After a record-breaking 2021, the new year has started slowly but there is an upwards trend.

The world we find ourselves in a few months into 2022 is significantly different from that at the end of 2021. Russia has invaded and is seemingly committing war crimes in the European democracy of Ukraine, sending shockwaves through the western world and prompting Germany to change its foreign policy with a single speech by chancellor Scholz that will inevitably be studied by historians for many years to come. One of the reasons for Putin’s unprovoked war is his paranoia of an ever-expanding Nato, so it is ironic that the autocrat’s actions have led both Sweden and Finland to be openly considering membership of the military alliance – put-ting the organisation much closer to Russia’s territory.

Financial markets have struggled in this reality. Much of Europe – chief among them Germany – relies on Russia’s gas reserves to keep homes heated and industries manufacturing, and the invasion has pushed up prices. It adds to challenges already created by a reawakening economy after the pandemic slowdown – problems that have caused a cost of living crisis even in countries that barely consume any Russian gas at all, like the United Kingdom.

Tony DeSpirito, chief investment officer at BlackRock’s US Fundamental Active Equity, predicted that the market would transition to one that warrants “greater selectivity and a rebalance toward value”.

This greater selectivity is something that will likely also impact spinouts. Although investor interest is still high – see the editorial in this issue for a selection of new funds launched, particularly in Europe – much of that interest is in helping solve huge challenges. That trend, of course, is not new and spinouts have long been exceptionally good at tackling big challenges. But the focus is becoming sharper and the actors more mature – be that through Bristol building quantum technologies and biotech clusters essentially from scratch (see our feature article in this magazine) or through funds focused on deeptech that are likely to take a long time before a return can be generated becoming more popular.

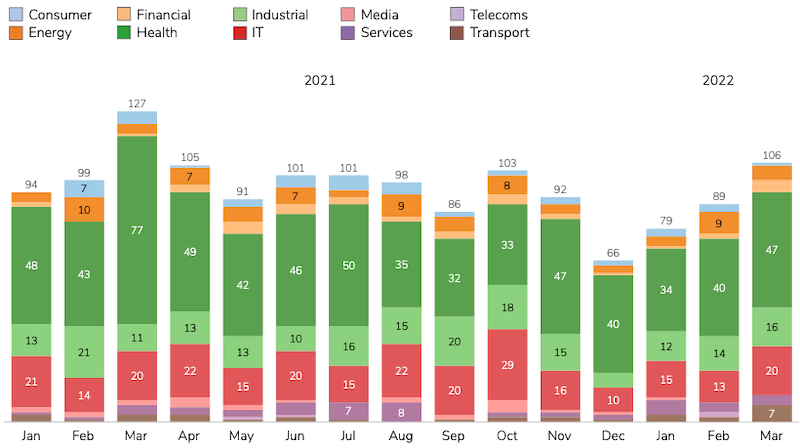

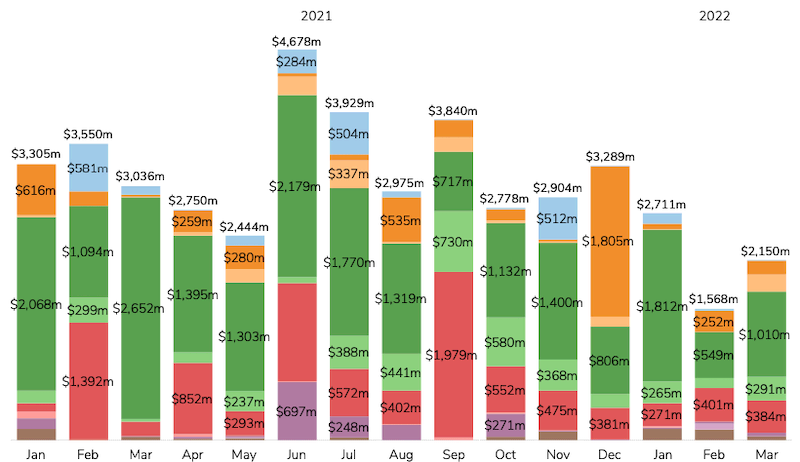

The 274 deals closed in the first quarter of 2022 appear to prove this point. The deal count is a notable drop from the 320 in the opening three months of 2021, although it is an upwards trend month on month since the December 2021 slowdown. Interestingly however, the money in-vested through those 274 deals only totalled $6.4bn – a staggering drop from the almost $9.9bn in the first quarter of last year. February 2022, in particular, saw the least investment in terms of capital in the 15-month period.

