Personalised treatment, combination therapies, vaccines and of course AI: pharmaceutical investors are backing a surge of new cancer technologies.

Two of the biggest acquisitions in healthcare in the past year were cancer drug developers RayzeBio and Fusion Pharmaceuticals being snapped up for a combined $6.5bn. Both are focused on radiotherapy, a century-old area of cancer treatment, to which these young companies are now bringing new techniques.

And radiotherapy is just one of many areas of oncology where new technologies and therapies are emerging, bringing hope and options for cancer patients.

“What’s old is now new,” says Rakhshita Dhar, Leaps by Bayer’s senior director of venture investments in health.

“The antibody-drug conjugate (ADC) and radioligand therapy spaces have both gained so much momentum in the last three or four years, where they are suddenly the hottest areas in oncology, both from a private and public investment standpoint and also what’s being delivered to patients.”

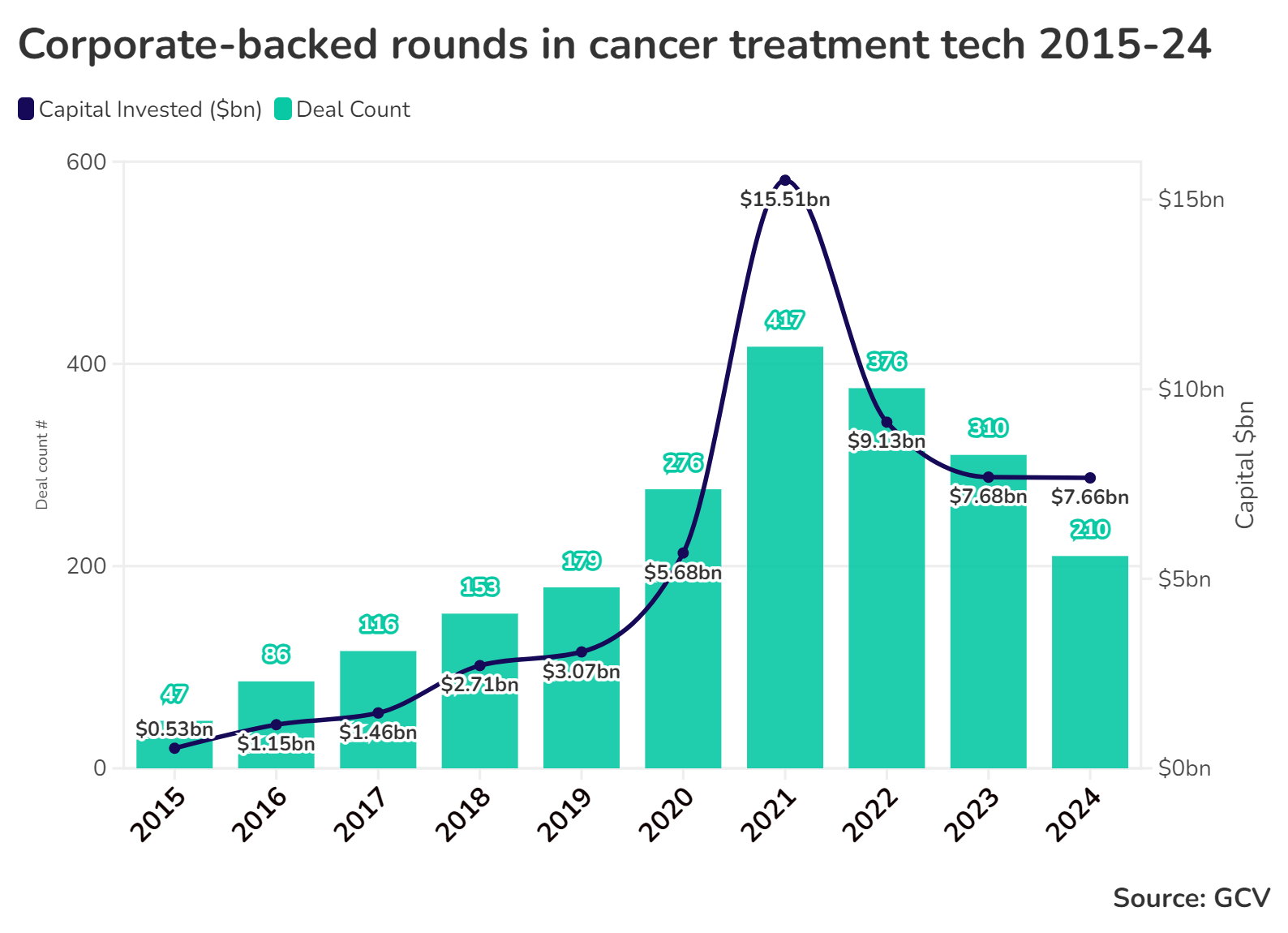

Investors have been increasing their spending on cancer treatment technologies. While funding in this sector is still below the peak period it reached during the covid era, it remains comfortably above pre-pandemic levels. If funding rates hold steady this year, the amount raised in corporate rounds will be the highest since 2021.

The advances creating excitement in oncology include genetics technologies that make it easier to create precision treatments and immunology breakthroughs that are informing the creation of cancer vaccines. Artificial intelligence is being used to enhance diagnostics and drug development, while combining several of these elements is leading to several pharmaceutical areas being rejuvenated.

There can be no silver bullet ‘cure’ for cancer, which is a blanket term for a wide range of different diseases. But some of the most influential investors in oncology say things are moving forward now on many different fronts.

Treatments are becoming more personalised

“I think the biggest advancement in developing cancer therapies is truly understanding the right patient population,” says Dhar (below).

Because cancer comes in so many forms, finding a drug that works for every patient is incredibly difficult, but advances in genetics mean it is possible to work out which parts of the population certain drugs will work on before they’re even approved.

