Overseas investment is flowing into Japan's startup sector, but it is still small compared with other countries' ecosystems.

Earlier this year, in July, Japanese fusion startup Kyoto Fusioneering received funding from In-Q-Tel, the investment arm of the US government and its allies. The In-Q-Tel team are exploring the Japanese startup market and the fusion company stood out for its plans to expand globally and its willingness to engage with foreign investors.

“Kyoto Fusioneering brought us to the Japanese market,” said Olivia Jones, director at In-Q-Tel, on a panel at the GCV Asia conference in Tokyo, Japan, last week. The firm recently installed a member of its team in the country to scout for startups.

“It really helped that Kyoto Fusioneering saw itself as global from day one,” said Jones. “When we did the transaction, we didn’t have to sell ourselves as an offshore investor.”

The fusion startup is In-Q-Tel’s first direct investment in Japan and the investment team knows it lucked out on finding a startup that was willing to smooth the transaction with an overseas investor. The startup translated the deal documents in English, for example.

“We know this is not going to be representative of what future investments will be like,” said Jones.

Japan’s government is doubling down on efforts to attract foreign investment in its startup sector. The capital, Tokyo, is positioning itself as a startup hub. The city government aims for a tenfold increase in the number of unicorns and startups in its ecosystem.

Room for growth

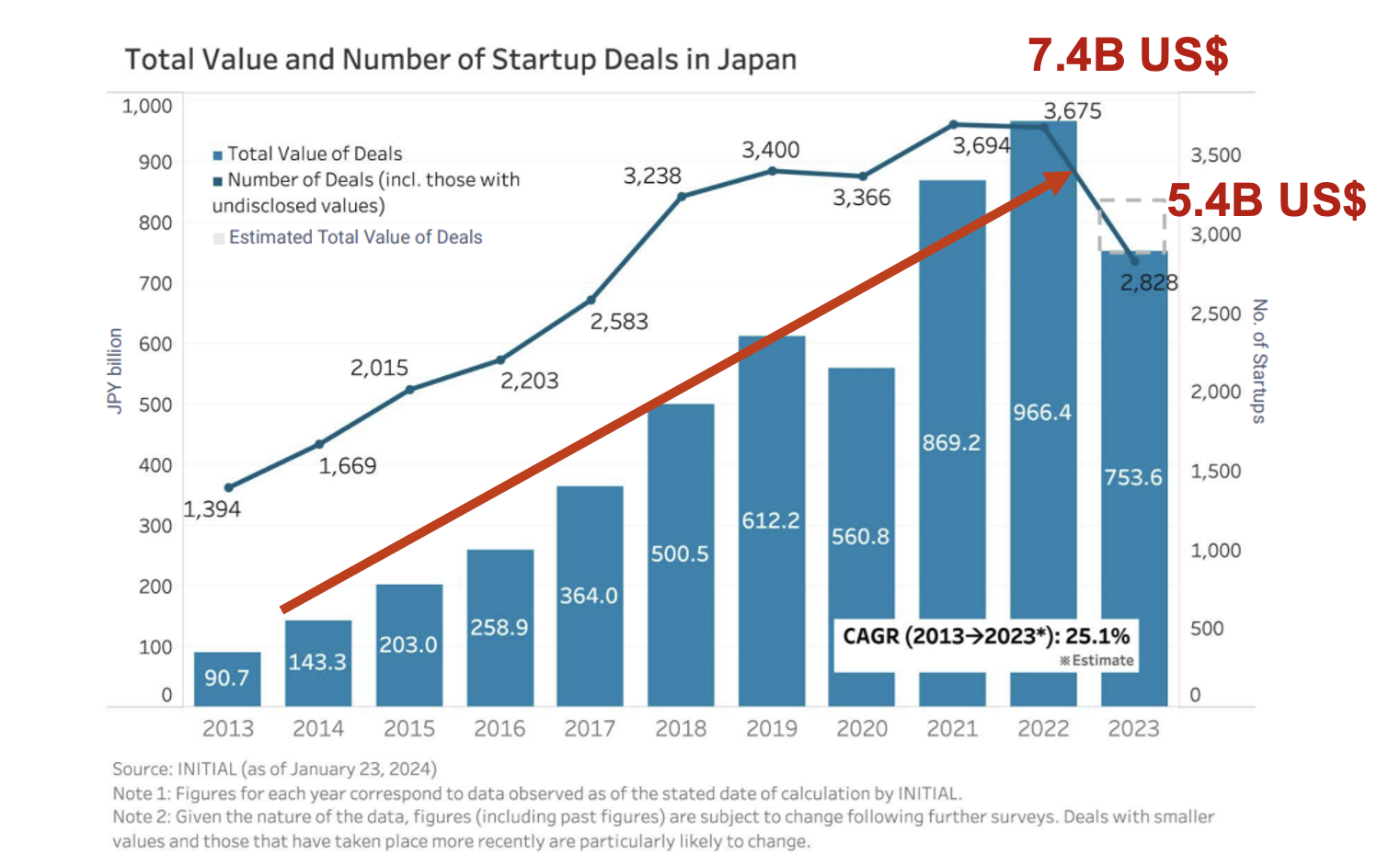

Total investment in Japanese startups increased 25% between 2013 and 2023, reaching $5.4bn in 2023, according to Initial, a Japanese VC data provider.

Funding rounds raised by Japanese startups 2013 – 2023

But Japan’s venture capital sector is still small. VC investment is about half that of South Korea’s, for example, and only 3% of the US market.

Historically Japan’s startups have focused on serving the domestic market, a barrier to attracting foreign VC investment. The government is pushing its startups to plan for global expansion through accelerators and mentorship programmes.

US accelerator and seed investor Techstars recently set up in the country. Its team are pushing startups in its programme to think globally so that they can attract foreign investment.

The accelerator also hopes that its startups can start to raise more capital. The size of the average series A funding round in Japan is $5m, only a fraction of what is raised at that stage by startups in the US.

“I want startups to be more ambitious,” said Yuki Shirato, managing director of Techstars in Japan. “It is hard to scale on that capital,” he said, referring to the small funding rounds. Initial public offerings in Japan also tend to be smaller compared with the US.

Japanese startups also need to do a better job at marketing themselves to overseas investors. “Japanese people are bad at storytelling, telling what they are building,” said Shirato on a panel.

