Delegates' optimism was palpable at the 7th annual GCV's Corporate Venture in Brasil conference in Sao Paulo last week.

As familiar industry faces met in Sao Paulo last week for the seventh annual Corporate Venture in Brasil conference, you could cut the optimism for the future of the Brazilian corporate VC industry with a knife. Despite the wider-market cooling of the past year, the Brazilian market has remained resilient and is flourishing even without the same level of late-stage investors in the frothy peaks of 2020 and 2021. Early-stage investment has remained robust.

In the opening panel of the conference, Tamara Steffens, managing director of Thomson Reuters Ventures, said that Brazil is the fastest-growing region it is looking at. This tracks with the vibrancy of the nascent market, where two-thirds of CVCs have been formed in the past few years, according to provisional results from GCV’s Keystone survey, a benchmarking platform designed to provide data and insights on corporate venture operating models and performance.

The data also show that 60% of Brazilian CVCs are independent of their parent corporations compared with 30% globally.

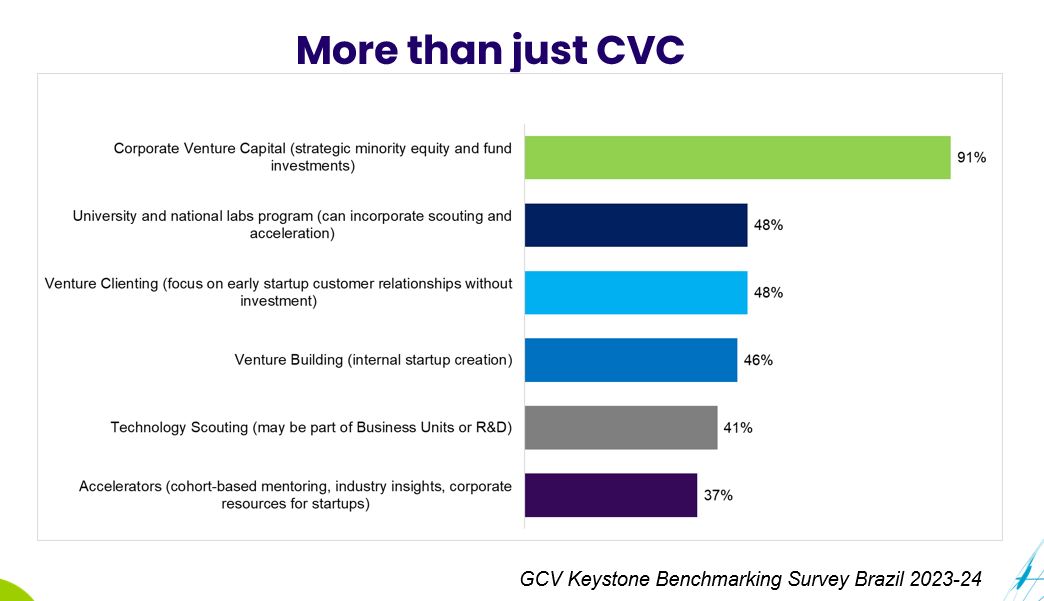

More corporates are starting to think seriously about adding CVC to their innovation toolkit, seeing it as a natural progression of having a culture of innovation. At the same time, even in a market like Brazil that is still maturing, it is important to not lose sight of the fact that – as 100 Open Startups’ CEO Bruno Rondani said on stage – CVC and open innovation are not mutually exclusive. Creating an CVC unit does not mean turning away from the rest of your open innovation initiatives. To maximise their effectiveness, they should be seen as two prongs of a trident that also includes earnest efforts to develop and nurture the wider ecosystem.

Where things can improve, however, is in the red tape and bureaucracy surrounding investments in Brazil, as well as the enduring – though demonstrably improving – tendency among some corporates to approach venture investment as a tool for M&A.

Not only are corporates getting more comfortable with the lower level of control required for CVC, but they’re also much more comfortable with collaborating with ostensible rivals if the outcome would benefit all involved. Vale Ventures, for example, sees the value in having a peer/rival on the same cap table to minimise the startup’s risk of failure, according to unit chief Bruno Arcadier.

Newer CVCs are also getting more savvy on effective entryways into the sector. This can be taking LP positions in other funds to gain access to other geographies, or partnering with a third-party investor like CVC-as-a-service firms or multi-corporate LP fund managers. The exit markets are also looking better, with the public markets creeping back slowly. Cash-rich buyers are seeking growth-stage opportunities, providing a good M&A market, according to SoftBank’s Maria Tereza Acevedo.

The future looks bright for young talent going into the sector, too. Being a relatively young industry in Brazil, it has been difficult to get university graduates to sign up compare with the mountains of applications traditional VCs receive each year. That is slowly changing due in part to the idea that CVCs have a different energy than the rest of the corporate, and tend to be geared towards not just creating financial returns or even strategic benefits but also striving to create a better society.

Corporate Venture in Brasil Awards 2023

This year’s conference also saw the second edition of the Corporate Venture in Brazil Awards. Whereas the first edition last year saw four winners take home prizes, this year there were six winners across four categories: most active CVC (number of deals), largest exit, largest investment and largest fundraising announcement.

Two CVCs won the most active CVC category – Banco Bradesco’s venturing unit Inovabra Ventures won for its seven deals struck over the awarding period, while SRM Asset’s SRM Ventures was awarded for pioneering venture debt investments, of which it closed 13 over the same time.

The award for largest exit was also a double-header, with Brazilian stock market B3 taking home a prize after having made an initial investment of $10m investment in payment processor Pismo, which was recently bought by Visa for $1bn. Inovabra Ventures also bagged its second award following the $127m listing of its portfolio company Semantex, which was notable for having a cap table made up mostly of CVCs

Kinea Ventures took home the prize for largest investment for its participation in the $60m series B round for Digibee, the Brazilian and US-based integration platform.

The final award, for largest fundraising announcement, went to Oxygea Ventures, the CVC unit of Braskem, which raised a total of $150m in the relevant time period – $100m of which is allocated to venture investments and $50m to its incubation and accelerator functions.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.