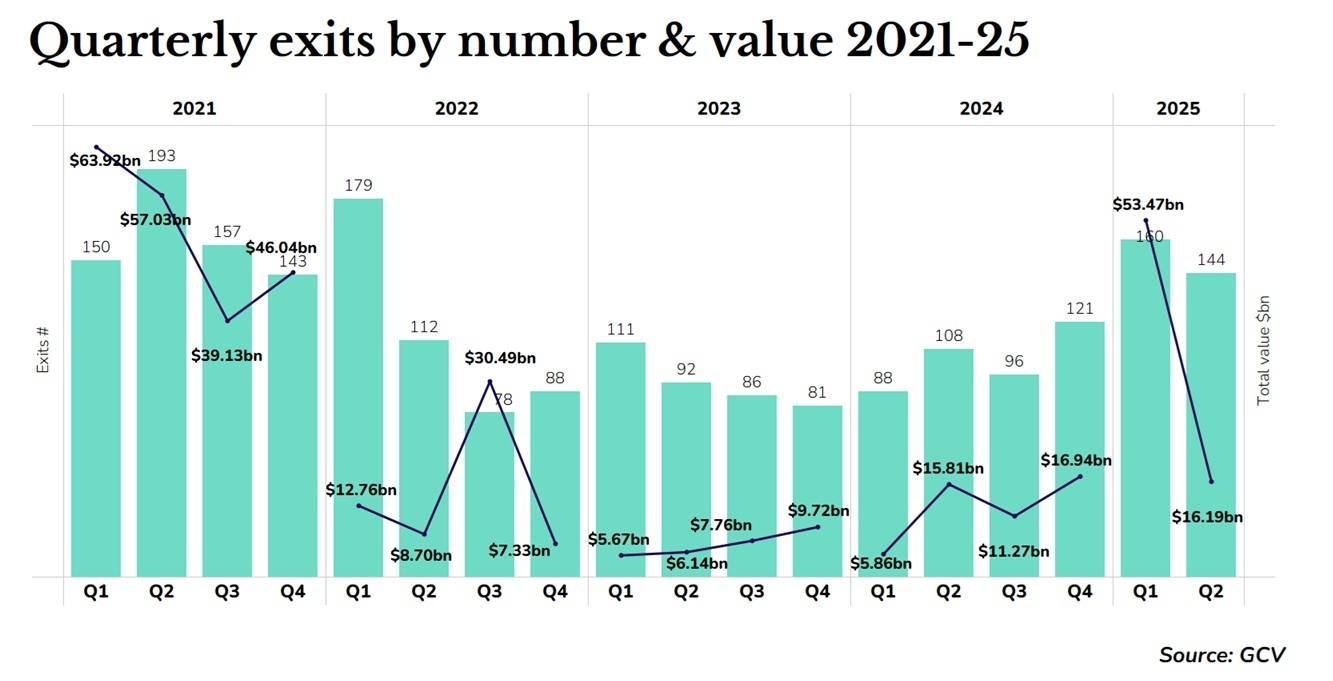

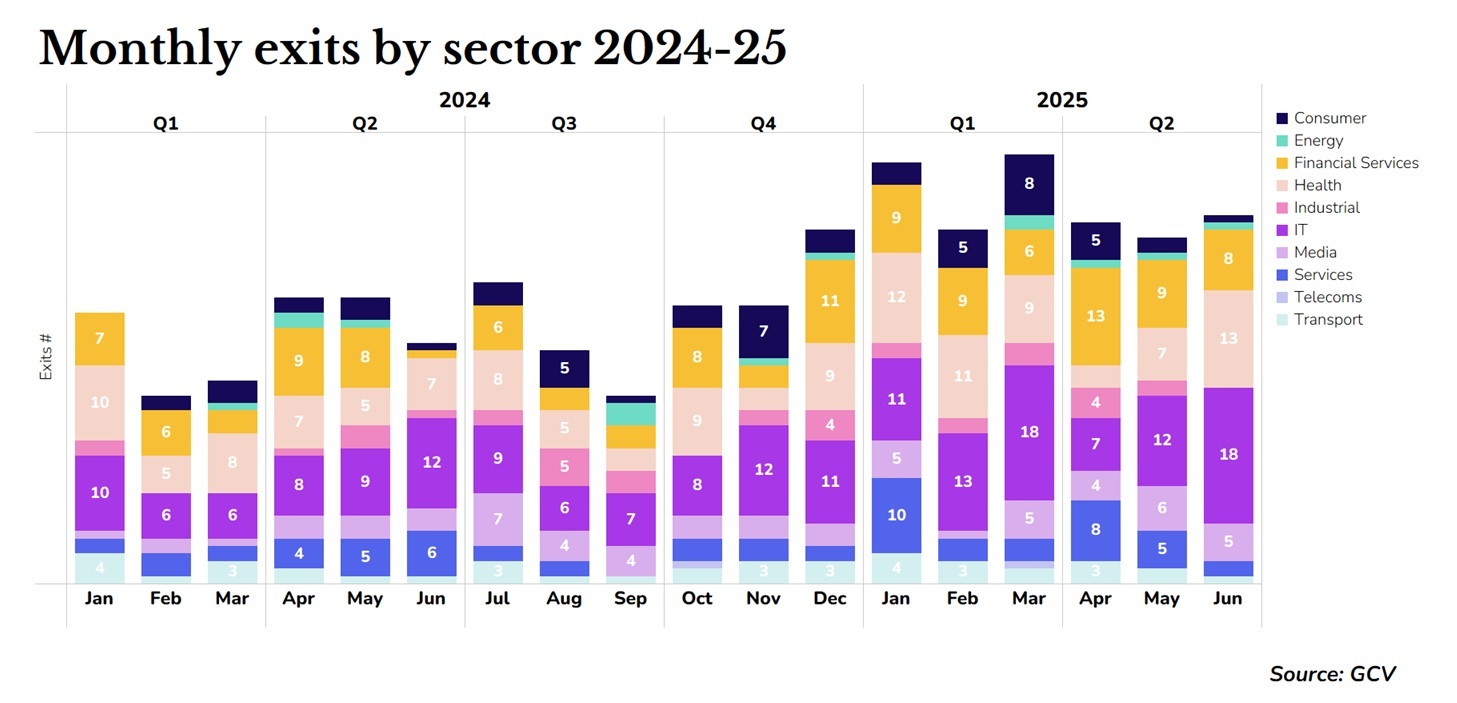

Overall, GCV tracked 144 exits in the second quarter, down 10% from the first three months of the year but still stronger than most quarters in 2024.

US IPOs

The biggest stock market debut was the listing of cryptocurrency platform Circle, on the New York Stock Exchange. The IPO came at a price above the expected range, raising $1.05bn, and the shares are still trading at more than six times their initial listing price. Circle, which is backed by Coinbase Ventures and Baidu Ventures, saw a big boost to its shares in mid-June when the US Senate passed the Genius Act, which will establish a federal framework for US dollar-pegged stablecoins.

Circle has recently launched Circle USDC, an internally developed currency backed by the US dollar.

The company’s successful IPO is seen as a positive sign for many other late-stage cryptocurrency companies that are eyeing stock market listing. The Trump administration’s favourable stance towards stablecoins is expected to inspire several more companies to come to the market this year.

Another fintech sector IPO was the listing of US mobile banking company Chime, which offers fee-free mobile banking services through its platform by partnering with Federal Deposit Insurance Corporation-insured banks.

The Access Industries-backed Chime saw its shares surge on the day of its Nasdaq debut, valuing the company at $18.4bn.

Meanwhile, in the healthcare sector, Omada Health listed on Nasdaq in an IPO that raised some $150m and valued the company at more than $1bn. The startup, which is backed by several corporate investors including Novartis, Sanofi, Intermountain Ventures and Cigna Ventures, provides digital technology to help patients modify their behaviour to deal with chronic conditions such as heart disease and type 2 diabetes.

Omada Health is the first corporate-backed healthcare company to reach an IPO for several months.

Chinese IPOs

Three corporate-backed startups in China launched IPOs in Q2, amid a push by the Chinese government to urge tech startups, especially in fields such as chipmaking, to go public following a brief market slowdown.