“We now understand certain genetic or biological markers that are present in certain tumours and types of cancer in certain patient populations,” Dhar adds. “There is so much patient heterogeneity, even in those markers. You and I could be positive for the same mutation, but you might be a high responder while I’m a low responder.”

More precise targeting means it is possible to develop drugs that work with the genetic marker associated with a particular type of cancer. One of Leaps’ largest investments in the past 18 months was to co-lead a $100m round for Boundless Bio, a precision oncology startup targeting cancers with a particular genetic abnormality known as oncogene amplification.

Being able to target patients precisely also means clinical trials can be more precise, making them more affordable for startups develop therapeutics, says Hakan Goker, managing director of pharmaceutical firm Merck Group’s M Ventures unit.

“The big breakthrough we expect is in spatial biology, which is the comparatively new science of looking at where and how various cells sit in the tissue, which molecules are there, and where they are located exactly, and how are they all interacting with each other in the tissue itself rather than out in a test tube,” Goker says.

Last month, M Ventures invested in PictorLabs, an existing portfolio company developing AI software that can enhance the histological staining technique used to examine tissue in cancer research. Goker says there has been “significant movement” in spatial biology as a whole in the past two years.

“These technologies have the potential to significantly impact approaches in diagnostics which in turn links to the therapeutic side – being able to identify biomarkers you can use for more accurate patient selection, first in the trials, so you can have an acceptably sized clinical trials at an acceptable cost, which is highly relevant for small companies. And then for treatment response and patient follow-up once your product hits the market.”

New techniques are rejuvenating existing approaches

Another cancer treatment area that is seeing a lot of activity right now is radiotherapeutics, a move forward from radiation therapy which been used for over a century but which leads to an array of side effects including nausea, hair loss and fatigue.

Radiotherapeutics are a type of medicine that avoids those by using a targeting compound called a ligand to deliver the radiation directly to the cancerous cells. While Bayer and Novartis are both actively exploring the space, it’s also been ripe for startups. RayzeBio was acquired by Bristol Myers Squibb earlier this year for $4.1bn while AstraZeneca bought Fusion Pharmaceuticals in June for $2bn, but many other startups are also emerging.

