The language may be changing but the opportunities and the returns are still there for impact investors.

Impact investment funds are still viable and still well positioned for success despite a recent backlash over environmental, social and governance (ESG) and diversity, equity and inclusion (DEI) initiatives in the US, several investors have told GCV.

“The needs haven’t changed,” says Jason Robart, managing partner of Seae Ventures, a corporate-backed venture firm that focuses on US healthcare disparities. Those disparities are still there, whether it’s rural Kansas or an urban area in the Northeast, and the need for the fund remains.

“A shift in administrations in Washington, a shift in some sentiment across the country has meant folks are perhaps using different language than they could before,” he says. “But I don’t think there’s any perception that the needs that became really prominent, frankly, post-George Floyd aren’t still there.”

The Trump administration has put diversity programmes in its crosshairs and sought to cancel financing pledged for green industry areas like hydrogen technology and electric vehicle infrastructure in the Inflation Reduction Act of 2022. That has raised concern for ESG approaches that have helped shape investment targets in recent years, including many at a corporate VC level, and for impact investing, which aims to make positive social and environmental changes through early-stage funding.

But Ash Puri (left), a partner at Lightrock, a growth and private equity firm that targets impact investment across areas like healthcare, education, financial accessibility, food and agriculture, is bullish about things.

For one thing, Puri says, studies have shown that increased diversity leads to better outcomes, and so more diverse organisations will naturally thrive anyway. Meanwhile, in areas like climate tech, there is enough demand to keep the momentum going.

“Governments change, and thus the narrative of it changes,” says Puri. However, demand from shareholders and international regulators means that large, publicly listed companies will likely continue to switch to cleaner and more sustainable technologies at an unprecedented rate.

“And it’s happening globally,” he adds. “There is a narrative in certain countries that they will cut down grants, cut out the financing on certain things.” But, says Puri, companies with compelling offerings don’t need the grants in the first place and can survive without them. “But the companies which are absolute must-haves never really need the grants in the first place if they can survive without that. “The must-have technologies which are decarbonising certain verticals will find investors anyway,” he says.

Corporate impact funds can thrive – if they’re willing to evolve

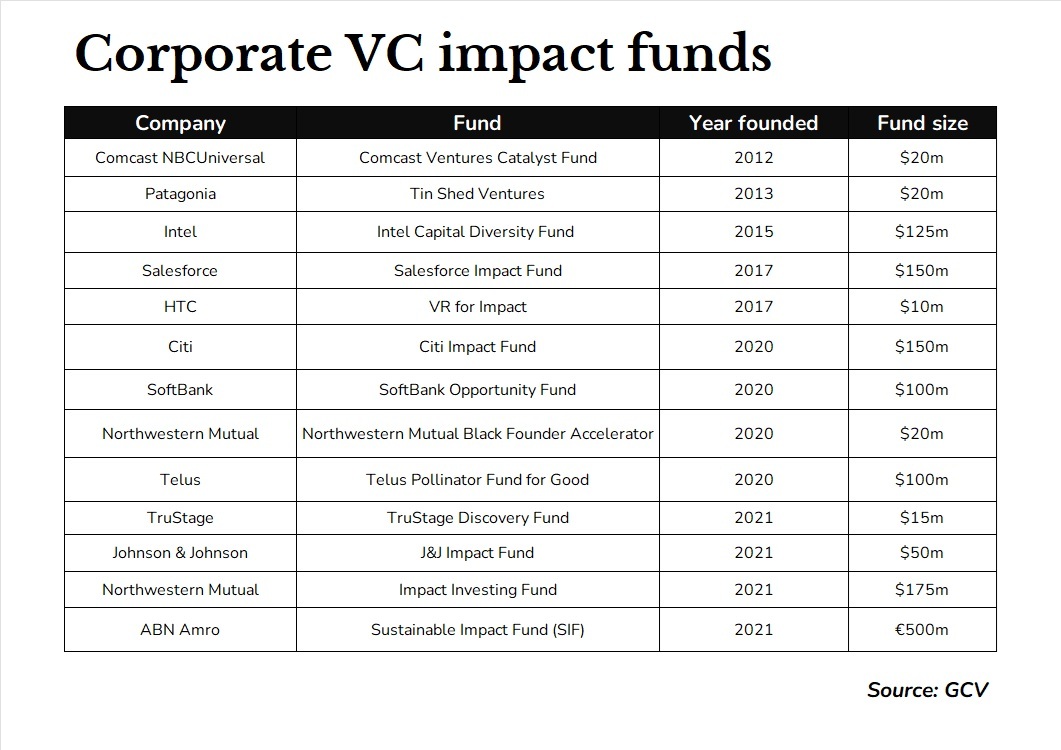

Impact investing was once a hot area for CVC. Comcast, Intel and Salesforce were among the corporates that launched diversity or impact-focused funds with nine-figure allocations in the 2010s, and 2020 alone saw similar initiatives from SoftBank, Telus, Northwestern Mutual and Citi.

