Despite being the first year spent entirely during the pandemic, 2021 underlined the strengths of the ecosystem with spinouts raising nearly $39.2bn.

It was arguably optimistic to claim, in our annual review a year ago, that normality would return to the world once vaccines had reached a majority of people. Delta and then Omicron variants have wreaked havoc with people’s and governments’ hopes to resume lives as they once were – and that is nothing to say of a terrifyingly large minority who continue to refuse the vaccine. While booster campaigns have meant that the death toll from the Omicron wave has thankfully been lower than that of earlier peaks, those same campaigns have also underlined the reality that vaccine inequity persists globally.

And that is a problem for everyone: for the pandemic to truly end, it needs to end everywhere. Omicron originated in South Africa, where as of January 24, 2022, still only a third of the population has been fully vaccinated. Africa, in general, is struggling: Rwanda, Botswana, Morocco and Tunisia are the only countries where more than half the population has had a first dose. The majority of nations on the continent have administered less than 10% of first shots, many even less than 5%.

Afghanistan, Syria, Bulgaria, Ukraine, Papua New Guinea and Guatemala are some other countries throughout the world that have not yet reached 50% for first doses.

So far, so bad. But…

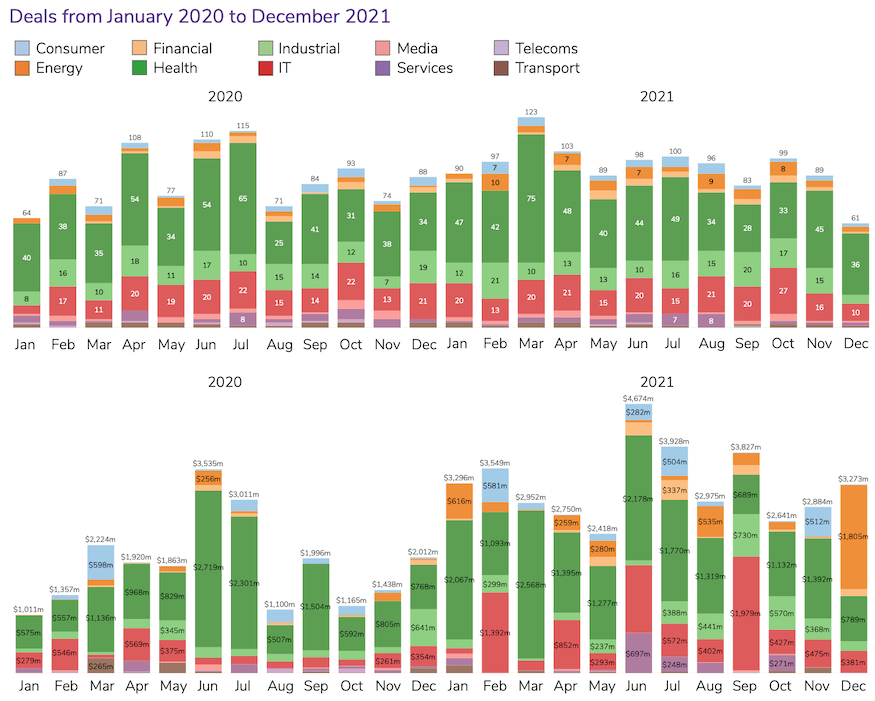

Technology transfer has thrived more than ever before under these pressures. Global University Venturing tracked 1,128 deals throughout the past twelve months – the most since the publication began collecting data in 2013. The previous year came in at an already impressive 1,042 deals, and nearly three of those months were pre-pandemic.

An 8.3% increase in deals is noteworthy, but what is even more phenomenal is the capital raised. In 2020, spinouts pocketed a collective $22.6bn. In 2021, they received close to $39.2bn altogether. That is a more than 73% increase of money being pushed into these companies. In 2019, spinouts had raised $17.6bn between themselves. That is an increase of almost 123% from 2019 to 2021. The arrow is very much pointing upwards.

