Sabancı is building a multi-gigawatt renewables portfolio, and Sabancı Climate Ventures is helping find US and European start-up technologies to plug in.

In 2022 Turkish conglomerate Sabancı, already strong in renewable energy in its home market, set its eyes on a more ambitious goal — establishing a renewables footprint in the US. A corporate venture team — Sabancı Climate Ventures — was to be a crucial part of this push into a new market.

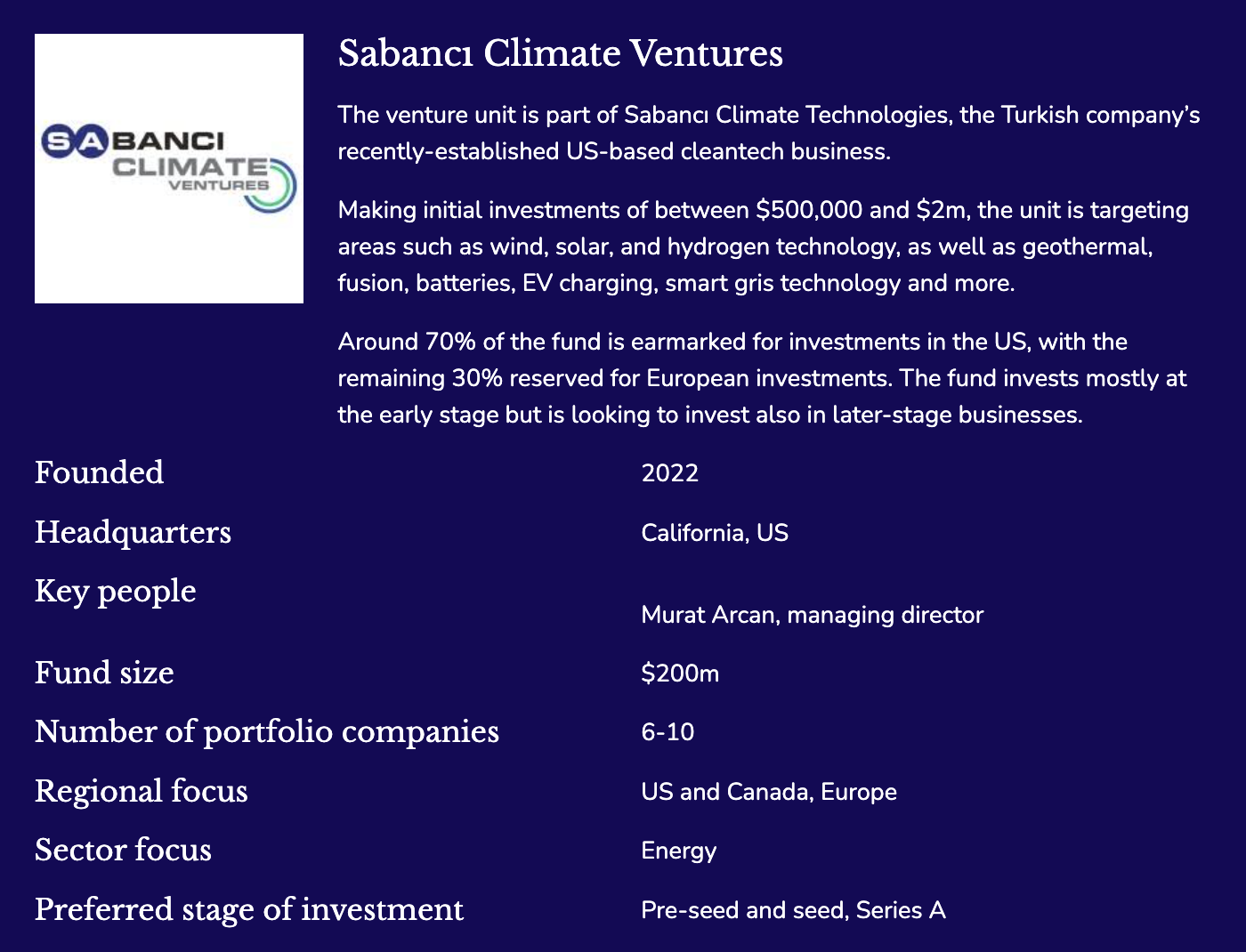

The venture unit is part of Sabancı Climate Technologies, the Turkish company’s recently-establised US-based cleantech business. In addition to the venturing arm this business also includes the Sabancı Renewables, which owns and operates the physical renewable energy projects.

