After a promising start the Thai startup ecosystem has slowed. Some say too much corporate money may have been part of the problem.

What everyone in the Thai startup ecosystem agrees on is that something has gone wrong. What they can’t agree on is what, exactly, would fix it.

After a promising start a decade ago, when numerous startup accelerators emerged and venture capital investors flocked to the market, the pace has slowed, and many overseas VCs appear to have lost interest in the market.

“It’s only a handful of Thai VCs that are doing deals. Every time I talk to VCs from Singapore they say they are still looking at the market but I haven’t seen them make investments,” says Martin Khamphoukeo, an investor at GC Ventures, the investment unit of GC, the chemicals arm of Thai energy conglomerate PTT.

Though Khamohuokeo is a corporate investor himself, he’s one of many in the sector that say too much CVC investment, too early may have had a negative impact on Thailand’s startup ecosystem because it pushed up valuations to unsustainable levels.

Funding activity slumps

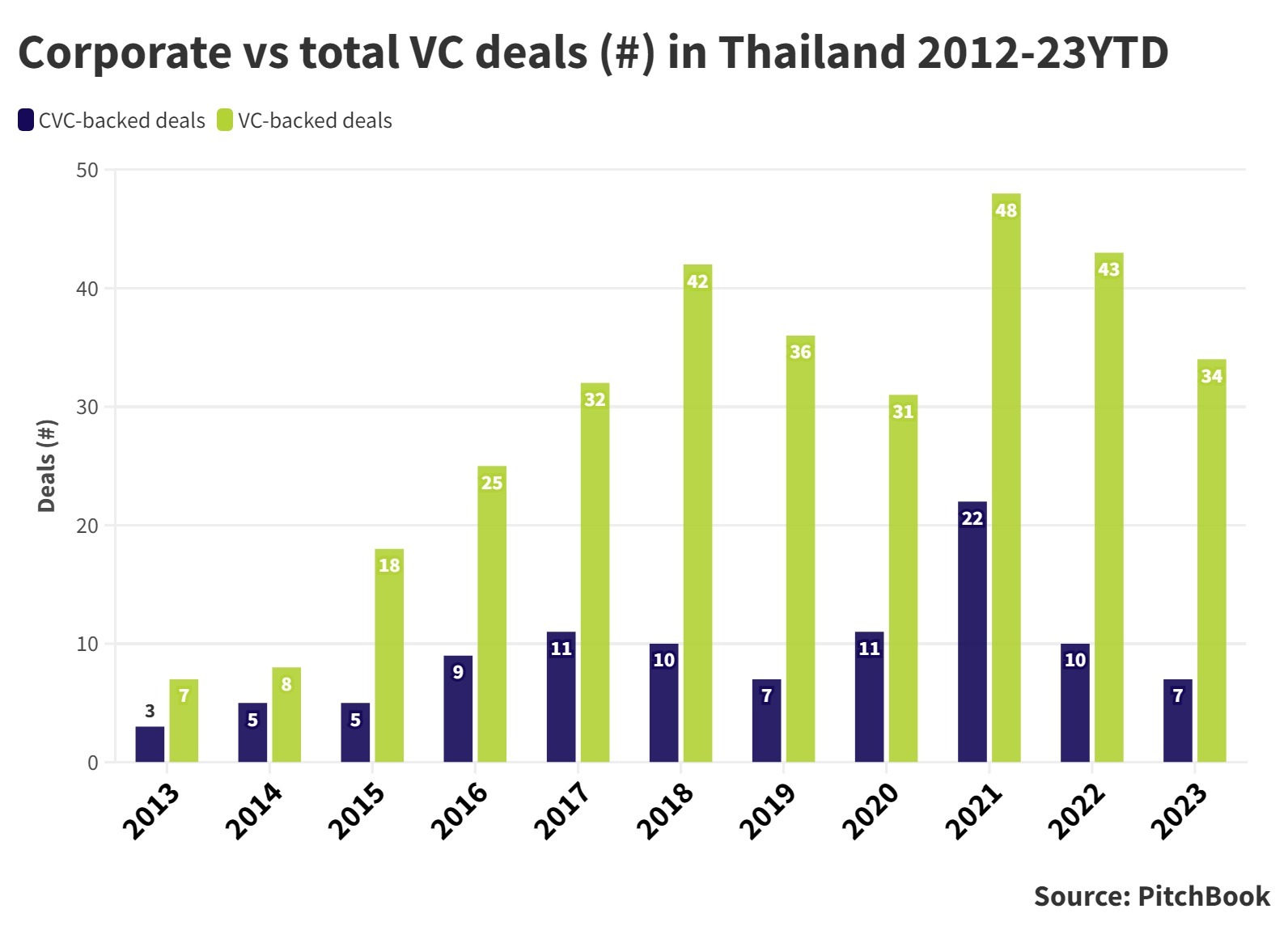

Although there was a brief peak of startup funding rounds in Thailand in 2021 — like there was in much of the rest of the world — funding activity has returned to levels seen six years ago. In 2023 there were 34 VC-backed startup funding rounds, similar to the 32 seen in 2017.