Caocao Zhuanche, which operates a ride hailing service relying on a 12,000-strong fleet of EVs produced and supplied by Geely, raised $236m in an IPO on the Hong Kong stock exchange at the end of June. Zhejiang Geely not only supplies vehicles for the company, but also backs it financially.

Voice dialog and digital audio ad network media company Unisound also listed on the Hong Kong stock exchange in June, raising a more modest $40.8m. The startup offers conversational AI products to clients such as hospitals and insurance companies.

TransThera Biosciences, which develops small molecule therapeutics designed to address cancer, cardiovascular and liver diseases, also debuted on the Hong Kong stock exchange, raising $25.6m. The company counted China Merchants Capital, the private equity arm of state-owned conglomerate China Merchants Group, as one of its backers.

Acquisitions

IT and healthcare accounted for the largest number of acquisitions in June, with 18 IT companies and 11 healthcare companies acquired.

Notable IT exits included that acquisitions of quantum computing company Oxford Ionics by quantum IonQ for just over $1bn. Meanwhile, Cellebrite, a company that provides tools to help law enforcement break into encrypted devices, bought Corellium, a US business that makes mobile virtualisation tools for this same purpose, in a $170m deal. Cisco Systems was among Corellium’s investors.

Xero, the New Zealand-based small business accounting software company, bought Melio, an SME bill payments platform, in a deal worth up to $3bn. Melio has built an online platform that allows businesses to digitally make, receive and manage their payments to and from suppliers in a single place.

Closures

There were two business shut-downs that were publicly disclosed in June.

Meanwhile, Toronto-based AI chip startup Untether AI shuttered its business, with the team moving to AMD in an acqui-hire. Moonhub, a company that had been building an AI for hiring and vetting staff, also wound down its business with some staff moving to Salesforce.