Previous attempts to create financial reporting tech for startups have faltered, but is now the right time for this Slack-backed platform to try again?

Private capital markets were worth some $11.4 trillion in 2022, according to McKinsey, but keeping track of these assets is still something of a haphazard business, with few standards and relatively little bespoke software.

“When it comes to sharing information, investors and companies purely use a form of manual exercise. It’s similar to copying and pasting numbers out of Excel into emails,” says John Melas-Kyriazi, the co-founder and chief executive officer of Standard Metrics.

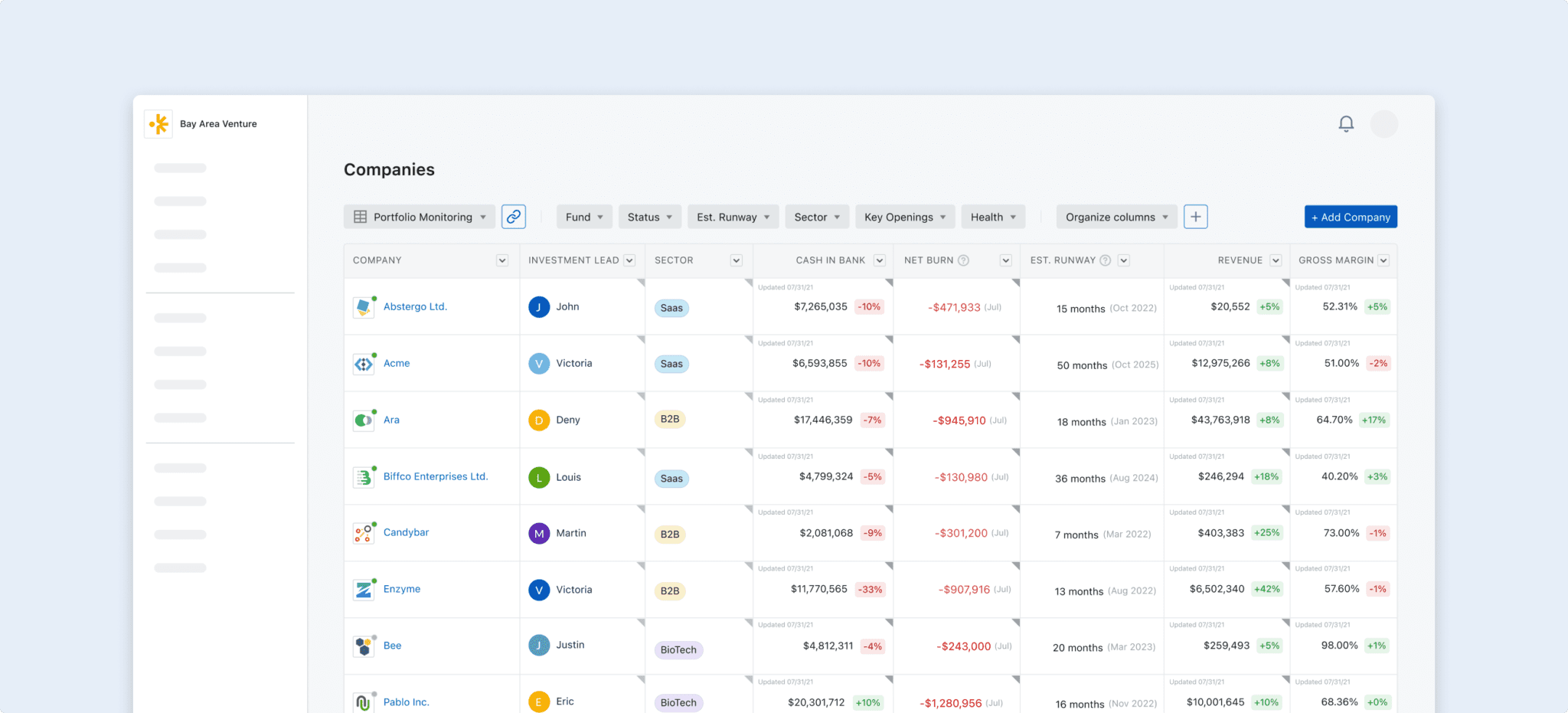

Kryiazi is on a mission to change this with a platform that allows venture capital companies to collect financial data from all their portfolio companies more easily.

