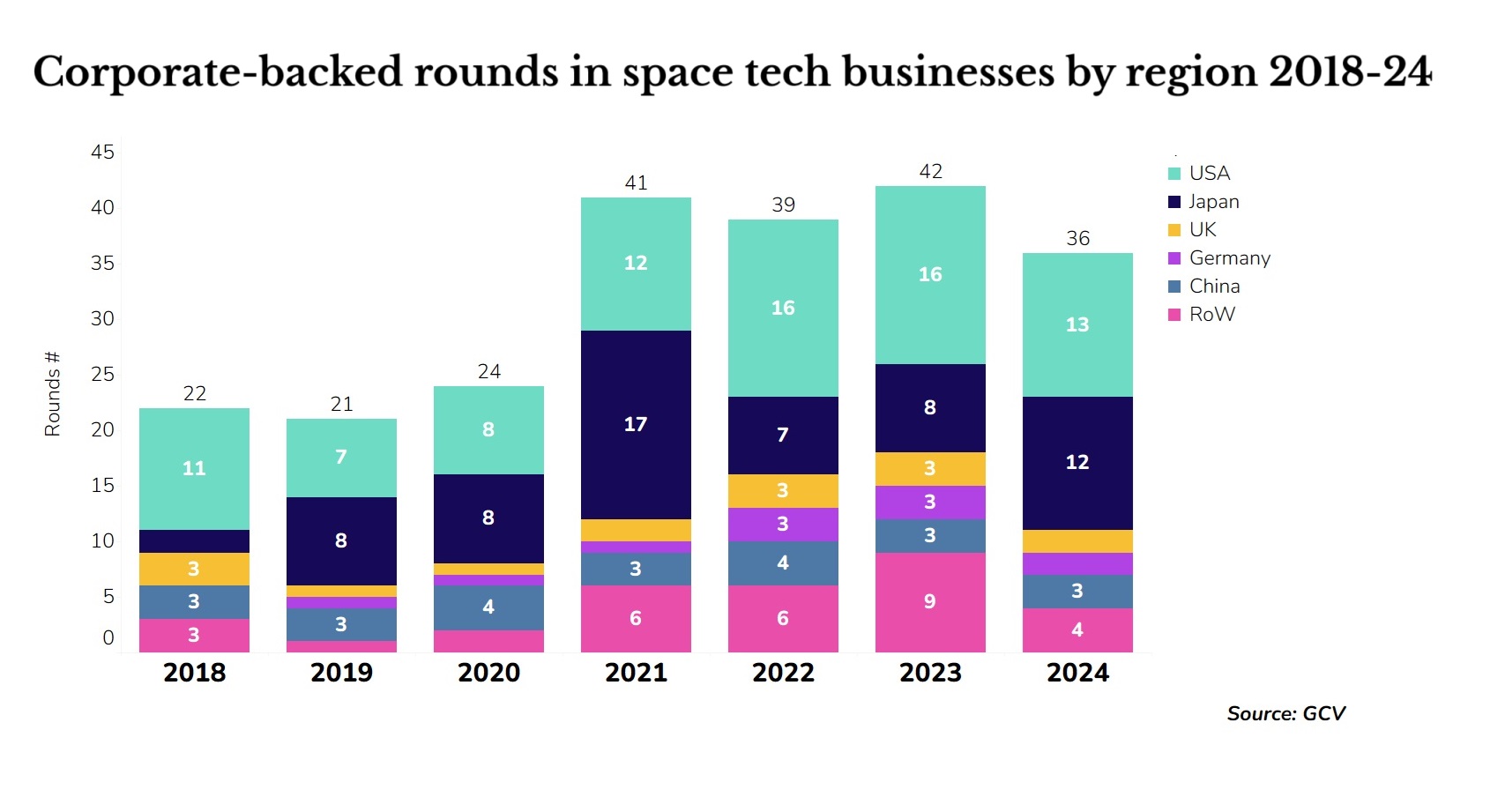

Japan is second only to the US when it comes to spacetech startups raising funding from the corporate sector.