This puts the venture team in uniquely strong access to renewable energy projects, opening doors to help portfolio companies test out technology and add value

“It’s our testbed pilot place,” says Murat Arcan, managing director of Sabancı Climate Ventures told the CVC Unplugged podcast.

Some 20% of the Sabancı Climate Technologies’ capital allocation is earmarked for the venture fund. Of that, around 70% is allocated for investment in US startups, while the remaining 30% is reserved for investments in Europe.

The US market allows for the faster development of larger projects relative to other markets where space is more scarce. Sabancı Renewables’ first solar project was the 272MW Cutlass II project in Texas, and has another 232MW solar project – called Oriana Solar – in the pipeline due for completion in Q2 next year.

“Our aim is to grow our renewable energy base to up to 3GW in the next five years. We’re currently probably going to be at 500MW by March next year, so we’re going to six-fold that in the next five years,” says Arcan.

The unit’s portfolio includes floating offshore wind technology developer Aikido, climate project monitoring software AiDash, fusion technology company Commonwealth Fusion Systems, geothermal technology company Quaise Energy, and compliance tracking platform PulsESG, among others.

These come alongside LP positions in other funds such as Safar Partners.

Starting with funds

Like many CVCs, Sabancı Climate Ventures started with an into another VC fund, Safar Partners. It’s a common route for new units who want to get a lay of the land or expand their networks. Subsequently, it was able to co-invest alongside that fund into two startups – focused respectively on fusion and geothermal energy technology.

How to get the most out of investing in other funds

Some 56% of corporate venture teams take LP positions in other funds. Here’s how to make the most of that relationship.

Teaming up with other funds meant that they could speed up their technical diligence on startups from the very beginning, without having to build up an internal capability right away.

“We started looking at things like, okay – this is a game in which, from a technology perspective, either we will need to create a good team to research and analyse all these technologies, or we work with the funds that do this and try to find the best fund managers. We chose option number two,” says Arcan.

“We understood that we’re not going to be a CVC which has 10 research analysts and 15 investors that is going to be huge, so we said the best thing that we could do here, with our current experience, is try to find out who are the best fund managers and get connected to the other funds.”

They’ve since invested in two other funds and are in the process of closing a third. They hope to bring additional value to those LP positions by potentially co-investing in underlying startups as well, helping them expand into other geographies.

The team is currently a two-person operation, with one in California and one in Boston. By the end of the year, they want to get another two people in, followed by another two next year, spreading them geographically between the US and Europe.

A switch to evergreen?

Sabancı Climate Ventures is currently set up as a regular 10-year fund capitalised to the tune of $200m. Arcan says it may well turn into an open-ended or evergreen fund in the future, given that it invests in very nascent technologies which may take longer than a decade to mature.

“If it turns to an evergreen fund, that will not be a surprise to me, but has the decision been taken by the board of directors? No, it has not,” he says.

Most of the initial investments have been in earlier stage companies – pre-seed through series A. However, it is also looking for the later stage, more de-risked series Bs and Cs, where its parent company can bring more value and help embed them into operational renewables assets.

Making initial investments of between $500,000 and $2m, the unit is targeting areas such as wind, solar, and hydrogen technology, as well as geothermal, fusion, batteries, EV charging, smart gris technology and more.

“Our presence in the United States, we believe, is going to help us get us closer to our vision, which is to connect the emerging world to developed world,” says Arcan.

Want to see the details of more than 500 CVC units?

GCV subscribers can get access to our full CVC directory, with details of corporate venturing unit details including investment focus, key people, fund size and more.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.