The corporate-backed startup informs more 100,000 farmers in Latin America about precise soil and climate conditions to optimise planting.

Can software and sensors help farmers to precison-plan their crops in such a way that they use 60% less water and 20% less energy?

That is what Agrosmart, a Brazil-based digital farming startup, claims it can do, increasing the efficiency and sustainability of various crops, from grains to sugar cane.

“Our product helps to support over 100,000 farmers in the Latin American region to adopt climate smart agricultural practices, whilst pushing for the sector to become more resilient against all the economic and social setbacks the industry has had,” says co-founder and chief executive Mariana Vasconcelos.

The startup’s technology relies on soil sensors that are implanted into the ground, as well as drones and satellite images that collect information on the soil type and microclimate of each field. This harvested data is then placed into AgroSmart’s algorithm, providing recommendations to farmers through every step of the planting chain including seed placement and sustainable practice guidance.

“By leveraging climate solutions and mitigating financial risks through helping food systems, we have created a truly unique sense of community amongst our farmers, uniting our community. We are the largest agronomic user based platform outside of India and developed a huge data set for the climate that can be used not only to benefit sustainable practices in agriculture but also in other industries,” says Vasconcelos, speaking to GVC at the sidelines of the GCVI Summit in Monterey.

In addition to working with farmers, Agrosmart has created another digital platform that helps corporations benchmark and track the sustainability of their supply chain. Corporations such as Cargill and Coca-Cola have become customers of Agrosmart to monitor their farms and products.

Vasconcelos co-founded Agrosmart in 2014, following six years as a global ambassador and advisory board member at the food startup incubator Thought for Food. She also worked for nearly two years as a columnist at the Brazil-based climate-focused magazine Um Só Planeta.

Responding to the crises of the future

Agriculture generates between 19 and 29% of total greenhouse gas emissions, according to the World Bank, making it the second largest contributor to global emissions after the energy sector. Vasconcelos says the industry must transform to avert an international crisis.

“We have a major challenge in our midst,” says Vasconcelos, “And that is stopping climate change. Agriculture is responsible for a vast amount of emissions, and in the future, the sector needs to capture at least 40% of these emissions to help support climate efforts.”

She says there is also a need to increase food production 70% by 2050 to feed the ever-growing population, which today’s systems cannot achieve, especially with the number of food and water shortages.

According to Action Against Hunger, 43 million people in 38 countries globally are at risk of falling into famine or a severe hunger crisis, with rising temperatures, droughts and floods attributed to climate change being the main contributor.

Vasconcelos believes that Agrosmart’s technology can help farmers redesign their practices to respond to emerging climate and population issues.

“Farmers are finding it more tricky to adapt to growing social issues around food accessibility and climate change. But Agrosmart’s platform helps support these workers by mitigating the risks of greenhouse gas emissions whilst also helping food production systems as a whole become more resilient,” says Vasconcelos.

Lack of investment in agriculture

Since its launch, Agrosmart has raised around $9m in funding, most recently a $5.8m series A round in 2019. The round was co-led by the venture capital firm E3 Negóciosm, as well as Inovabra Ventures, the corporate venture fund of Brazilian financial services company Banco Bradesco.

Part of the funding goes towards building a financial product into its platform.

“We are also looking to embed finance into our platform, where we plan to bring in credit to support the transition for both farmers and corporate levels. By using our climate database, we can price better and stimulate financial instruments,” says Vasconcelos.

She says that it is still challenging to find investors willing to back agtech companies. “AgTech is quite a niche sector so there are not many funds or individuals who are willing to put in money,” she says.

“The agricultural sector is in almost a liminal stage at the moment. It is trying to transition between the old school practices and the adoption of new technologies and innovation. This transition takes a long time, which may dissuade investors from such products.”