Many of the biggest headlines about space technologies are still captured by US companies, from the recent launch of NASA’s Europa Clipper spacecraft to the the chopstick manoeuvre performed by SpaceX’s Starship during its test flight.

But a rising power in the new space industry is Japan, at least judging by the number of spacetech startups in the country that are receiving backing from corporate investors.

Japan, more than any other country, that has been neck and neck with the US when it comes to spacetech startups raising funding from the corporate sector.

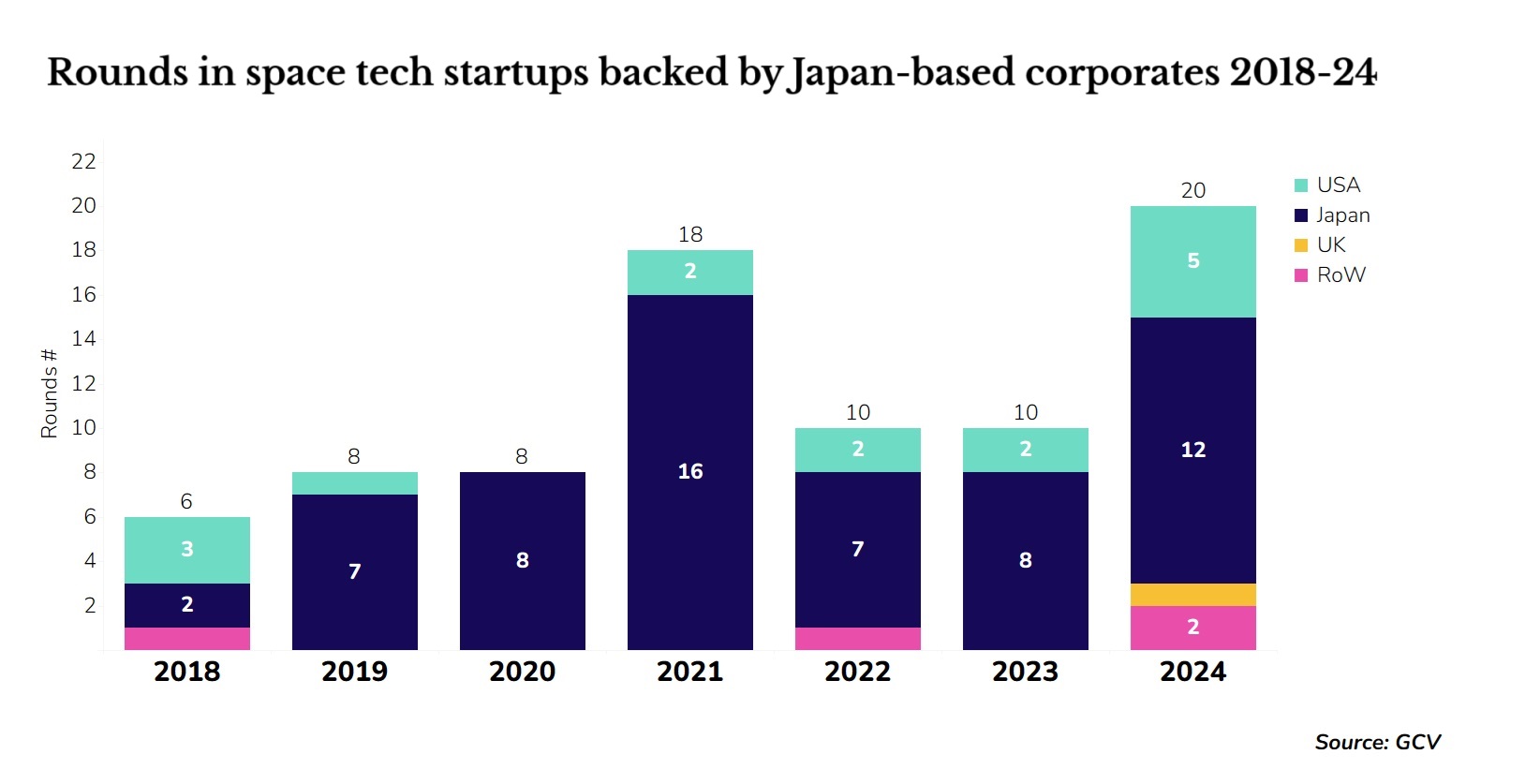

Japanese corporations have become increasingly willing over the past few years to invest in emerging spacetech companies. Companies including financial services company SBI, camera maker Nikon and logistics firm Yamato have all raised funds recently with spacetech mentioned as one of the target areas.