Notable, if perhaps unsurprising, is that the largest deals in the last quarter of 2021 all focus on signifcant challenges for the human race: Commonwealth Fusion Systems out of Massachusetts Institute of Technology, is – as the name suggests – working on fusion power and attracted a jaw-dropping $1.8bn in series B funding in December 2021. Equally impressive is the list of backers: from MIT and Harvard University-backed venture fund and incubator The Engine to Google, the internet technology subsidiary of conglomerate Alphabet the cap table reads like a who’s who of the world’s most sophisticated investors.

Hinge Health, a US-based digital therapeutics company backed by commercialisation firm IP Group, had closed a $300m series D round in January last year but wasted no time moving on to its series E round, which brought in $400m in fresh capital, with another $200m in a secondary transaction that allowed Alkeon and Whale Rock to buy into the business. The round valued Hinge Health at $6.2bn and brought its overall financing to more than $1bn. Hinge Health has built a digital musculoskeletal clinic that combines wearable sensors with access to physical therapists, doctors and health coaches to help reduce back and joint pain.

Similarly impactful is the mission of Impossible Foods, one of the biggest global players in plant-based meat alternatives. The company has now raised some $2bn and pushed its valuation to a reported $7bn valuation, all in just a decade after it was founded by Patrick Brown, then a professor of biochemistry at Stanford. Brown’s interest in the space pre-dates the creation of Impossible Foods: a year earlier he had already co-founded Lyrical Foods, which sells plant-based dairy products such as yoghurt, butter and cheese under the Kite Hill brand.

| Company | Institution | Sector | Round | Size |

|---|---|---|---|---|

| Commonwealth Fusion Systems | Massachusetts Institute of Technology | Energy | B | $1.8bn |

| Hinge Health | Health | E | $600m | |

| Impossible Foods | Stanford University | Consumer | Undisclosed | $500m |

| Personio | TU Munich | Services | E | $270m |

| Vastai Technologies | Tsinghua University | IT | B | $251m |

| Alchemy | Stanford University | IT | C | $250m |

| SkyRyse | Stanford University | Industrial | B | $200m |

| Quell Therapeutics | King’s College London | Health | B | $156m |

| Hawkeye 360 | Virginia Tech | Industrial | D | $145m |

| Dexterity | Stanford University | Industrial | B | $140m |

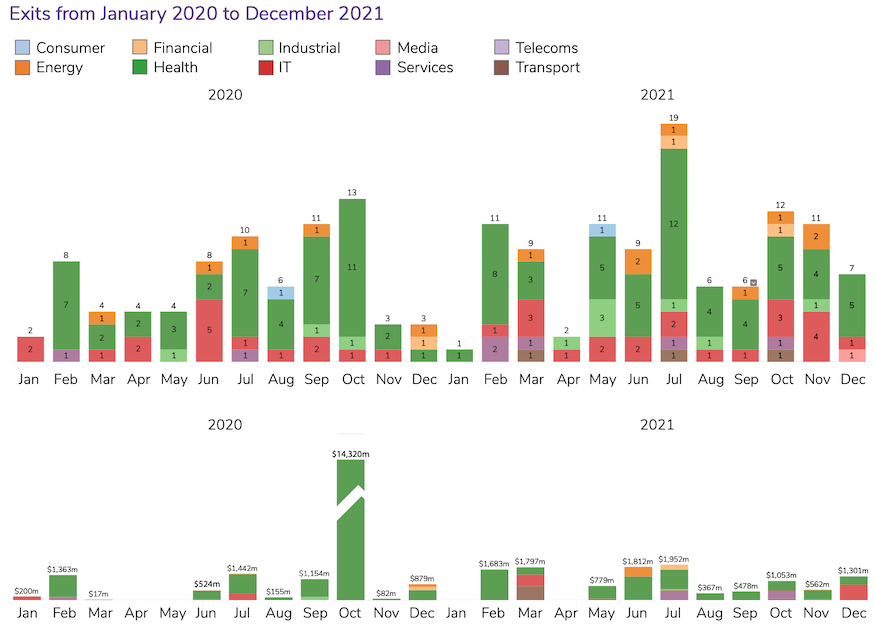

When it came to exits, 2021 was just as remarkable as 2020. Across an extraordinary104 exits, a total of at least $11.8bn flowed back into the ecosystem – the true amount likely being much higher, as several mergers and acquisitions simply do not disclose financial terms.