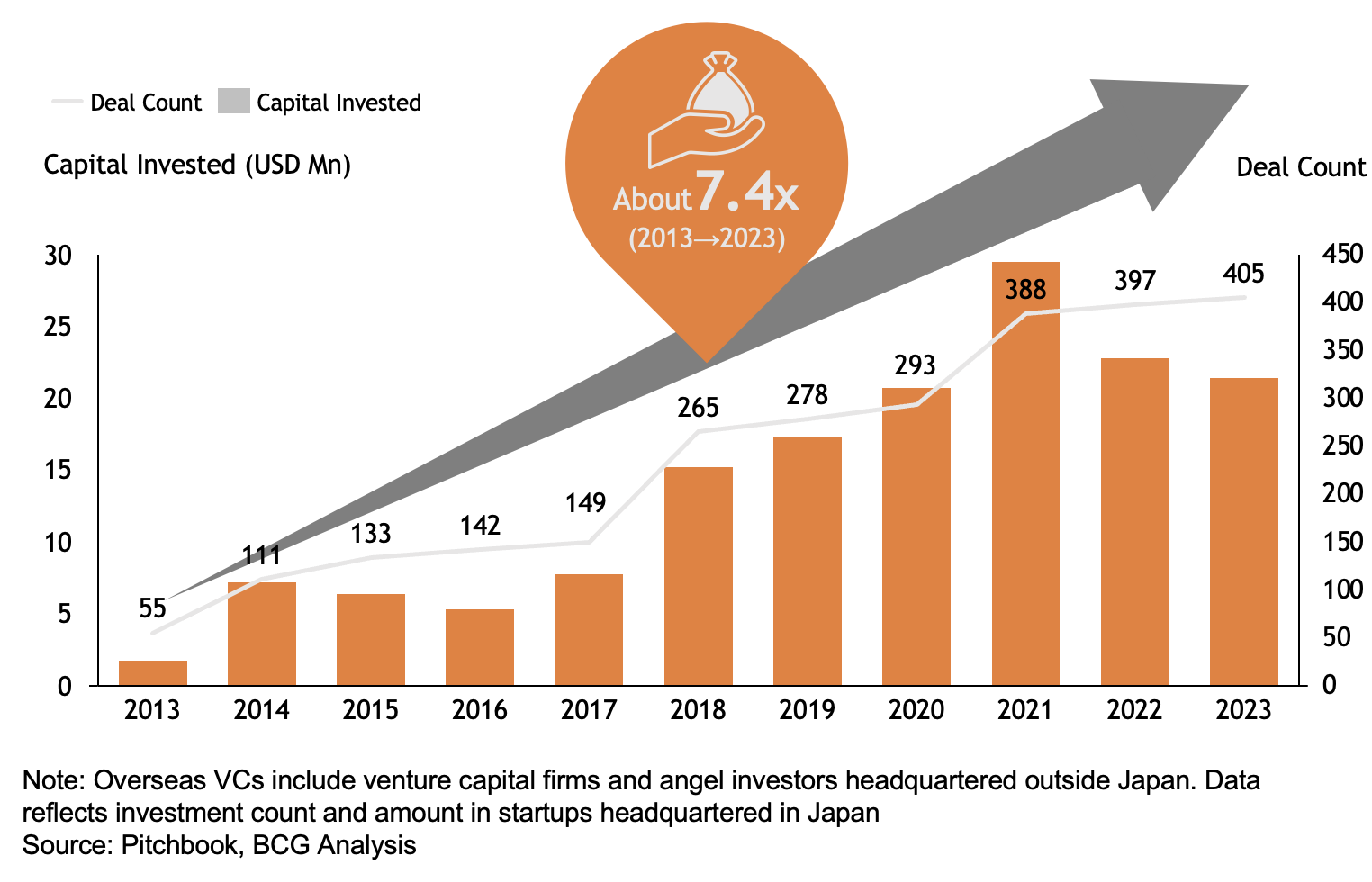

Despite the barriers, overseas VC investment in Japanese startups is on the rise. Foreign investment has grown more than sevenfold over the past decade, reaching a peak of around $30m in 2021, according to figures compiled by the Japan External Trade Organization. The number of startup deals financed by overseas investors has consistently increased since 2013, reaching 405 in 2023 from 55 in 2013.

Overseas investment in Japanese startups 2013 – 2023

In-Q-Tel points to the depth of technical expertise in Japan as a reason to invest. The country has a strong deeptech manufacturing base which startups can tap into through their corporate investors.

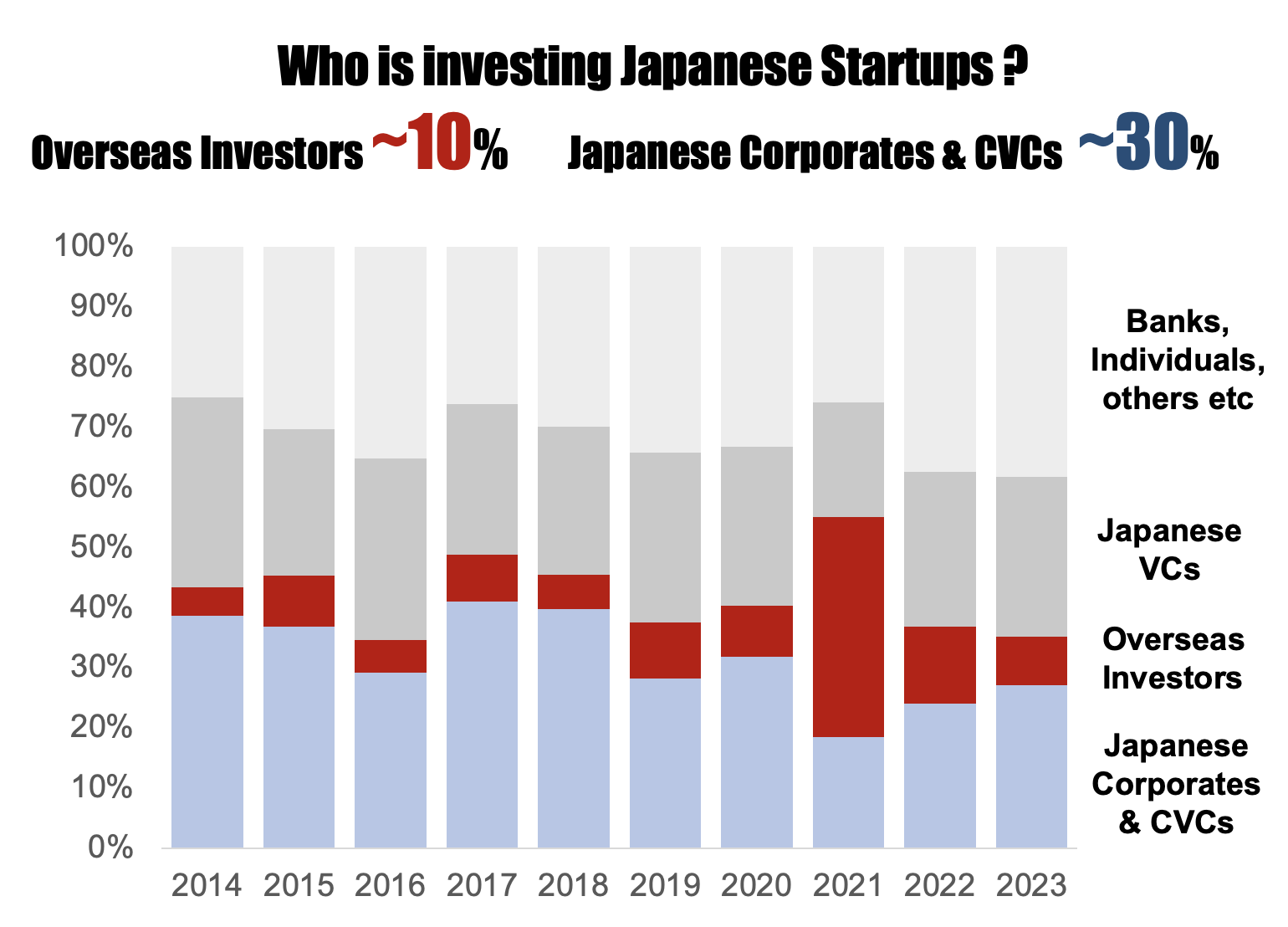

Japanese corporate investors are heavy investors in the country’s startup ecosystem. They represent 30% of VC investment in Japanese startups compared with 10% from overseas investors. The proportion of domestic VC is set to rise further as many Japanese corporates set up venturing units. Corporate-affiliated capital for startup investment increased to $3.4bn in 2023, from $140m a decade ago, according to Initial.

Overseas vs Japanese investment in Japanese startups

Japanese CVCs are also thinking more globally. Japan’s ageing consumers mean growth is declining in sectors such as consumer finance, and corporates are looking abroad for new markets. Japanese corporates are increasing investments in high growth markets such as India and the Nordics.

“We have to convey the attractiveness of Japan’s ecosystem,” said Kazuki Nobue, principal of 31Ventures, the CVC arm of Japanese real estate company Mitsui Fudosan. “We have to strengthen that.”