A number of eagerly-awaited IPOs, such as those of ecommerce enabler aCommerce and Sunday, the AI-powered car insurance company, were delayed amid unfavourable market conditions in 2022.

Thailand ranks as number 52 in in the StartupBlink index of global startup ecosystems, lagging behind countries like Singapore, Indonedia and Malaysia.

“Thailand feels like it is coasting, we are in gear two and trying to shift to third gear, but the clutch hasn’t engaged yet.”

“We’ve stalled,” says Paul Ark, venture partner at The Radical Fund, an early-stage climate fund focused on Southeast Asia. “Thailand feels like it is coasting, we are in gear two and trying to shift to third gear, but the clutch hasn’t engaged yet.”

Ark was one of the early pillars of the Thai ecosystem, an investment banker by background, he set up Siam Commercial Bank’s corporate venture fund in 2016, one of the first homegrown venture capital funds in Thailand. He has subsequently moved to work for other funds, but remains based in Thailand and has become, he jokes, the Simon Cowell of the Thai startup ecosystem, known for his critique. But he is far from the only one voicing concern.

The RISE Corporate Innovation Summit, set up by Dr Kid Parchariyanon to boost awareness of Thai tech, once again brought an international crowd into Bangkok this November. Attendees like Am Uruponsa, chief digital officer of McFiva, a digital marketing agency, says these kinds of conferences are helpful because Thai startups “don’t know how to connect with investors or advisors.”

In between conference sessions, however, many startups and investors voiced worries about a lack of local investors, a lack of exits and general stagnation.

Promising start a decade ago

The Thai ecosystem had a start in around 2013, with first the telecoms companies like True, AIS and DTAC creating startup accelerators and funds. The banks came a few years after that, starting accelerator progammes and venture capital funds in 2015 and 2016.

SCB Digital Venture, Kbank’s Beacon Venture, Krungri Finnovate, Bangkok Bank’s Finnovate and Bualuang Ventures were some of the accelerators and funds created in the financial sector, followed by Siri Venture and Urban Tech in the real estate sector.

At this point, says Khamphoukeo, “it became hip, more trendy to be a startup, and that started the development of venture capital.”

At the same time, in 2016, the Thai government outlined a series of tax breaks for startup companies and venture capital firms.

“In 2016 the government and ministries all came together and pledged support for startups. Before that, startups were grass roots, there were no government support. It was fuelled by a few individuals who had been inspired by Silicon Valley and Singapore,” says Khamphoukeo.

Was it the fault of too-dominant corporations?

While corporate enthusiasm to embrace venture capital helped bring more funding, it may have ended up unwittingly damaging the ecosystem, says Khamphuokeo.

“Suddenly there was a rise of corporate venture capital; every year maybe six, seven new corporate venture capital units came in,” he says. “But the number of really solid startups that were being built was limited, so the number of things those CVCs could invest in was limited. That drove up the valuation, which made the international VCs back off and not invest in the system, and that’s where we are today where I think the whole system needs to be rebalanced.”

This year, around one in five startup funding rounds in Thailand included a corporate investor, in line with the global average. But at the peak, in 2021, corporate venture investors were part of nearly half of funding rounds.

Companies like ecommerce logistics provider Flash Express became “unicorn” companies with valuations of more than $1bn, with the backing of Krungsri Finnovate, the investment arm of Bank of Ayudhya, SCB 10X and PTT, the petroleum company. Ascend Money became Thailand’s first fintech unicorn in 2021 with the backing of China’s Ant Group and Thai food company Charoen Pokphand.

Ark agrees that startups became overpriced during this period.

“I think part of the reason why a lot of VC funds haven’t looked at Thailand is because they feel like some of the asking prices are a bit overpriced. Sometimes it’s because they were the previous rounds by less savvy angels or corporates, they paid too much and so they can’t get in now,” he says.

It may not have just been an inflation of price that put financial VCs off, he adds. Startups that take corporate investment can end up being too influenced by them.

“Corporates know that if they’re the only money out there putting money into the Thai startups and it gives them a certain leverage. And sometimes that leverage can induce some bad behaviour on the part of the startups or corporates or their investment teams. That’s a bit of an issue,” says Ark.

Lack of strong startups

But the problem may not just be the corporates. The issue is far more nuanced says Ark. At the heart of it is the fact that Thailand doesn’t have enough scalable startups with unique technologies.

“If you look at it from one angle, it looks like the corporates are dominant because they are basically doing the lion’s share of investments in startups. But is that because Thai CVCs are crowding out non-institutional overseas funds, or is it because they’re the only ones investing in Thai startups?” he asks.

“If you talk to the non-corporate VCs, a lot of times they say they wouldn’t have invested in those startups anyway. We just don’t see any startups that are mature enough or unique enough.”

GC Ventures mainly invests in startups outside of Thailand, says Khamphoukeo. The team has struggled to find deeptech businesses that would have strategic value for GC’s chemicals business.