The figure pales in comparison to 2020’s $20.1bn generated through exits, but it should be noted that October of that year included not one but two blockbuster deals: pharmaceutical firm Bristol Myers-Squibb dropped $11.9bn on the stock of MyoKardia, which focused on genetic heart disease and was based on research conducted at University of Colorado Boulder, Stanford University and Harvard Medical School. The same month also saw the purchase of Thrive Earlier Detection, a US-based cancer screening technology spinout of Johns Hopkins University, by molecular diagnostics company Exact Sciences for up to $2.15bn – in any other month that alone would have counted as the largest deal.

But what were the largest exits of the last quarter of 2021? With 30 of them securing more than $2.9bn overall, they were certainly high in number if none of them were quite as significant blockbusters. SenseTime’s $851m initial public offering is nothing to scoff at: the Chinese University of Hong Kong spinout actually priced shares at the foot of its range when it listed in Hong Kong at the end of the year. The offering was noteworthy for something else too – the company had initially planned to price its shares on December 10, but the IPO was pushed back after the US government added the company to a blacklist due to its technology being used to aid human rights abuses directed towards China’s minority Uyghur population. Perhaps the idea that spinouts are always looking to make the world a better place is not always true.

The second largest exit of the quarter also occurred in China. Wayz Intelligent Manufacturing Technology (WayzIM), a developer of logistics automation systems for express delivery providers, filed for a $462m iniital public offering. The company emerged out of the Institute of Microelectronics at Chinese Academy of Sciences, and it will use proceeds to build a smart equipment manufacturing plant, among other plans.

Johns Hopkins University was among those to also have reason to celebrate in 2021: Personal Genome Diagnostics (PGDx), a US-based cancer diagnostics developer. Life sciences company Labcorp put up $450m to buy the spinout and will pay up to an additional $125m dependent on performance milestones. PGDx’s diagnostic kit is the only one with regulatory approval in the US for pan-solid cancer comprehensive tumour profiling using a 500-plus gene panel and Labcorp expects the addition of the spinout’s offering to allow it to provide oncology testing at every stage of care.

All of these are numbers that nobody could have foreseen when Global University Venturing first began tracking this data in 2013. And yet, it feels as though this is only just the begin of an ecosystem that has hardly begun proving the impact it can have on the world. It is certainly fantastic to see that with all the (rightful) focus in the mainstream press on covid vaccines developed by spinouts, every area is proving its worth – and all of this is happening as tech transfer offices around the world are only just beginning to explore the opportunities in their social sciences, humanities and arts departments.

| Company | Institution | Sector | Type | Size |

|---|---|---|---|---|

| SenseTime | Chinese University of Hong Kong | IT | IPO | $851m |

| WayzIM | Chinese Academy of Sciences | Services | IPO | $462m |

| Personal Genome Diagnostics | Johns Hopkins University | Health | Acquisition | $450m |

| Exscientia | University of Dundee | Health | IPO | $350m |

| Laboratoris Sanifit | University of the Balearic Islands | Health | Acquisition | $231m |

| Entrada Therapeutics | Ohio State University | Health | IPO | $182m |

| Pyxis Oncology | University of Chicago | Health | IPO | $168m |

| Forendo Pharma | University of Turku | Health | Acquisition | $75m |

| Sense Photonics | University of California | Transport | Acquisition | $71.3m |

| Agara | University of Tokyo | IT | Acquisition | $40 |

Consider this as a concluding thought: in 2013, GUV tracked 220 investments and 17 exits – worth around $1.9bn and $3.3bn respectively. The past year was the first where more than 100 exits were recorded and 1,000-plus deals per year have only been the norm since 2019.