In February 2022, the GCV Institute celebrates its first birthday with the launch of the first corporate venture capital (CVC) operational and performance benchmarking platform. This will serve as a reference point for CVC strategic and operational planning as well as provide timely best practices data for the Institute’s professional development curriculum.

The birth of the Institute

The concept for the GCV Institute was born out of the collaboration among Heidi Mason, Liz Arrington, and James Mawson on their 2019 book, Corporate Venturing: A Survival Guide. The book translated in depth BMG research on CVC industry best practices into a maturity framework and set of design rules for building impactful and resilient programmes.

In the research for the book, we consistently heard two key messages from CVC community leaders:

- CVC is now seen as a mainstream weapon in the corporate innovation arsenal and an influential player in the global innovation ecosystem — but corporate parents often do not understand how CVC works and the roles they should play in driving value

- The bar for CVC programme professionalism has been raised – this is critical to the reputation of the industry as well the impact and longevity of individual programmes

In response, GCV and BMG together created the first specialised Institute dedicated to corporate venturing industry advancement, staying power and impact. We envisioned three interlocking pillars:

With the motto ‘By CVCs for CVCs’, and guided by a luminary advisory board, the Institute launched its professional development curriculum and the foundation for alumni and expert community networks.

The Charter Institute Advisory Board (IAB)

Demonstrating their deep commitment to industry advancement, Tarik Galijasevic, Debbie Brackeen, Jaidev Shergill, Barbara Burger, Rob Coppedge, George Hoyem, Bill Taranto, Jacqueline LeSage, Dede Goldschmidt, Austin Noronha, and Nicolas Sauvage all contributed unique insights, best practice case studies, and pilot participants to fine tune course content and delivery.

Professional Development

Addressing the corporate venturing landscape

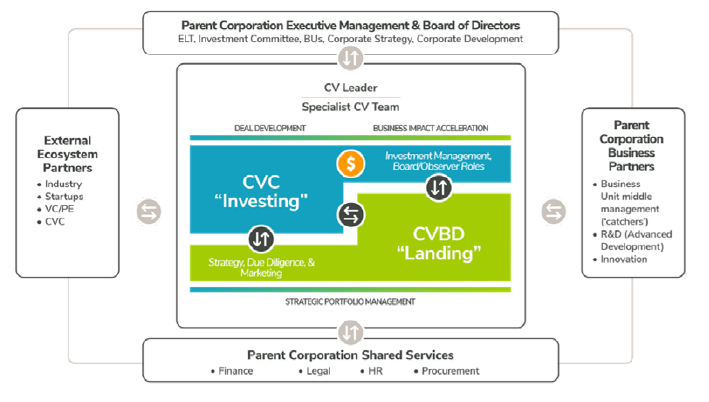

Corporate Venturing (CV) programmes operate in a complex set of interdependent ecosystems involving multiple internal and external stakeholders. As CV has become a mainstream weapon in the corporate innovation arsenal, leading programmes must manage hundreds of parent touchpoints at multiple levels with constant role rotations. Externally, savvy CVCs are no longer seen as poor stepchildren to VCs – but as different and potentially more impactful partners (for both parent and portfolio company). All of which makes CVC a harder, more complex job than institutional investing.

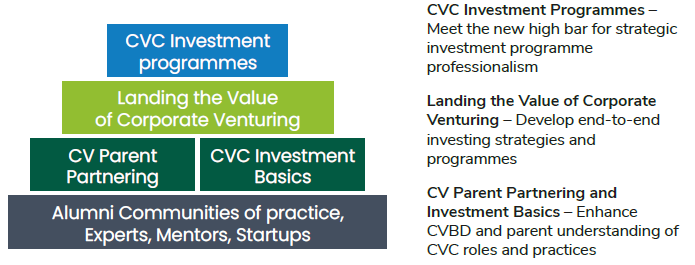

What distinguishes Institute professional development is our conviction that an end-to-end investing approach, integrating investment and partnering, is fundamental to both portfolio financial performance and to delivering the ultimate strategic impact needed to ensure CVC programme longevity. Over the past 5 years, high-performing programmes are increasingly building parallel teams of investment (VC) and Corporate Venture Business Development (CVBD) professionals, chartered with building relationships that benefit both the parent and the portfolio company.

Establishing a common corporate venturing language and understanding of its unique integrated characteristics is the foundation for all parties to work together and deliver the promised value. The Institute curriculum is designed to address CV team (VC and CVBD) professional development as well as promote effective engagement with both parent and external stakeholders.

2021 Professional Development Year in Review

The Curriculum – Over 18 months, the Institute established a state-of-the-art learning management platform and launched a foundational curriculum that is CVC community-driven, differentiated and designed to get all the parties critical to CV programme impact on the same page and working together effectively.

A rich combination of expert case studies (panels, videos), self-directed learning and resources, cohort-based live interaction, and mentored problem solving has led to overall course satisfaction ratings of 4.5 out of 5.

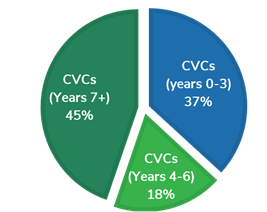

Course Participants – 2021 saw an accelerated rollout of 10 courses, with over 200 alumni representing more than 50 organisations across the globe.

▲ 45% represented long-term programmes onboarding new investment team members, building CVBD/portfolio development teams, and educating parent partners

▲ 37% of participants came from corporations new to CVC, primarily interested in best practices and networking

Contributing Experts – The Institute lives by our ‘By CVCs for CVCs’ motto. From the Institute’s inception, the IAB, the CVC community and specialist service providers have stepped up to give back by sharing wisdom and best practices. These Institute partners have participated in video case studies, interactive panels and acted as mentors to pods working on projects in the Landing the Value of Corporate Venturing course. Successful CVC portfolio company CEOs have been particularly valuable, showcased as ‘truth telling’ panelists with clear expectations of corporates as investors and partners.

