Consumer trends are increasingly coming from emerging markets and Jägermeister is tapping into African startups to get ahead of the shift.

Best Nights VC, the corporate venturing arm of German drinks maker Jägermeister, aims to increase investments in Africa and other emerging markets where it sees the most growth in consumer technologies that underpin its investments.

The CVC made its first investment in an African startup, Kenya-based HustleSasa, a platform for managing and selling tickets for live events, earlier this year.

The investment is a springboard for Best Nights VC’s expansion in Africa, where a young, tech-savvy population provides a strong consumer base for the kind of startups that it invests in.

Jägermeister’s CVC arm targets startups that create the kind of occasions where people might consume its eponymous liqueur. These include software platforms and businesses that promote nightlife and live entertainment.

Africa’s music scene, for example, where genres such as Afro house and other African dance and rap music styles are dominating global charts and global music production is the kind of sector that the VC team aims to tap into.

Other corporates that see potential in Africa’s entertainment and live events sectors include Japanese electronics and entertainment Sony, whose corporate VC, Sony Ventures, launched a $10m fund in 2023 to invest in African music, film, game and animation producers. US professional basketball league NBA recently established a men’s basketball association in Africa to promote the sport across the continent.

“Consumer trends will no longer come from the US or the UK. They are coming more and more from emerging markets.”

Lorrain de Silva, managing director, Best Nights VC

“Consumer trends will no longer come from the US or the UK. They are coming more and more from emerging markets,” says Lorrain de Silva, managing director of Best Nights VC. “Given Africa’s demographics – how young people are, how high the technological adoption is, and how strong the cultural momentum is, these are the ingredients for innovation – be it social, consumer or tech.”

The African startup market is also attractive to investors because sectors are not crowded with competitors. In more developed markets, for example, organising a live event such as a music festival can involve dozens of service providers. Whereas on the African continent, startups are emerging that are one-stop-shops for ticketing, payments, insurance and communications.

HustleSasa, for example, started off as a ticketing platform for live events but is including other services such as lending and hosting live events. It aims to expand into 15 countries across the continent. “We’re trying to be a leading pan-African commerce platform for event creators,” says Peng Chen, cofounder of HustleSasa, which is based in Nairobi, Kenya.

Africa is one of Jägermeister’s highest growth markets. It sells its drinks through local distributors in countries such as South Africa and Kenya. But the six members of Best Night VC team are all based in Berlin, Germany, and they will only do investments in emerging markets with a local institutional investor taking the lead on the deals. In the HustleSasa investment, it co-invested with global VC firm Antler, which has an office in Nairobi.

“There are cultural differences. It requires someone who really understands that, who lives on the continent, who understands the individual dynamics of the ecosystem and of the industry, and also who understands the unwritten laws and rules,” says De Silva.

Instead of leading deals in emerging markets, the team offer startups expertise in nightlife, consumer and entertainment sectors.

As a niche investor in the entertainment sector, Best Nights also tries to build an ecosystem of founders and investors by holding networking events in local markets where it invests. De Silva visited Nairobi in July and hosted an event that brought together 200 founders and investors. “There was a kind of energy and innovation that I don’t often see,” he says. “The people that we met will maybe become potential investment targets later.”

Best Nights VC is also looking to expand in other emerging markets such as Latin and South America. The continent also has a strong music scene whose artists top charts in US and Europe. De Silva has travelled to Argentina, Columbia and Mexico to meet investors and founders for potential VC investments.

The investment team are also looking at India and Southeast Asia for potential investments.

“We’re following a global agenda but with a very strong focus on emerging markets,” he says.

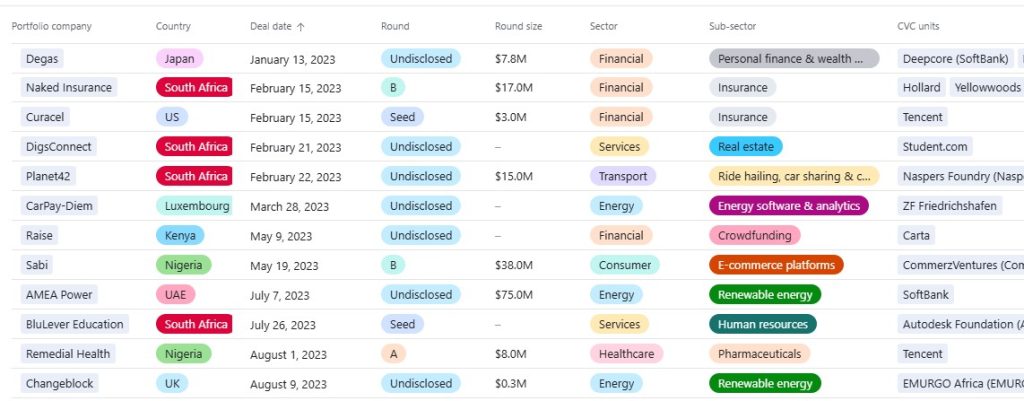

You can find out which VCs invest in African startups in the GCV CVC Funding Round Database: