Some 46 corporate-backed startups had an exit in May, a handful at more than $1bn. But the market is still in a holding pattern.

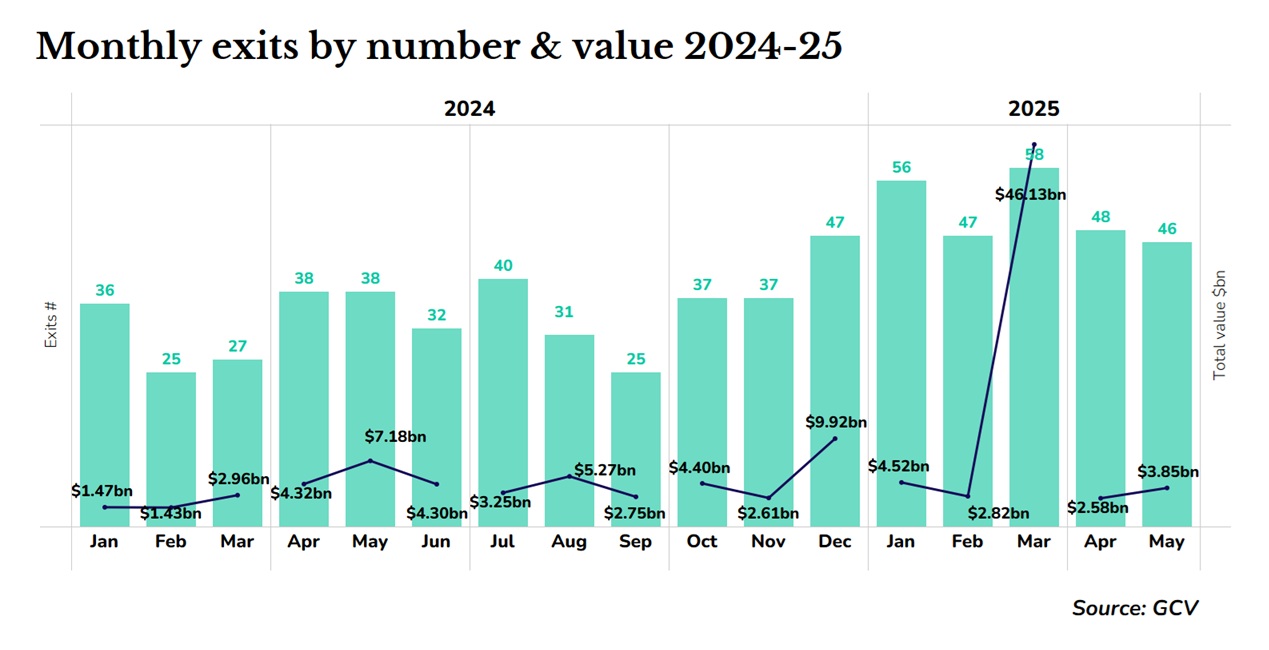

Corporate investors are waiting for the market to open for startup exits, but May brought no respite. There were a handful of large acquisitions of more than $1bn for corporate-backed startups in May and the number of exits was up from the same month a year ago, 46 versus 38 transactions.

But overall, the exits market appears to have been in a holding pattern for the past six months.

The total dollar value of May’s exits was more encouraging compared to the previous month’s, with May rising 50% over last month’s value, at $3.85bn, compared to the $2.58bn seen in April. However, it is only an indication, considering many reported exits do not usually disclose values.

Three of the biggest exits in May stood above $1bn in value, including the acquisition of Belgian immuno-oncology technology developer EsoBiotec by AstraZeneca for $1bn.

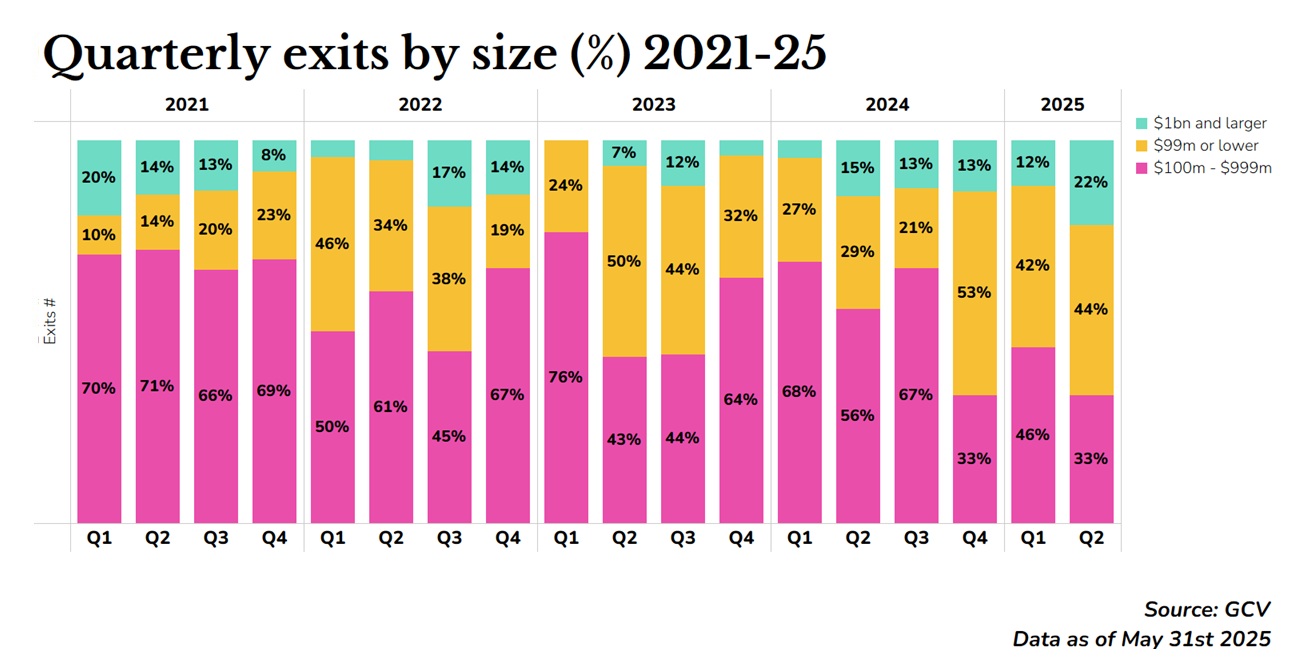

However, roughly half of the exits (44%) in the second quarter of 2025 so far have been below $100m, a trend we’ve observed since the last quarter of 2024.

This month also saw Microsoft-backed AI software company Builder.ai, which was previously valued at over $1bn, run out of cash and file for bankruptcy.