“I would put radiopharmaceuticals and radioligand therapies at the top of the list,” says Manu Nair (right), head of corporate development for healthcare provider Mayo Clinic. “There was a time when radiopharmaceuticals and radiation treatment was hot, but then its attractiveness was reduced for some time.”

Mayo Clinic itself is actively exploring the area through Nucleus RadioPharma, a startup it launched two years ago with venture firm Eclipse. Nucleu RadioPharma is working on technology that can modernise the development and production of radiopharmaceuticals. It closed a $56m series A just a year later.

“In the last four or five years, some really good modalities of treatments have come through, a lot of drugs have been developed,” Nair says. “You can clearly image the distribution of the drug and manage the toxicity, and these are being developed by multiple companies – there is a lot of investment going in.”

Another highly cited area is antibody-drug conjugates (ADCs), which combine a cancer drug with an antibody that target cancerous cells, in theory meaning you can then kill those cells without harming the surrounding healthy cells.

ADCs have been around for well over 20 years, but their use in new cancer treatments has taken off in recent years. Both ADCs and radiotherapeutics are examples of areas where excitement had cooled due to a lack of initial progress, only to be rejuvenated when new datasets revealed their potential to be used on a different target.

Dhar points to ADC developers Seagen, which was acquired by Pfizer for $43bn last year, and ImmunoGen, bought by AbbVie for $10bn not long afterwards, as companies that did not get great results at first, but which ended up still being valuable.

“People kind of lost hope in whether this was actually going to make it, but then you wait until the right dataset comes along and while some companies obviously fell into the cracks, some were able to stick around and make it work.”

Combining therapeutics to attack in multiple directions

“Combination therapies will always be important,” Nair says. “Because cancer is a very smart beast. It evolves.”

The idea behind combination therapies is similar to ADCs – you use two drugs in tandem, often targeting different genetic pathways, with the second drug either amplifying the effectiveness of the first one or reducing its side effects.

“That is really something a lot of people are thinking about and it’s being done in practice,” says Anne Horgan (left), a partner focusing on life sciences for Cambridge Innovation Capital (CIC), a venture firm with close ties to the University of Cambridge, home to one of Europe’s top oncology research centres.

“A lot of clinical trials we see are combining different elements – it might be two antibodies, an antibody and a small molecule, but the idea of combining is that you hit particular cancer cells in different ways…which means they won’t be able to get over that therapeutic challenge and they cannot survive.”

Take Carrick Therapeutics, for example, a CIC portfolio company that has raised over $150m from investors also including Evotec, Pfizer and GV. It kicked off a clinical trial for breast cancer in February combining an immunotherapy called samuraciclib with an estrogen receptor degrader being jointly developed by Pfizer. One element is responsible for killing cancer cells, the other helps overcome resistance to the drug.

The problem is finding which two elements will work together, and that’s where artificial intelligence can help.

“There is still a long way to go with combination therapies,” Horgan says. “We’ve only just scratched the surface.

“And that’s where having a way of mining the huge amount of information that’s out there and trying to see some trends or some signal – which is very hard to do for a human being – may end up yielding some very interesting combinations once you apply AI and machine learning to those datasets.”

Artificial intelligence is going to make a difference in several places

Help on drug combinations is not the only part of oncology where AI has potential. It can potentially model the exact way a potential drug works in the body.

“That’s the spatial biology part,” Goker (right) says. “Once you get the drug, how are the cells moving in the tissue? Are they going this way or that way? Are they coming close to some other immune regulatory cell and so on? Those are all bits of information that AI will be able to process a lot faster than having thousands of people, which pharma also doesn’t have.”

Then, there’s the diagnosis stage. While AI isn’t expected to replace trained oncologists, the technology might be able to help them detect cancer. That’s an area being explored by startups like Paige, which closed a $125m series C round three years ago for its computational pathology system.

“One of the places you’ll see a lot of activity is digital pathology,” says Nair. “Places like Mayo Clinic are digitising pathology slides and what will happen is that you’ll have AI models.