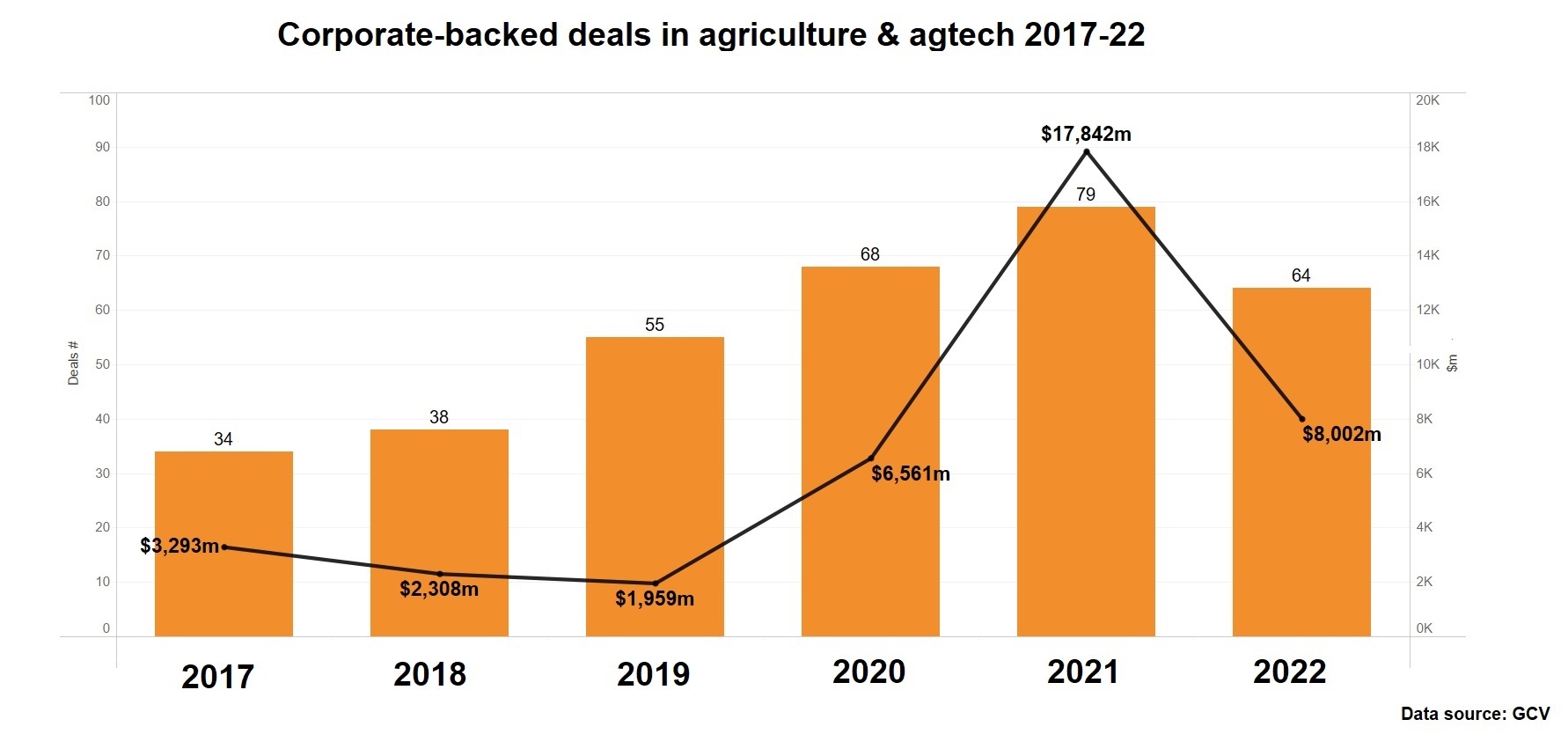

GCV has also reported a recent decline in the number of corporate backed deals in the agtech sector. The year 2021 saw $17.8bn of capital invested into these startups, whereas 2022 saw that figure decrease to $8bn.

But Vasconcelos says that startups like Agrosmart that also focus on climate initiatives are able to get funding more easily.

“Agrosmart deals with climate issues, and this factor has allowed us to garner more attention,” says Vasconcelos “Climate, as we know, is a growing issue, so startups relating to the carbon energy transition are growing, which further represents an opportunity to bring capital from climate-related issues through the lens of agriculture.”

Strong corporate ties

Agrosmart’s management team consists of four individuals: Thales Nicoleti, hardware director and co-founder; Raphael Pizzi, head of products and co-founder; Matheus Marques, hardware engineer; and Vasconcelos.

The team has attracted notable investors aside from Banco Bradesco, including Positivo Tecnologia Venture Capital, the corporate venture arm of the Brazil-based computing company Positivo Technologia.

Vasconcelos discusses Agrosmart’s positive relationship with corporate investors and the need to have specific companies investing. “It was key to get a hardware manufacturer like Positivo on board since we have a hardware device, our soil sensors, that collects data. So, it was key to have someone to scale this product, who also understood the global supply chain, and who had stations throughout Latin America.”

She says that Brandesco Bank was also important in allowing the company to test its thesis around credit distribution and competitive interest rates based on the climate data it has collected.

“I think both investors have not only provided necessary capital but have created a form of synergy within the company,” says Vasconcelos, “It takes a lot of work to do business with corporations and it can be hard to make something happen, but when there is an equity investment it is easier to align interests and keep pushing forward until it works.”

Positivo Tecnologia Venture Capital so far has invested in two startups: Hilab, the Brazil-based remote patient diagnostic and monitoring platform which has raised $27.8m, and Agrosmart.

Founded in 2017, Inovabra Ventures invests in the IT and financial sectors. It has 19 companies in its portfolio. Two have had exits, including Semantix, an integrated data platform that was merged with Alpha Capital and listed on NASDAQ in 2022.

“Despite the challenges that come with seeking corporate investors, the great commercial partnerships and capital gathered at the end are vital in helping future operations and propelling a startups success,” says Vasconcelos.

She hopes that her startup will showcase the potential of the Latin American region. “I want to raise a spotlight on Latin America. The solutions towards the climate crisis, I believe, will be found in the global south, but there are very few VCs willing to invest in the region.”