“We like to view our product as a way for investors and startups to internally build a common language for the innovation economy,” says Kyriazi. “Allowing investors to automatically fill out reports not only saves time but allows further integration between startups too, which is something quite differentiated in this field.”

Melas-Kyriazi co-founded Standard Metrics in 2020, after previously serving as a venture capital investor for over five years at Spark Capital, a US-based venture capital firm. He is also an active angel investor in companies like Clipboard Health, a US-based healthcare recruitment marketplace.

Previous attempts at getting the venture capital industry to adopt financial reporting technology have faltered, says Melas-Kyriazi, with several companies launching data platforms for investors but receiving limited attraction, including Baromitr, the US-based revenue and assets manager that was launched in 2019 yet has received no funding and Visible.VC, the US-based reporting data platform for investors was launched in 2014 but has only raised $1.9m to date.

But the disruption of Covid-19 has made them more willing to try it and the timing may finally be right for automating the industry.

Going above the standard

Standard Metrics is trying to make the sharing of financial data as automated as possible.

“One way we do this is through accounting integrations which allow companies to plug in with QuickBooks or Xero. We are also launching a collection of accounting providers and ERP systems soon which will allow the data to flow smoothly,” says Melas-Kyriazi.

The data provided by Standard Metrics is protected by an AES 256-bit encryption protocol which helps sensitive data remain secure, as well as offering 24/7 automated security monitoring for risks and vulnerabilities running on all the company’s machines.

“Our big differentiator is that we focus on building networks. We build analytical tools for investors to publish tear sheets, for instance, and have built an API to allow investors to pipe data out of our system into data warehouses.”

Standard Metrics has also designed the platform so that it has benefits for startups as well as investors. Startups can use the tool to upload and share their financial details when they are looking for new investors.

“Many players in our space are thinking about this form of data sharing from a one-sided investor analytics tool, whereas our network approach and the two-sided platform allows us to stand out,” says Melas-Kyriazi. “We really embedded ourselves with our customers, many of whom are investors in our company too.”

The investment climate

Standard Metrics has raised a total of $29.5m in funding, most recently a $23.7m series A round in 2022, led by the global firm, 8VC with participation from Slack Fund, the corporate arm of the US-based software developer, Slack.

Although financing in the fintech sector has slowed significantly since the peak in 2021, Melas-Kyriazi believes early stage companies can still find funding. “There is still an active funding environment for high performance tech companies with early stage investments, the seed and series A stages being the least impacted from the market shifts,” he says.

Funding and corporate financing

The startup consists of a team of over 50 industry experts, with the company leaders including Dalen Chow, Head of Revenue and previously the Head of GP Commercial Strategy at IHS Markit, as well as Melas-Kyriazi.

Melas-Kyriazi believes having corporate venture investors helps the company get valuable insights. “The relationships we have built with CVCs such as Slack Fund have been built through our long standing ties in the venture community. Corporate venture funds are key to customer segments for us, so it is important to involve them as investors in our company because involving our customers as investors have allowed us to be unique.”

Founded in 2016, The Slack Fund invests in information technology and SaaS sectors from seed to later stage companies. The Slack subsidiary has 71 companies within its portfolio including Loom, a US-based technology and video recording company that raised $130m in a series C round led by Andreessen Horowitz in 2021.

“We have learned a lot since working with corporate backers,” says Melas-Kyriazi, “Outside of the typical forms of help, such as recruiting and introductions to other investors. Other investors really helped us to consider the needs of CVCs more, which can be different compared to VCs around things such as security, as well as requiring distinct product needs.”