Deals from January 2021 to March 2022

Numbers are never the whole story, of course, and noteworthy news emerged in February. Apollo Therapeutics, the biopharmaceutical company co-founded by Imperial College London, University of Cambridge and University College London, welcomed King’s College London as its newest partner, strengthening a business that was already offering a unique proposition.

And nine-figure deals still happened in the shortest month of the year, too. Although not the biggest, Seismic Therapeutic, a US-based immunotherapy discovery technology developer, is significant because of its co-founder Timothy Springer. Springer, a faculty member at Harvard Medical School, is arguably best known for his involvement in mRNA vaccine developer Moderna, but his portfolio also includes gene-editing company Editas, biotech developer Tectonic Therapeutic and integrin drug developer Morphic Holding.

The biggest deal of the first quarter belonged to Eikon Therapeutics, a US-based drug discovery and development company co-founded by University of California (UC), Berkeley researchers, which completed a $517.8m series B round from investors including UC Investments in early January.

Insurance provider Harel Insurance took part in the round, as did T Rowe Price Associates, Canada Pension Plan Investment Board, EcoR1 Capital, StepStone Group, Soros Capital, Schroders Capital, General Catalyst, E15 VC, Hartford HealthCare Endowment, Abu Dhabi Investment Authority’s ADIA subsidiary, AME Cloud Ventures, Column Group, Foresite Capital, Innovation Endeavors, Lux Capital and Horizons Ventures.

Founded in 2019, Eikon Therapeutics is building on super-resolution microscopy that enables the precise characterisation of protein interactions in living cells – offering a much more comprehensive insight than the static snapshots of frozen materials that are currently used. Eikon plans to focus on previously undruggable targets, though it has not revealed details yet.

Its underlying technology was created by co-founder Eric Betzig, whose appointments at UC Berkeley include professor of molecular and cell biology. He received the 2014 Nobel Prize in Chemistry for the development of the technology.

The second and third largest deals went to medical device developer Enable Injections and employer-focused personalised healthcare platform Transcarent, which raised a respective $215m and $200m in series C funding.

Enable Injections’s backers included Ohio Innovation Fund, the venture capital vehicle co-founded by Ohio State University, Ohio University and Kent State University, as well as Cin-cinnati Children’s Hospital Medical Center. Transcarent’s backers featured Rush University Medical Center, the teaching hospital of Rush University.

| Company | Institution | Sector | Round | Size |

|---|---|---|---|---|

| Eikon Therapeutics | UC Berkeley | Health | B | $517.8m |

| Enable Injections | Cincinnati Children’s Hospital | Health | C | $215m |

| Transcarent | Rush University Medical Center for Health | Health | C | $200m |

| Jeeves | Stanford University | Financial | C | $180m |

| Affini-T Therapeutics | Fred Hutchinson Cancer Research Center | Health | Undisclosed | $175m |

| SiFive | UC Berkeley | IT | F | $175m |

| Scandit | ETH Zurich | IT | D | $150m |

| Source Global | Arizona State University | Energy | Undisclosed | $150m |

| Superpedestrian | Massachusetts Institute of Technology | Transport | C | $125m |

