Despite uncertainty in the wider economy, April has seen the most corporate-backed startup funding rounds in more than two years.

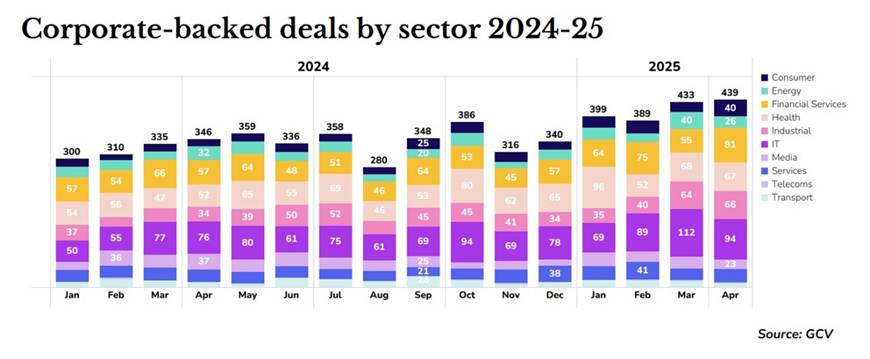

Corporate venturing continues its steady upward climb as we move into Q2, even as macroeconomic uncertainty makes investors nervous. April 2025 saw the highest number of corporate-backed funding rounds for startups in a month since 2022, following a standout Q1 2025. This exceeds March, which was also a two-year high.

This has been driven by strong performances in the financial, industrial and – unusually – consumer sectors, with their gains offsetting falls in the energy and IT sectors.

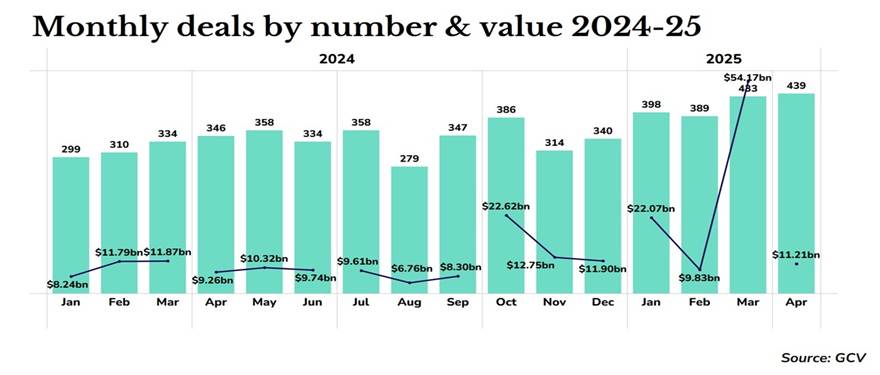

Deal values have fallen over recent months

The total dollar value of deals where the amount was disclosed was up by nearly $2bn from April 2024.

However, compared to recent months, the average value of deals below $1bn has fallen to $28.5m, compared to $34m in March and $36.1m in February. Because not all deal values are disclosed, this figure is only a rough indication, but it suggests the higher dealmaking volume is not being met with increased capital.

April’s largest round: safe AI

It says something about the enthusiasm for large AI startup funding rounds recently that April was a comparatively quiet month, even with one standout raise. Safe Superintelligence (SSI), an AI company that has the stated aim of developing what it calls superintelligence while emphasising safety, raised $2bn in a round led by VC firm Greenoaks.

Its co-founder Ilya Sutskever previously worked at OpenAI, where he was a board member. SSI has not publicly announced a product or shown any indication of revenue, and reports have suggested that much of the investment was secured on Sutskever’s reputation. The startup’s name could be read as a rebuke to OpenAI, which Sutskever left following a disagreement with CEO Sam Altman, with Sutskever feeling Altman had failed to prioritise safety.

Nvidia and Alphabet took part in the funding round. SSI has partnered with Alphabet’s Google Cloud division to use Google’s TPU, or Tensor processing unit, chips in its work.