This year has been a record, with Japanese businesses helping bankroll at least 20 spacetech startups.

A large proportion of the startups these corporates back are Japanese. Some example of domestic spacetech support include:

● Toyoda Gosei, the automotive parts maker, invested alongside Nomura SPARX, Jafco and Mizuho Capital in a ¥7bn ($44.2m) series C round for satellite data tech developer Synspective, led by Japan Growth Capital Investment Corporation. The fundraising reportedly put the startup’s pre-money valuation at ¥37.33bn ($236m). Synspective’s technology provides various satellite services such as remote sensing and imagery using small synthetic-aperture radar (SAR) satellites that can measure human activity over a wide area on Earth, irrespective of time or weather.

● NTT Docomo Ventures, the investment arm of the telecoms company, and SBI Investment the investment arm of the Japanese financial services company SBI Group, took part in the ¥3.1bn ($21.4m) series E round for satellite company Interstellar Technologies. Japan’s Resona Bank also participated in the transaction. Interstellar offers vertically integrated rocket and satellite development, providing low-cost spaceflights and comprehensive space solutions.

● Japanese propulsion system developer Pale Blue raised ¥1.5bn in a series B venture round that included conglomerate Itochu, San-in Godo Bank and Yamato Holdings. Pale Blue develops propulsion systems for small satellites. The systems are water-based and do not employ harmful chemical compounds such as hydrazine. The company claims these systems not only enable launching microsatellites but also manoeuvring them once in orbit.

● Japanese space services provider Elevation Space raised ¥1.4bn ($8.8m) in a series A venture funding round, led by Beyond Next Ventures and featuring Japanese insurer Nippon Life and Sendai Bank. Elevation Space runs a small space utilisation and recovery platform to help space experiments. The company’s platform allows scientific research in a micro-gravity environment and manufactures small artificial satellites that can bring deliverables back to Earth.

But Japanese corporates have also invested in spacetech deals beyond the borders of their country.

● An example is the €150m series C round raised by Italian space logistics provider D-Orbit at the end of September this year. The round was co-led by Japanese conglomerate Marubeni alongside Iberis Capital, United Ventures and the European Investment Bank. The funds will be used to develop space-based cloud computing and in-orbit servicing systems. D-Orbit provides space logistics, engaging in last-mile delivery of satellites, orbital transportation and space waste management.

● But this was not the only high-ticket round involving Japanese corporate investors. As of June this year, Airbus Space was reportedly in talks to sell its stake in the UK-based Aalto Haps to Haps Japan, Mizuho Bank and Development Bank of Japan for $100m, according to PitchBook. The company is developing AALTO Zephyr, a fixed-wing, zero-emission high altitude platform station (HAPS) that would float in the Earth’s stratosphere (11 to 14 miles in altitude), providing earth observation and connectivity services.

● US-based satellite operator Xona Space Systems raised $19m series A round, which included Japanese electronics component manufacturer Murata, along with other corporates like Nokia. The company runs a constellation of low-cost, low-earth orbiting satellites to offer higher availability and location precision, enabling navigation for autonomous vehicles, unmanned aerial vehicles, mobile robotics and others.

● Spain-based satellite company Fossa Systems raised a €6.3m series A round, featuring Nabtesco Ventures, the venturing arm of Japanese engineering company Nabtesco. Fossa is developing picosatellites for low earth orbit services. Picosatellites are artificial satellites with a wet mass of up to just one kilogram. The company had been previously backed by the venture capital arm of Spanish bank Sabadell.