“Pathologists can create an AI model trained on pathology images to detect specific cancers. Then, a pathologist using that AI can see significantly more efficiencies in catching those cancers early, and with more accuracy, than otherwise. That is an area where you’ll see significant developments in the future. There are companies working closely with pharma companies on doing exactly that, so the AI becomes a companion diagnostic in the future.”

Cancer vaccines could be closer than we think

“In my mind, in 10 years we will have some cancer vaccines that hopefully work well for some particular cancers,” says Horgan. “We’re very excited about the area.”

Scientists have been working on cancer vaccines for a long time, but it’s been almost 15 years since one got regulatory approval in the US. These vaccines rely on using messenger RNA to trigger the body’s immune system to fight cancer, which sounds straightforward, but the devil is in the details.

A vaccine needs to identify and target an epitope, a specific element on the surface of the tumorous cell that will produce an immune response. But how do you know which epitope to go for, and how many do you need to target so you cover as many patients as possible with an off-the-shelf vaccine? Or, if you’ve created a personalised vaccine programme, how fast can you turn the biopsy results into an accurate vaccine?

“In 10 years we will have some cancer vaccines that hopefully work well for some particular cancers.”

Anne Horgan, Cambridge Innovation Capital

M Ventures’ portfolio includes Theolytics, which is working on oncolytic virus technology that can trigger the immune system to destroy cancer cells. Their technology has been created to prime the immune system so that it responds in the right way for longer than past attempts at vaccines, Goker says, and the company just closed a $24.5m round as it prepares to move an ovarian cancer product into clinical trials.

“Those technologies have significantly advanced,” says Goker. “Last year, we invested in a cancer vaccine company called Nouscom, and they’re now awaiting the readout of their phase 2 trial for an off-the-shelf vaccine utilising multiple epitopes. Then, their second programme is a platform around personalised vaccines that makes the process a lot faster through the technologies they use.”

But hold on, some cancers are a lot harder than others

Even as new therapies come on board, however, cancer cases are increasing, particularly in some of the more widespread types like breast and prostate cancer – the biggest killers for women and men respectively – as well as lung cancer. That may be in part of do with an increase in public information and early screening facilities.

There has also been far more progress in ‘liquid’ cancers like leukaemia and lymphoma, which can be effectively treated with immunotherapies, than with solid tumours.

In order to treat solid tumours, you need to deliver a drug that goes into circulation in the body, then enters the tissue, then gets to the tumour and penetrates it, and a drug can hypothetically lose its efficacy or cause side effects at every step of the way. As a result, some of the largest recent rounds for oncology startups have been for companies like ArsenalBio and Myricx Bio that are specifically targeting solid tumours.

A particular problem is that some cancers, notably glioblastoma (ie. brain tumours) and pancreatic cancer, are ‘cold’ tumours that can’t easily be detected by immunotherapies, but which are also difficult to diagnose early because of a lack of visible symptoms. Both have survival rates well under 50%, and cold tumours remain “a nut everyone is trying to crack,” according to Dhar.

Nevertheless, new approaches such as precision treatments, advanced diagnostics, big data and AI technologies – are already taking the oncology sector forward.

“We’re in a better place for sure; there are more therapy options, there is so much advancement in the cancer therapy space,” says Dhar. “There are options that give you a good lifespan, progression-free survival anywhere from 12, 18, 24 months – that is very significant in the lives of patients that have these aggressive cancers, and that sort of success has already been achieved.”

“If you were diagnosed with HER2-positive breast cancer 30 or 40 years ago, the prognosis was really bad,” adds Horgan. “Now if you’re diagnosed with it, it’s not a life sentence anymore and it can be very well treated. That’s really changed the paradigm of how you treat certain patients.

“That hasn’t happened for every type or subset of cancer, so we still have some way to go, but the way we look at targeting cancer cells now is a lot more focused. We aren’t just trying to put something in there that’s going to poison cancer cells more than healthy cells.”