Startups are always anxious to know if their investors can provide follow-on funding. The good news is, corporate investors a putting aside good reserves for this.

One of the big concerns for startups is whether their investors will participate in follow-on funding rounds after making the initial investment. Especially now, when investment capital has grown harder to find, startups like to know that they can tap their backers for funds down the road if they need to.

The big question has been whether corporate investors are likely to honour the same follow-on commitments that a financial investor might make. The answers from our recent poll on this indicate that yes, a majority of corporate investors are certainly putting aside the reserve firepower to do this.

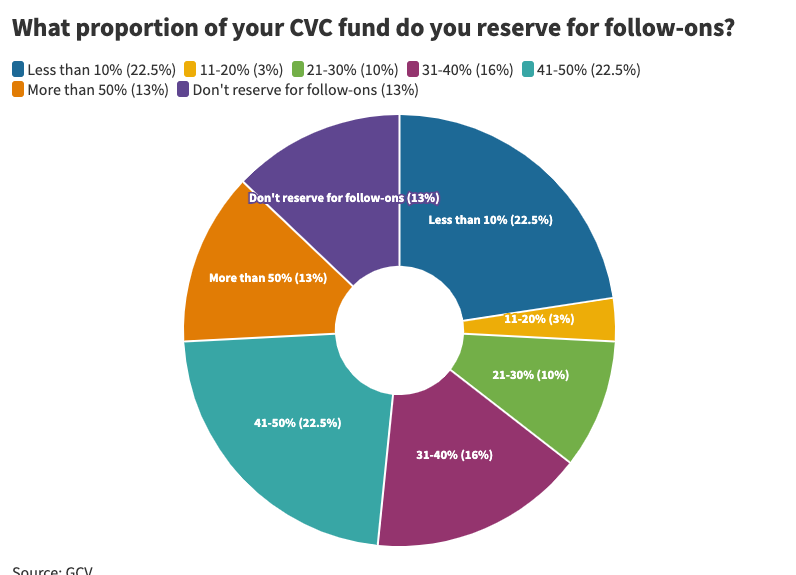

Only around 13% of poll respondents told us that they didn’t reserve anything for follow-ons. Another 22.5% said they reserved less than 10% of their fund.

But on the flipside, 22.5% said that they reserved between 41% and 50% of their fund for follow-on, with a further 13% reserving more than half of the fund for this. Add to that the 16% who told us that they reserve between 31% and 40% of the fund, that makes more than half of respondents reserving 30% or more.

Is reserving a third or more of the fund enough? We’d love to hear corporate investors’ thoughts on what the prudent amount is. But a third or more appears to be the common practice.

This is one of the questions from our annual benchmarking survey, which we put together in order to give the corporate venturing community an idea of what the norms are for the industry. We would love it if you would take part and fill out the survey, so we can make sure that we really are capturing the complete data. Respondents will all get a copy of the benchmarking report when it is published in January.

Maija Palmer

Maija Palmer is editor of Global Venturing and puts together the weekly email newsletter (sign up here for free).