Where does the collapse of Silicon Valley Bank leave corporate investors? Here's what CVCs said about short and long-term challenges.

The saga of the Silicon Valley Bank collapse continues to unfold and we’ll bring you updates here of the latest developments. The most acute crisis appears to have been averted as US regulators guaranteed that all customers of SVB would have access to all of their money starting Monday.

Meanwhile HSBC has bought the UK arm of SVB for £1, and customers and businesses who have been unable to withdraw their money will be able to access it as normal. The spectre of hundreds of tech companies being unable to make payroll has receded.

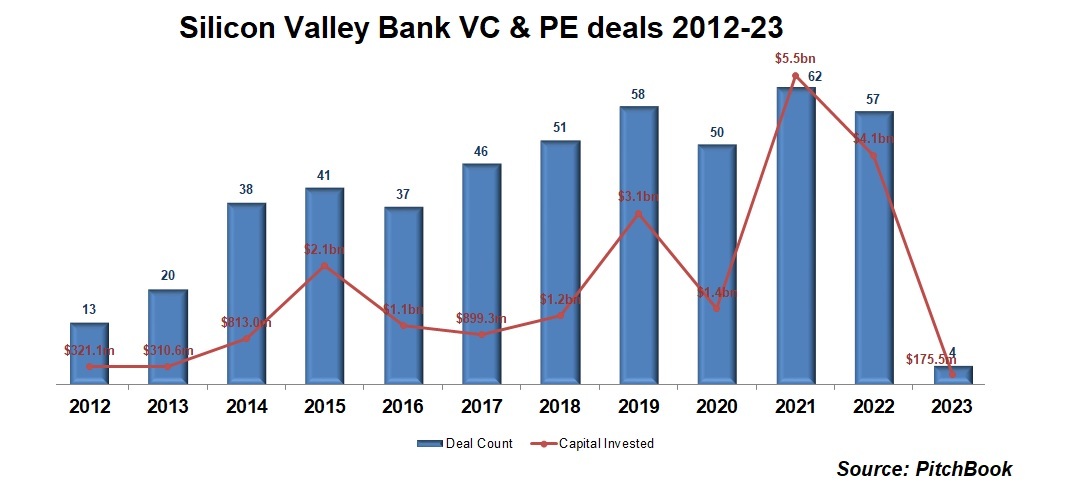

But we’re looking now at where this leaves the tech ecosystem long term, and specifically where it leaves CVC investors. The speed at which SVB withdrew from investing this year is apparent in this chart, raising some questions about exactly when the problems arose (Jim Mawson wrote the bank’s fall in market capitalisation back in November). It also emphasises the funding hole that will be left by the SVB’s absence.

In some senses corporate investors are less directly affected by the SVB fallout as they are less likely to have banked with SVB than VCs. But everyone will have portfolio companies that are affected.

“SVB has been a critical part of the startup venture ecosystem for so long, everyone was panicking regardless of direct impact or not,” says Jay Eum, managing partner at GFT Ventures.

“Everyone has portfolio companies that have SVB exposure — they claimed to have had over 50% of all US startups as client. As you may have seen, their funds will be fully available due to the feds intervention so no major impact for now.”

Bruce Niven, executive managing director of strategic investing at Aramco Ventures, says 25 of his unit’s portfolio companies had “material exposure” to SVB comprising more than $1bn in deposits. Ten of these companies were uncertain whether they could make payroll. The unit was prepared to support the companies with short term credit, says Niven.

“The decisive action of the Fed and UK regulator was very necessary here to prevent this becoming something much worse,” says Niven.

Most investors will be advising their portfolio to diversify their bankers.

“Everyone has learned that diversifying banking partners is critical going forward – perhaps with a traditional bulge bracket firm,” says Eum.

Despite the US government guarantee of deposits, those startups that had all of their capital at SVB will have to work to rebuild confidence in their capital position, says Brian Walsh, head of Wind Ventures.

“The government’s guarantee of full deposit amounts is a blessing. But work remains to ease fears of risks,” he says. “Partially exposed companies may not have the immediate concerns of fully exposed, but any unintended hit to capital resources is a major concern. These companies are also repositionng capital to add confidence in capital access.”

Longer-term, startups will be left looking for a new place for venture debt, says CVC industry veteran Sherwin Prior. SVB was more ready to extend debt to early-stage startups than most major lenders, and would do so on generous terms. As Sherwin Prior puts it in this LinkedIn note:

There may be an opportunity for corporate investors to step into the vacuum left by SVB, at least partially.

“SVB means now is a crucial time for CVC arms and their corporate parents to step-up their activity and visibility,” says Greg Watson, founder of Partnership Capital. Watson suggests that corporate investors offer fast support for affected investee companies — including measures like faster payments and sponsorship. SVB was a lynchpin of the tech ecosystem, and so there are opportunities to step up as a provider of information and events, as well as money.

Sam Patel, partner at UK-based consultancy Digital Innovation, agrees: “CVCs will have an advantage over VCs to invest in more distressed deals and opportunities which will inevitably fallout of this event. Ventures will hopefully start dealing directly more with corporate investors instead of through intermediaries. Win win situation for corporates and companies. Now’s the time for corporates to stand up.”

Although others are more sceptical about whether corporates will step up.

“In reality we can’t ignore the corporate mindset. History has shown that the majority of corporates are herd followers, and during downturns they will invest less and focus more on protecting [their] share price at the expense of long-term value creation,” says Mario Augusto Maia, partner at Cogent Venture Partners. “Another headwind to unfold relates to the overhyped M&A upcycle which has also burst but has yet to hit the accounts of most corporates (and the write-offs to come from fluffy ‘strategic’ M&A deals will be significant).”

Much of the full impact will take some time to fully play out. The collapse of SVB is likely to lead to a wider reappraisal of venture investment practices. Many parallels will be drawn with the dotcom crash, and CVC investors will need to weigh in on that, says Watson.

“Don’t let the crisis go to waste – help tackle the systemic dangers of homogeneity which SVB catalysed – have the courage to establish different, bold, more robust long-term models / practices – above all don’t allow the post 2002 collapse in venture and co-development to be repeated,” he says.