AI, connectivity and electrification are changing the customer’s automotive experience, and incumbents must innovate while shepherding them through it to avoid disruption.

The car industry is facing a “disruptive technology jump” — a dangerous time during which consumer loyalties can change swiftly, says Marcus Behrendt, managing partner at BWM i Ventures. This is a moment when it is crucial for car makers to stay on top of technological innovation

Consumers are generally loyal to familiar brands. But when there is a big shift in technology — such as a move to electric vehicles or self-driving cars — loyalties can change rapidly.

“Suddenly your notion changes, your rhythm changes, and then you might as well also change your product,” says Behrendt on the CVC Unplugged podcast. “That is, I think, what is so dangerous about these disruptive technology jumps where you suddenly ask for different behaviour and then the customer says, okay, I might as well use a different product. That’s what we as an industry have to control.”

EVs – where Chinese automakers are looking to set up a dominant global position – are a great example of this. Where people fuel their cars, the way they drive them, and the technology onboard is all different from how it has been. Incumbent car makers need to embrace the trend and ensure they can give their customers a gentle transition into it or they could risk that user base.

Automotive is more than cars

One of the trends BMW i Ventures has been investing in recently is autonomous driving, which has seen a pick-up in interest in the past year, after several years in the doldrums.

“ Some things go through this classical life cycle, right? So in the beginning there’s the idea, then there’s this big hype, then you sober out and then, actually, the technology prevails,” says Behrendt.

“Some of the things we have been looking at from the very beginning, like autonomous driving, we’ve gone through the highs and lows and we’re just seeing it picking up.”

BMW i Ventures has investments in companies like autonomous trucking startup Kodiak, autonomous transit startup May Mobility, as well as Embotech, which uses its autonomous technology for industrial and logistics solutions, such as marshalling newly-made vehicles from the factory to parking and storage facilities.

But investing for car manufacturers, these days, also goes far beyond the car itself. Like many of its peers, BMW i Venture is investing in generative AI, and last summer BMW’s plant in Spartanburg successfully trialled the use of humanoid robots with a startup called Figure AI. Figure AI is not a BMW i Ventures portfolio company but demonstrates how a crossover is developing between robotics and autonomous vehicles.

Sustainability, of course, is something that cuts across every one of BMW i Ventures’ focus areas.

