The drone technology provider raised capital from a host of corporates, bringing its total funding to over $84m.

Japan-based drone software developer Terra Drone received $70m in a series B round featuring a number of corporate investors, including conglomerate Mitsui, mechanical equipment producer Seika, energy utility Kyushu Electric and property developer Tokyu Land. The participants were filled out by SBI Investment, a subsidiary of financial services provider SBI, as well as Japan Overseas Infrastructure Investment Corporation and Venture Labo Investment. Some of the previous corporate backers of Terra include oil and gas supplier Inpex and financial services firm Nanto.

Founded in 2016, Terra Drone provides hardware and software for unmanned aerial vehicles, designed for industrial applications that involve surveying, inspection and surveillance. The company counts oil and gas producers Chevron and Shell, chemical producer BASF, agribusiness Bunge and engineering firm Aecom among its customers.

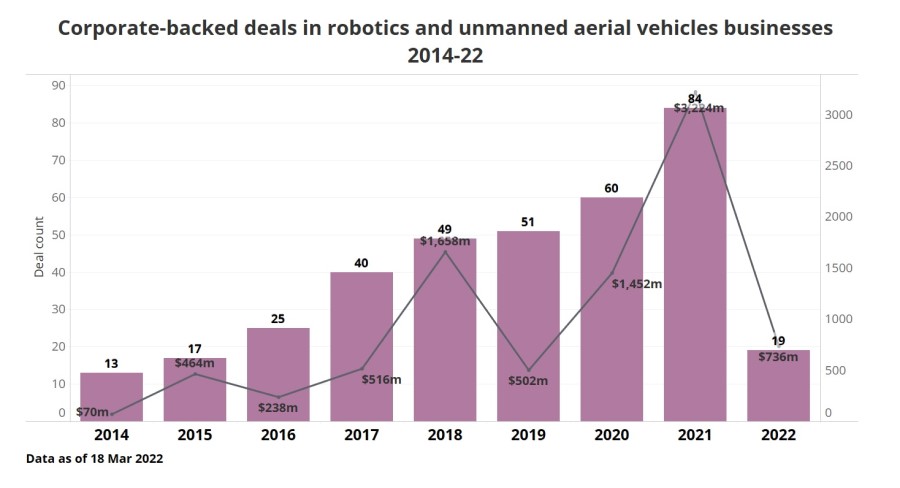

Terra Drone is part of the broader drones and robotics space, which has enjoyed much interest from corporate venture investors, according to GCV data, as illustrated on the chart below. Both the number of such corporate-backed deals and the total estimated capital in them have increased multifold over the past years – from an estimated $70m deployed in 13 deals to over $3.22bn in 84 deals reported by the end of last year. This illustrates how the interest of corporate venture investors has increased over time, as unmanned areal vehicles have gained more traction and been employed across many sectors.