China’s rising number of startup rounds

China has been seeing a rise in CVC deals over the past few months, with 55 corporate-backed startup funding rounds recorded in the past month. More than half of the Chinese funding rounds were across only three sub-sectors: robotics and UAVs (12), medical devices (9) and AI (8).

In the robotics category, many of the Chinese investments are into companies making humanoid robot technology, including PaXini Tech, which received a $13.8m investment from electric carmaker BYD. The startup’s sensing technology means the robots can be positioned to be used in manufacturing. Similarly, Zhipu, a Chinese AI company, invested in Dong Yi Technology, another humanoid robot developer.

This is part of a global trend seen across CVC units, as corporates, particularly in the automotive industry, move to invest in humanoid robotics. Nevertheless, in April, China was by far the most prolific investor.

The two largest robotics rounds were for US startups. These were the $137m raise for Aiper, maker of cordless robots for pool cleaning, which was backed by pool servicing tech company Fluidra, and Brinc, an emergency response drone manufacturer, which Motorola solutions invested in.

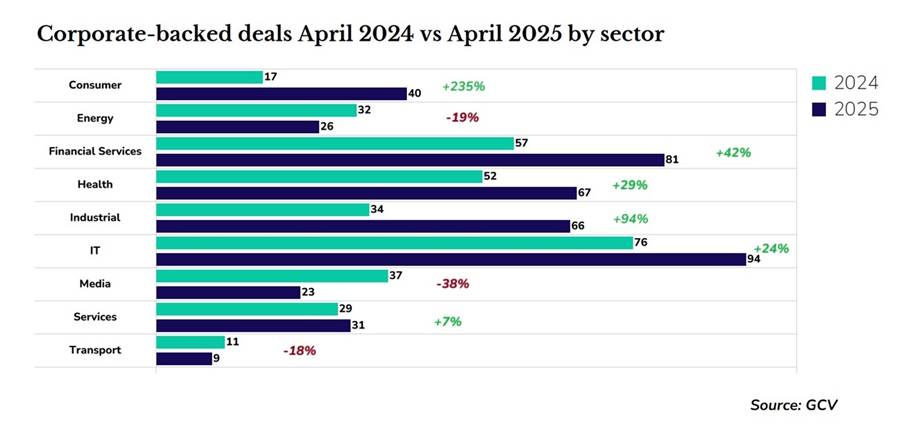

Sectors year-on-year

Comparing the level of investment in April 2025 against April 2024 across sectors reveals some significant changes.

Consumer startups are surprisingly strong

The most striking is the 235% jump in consumer startup investments, which is often an overlooked area. A quarter of the 40 investments last month were for Indian startups.

The largest raise among the Indian companies, where funding was disclosed, was for the skincare brand Foxtale, which makes cosmetics designed for skin types common in India. It raised $30m in a series C round, which the Japanese cosmetics company Kose Corporation took part in.

Anveshan, an Indian direct-to-consumer health food brand, raised $3.5m from backers including Wipro, a tech company.

Financial management startups are popular

With 81 deals recorded, April saw the most corporate-backed funding round for financial startups than any month since 2022, with a 41% increase on April 2024.

A large proportion of this rise has been concentrated in financial management startups, including those for personal and corporate finance.

Altruist, a US company providing a digital custodian platform designed for investment advisors, where they can open client accounts and trade securities, raised $152m in a round led by a Singapore sovereign wealth fund GIC. Salesforce took part through its CVC unit Salesforce Ventures, along with investment firm Baillie Gifford.

Mexico’s Clara, maker of an enterprise spending management platform, raised $80m in a round, which included a $40m equity investment led by Citi Ventures and Kaszek Ventures, as well as a separate $40m non-dilutive investment from General Catalyst’s Customer Value Fund.

Losing energy

In March, there were 40 deals for energy startups – more than there had been in a single month for over a year. In April, however, the number had fallen to a more modest 26 deals. This number represents a 19% fall from April last year. So what has happened?