| Korro Bio | University of Chicago | Health | B | $116m |

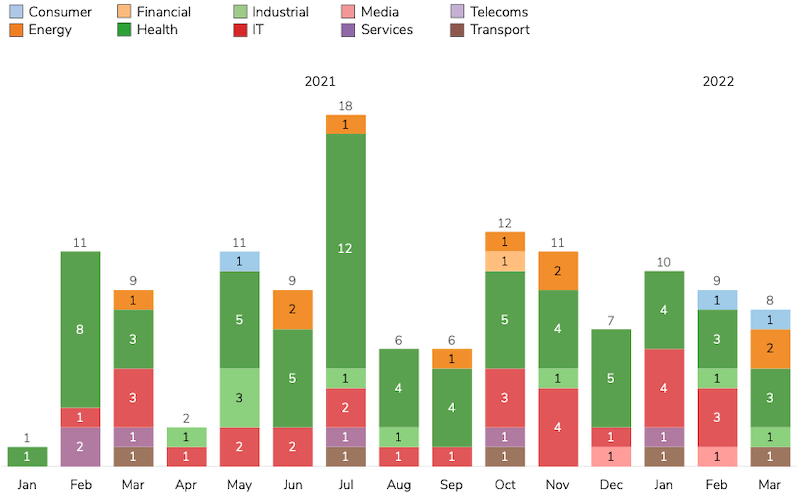

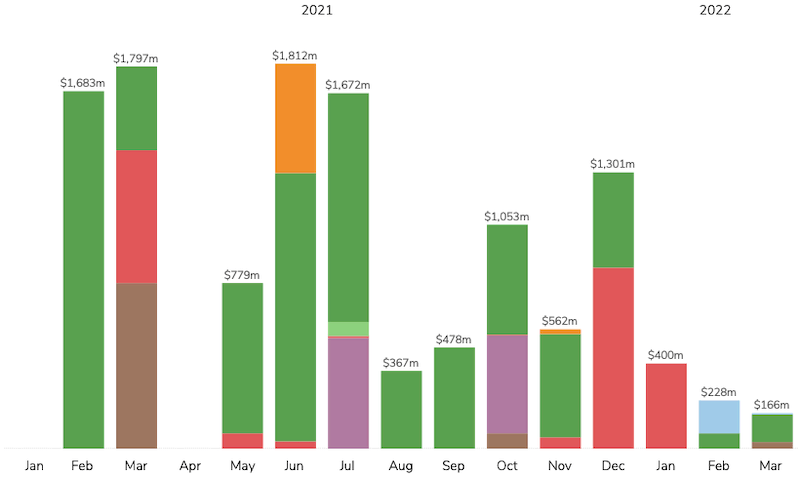

The number of exits meanwhile increased year-on-year to 27 in the first three months of 2022. With public markets having cooled down, however, many of these exits were in the form of mergers and acquisitions, where the price paid for spinouts often remained undisclosed. The relatively modest $794m in proceeds should therefore be read with some caution – the actual figure is likely higher.

Exits from January 2021 to March 2022

The largest three exits were indeed all acquisitions, with Trifacta, a US-based data management software producer based on research at Stanford University and University of California, Berkeley, coming out on top. The company agreed to a $400m all-cash acquisition by analytics automation technology provider Alteryx. The acquisition also allowed corporates Telstra, NTT Docomo, BMW, Google, Infosys, ABN Amro, Deutsche Börse, Ericsson and New York Life to exit. Trifacta had raised a total of $224m as of a $100m funding round in 2019 valuing it be-low $1bn.

C-Lecta, a Germany-based enzyme engineering and bioprocess developer spun out of University of Leipzig, meanwhile agreed to an acquisition by food group Kerry for €137m ($155m). Kerry bought a 92% stake, with the remainder held by C-Lecta’s management. C-Lecta specialises in precision fermentation, optimised bioprocessing and biotransformation to create high-value, targeted enzymes and ingredients for consumer segments including food and beverage. High-Tech Gründerfonds had joined an unnamed angel investor for a €600,000 ($733,600) investment in January 2006, after which C-Lecta raised undisclosed sums in August 2006, in 2008 and in 2018.

And Syndesi Therapeutics, a Belgium-based developer of therapies to treat cognitive impairment, was acquired by pharmaceutical firm AbbVie for $130m upfront, with the potential for up to $870m in milestones. The agreement provided an exit to Vives Louvain Technology Fund, the university venture fund of Université catholique de Louvain, and V-Bio Ventures, the venture capital firm linked to research institute VIB. Syndesi last raised $21m in a series A round backed by the two aforementioned investors in February 2018, a month after it was spun out of biopharmaceutical firm UCB.

One other interesting exit in the table was the merger of Alpine Intuition and Cohesive Computing, two Switzerland-based artificial intelligence technology spinouts of EPFL. The combined company will operate as SquareFactory and will aim to offer an end-to-end machine learning operations platform to train, deploy and host AI applications, while also offering consultancy and development services. Sergio Giacoletto, board member of Cohesive Computing as well as adviser to Alpine Intuition and one of its investors, has been appointed president and interim chief executive of SquareFactory. Details about either company’s historical funding could not be ascertained beyond a low six-figure sum secured by Alpine Intuition from members of Business Angels Switzerland in January 2021.

| Company | Institution | Sector | Type | Size |

|---|---|---|---|---|

| Trifacta | Stanford University, UC Berkeley | IT | Acquisition | $400m |

| C-Lecta | University of Leipzig | Consumer | Acquisition | $155m |

| Syndesi Therapeutics | Université catholique de Louvain | Health | Acquisition | $130m |

| Rewrite Therapeutics | UC Berkeley | Health | Acquisition | $45m |

| The Floow | University of Sheffield | Transport | Acquisition | $31.5m |

| Aelis Farma | Inserm | Health | IPO | $28.1m |

| TouchBistro | Allied Minds | Consumer | Stake sale | $4.4m |

| Adaptate Biotherapeutics | King’s College London | Health | Acquisition | |

| Alpine Intuition, Cohesive Computing |

EPFL | IT | Merger | |

| Aurtra | University of Queensland | Energy | Acquisition |