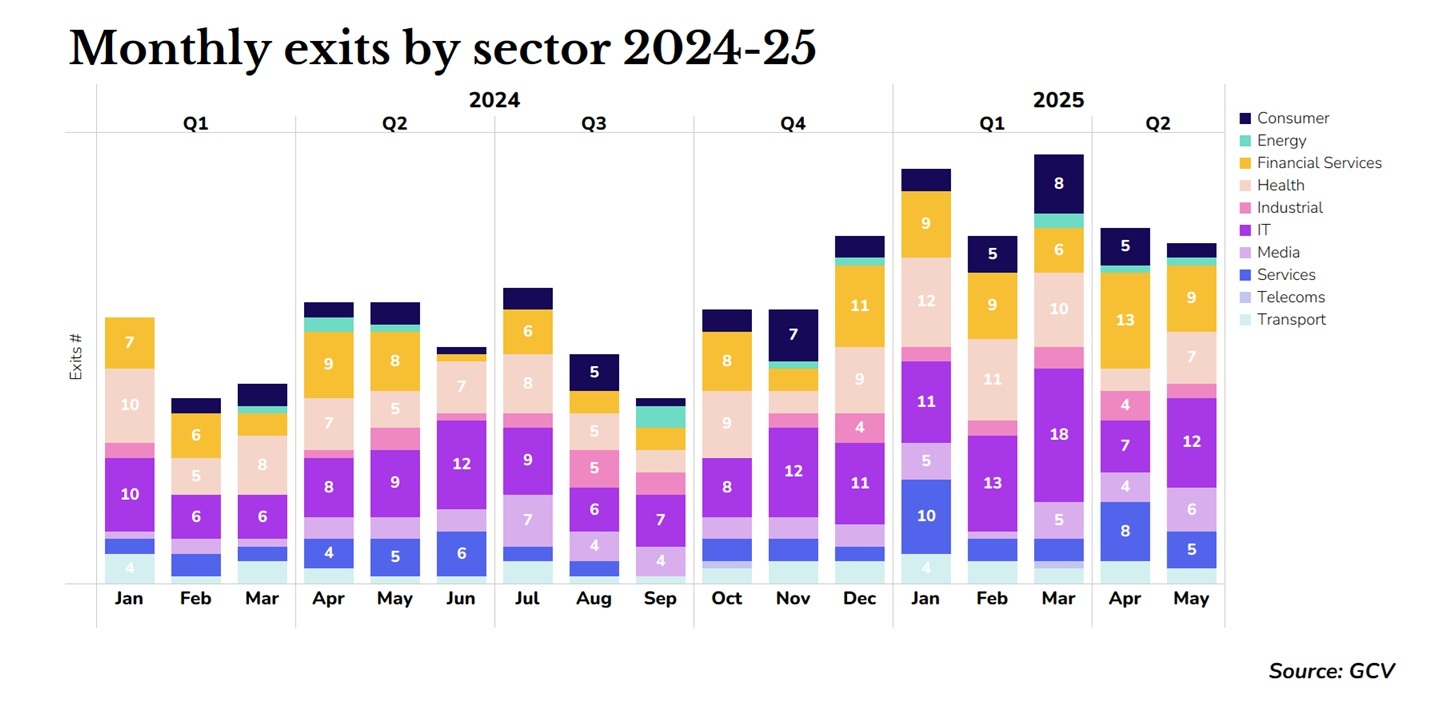

Exits by sector

There were fewer exits for corporate-backed startups in the financial services sector, while IT and healthcare-related exits were on the rise.

Finance

Among finance startups, there was a decline in acquisitions, with just nine transactions in May, down from 13 in April.

Employer.com acquired US provider of personal finance tips MainStreet, demonstrating the rising popularity of hands-on budget management services. The startup was previously backed by Alphabet.

Main Capital Partners, meanwhile, acquired Aritma, a Norwegian fintech company specialising in financial data automation between banks and ERP systems with the company previously receiving investment from Norwegian bank and lender Sparebank 1 SR-Bank.

IT

IT startup deals saw a slight increase from April’s low of seven to 12.

Saudi Aramco-backed threat detection software developer Spidersilk was acquired by CPX Holding, showing the move towards specialised software security amid the rise of cyber threats.

US startup Data.world, which has built an online platform that enables users to share and contextualise datasets and communicate with each other through social tools, was acquired by software company ServiceNow. One of the previous investors of Data.world was Workday Ventures, the investment arm of HR and finance platform Workday.

Healthcare

There was an unusually low number of exits for healthcare-related startups in April, with just three transactions. This recovered to normal levels, with seven exits in May.

Aetion, operator of a healthcare analytics company intended to offer real-world analytics and evidence to transform data into decisions, was acquired by Datavant and was previously backed by Johnson & Johnson, Amgen, EDBI and NEC.

Danone in turn acquired US startup Kate Farms, a provider of plant-based formulas used for tube feeding as part of the treatment of chronic illnesses. Kaiser Permanente and Novo previously invested in the company.