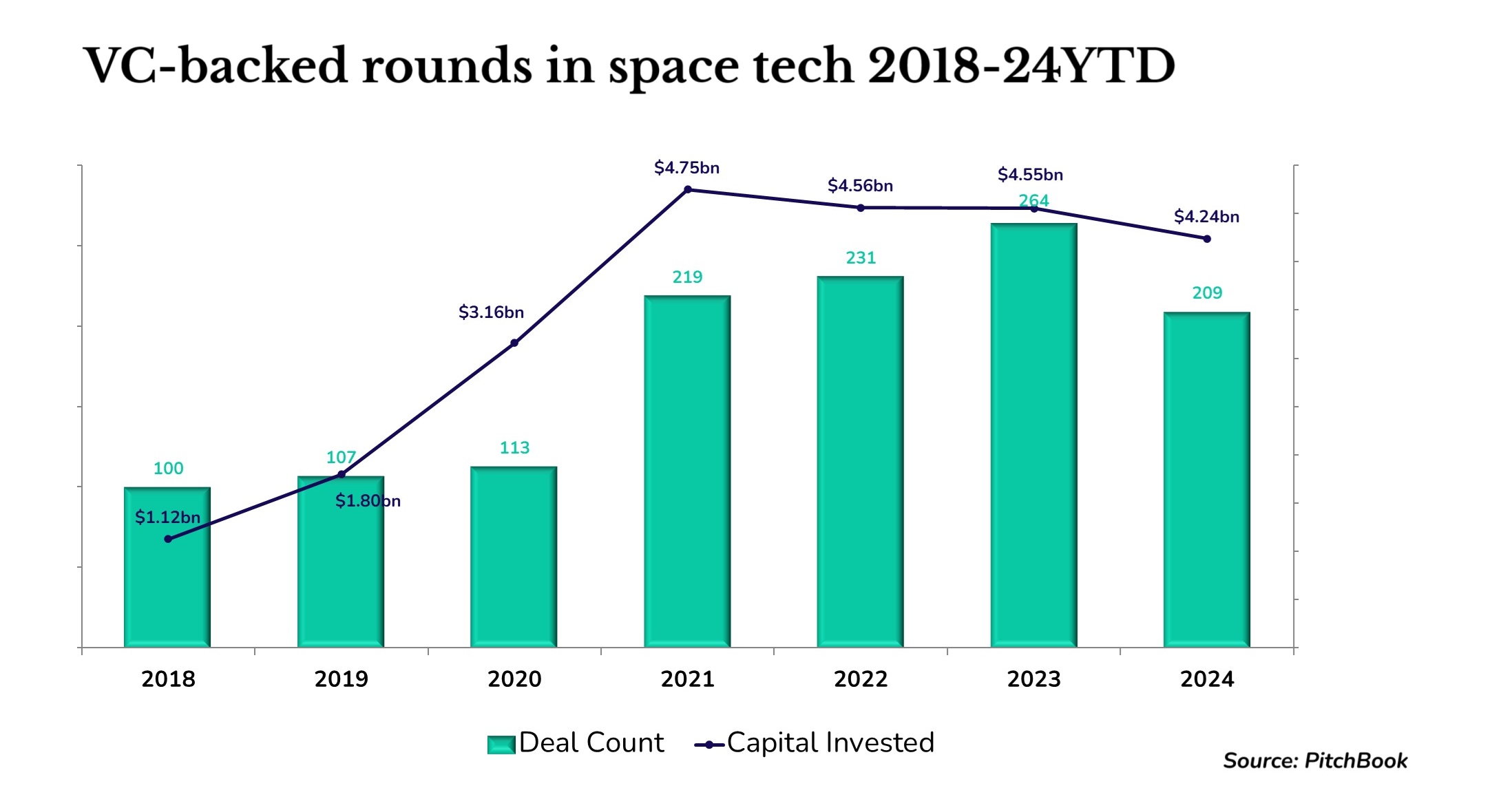

Venture capital interest in spacetech has, in general, been rising. The total number of VC-backed rounds in spacetech worldwide grew to 264 by the end of 2023 from 219 in 2021. The total estimated dollar figure raised in these rounds, according to PitchBook, has been above $4.5bn since 2021.