Looking at the data, it is the US that accounts for the boost in March and the subsequent drop-off. 20 (50%) of the March deals were in US startups, but in April only seven were (27%). Europe, by contrast, has held steady with 11 deals in March and 10 in April.

Investors in the energy sector have been infected with uncertainty since the Trump administration took office in January. Trump’s rhetoric has placed a question mark over the grant funding that would be available under the Inflation Reduction Act (IRA) to support investments. Confidence in renewables and climate tech investment has been hit, as the administration is widely perceived as being pro oil and gas. With only three US renewable energy startup investments in April, this is the lowest monthly total in the year so far.

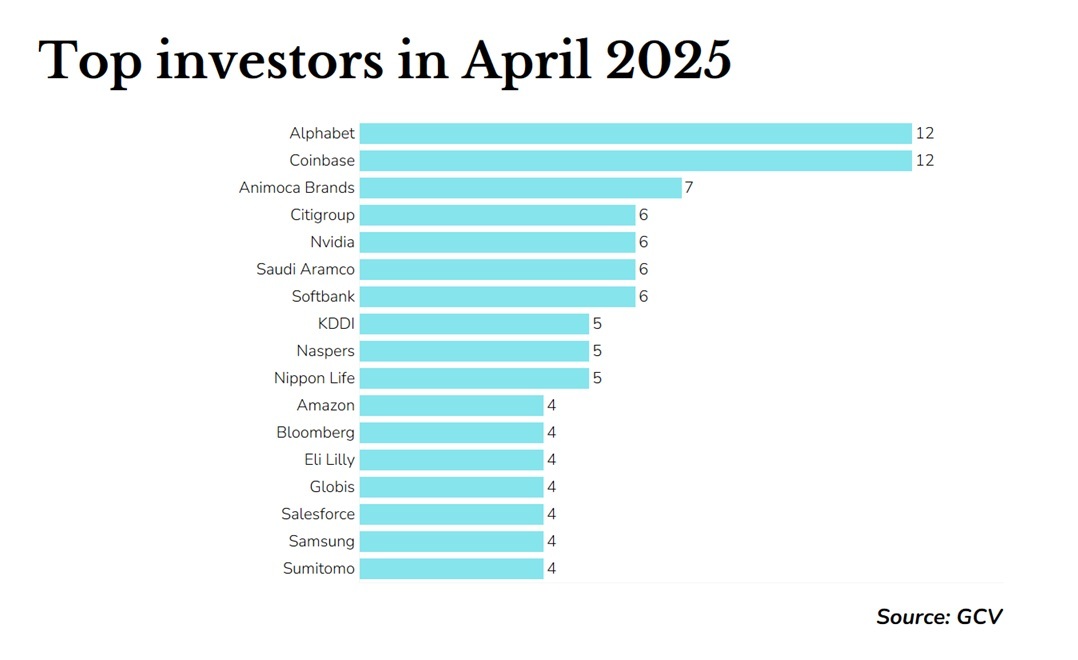

Alphabet shares top investor spot

It hasn’t quite been dethroned, but it is at least noteworthy that Google’s parent company, which is almost always the most prolific investor in a given month, is now only joint-first.

Crypto exchange Coinbase, which invests in blockchain and Web3 technology, has matched it with 12 investments in April. Some of these include its participation in the $30m funding round for Recall, a US startup making a decentralised AI agent testing platform. It also invested in Codex, which makes blockchain infrastructure for stablecoin transactions.

Most of the Alphabet investments were in tech startups. Beyond the $2bn SSI raise mentioned above, it also backed SandboxAQ, a company that began within Alphabet and then spun out. SandboxAQ is using a combination of AI and quantum technology to develop commercial products for a range of sectors, including healthcare and cybersecurity. It has partnered with the chipmaker Nvidia, which also took part in the $450m funding round.