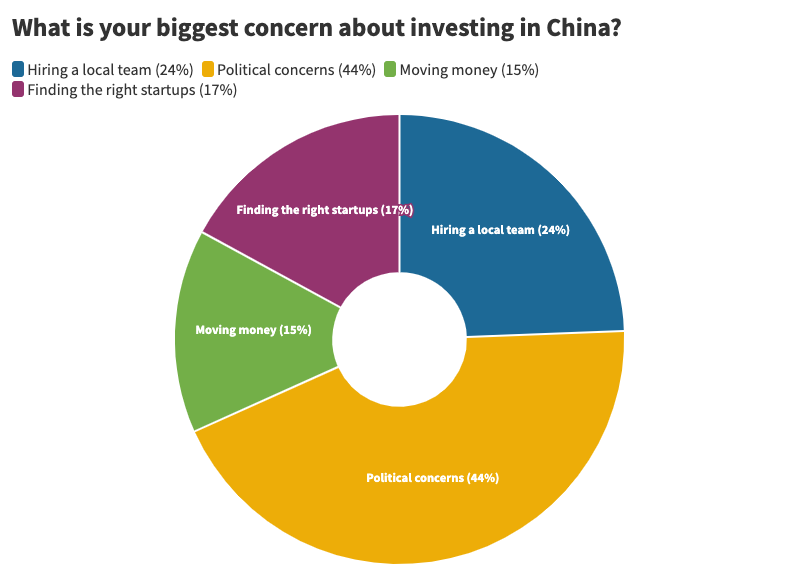

Some 44% of respondents said politics was their biggest worry about investing in China, followed by the difficulty of hiring a local team.

“None of these are the “biggest” concern — everything about doing investments in China is a concern.” This comment by one of the respondents to our recent poll on China sums up the attitude we’ve seen recently.

Corporate investors have become more hesitant about investing in China, with some companies telling us recently they are still keen to invest in Chinese startups — but not necessarily ones that are based in China. There are exceptions — Japanese beauty company Shiseido, for example, has increased the amount it is investing in China with its new $140m investment fund.

China’s territorial claims to neighbouring countries like Taiwan have been increasing geopolitical tensions with the West, and the trade war between the US and China, started by Donald Trump in 2018, has significantly decreased the amount of collaboration with western companies.

But corporate investors are unlikely to be able to detach from China any time soon, Min Zhou, partner at China-based CM Ventures, explains in this opinion piece. Despite the fact that initiatives like the US CHIPS Act and the Inflation Reduction Act are attempting to re-shore some manufacturing in the US, considerable parts of the supply chain are likely to remain in China for some time.

Only a very small minority of respondents told us they had no concerns about investing in China.

When we looked at specific concerns, 44% of respondents — if you took in both our LinkedIn poll and the one we ran in the newsletter — cited political concerns as their main worry about investing in China.

Another 24% were concerned about the difficulty of hiring a good local team. This was, in fact, the chief concern for people who responded to the poll we ran in the newsletter, while on LinkedIn it was the political concerns that came out top. [We’re planning to dive into a few of these topics in the next couple of weeks to see if there is advice or solutions to share. Watch this space.]

The challenge of finding the right startups among an avalanche of new tech possibilities was lower down the list. Good investors are usually fairly confident of their abilities to spot companies, and although China’s startup market is exceptionally noisy, most don’t seem daunted by this. The complexities of moving money in and out of China, meanwhile, featured fairly low on the list of concerns.

GCV runs poll questions about corporate investing practices and attitudes every Monday. If you’d like to suggest a poll question for us to ask, please get in touch with Maija Palmer at mpalmer@globalventuring.com.

Our short polls are only part of the data we regularly gather about the corporate venturing industry. Much more information is available on at the GCV Institute.

Maija Palmer

Maija Palmer is editor of Global Venturing and puts together the weekly email newsletter (sign up here for free).