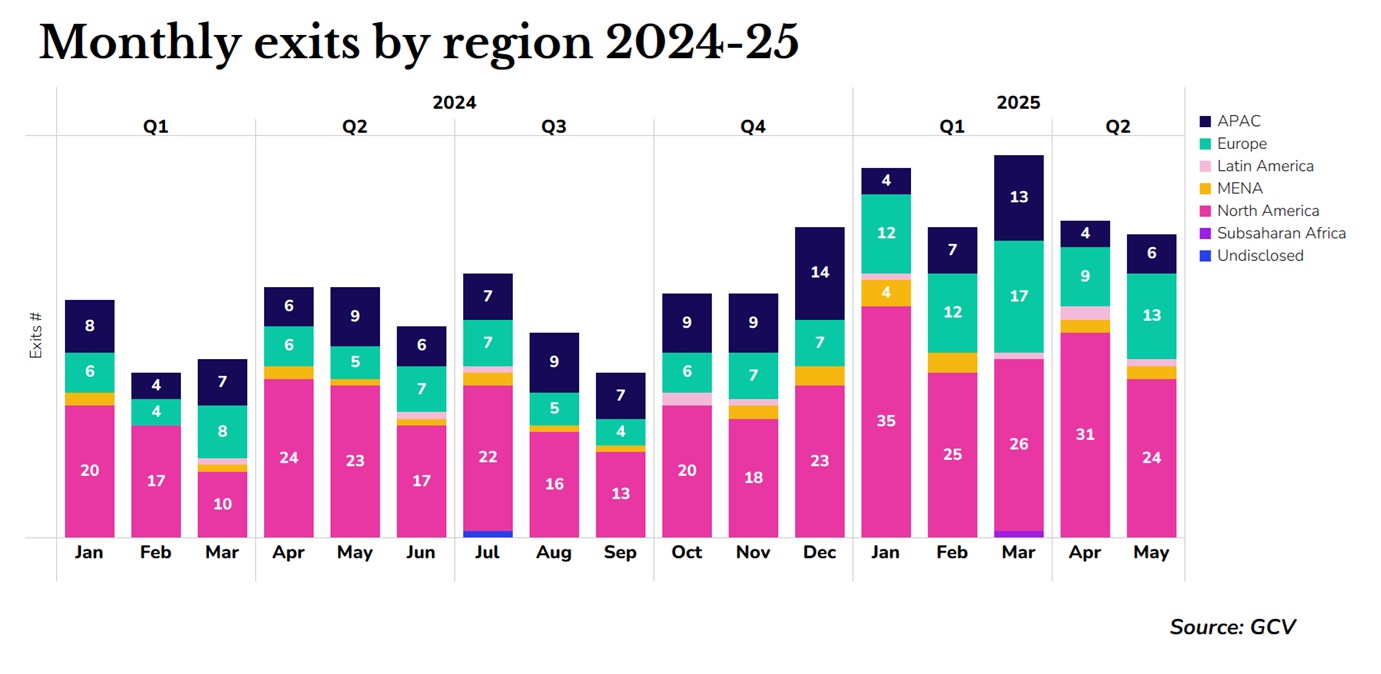

Exits by region

Europe

There were 13 European corporate-backed startups that exited in May, four more than last month, with a diverse split of startup origins as six of them were in the UK, three in Norway and one each in Belgium, Switzerland, Luxembourg and Portugal.

A notable deal where the amount was disclosed was the acquisition of UK publisher of PC and console video games Curve Digital for $29m by Nazara Technologies, which the corporate had previously backed, along with video game and entertainment investor Catalis Group.

North America

Exits for startups in the North America region fell slightly from April, down to 24, but remained relatively steady and higher than the lows seen in the third quarter of 2024.

One of the biggest acquisitions was the purchase of personal care products company Touchland by Church & Dwight, for $700m.

Largest exits

EsoBiotec

AstraZeneca acquired the Belgian immuno-oncology technology developer EsoBiotec for $1bn, in the most notable exit for the month.

EsoBiotec has engineered a NanoBody Lentiviral (ENaBL) platform to assist immune systems in attacking cancers and offering more patients access to cell therapy treatments delivered quicker than traditional therapies which take weeks.

This aligns with AstraZeneca’s strategy of tapping into innovative cancer treatments like the developing field of radiotherapeutics, a move from radiation therapy that usually comes with an array of side effects. The corporate acquired a radiotherapeutics business Fusion Pharmaceuticals in June 2024 for $2bn. It also invested in US developer of cancer immunotherapies Asher Bio in April of last year.

Neon

Databricks in turn acquired US serverless database developer Neon for $1bn. The enterprise provides database management on a serverless platform for integration into existing workflows designed to ease developers’ job of building applications faster. Databricks is one of Neon’s previous investors, along with Microsoft and Snowflake Computing.

SiteOne Therapeutics

US startup SiteOne Therapeutics, developer of a non-opioid pain management drug was acquired by pharmaceutical company Eli Lilly for $1bn. Previous backers included Novo and Amgen.