Benchmarking

Although corporate venturing has become a mainstream innovation vehicle for increasing numbers of corporations, it is a unique specialist activity that is not well understood by most corporate executives. When key decisions need to be made about CVC programme creation, expansion or redirection, executive decision-makers look to the outside for competitor and cross-sector reference points.

The same questions come up again and again with no single source available for industry operational and performance data:

| New programmes | Existing programmes |

| What are common CVC programme goals?What should be the team construct, sourcing, and compensation strategies?What is the right organisational and legal structure?What governance/investment decision-making will balance strategic rigour and agility?What is an appropriate starter fund size?How to measure performance in the early days? | How should the CVC operating, and compensation models evolve to address team retention challenges?What are industry trends regarding fund size beyond the initial allocation? Should we take board seats and who should hold those seats? How to categorize and measure strategic impact?How to assess CVC financial performance relative to VC metrics? |

The Institute 2022 Benchmarking Initiative

In response, the Institute has developed and is launching the first benchmarking platform to offer current, broad and deep insights on CVC programme operating models and performance.

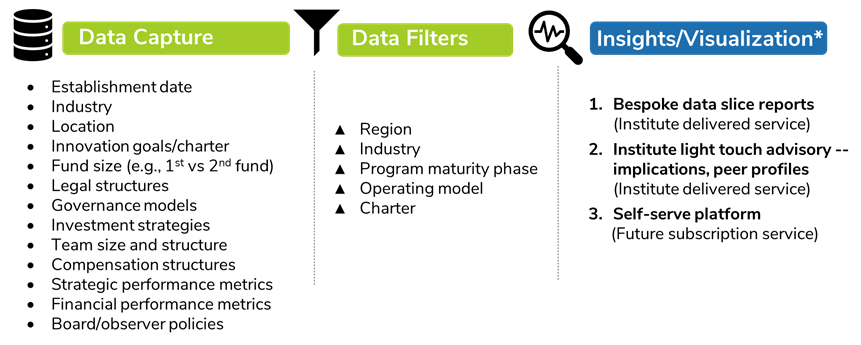

The Benchmarking platform will be designed to:

- Enable the capture and management of high-quality data

- Allow aggregate industry data to be filtered to reflect individual CVC programme context

- Deliver insights and data visualisation

The foundational anonymous aggregate industry data set will leverage the annual GCV industry survey with new data sets to be developed through ongoing drill down surveys and bespoke benchmarking projects driven by priority industry inquiries. Recent examples include topics such as CVC programme spinouts, portfolio financial accounting approaches and treatment of OPEX.

Building on the BMG case study framework in Corporate Venturing: A Survival Guide, the Institute is also developing a library of (public data) CVC programme demographic profiles that will highlight best practice peer examples, provide insights on the implications of benchmarking data, and serve as resources in Institute courses. (See profile for NGP Capital).

Sample Corporate Venture Programme Profile

| Programme Name | NGP Capital (formerly Nokia Growth Partners) |

| Date Established | 2005 |

| Parent HQ & CV Locations | Nokia (Finland) Bell Labs (North America) CV Programme Locations: North America (HQ – Palo Alto, CA), Europe, Asia |

| Programme Charter | The next technology era will be shaped by the digitisation of businesses and industries at an unprecedented scale. We back entrepreneurs and partner with corporates that make the world increasingly connected, secure and sustainable.

From post-product market fit and beyond, we actively support our companies globally. |

| Legal, Reporting Structure | LLC (spinoff): Independent VC fund structureReports to (Executive): CSTOInvestment Committee members: 4 – CSTO, CFO, Treasury, M&A |

| CV Programme Elements | Strategic minority equity investing (VC)Growth CapitalCVBD/partnerships |

| Team Size (28) | Investment (17)Partner (6): North America – 3, Europe – 2, Asia – 1Vice President (6): North America – 3, Europe – 2, Asia – 1Venture Partner (3): North America. Europe, AsiaSenior Associate, Analyst (2): AsiaPortfolio Development (1): Vice President in Europe Operations (8): CFO Finance & Administration (5): North America – 3, Europe – 1, Asia – 1Marketing (2): North America, AsiaData & Analytics (2): Europe |

| Focus Areas | Intelligent enterpriseSmart mobilityMobile technologies |

| Programme Scale | AUM: $1.2B +# Portfolio companies: 52Typical investment size: $8-12MCurrent average annual investments $: 100M<# Of investments/year: 10-12Board/observer seats? YesInvest globally at growth stage, committed to follow-ons37 exits: IPO – 9, M&A – 28% of portfolio engagement with parent – 50% |

| Sample Investments | Security Scorecard – cybersecurityPlatform 9 – edge cloudXiaomi – smartphone, IOT ecosystem |

| Awards | GCV Fund of the Year (2016)GCV Powerlist: Paul Asel, Bo Ilsoe |

2022 Benchmarking Services

Year 1 benchmarking offerings will be delivered ‘as a service’ so that the Institute can evaluate CVC community data needs and ‘wireframe’ the logic needed to deliver self-service data:

- Bespoke data slice reports = Generate custom reports that slice aggregate data to reflect individual programme characteristics

“We are proposing a new CVC programme and need to present industry benchmarks for starter fund size and operating model”

- Light touch advisory services = Add insights on the implications of bespoke data and highlight best practice peer examples (via library of Institute public profiles)

“We are thinking about spinning out our CVC programme and would like to know what approaches others have taken”

The Institute team is looking forward to an exciting year and to collaborating with the CVC community to drive our industry advancement mission!