The key to maintaining those funds is adaptability. While several of those funds have gone quiet of late, financial services firm Citi’s Impact Fund is an exception. It was launched with $150m in 2020, just as the Covid-19 pandemic was beginning, to fund workforce development, financial capability, sustainability, and physical and social infrastructure startups, with an emphasis on women and minority entrepreneurs.

That emphasis is no longer visible in the language used on Citi’s website, but the fund itself has kept up momentum, expanding to $500m and building a portfolio of more than 50 startups. It backed healthcare analytics provider Intus Care and TailorMed, a startup looking to make healthcare costs more manageable, at the end of last year, and it’s built its own impact measurement tool so it can constantly track which areas need funding and what effect its capital is having.

“For the last five years it’s felt like the velocity of change has been so much faster.”

Meredith Shields, Citi Impact Fund

“We don’t just invest in one thing,” says Meredith Shields (below), head of Citi Impact Fund. “We’re investing in the needs of people and communities, and those change rapidly.

“I’ve been in and around private capital investing for 20 years now, but for the last five years it’s felt like the velocity of change has been so much faster.”

Those changes have meant Impact Fund has evolved to focus less on areas like micromobility and concentrate more on themes like personal finance management – especially around healthcare – and the care economy, helping people who need to balance full-time work with caring for children or ageing relatives.

The other big development has been generative artificial intelligence, which Shields says has become a key priority for the fund. AI could potentially automate and scale personalised services, expanding access to healthcare or improving the underwriting process for credit products that can increase financial inclusion.

Citi Impact Fund doesn’t look at infrastructure – you won’t see it in the next OpenAI round – but instead at applications like Clerkie, creator of an AI financial planner that can help people get out of debt, and Wellthy, which combines human concierges with AI to help people navigate the healthcare system. But it also has to be careful it doesn’t end up increasing problems.

“When we look at tech booms of the past and big convergence moments where technology has fundamentally changed the way we work and live historically, that has created a wider gap between the most underserved and the most well served among us,” Shields says.

While there are plenty of potential benefits of AI for underserved communities, in areas from education to professional training and financial health, the fund is also treading carefully and examining the potential consequences of relying on models that are still being developed and which could use flawed or biased data, in turn deepening the economic divide it’s trying to reduce.

“In addition, underserved communities often report lower trust of many major systems across the US,” she adds. “Be it financial, health, education or otherwise. Essentially asking them to start trusting a robot will require a very clear and transparent commitment to consumer safety.”

Understanding the strategic value in a slow market

Despite impact investors’ optimistic, there are challenges for these funds right now.

Seae is currently raising its second fund since it spun off from health insurer Blue Cross Blue Shield of Massachusetts and although it expects to close in the coming months, it has found the going slower than expected. But that’s chiefly due to high interest rates and a lack of certainty around the financial markets, which is making prospective investors more cautious.

“There are perhaps more questions about understanding the strategic value and putting some financial metrics around that strategic value, as well as the financial return of what they are doing,” Robart (left) says. His peers describe a similar situation.

“We have not heard anyone suggest that the goals of their impact investing have changed. We’ve heard: ‘there is a little more scrutiny on us proving the strategic and financial value of that impact investing’,” he says. “And we’ve been happy to work with some of our LPs to calculate that and put together a financial model that helps articulate that, specific to their business.”

For Citi on the other hand, the purpose of the Impact Fund goes beyond basic financial returns, Shields says. The bank’s website pledges to provide economic opportunity to communities across the US and across the world.

“So,” she adds, “It makes a ton of sense for Citi, with that mission, to leverage the assets that we have – and that is that we’re a bank. We’re leveraging our balance sheet, our people, we’re leveraging our access to find and support the best companies.”

As a growth-stage investor, Lightrock has some extra complications because of the stagnant IPO market. Those series C and D companies in its portfolio aren’t going public, which means the returns may not be matching the exits in the last boom period.

But Puri says that isn’t a major concern, because if portfolio companies are showing the growth rates and financial margins they expect – and he maintains they are – there are multiple routes to get liquidity for an investor.

“Irrespective of the IPO window, we feel fairly bullish that we will find an avenue to exit our opportunities the moment the time is right”

Ash Puri, Lightrock

“We have been focusing on core problems, and those core-problem companies continue to grow at very healthy rates,” says Puri. “Some of our companies are profitable. Some are turning profitable very soon. And so, irrespective of the IPO window, we feel fairly bullish that we will find an avenue to exit our opportunities the moment the time is right.

“So overall, I feel bullish. I know the microeconomic climate is slightly challenging in general. But despite that, I have an optimist mindset that these big problems are so big now that you cannot ignore them. And if people are finding the right solutions to these problems, you will naturally find investors to kind of back these businesses.”