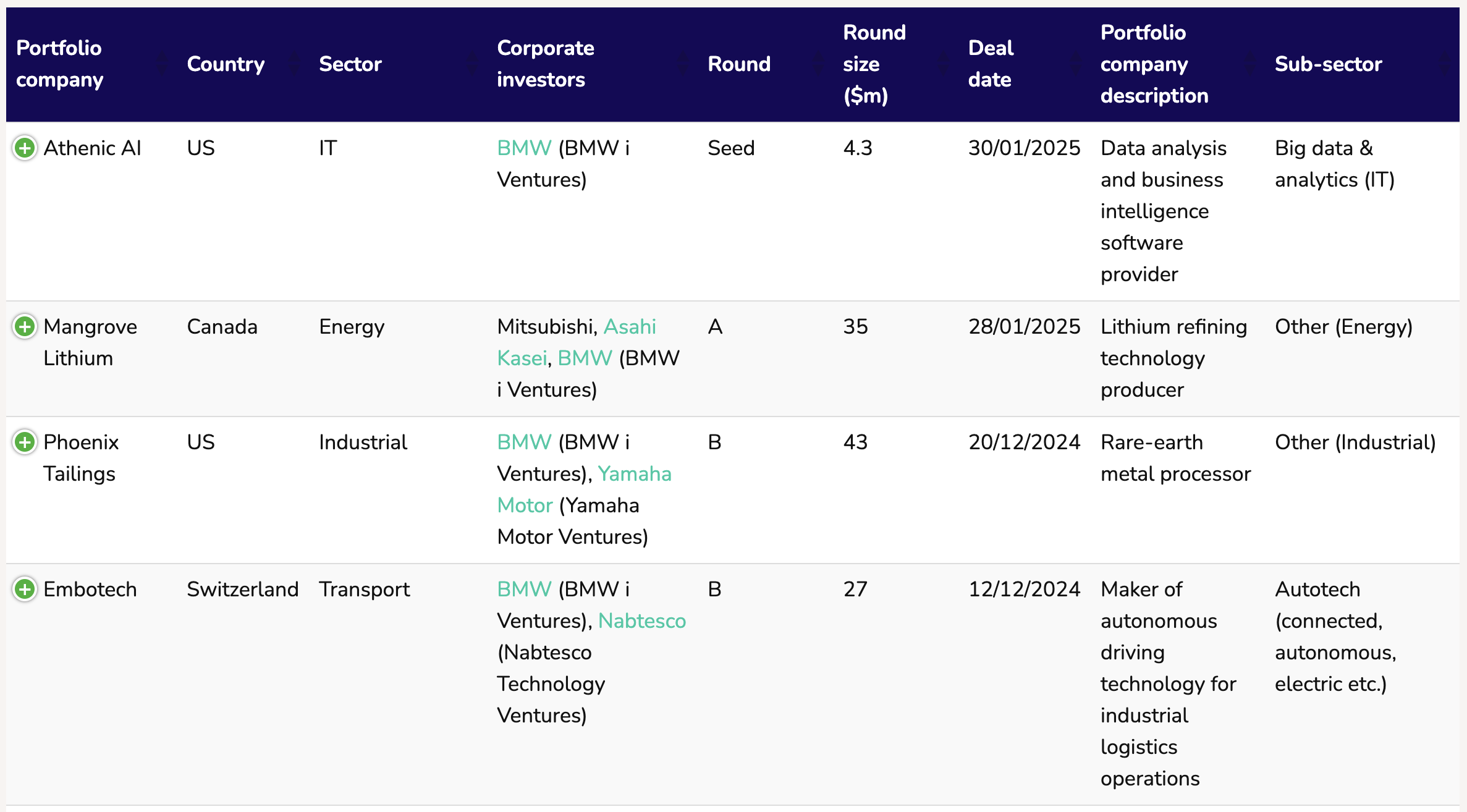

See all the recent startup funding rounds backed by BMW i Ventures in our Corporate Funding Round Database.

“ [Helping the corporate decarbonise] is something that will not happen evolutionarily. It’s not going to happen just by improving a little bit every time,” says Behrendt. “Larger corporations usually do with their products, but I think we need disruptive technologies. We need really new ideas to do so. We have seen quite a few ideas coming out of that are promising to be actually more efficient and more cost-efficient than the traditional way.”

Portfolio companies like green steel producer Boston Metals and plant-based carbon composites manufacturer Bcomp are among those that the unit hopes will one day be more attractive, on a cost basis alone, than their carbon-based counterparts.

A CVC model to learn from?

BMW i Ventures, which has been operating for more than 14 years, is also a good example of how to structure a CVC unit for success.

For the first five years, the unit invested from BMW’s balance sheet, but this proved not to be an efficient way to move forward. The unit then launched in a new, independent form in 2016 with a $500m fund, followed by a second, $300m fund in 2021.

Behrendt says all CVC units should be set up with this kind of independent structure.

“We came to the conclusion, if you really want to be in the good deals, the deals that will change the world, you probably have to be faster. You have to be more dedicated. You have to take risk – controlled risk – but you have to take risk,” he says.

“We needed to build a unit that was allowed to take risk, that was allowed to go out and play the game as institutional venture capitalists do.”

It also helps to have some distance between the venture arm and the parent corporation. One of the things that helped BMW i Ventures in the early years was that the fund was operating in Silicon Valley, far from the corporate headquarters in Germany. This allowed them to be out of sight and out of mind, able to work independently, without pressures to show results right away.

“ What you really need is a three, four-year period where you can execute, which is full of trust of the mothership – trusting the execution of the GPs that they will actually find the right companies. And then you start, of course, reporting back to your LPs and saying, hey, this is what we did, here’s the first strategic, relevant company.”

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.