“You need to find unique technologies that are not available in the US and Europe. The outlook for startups is just better in the US and Europe because the funding ecosystem is greater and there is government support. So, if we don’t see some technology that is really unique, and we cannot find in other places, this doesn’t make sense,” he says.

“What is tough in Thailand is that there aren’t many one-of-a-kind technologies.”

This is a sentiment echoed by Wanwipa Siriwatwechakul, partner at Vectors Capital, a climate tech-focused investment fund and accelerator programme. Siriwatwechakul is a former petrochemicals and biofermentation scientist who recently turned to investing, and who now specialises in deeptech investments. These are not easy to find in Thailand, she says.

“What is tough in Thailand is that there aren’t many one-of-a-kind technologies. There are technologies that are good for the Thai market but kind of me-too,” she says.

At the same time, the Thai market is not growing fast enough to excite investors who may be comparing several markets across Southeast Asia. Companies in Vietnam, for example, might be growing at twice the rate as their peers in Thailand.

“A number of regional funds like Gobi and Golden Gate Ventures that have previously been active in Thailand haven’t made investments with the level of frequency that the ecosystem would like. That’s because it’s challenging to find startups in Thailand that would reach the type of scale that would satisfy their ICs and their LPs,” says Ark. “You go where the scale is.”

Is the university spinout system not working?

Siriwatwechakul, a former professor of engineering at Thammasat University, says Thailand’s universities may also be part of the problem. Many of them started accelerator programmes, but they didn’t necessarily couple that with policies to make it easy for academics to create spinout companies based on their research breakthroughs.

She says some universities simply have no process for helping entrepreneurs, while those that do have a tech transfer function tend to have in place overly strict policies on intellectual property.

“The ones that have no process are confusing and the ones that are too strong become almost a police state,” she says.

Khamphoukeo also feels that university spinout policies should be reformed. “We need to take a look at the process of getting IP out of universities,” he says. “Universities keep a big share of the IP. It is definitely hard for PhDs to take their IP and commercialise it.”

Not enough experienced people — or exits

Another problem is that the pool of experienced founders is still very small in Thailand. But the only way to create more founders is to have more startups, preferably successful ones that achieve an exit.

“You need a very special kind of people with risk tolerance, that know how to raise funding and manage it. Those kinds of people tend to be created by working in startups,” says Khamphoukeo.

“A sustainable startup ecosystem needs successful exits. At the end of the day, it’s the successful founders which are the north star for the next generation,” he says.

“A sustainable startup ecosystem needs successful exits. It’s the successful founders which are the north star for the next generation.”

But founder success stories have been thin on the ground, says Siriwatwechakul.

“There are a few founders that exited, but not through a public listing but because they got acquired. There are a few that have come back as angels, but you have to be a little bit in the know to know about them,” she says.

Even trade sales have been hard to get at times. Bitkub, the Thai cryptocurrency exchange, was expected to achieve a more than $1bn valuation by selling a 51% stake to Siam Commercial Bank, but the acquisition was scrapped in 2022 due to regulatory issues.

“M&A and trade sales don’t get as well publicised as IPOs so it’s kind of hard to inspire people,” adds Ark. “We’re relying on the handful of IPOs that have happened, which had varying degrees of success.”

Sabuy Technologies, a startup offering fintech solutions to food and retail companies, has seen its shareprice in a steady decline since it listed on the Stock Exchange of Thailand in 2020.

A lack of IPOs is not unique to Thailand, of course, says Ark.

“Southeast Asia is not the greatest IPO story at a moment. And if Singapore can’t get its companies listed, Thailand is going to have an incredibly rough time.”

No silver bullet — but alignment would be a start

A successful IPO or two could be the shot in the arm the ecosystem needs. Even well-established businesses such as Siam Cement and Berli Jucker, owner of the Big C supermarket group, have had to put on hold plans to list business units because of unfavourable conditions.

The IPO of food delivery app Lineman Wongnai, however, may be going ahead with a listing next year. CEO Yod Chinsupakul, who founded the company with three friends from Chulalongkorn University, has previously said he is hoping for the company to achieve a $10bn valuation on listing.

Others are looking to the government to help the startup ecosystem out of the current stagnation.

“We won’t see startups develop if there is no money to build them and VCs won’t come in if there is no pipeline. I think the government needs to re-ignite the engines of the startup ecosystem,” says Khemphoukeo.

But, he says, this needs to be done “in a way that the CVCs aren’t fighting over the startups that pop up and valuations don’t go crazy”.

“We currently have six people in a raft, paddling six different ways.”

There isn’t one solution, says Ark. “Everyone needs to do something better.” But a good start would be getting some more consensus on what needs to be done, he says.

“We currently have six people in a raft, paddling six different ways. We need to get at least four of them paddling in the same direction.”

Maija Palmer

Maija Palmer is editor of Global Venturing and puts together the weekly email newsletter (sign up here for free).