The departure of Sven Furhmann from Northvolt's board comes after a series of setbacks that have raised questions about the battery maker's future.

German automaker Volkswagen’s head of investments Sven Fuhrmann has left the board of Swedish battery manufacturer Northvolt, raising more questions around the beleaguered company.

Following a series of setbacks for Northvolt, which had once been seen as a major asset in Europe’s battery supply chain, Dagens Industri first reported that Volkswagen – the company’s largest shareholder at 21% – will be seeing its head of group investments stepping down from its board.

It is unclear what implications the move will have for Volkswagen’s relationship with Northvolt, and at the time of writing Volkswagen has not replied to requests for comment on the reasoning behind the resignation or what it means for its governance of the battery maker. Reuters reported that Northvolt expects Volkswagen to replace Fuhrmann with another board member.

Volkswagen first invested in Northvolt in 2019, committing €900m ($953m) to the company in a round that also included BMW, Ikea and other investors. It followed up in 2021 with a further $620m.

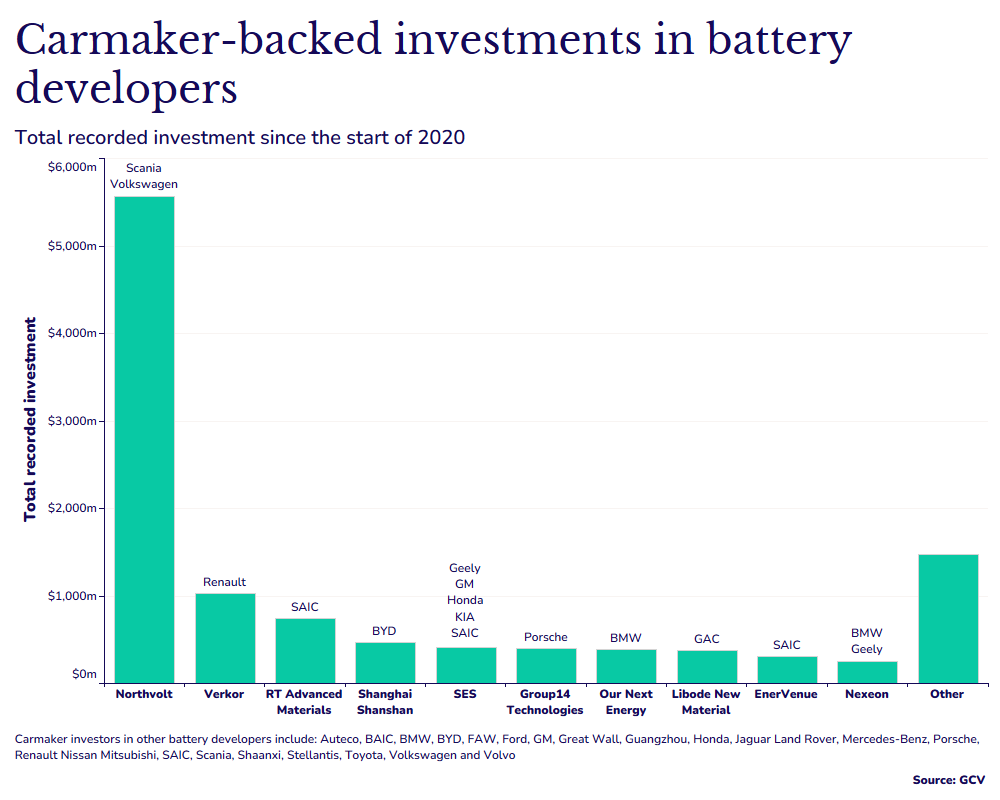

Out of all the battery companies, Northvolt has raised by far the most money from funding rounds involving carmakers, chiefly Volkswagen and Scania. Other investors in these rounds have included names like Baillie Gifford, BlackRock, Omers and Goldman Sachs.

Northvolt had been touted as Europe’s answer to behemoths like CATL, LG Chem and Samsung, but those hopes have yet to materialise.

Cascade of setbacks

The move follows a litany of setbacks for the Swedish battery company, including German automaker BWM pulling out of a multi-billion-euro supply contract because of production delays, which had also reportedly affected its timeline to other customers like Swedish truck maker Scania. Volkswagen itself, apart from being the largest shareholder, also made the largest single order with Northvolt.

Northvolt’s competition with its Asian rivals has proved too much so far, and there have been reports of an over-reliance on Chinese equipment, operated by workers from China and South Korea at Northvolt’s flagship factory in Skellefteå, Sweden. There has also been reported issued with communication and siloing among factory workers.

Northvolt had ambitious expansion plans that have had to be put on hold, with the company announcing last month that the subsidiary managing the expansion project filed for bankruptcy.

In September, Northvolt released the results of its strategic review, which concluded that it would place operations at a cathode active materials production facility into “care and maintenance” until further notice, and that it had agreed to sell a site that was planned for another cathode active materials facility, as well as potentially cut its workforce going forward.

Northvolt is not alone among European corporate-backed battery manufacturers who have faced hard times. Last year, Australian battery technology producer Recharge Industries agreed to buy UK-based Britishvolt’s technology for pennies on the pound.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.