Power-hungry data centres are putting power grids under unprecedented strain, and National Grid Partners is racing to find new technologies that can keep networks running.

Power grids are facing a perfect storm. That was made dramatically clear this week when a massive blackout left most of the Iberian peninsula without electricity for the best part of a day.

While the exact cause of the Iberian power grid failure is not clear, all networks are coming under an unprecedented strain, says Pradeep Tagare, head of investments at National Grid Partners, the VC arm of grid operator National Grid.

“This industry has not seen this level of growth in a long time, and all of a sudden because of all of these factors coming together, we are seeing incredible load growths on the network. So the challenge then is a how do you model this? And how do you predict what the network is going to look like and react to it in real time?” Tagare says.

The power grid was designed to be distributed outwards from a central generation point to its final user. That’s changed now, as it resembles more of an internet-like network with many points interacting with each other.

“That creates an interesting challenge for grid operators. One is how do you know where the energy generation points are gonna be? In other words how do you know where EVs are going to be, where the storage is going to be, and so on,” he says.

“On the other end, the consumption points are getting hungrier and hungrier, so how do you then make sure that you have enough capacity on those network segments to make sure that you can accommodate a large load customer – say, a data centre?”

Use better rather than remake?

It is hard for any single company to upgrade grid capacity by itself. But National Grid Partners (NGP) has investments in startups that are working on ways to work around that problem.

Line Vision, for example, is a startup that uses sensors to gain visibility over a segment of grid with a view to free up capacity. Depending on where it’s deployed, it can increase capacity by 20-30% without the need for outages due to upgrades.

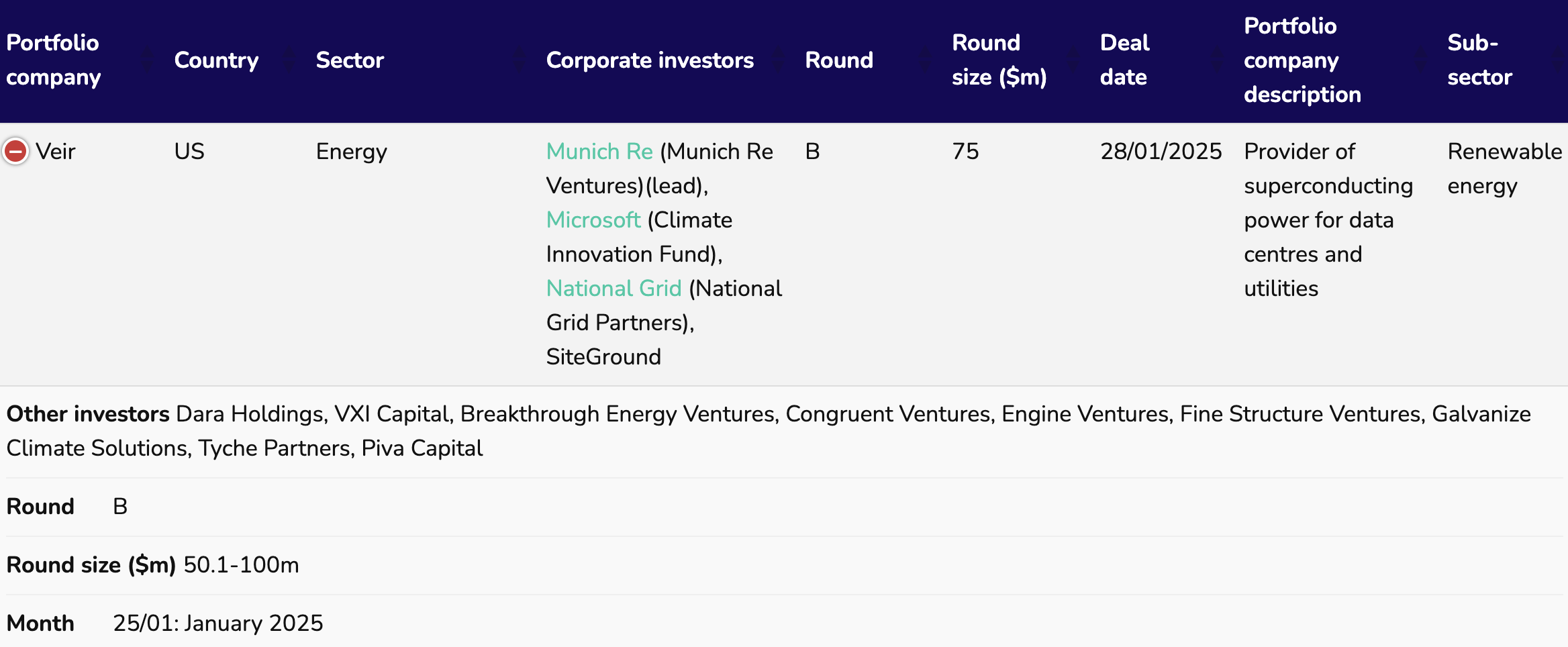

It also has investments in next-generation conductor companies that can replace the materials in the transmission lines without having to uproot the towers or other infrastructure – one startup, Total Solutions Conductor, could potentially double – or triple – the capacity that can go through existing infrastructure, while another startup, Veir, could increase capacity five or ten-fold depending on the specific use case.

Veir recently raised a $75m series B round backed by National Grid, Munich Re and Microsoft.

See details of all recent corporate-backed startup funding rounds in our database.

No one solution will work in isolation for the entire grid, a combination of approaches will be needed depending on the region or use case.

AI – making or breaking?

In the age of AI, data centres are among the hungriest users of data – they may eventually in aggregate grow their demand for power by up to 1000%.

“They imply almost anywhere from seven to 10 times increase in capacity that they are expecting from the grid. And that is not an overnight thing. So both on the generation side, even if you say nuclear, that is going to take a while. You can’t just turn around and deploy nuclear tomorrow. It’s going to be a process,” says Tagare

“I think everyone understands that. In our discussions with the large data centres, they want to work with the grid companies for a variety of reasons, resiliency being probably one of the most important, so we are trying to work out a solution – or rather a path to a solution – that gets these companies there, but it’s not a straight road.”

AI can also be part of the solution to the problem it has created for grids. Earlier this year NGP announced that it was allocating $100m specifically to invest in AI technologies that it believes can help upgrade power grids to cope with unprecedented new levels of demand.

One area of interest is using AI tools to automate compliance processes related to grid connection for power provision. NGP has invested, for example, in a startup called Transcend, which uses generative AI to automate the preliminary engineering of infrastructure to be able to accelerate the process of getting queued up to the grid.

Tagare also sees a lot of game changing potential in the use of AI models on the network side to figure out where it would make sense to locate the big use customers like data centres, and where there is capacity that can be unlocked to help with the interconnection process.

Data centres are also increasingly generating their own renewable energy for their facilities – so-called “behind-the-meter” energy — rather than relying solely on the grid. They also use flexible load management as part of the demand response network to balance the demand on the grid.

Read more

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.